Finally, it has happened. After months of investors trying to pinpoint when the Fed would begin to ease monetary policy and how much they would cut, the Fed acted by reducing the Fed Funds rate by 0.50% (50 basis points) in September. Whether looking at the Fed Funds futures market or the Federal Reserve’s dot plot, the 0.50% is expected to be the first in a series of moves by the Fed to ease monetary policy. The exact path of rate cuts will depend on many factors including progress of inflation back to the Fed’s 2% target, strength of the labor market, and stability of the economy. The question many investors are asking is, what will this mean for my bond portfolio?

Depending on the duration profile of the portfolio, the impact of these rate cuts may not be as dramatic for insurers’ portfolios as one may expect. Historically, Fed actions have a much more significant impact on short interest rates. Longer interest rates incorporate long term expectations for economic growth and inflation. While these factors are impacted by changes in the Fed Funds rate, the impact is more muted.

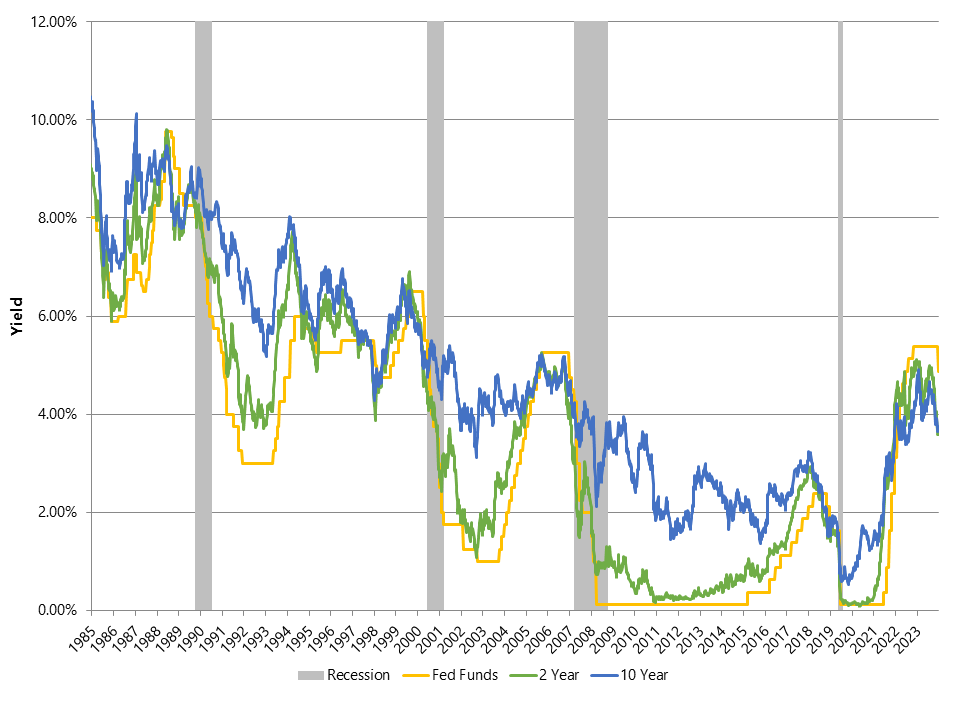

Exhibit 1 shows a history of the Fed Funds rate in gold, the 2-year Treasury in green, and the 10-year Treasury in blue back to the mid-1980s. The shaded regions reflect recessions. Over this period, significant Fed easing has generally coincided with recessions. AAM does not anticipate a near-term recession, meaning the Fed may be in an environment we have not seen in several decades. Looking at Exhibit 1, one can see that the 2-year Treasury follows the Fed Funds rate closely. In periods when the Fed Funds rate declines, the 10-year Treasury does not fall as dramatically and the spread between the 2-year Treasury and 10-year Treasury widens. Said differently, the yield curve steepens. As of October 7, 2024, the market was pricing 125 – 150 basis points of rate cuts in the next 12 months1.

