Financial market uncertainty is a constant, but its complexity has grown. The globalized economy, evolving geopolitics, and rapid technological change all heighten volatility for insurers. While uncertainty cannot be eliminated, insurers can manage it through three strategic priorities: capital preservation, yield optimization, and portfolio diversification with flexibility.

Capital preservation demands strict discipline, utilizing duration matching, liquidity management, and stress testing. This approach protects against risks that might threaten solvency. However, with yield environments shifting from prolonged lows to rapid tightening cycles, insurers must also seek returns by allocating to higher yielding asset classes, including high yield debt, commercial mortgage loans, and private credit, while remaining mindful of risk tolerance. Diversification, across asset classes and time horizons, is the primary defense against volatility. It promotes innovation and resilient performance, especially when familiar strategies like investment grade bonds are insufficient.

Investment Trends and Industry Growth

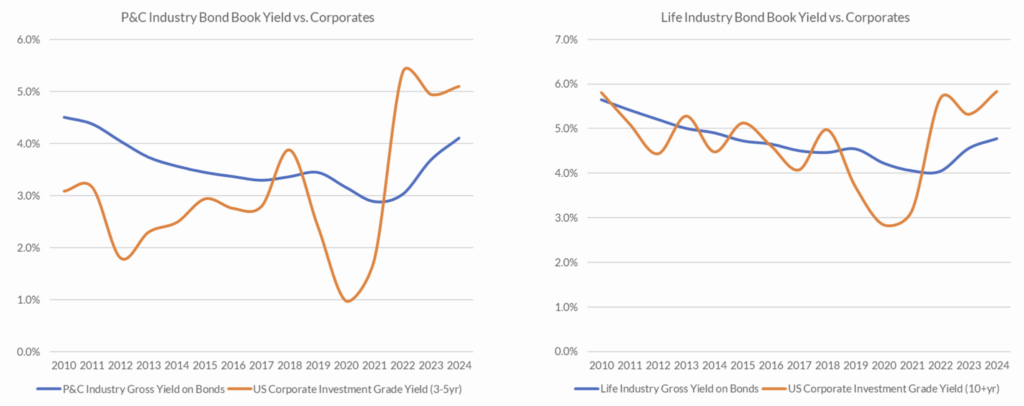

The insurance industry’s invested asset base has expanded steadily, surpassing $9 trillion. Growth in insurer earnings and surplus as it relates to investment portfolios is linked to equity market gains, benign credit conditions, and improved recurring investment income as new money has been put to work at higher interest rates. Book yield, which measures the portfolio’s earnings power, declined to historic lows in 2021 but have since rebounded, driven by rising new money yields. Average book yields now exceed 4% for Property & Casualty insurers and are projected to surpass 5% for Life and Annuity writers by the end of 2025. Recent yield curve steepening encourages investment in longer duration assets for additional return.

The Necessity for Diversification

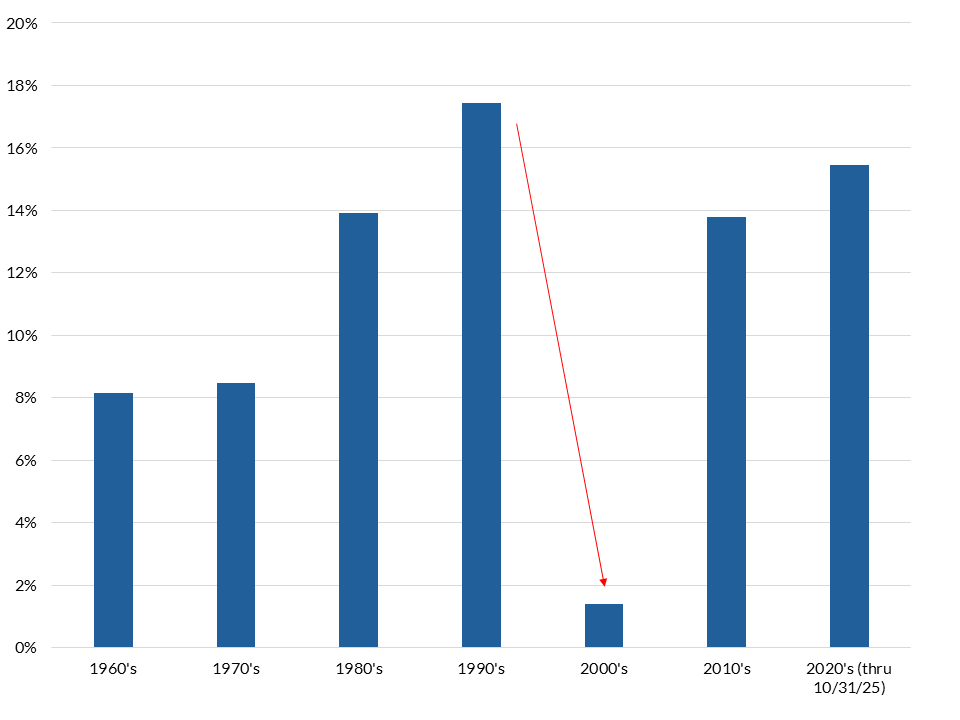

Equity allocations among P&C insurers have increased markedly, rising from 11% of investments in 2010 to 18% in 2024. Equities have been remarkably resilient, despite repeated shocks, now sitting close to all-time highs buoyed by major themes such as artificial intelligence. For insurers, diversified equity exposure, through exchange-traded funds (ETFs) or individual equities, has been a lifeline, especially during the low‑rate environment of the 2010s. For much of the last 15 years, the single biggest driver of an insurer’s investment results was simply how much exposure they had to U.S. equities. Their strong run raises the likelihood of mean reversion over the next cycle. U.S. equities delivered 14% average annual returns in the past 15 years, significantly above the historical norm of 8–10%.

