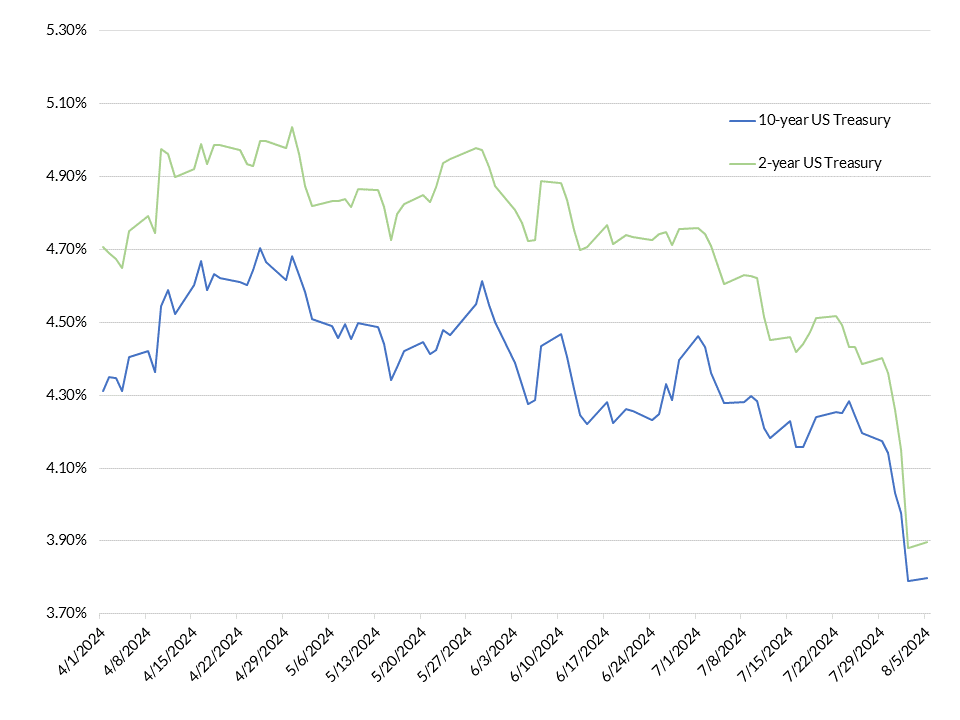

Treasury yields plummeted last week and again, briefly this morning, as markets re-price for weaker economic conditions and a more aggressive sequence of Fed Funds Rate cuts on the horizon. The yield curve (2s/10s) is closing in on a positive slope and futures markets reflect expectations for a target rate of 3.9% at year-end, more than 125 basis points of accumulated cuts in 20241.

Treasury Yield History (4/1/2024-8/5/2024)

While AAM had forecast a slowing economy and modestly lower rates as the Federal Reserve normalizes policy, markets have re-priced quickly and led to increased discussion surrounding recession risks. Volatility in market indicators, including the 2-year Treasury note yield, Corporate bonds spreads, and crude oil are reflecting increased risks of recession, but absolute levels are inconsistent with a base case expectation of this outcome in the near term.

The earnings season at a sub-sector level has been mixed with financials, technology and noncyclical sectors outperforming those related to the consumer and industrial segments of the economy. We are hearing firms talk about a higher level of uncertainty in months ahead. With all this said, earnings are generally beating estimates and fundamental growth remains intact. The Russell 3000 Index remains within approximately 8% of the all-time high, set on July 16th and is up more than 8% year-to-date. Our research teams note that falling rates should support areas of the economy that had been under pressure, such as real estate (residential and commercial) and banking. At the same time, modest economic growth and lower rates should support increased capital spending and weaken the USD, aiding the lagging manufacturing and industrial sectors.

We observe ongoing value within fixed income for insurance investors. Intermediate duration Corporate Bonds, Residential / Commercial MBS, and Asset Backed Securities continue to offer yields near 4.75%, still a full percentage point above the Property & Casualty industry’s 3.68% book yield on bonds2. The current environment remains one that should support investment income growth in the quarters ahead as new money yields exceed run-off book yield. For Life Insurance & Annuity writers, a steeper yield curve and widening credit curves have resulted in a less dramatic shift lower in yields.

Reinvestment yields in long duration, public market sectors generally range between 5% and 6% depending upon issuer, industry, and quality. The rate decline has been material enough, however, to trigger a review of annuity product rate commitments which likely need to be lowered to preserve margins in this lower rate environment.

Should the ‘risk-off’ trade continue or economic conditions change meaningfully, our team will keep you informed of our views for opportunism. We have positioned portfolios for rate & spread volatility and the ability to shift investments in an effort to optimize income & return potential as market pricing evolves. Please reach out to your portfolio management team or business development contact should you have any questions.

1 Bloomberg L.P., Bloomberg Index Series data

2 S&P CapitalIQ

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.