Just a few years ago, hype surrounding the transition to battery electric vehicles (BEV) led to aggressive forecasts of explosive growth. A sharp slowdown in the sales growth of BEVs earlier this year brought a welcomed dose of reality to this hype. This slowdown was dubbed by some as an “EV Winter.” Like winter, this appears to have been a temporary condition and recent data has provided a more optimistic outlook for the sales of BEVs. It seems that the transition to BEVs is still occurring, just maybe at a pace that is more measured and manageable than previous expectations.

Global EV Sales

Global Penetration

After consistently strong global growth over the past few years, the pace of EV adoption encountered headwinds starting in late 2023. In the US, the penetration rate1 peaked at over 8% in the fall of 2023 before falling to around 6.5% in early 2024. In Europe, the headwind was even more pronounced, with penetration peaking at over 23% before falling to under 15%. China also saw a brief dip in early 2024 but has bounced back much quicker than the US or Europe. In all three markets, penetration seems to have bottomed and the trend appears to have resumed its upward trajectory over the past few months. In fact, the penetration rate in the US hit a new all-time high of 9.3% in September 2024. In China, the positive trend has accelerated significantly and BEVs have accounted for around 27% of vehicle sales over the past few months.

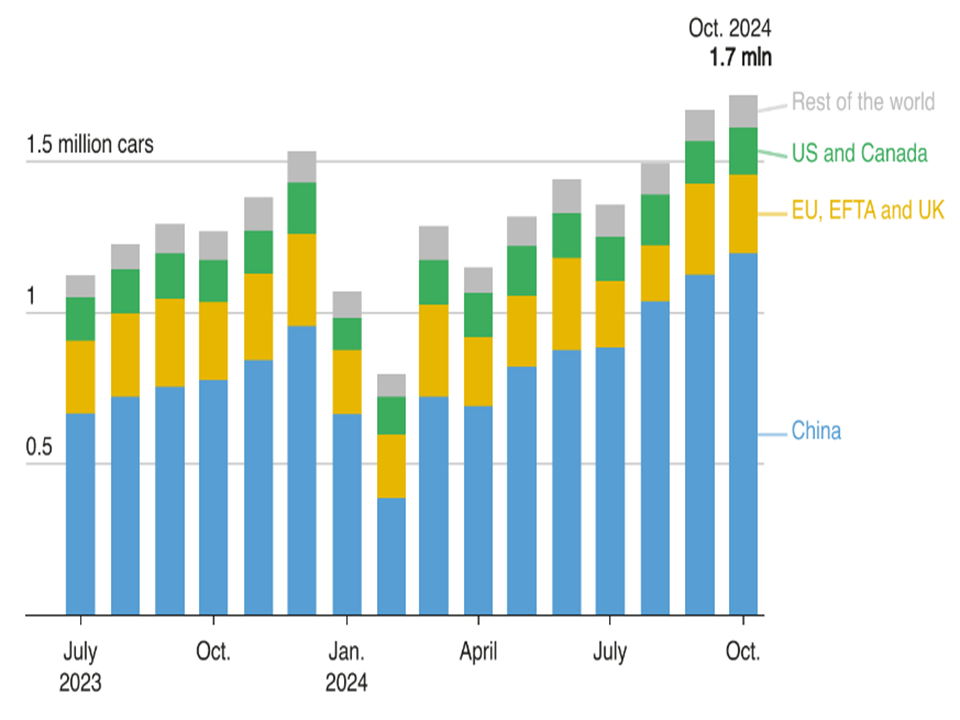

According to EV Volumes, third-quarter sales of BEVs grew 8.8% globally. This growth was led by China’s 13.2% growth while the U.S. grew at 8.3%. Sales in Europe were down 9.0% due to the still strong sales in the previous year’s third quarter. Sales in September and October are showing a positive trend again as comparisons to the previous year become easier.

The reasons for the slowdown vary by market. In Europe, the phase-out of incentives started having a negative impact in the second half of 2023. In both the U.S. and Europe, consumer enthusiasm seemed to have waned. This could be partially explained by the lack of excitement around new models but also explained by an increasing preference for hybrid vehicles. Hybrids have become an effective alternative to BEVs because they address consumers’ concerns about cost, range, and convenience. While all markets have seen an increasing popularity of hybrids, they have seen remarkable growth in China. In China, the combination of BEVs and various forms of hybrids are collectively known as new energy vehicles (NEVs). The China Association of Automobile Manufacturers just recently announced that annual production of NEVs has surpassed ten million vehicles and the penetration rate has exceeded 50% over the past few months.

While BEVs have become more common, future growth will continue to depend on the ongoing transition from a novelty to a practical alternative to the traditional internal combustion engine (ICE) vehicle. While the industry has made considerable progress addressing the roadblocks to this transition, more progress is needed to overcome the primary headwinds of affordability, performance, range anxiety, consumer choice, and convenience.

Affordability Depends on Achieving Cost Parity

Affordability continues to be a major headwind in the adoption of EVs. According to data from Kelley Blue Book the average transaction price in the US for EVs was $57,000 in the third quarter. This compares to the industry-wide ATP of $48,000.

A battery pack cost of $100/kWh has long been considered the threshold at which BEVs reach parity with ICE vehicles. While most of the world remains above this threshold, prices have declined rapidly in China and are now as low as $75/kWh, according to Bloomberg NEF. The declining cost can be partially attributed to a decline in raw material prices such as lithium but also to a rapid expansion of manufacturing capacity that has led to a significant overcapacity situation in China. Due to this declining battery cost and other manufacturing efficiencies gained from the rapid expansion of EV capacity, as many as two-thirds of EVs available in China are now cheaper than their ICE equivalents.