Exhibit 1: Treasury Yields & Fed Funds Rate

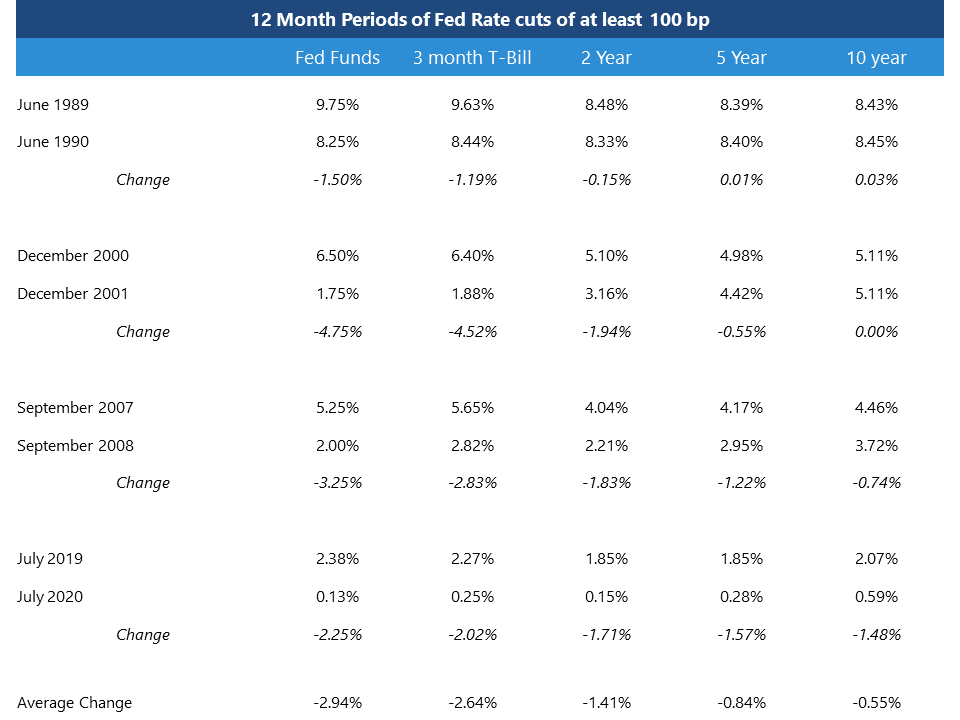

Since the mid-1980s there have been four periods where the Fed has cut by at least 100 basis points within a 12-month period. The data in the table in Exhibit 2 show changes in Treasury yields over the those four 12-month periods of significant Fed easing. Each of these periods includes unique circumstances. For example, the recessions in 1990 and 2001 were relatively mild with 2001 impacted by the Dot-com bubble. The 2007-2008 and 2019 – 2020 periods were obviously impacted by significant shocks from the Financial Crisis and COVID, respectively. The data in Exhibit 2 indicate that yields on the 10-Year Treasury were little changed in periods when economic shocks were more modest. Across all of the periods in Exhibit 2, on average the 10-year Treasury fell 55 bp or only 19% of the average decline in the Fed Funds rate. The average 5-year Treasury decline was 32% of the average decline in the Fed Funds rate, the average 2-year Treasury decline was 48% of the average decline in the Fed Funds rate, and the average 3-month T-Bill decline was 90% of the average decline in the Fed Funds rate.

Exhibit 2

Source: Bloomberg weekly data

We will have to wait and see the exact path of interest rates as we move forward, but there are some impacts investors should consider in light of the exhibits above. First, as the Fed cuts, yields for cash and equivalents will follow. For the past several quarters the inverted yield curve has allowed investors to hold cash or T-Bills and earn more than could be earned in longer term investments. As the Fed cuts rates, that will no longer be the case. If an investor is holding excess cash, this is the time to consider investing it more strategically to lock in relatively high long-term yields.

A significant concern about rate cuts for many clients, is that the cuts will result in a significant future decline of portfolio book yield. In the past few years, with yields higher, insurers have benefitted from the ability to earn meaningful investment income. The good news is that as we have analyzed portfolios, we do not expect book yield to decline significantly for most portfolios in the near term. As is demonstrated in Exhibits 1 and 2, the impact of cuts by the Federal Reserve should have a muted impact on investment yields further out the curve. This is combined with the fact that many of the securities that will mature in the near term were purchased in prior, lower interest rate environments. Even if new money yields do fall modestly from current levels, generally replacement yields will still be higher than the book yields rolling off, and portfolio book yield should stay relatively stable, if not increase. Portfolios with shorter duration profiles that typically buy shorter bonds do run a higher risk of declining portfolio book yield relative to portfolios with longer duration targets.

In summary, there are many factors that will impact the future path of the Fed Funds rate. If the Fed Funds rate somewhat follows the path expected by investors, short rates should fall meaningfully. While longer yields may fall as well, portfolio book yields should be largely insulated from the rate cuts, depending on the duration profile of the portfolio. As investors read about future Fed rate cuts, it is important to keep the dynamics of the shape of the yield curve in mind, and the changing dynamics of the curve may present opportunities for investors.

1 Source: Bloomberg World Interest Rate Probability (WIRP)

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.