Expecting More Opportunities with Heightened Volatility in the Second Half

Summary

The second quarter was not as friendly to bondholders as the first, with the Treasury curve steepening and most spread sectors underperforming Treasuries. Higher than expected inflation and increased geopolitical risk weighed on markets. Regardless, the bar to outperform Treasuries was quite high with spreads for most sectors at historic lows especially those with duration given the demand for yield.

We had entered the quarter with a preference for Structured Products and select Corporate Bond sectors such as Banks and Utilities. We saw opportunities in the Structured market in new issue ABS and single-asset CMBS and benefited from security selection in the secondary market in MBS and Corporates. As we start the second half, we see the most value in MBS and ABS markets and select short CMBS and are starting to add to our Treasury position given the expectation for volatility to increase. Earnings estimates reflect an acceleration in activity that we believe may prove difficult for certain sectors, and historically, spreads have been more volatile in the second half of an election year given the heightened uncertainty.

Corporate Credit – Spreads Widened Modestly; AAM Sees Less Value in this Sector

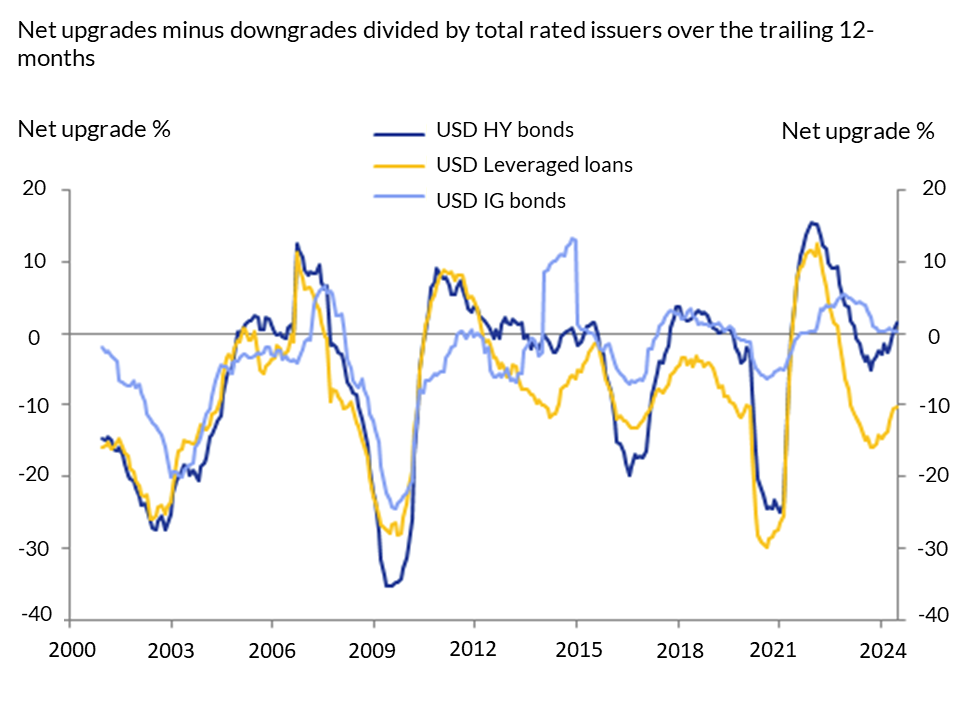

The environment for investment grade bondholders has been incredibly supportive with most companies deleveraging. They have benefited from strong sales and improving margins and have invested less given higher return hurdles and a more difficult regulator. This has resulted in a multi-year period of rating upgrades for investment grade bondholders (Exhibit 1). From a technical perspective, the demand for high quality yield has been so strong that it’s resulted in spreads tightening to multi-decade lows on the long end of the curve. Foreign investors have also looked to USD bonds given the yield advantages even after hedging costs are considered. Sectors that had looked attractive, like Banks, have outperformed and provide less opportunity1.

Exhibit 1: Rating Actions Have Been Positive Since 2020 in Investment Grade

While we do not expect the Corporate OAS to widen materially (i.e., more than 30 bps), at today’s level, the ability to outperform over the next six months is challenging. We expect spread volatility to increase as the cycle transitions from one in which companies benefitted from strong economic growth to one that relies more on inorganic means to generate earnings growth. We have started to see evidence of fundamentals weakening vs. expectations in the consumer, commodity and materials sectors. The industrial sector remains weak, not improving as expected. That said, technicals are expected to remain supportive with less supply in the second half and a Fed that appears likely to finally lower rates, supporting total returns. What about the election? Historically, in election years, spreads widen modestly in the second half of the year after having outperformed in the first half. Given the low starting point of spreads, softening in fundamentals, and uncertainty with this presidential election, we expect spreads to move wider in the second half of the year.

Structured Products – CMBS, CLOs and ABS Outperformed While Agency RMBS Continued to Lag; AAM Continues to See Value in this Sector

Risk rallied in structured markets with lower rated tranches outperforming. New issuance increased in the second quarter in the ABS and CMBS markets in particular. While banks were less of a technical driver in the second quarter, MBS spreads remained tied to interest rate volatility. Underlying collateral fundamentals continued to remain healthy despite normalization as the economy slows. We continue to see value in the Structured market due to the risk-adjusted yield advantages over municipal and corporate bonds.

Municipal Credit – Spreads Widened in Taxable and Tax-Exempts; AAM Sees Little Value in this Sector

The municipal market suffered through similar bouts of volatility as the Treasury market. Tax-exempt 10-year yields rose between the beginning of the quarter and June 3rd, before rallying on stronger market technicals. Taxable munis also exhibited weakness during the quarter as overall market volatility and expensive relative valuation levels at the start of the quarter resulted in weaker demand that pressured yields. Although the municipal market exhibited weaker performance for both taxable and tax-exempts during the second quarter, we remain cautious on our outlook for the sector over the balance of the year. This is due to expensive relative valuation levels that persist in both markets2.

For more municipal sector details, please see Greg Bell’s latest market commentary.

1 Bloomberg Corporate Index used for market data

2 Bloomberg, Refinitiv MMD

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.