While Chinese manufacturers are the first to show that cost parity (or better) with ICE vehicles is possible, the rest of the world is still behind. Manufacturers in China have an inherently different cost structure and replicating the results in the US or Europe is unrealistic in the near term. That said, the China experience has turned parity with ICE vehicles from a theoretical possibility into a reality. It is only a matter of time before EVs reach parity with ICE vehicles in other markets and eventually become a more cost competitive option.

Regulatory Policy Is Fluid

The outlook for EVs continues to be highly dependent on policy. In Europe, the phase-out of subsidies in Germany in September of last year led to a significant drop in the sales of EVs. Europe faces tighter emissions targets in 2025 and the slower-than-expected adoption of EVs is making it difficult to meet these targets. It is widely assumed that these targets will need to be relaxed or more aggressive EV subsidies will be needed.

In April, China implemented a scrappage program that provided incentives of up to 10,000 yuan to consumers who traded in older or less efficient fuel vehicles for approved new energy vehicle (NEV) models. In July, this incentive was doubled to 20,000 yuan. This cash-for-clunkers program has been highly successful and NEVs now account for more than half of all vehicle sales in China.

In the US, there is likely to be a meaningful change in EV policy following the election of Donald Trump. Bills passed under the Biden administration had numerous credits and incentives supporting the adoption of EVs. The most prominent provision is the credit of up to $7,500 for the purchase of an EV. There were also advanced manufacturing related incentives embedded in these acts that encouraged the domestic manufacturing of batteries. GM alone is expecting to receive $800 million of advanced manufacturing credits in 2024. Although not part of the recently passed bills, there are also EPA regulations in place that require a traditional manufacturer (OEM) to purchase carbon offset credits if its fleet does not meet emissions targets. The primary beneficiary of this program is Tesla, which received $2.0 billion in the first three quarters of this year from selling regulatory credits.

President-elect Trump has made it clear that all aspects of environmental policy will be under review, including a variety of regulations impacting EV adoption. An early target is likely to be the $7,500 consumer tax credit. Trump has publicly stated his desire to end this credit and representatives from Tesla have been reported to be supportive of the move. Predicting the outcome of this regulatory review is complicated by Trump’s relationship with Elon Musk, who has benefitted immensely from policies that favor EV adoption. Mr. Musk’s presence could, for example, lead to a more accommodative regulatory environment for robotaxis and autonomous driving. This could potentially offset the negative impact from eliminating the consumer credit. Whatever the outcome, policy changes are likely to have a significant impact on the pace of EV adoption.

The EV Transition Has a Significant Impact On Auto Industry Fundamentals

The pace of EV adoption has significant implications for the automotive sector. The legacy auto manufacturers were slow to react when EV adoption took off a few years ago and were forced to announce aggressive capex plans in an effort to catch up to the ambitious EV growth forecasts. Even after spending billions to expand capacity, EVs are still generating significant losses for the legacy OEMs. Catching Tesla is proving harder than expected. Fortunately, the moderating sales growth trajectory has given some relief to these OEMs, allowing them to be more measured with their EV plans. We have already seen some EV expansion plans postponed or canceled. GM, for example, expects to produce 200,000 BEVs in North America this year. This compares to expectations of 400,000 units set back in 2022. The legacy ICE business continues to generate significant cash flows and extending the runway is key to the credit profile of these companies.

Globally, the rise of Chinese EV manufacturers is a growing threat. China has made an enormous investment in battery and EV manufacturing, and this has resulted in significant excess capacity. Chinese OEMs produce EVs at a cost that US and Europe cannot compete with and these manufacturers have aggressive global expansion plans. This growing threat has already led to higher tariffs in Europe and will likely result in protectionist policies in other countries.

Domestically, Tesla remains the only profitable EV manufacturer. GM expects the price of its battery packs to drop by $60/kWh in 2024 and another $30/kWh in 2025. This improvement is due to economies of scale as the company ramps EV production higher. The company expects its EV business to achieve a positive variable profit run rate by the end of this year. Ford remains significantly behind its peers and still expects losses of $5.0-$5.5 billion in its EV business this year.

In addition to the rising threat of Chinese manufacturers, traditional OEMs are also facing a rapidly changing consumer within the domestic Chinese market. Chinese manufacturers are producing better vehicles that are becoming more attractive to the Chinese consumer. Many legacy OEMs are struggling to adjust. This is particularly true with European auto manufacturers who have historically generated significant profits from China.

An often overlooked consequence of the slower pace of EV adoption is the impact it is having on the supplier base. Many suppliers to the traditional OEMs made a significant investment in EVs and are now finding that growth is not living up to original expectations. This is particularly true for the European supplier base, which is facing the dual headwinds of weak demand in Europe and a changing landscape for European OEMs in China.

Conclusion

Recent surveys still show that there is still significant consumer interest in EVs, and the global auto industry is chipping away at the roadblocks facing the adoption of EVs. Costs are coming down, improvements in battery technologies are addressing range anxiety and recharging options are becoming faster and more ubiquitous. The recent surge in HEVs is providing a bridge to the future as the industry addresses the headwinds that are giving consumers pause. While the trajectory of EV growth may be flatter than assumed a couple of years ago, it still appears to be upward sloping. That said, the path of EV adoption relies on an ever-changing regulatory landscape. The EV winter may be over, but the outlook is still a little cloudy.

1 Market sales data sourced from EV Volumes through Bank of America and Morgan Stanley

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.