S&P 500 Avg Annual Return by Decade

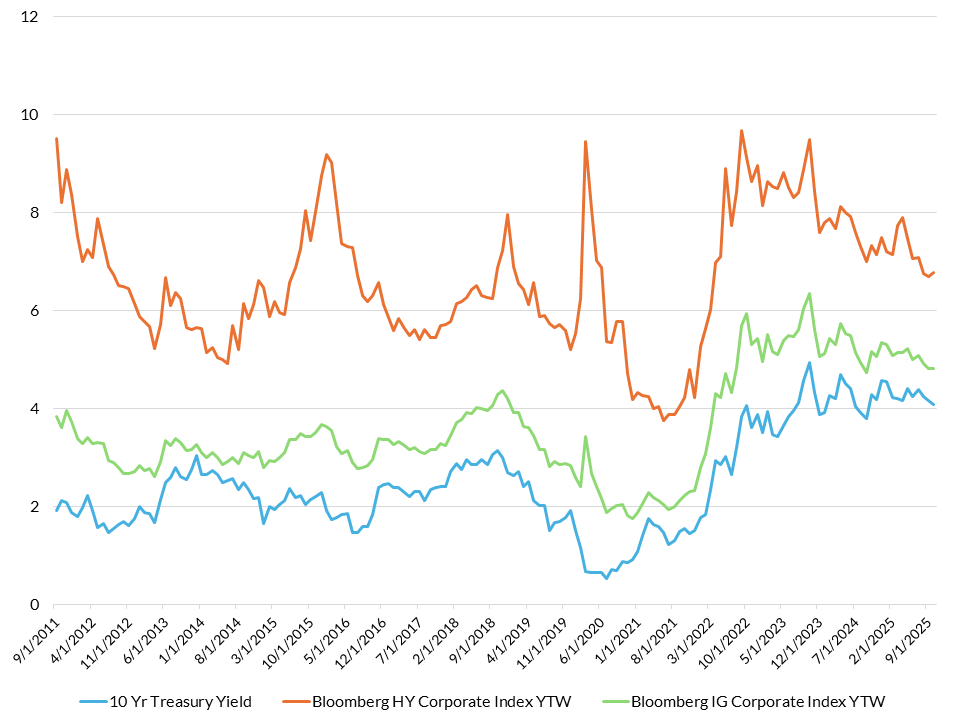

If long-term equity returns revert to their historical range of 8–10% annually, the comparative advantage of equities diminishes. In this scenario, stable bond yields of 6-7% with more favorable capital treatment become increasingly attractive. Unless there is a strong conviction that equity markets will repeat the exceptional performance of the last decade, insurers should view this as a timely opportunity to further diversify their portfolios.

10yr US Treasury Yield (%)

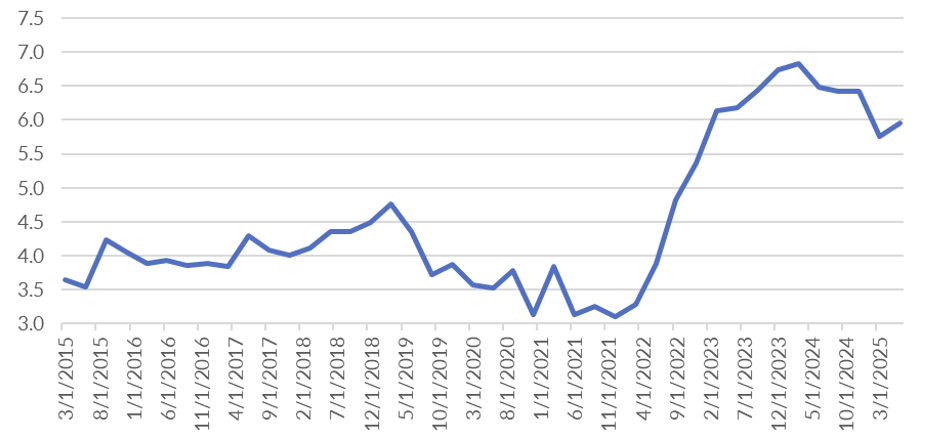

There has been increased allocation to private credit within insurance portfolios, especially among larger life insurers. However, this trend remains concentrated and has yet to see broad industry adoption. Notably, many high-yielding assets, such as commercial mortgage loans, which have recently offered life insurers yields in excess of 6% with investment grade credit quality, are still underutilized by smaller insurers. For example, only about 7% of P&C companies with less than $1 billion in assets currently have any exposure, highlighting a significant opportunity gap and the uneven pace of adoption across the sector.

Avg Yield on Insurer Cmmcl Mtg Loan Purchases (%)

Portfolio Construction and Strategic Readiness

Diversification is a cornerstone of effective risk management and long-term investment success. By allocating capital across a broad range of asset classes, sectors, and geographies, investors can mitigate risk exposure without necessarily sacrificing return potential. A diversified portfolio, constructed by combining assets with low or negative correlations, is the most powerful tool available to manage volatility, especially during periods of heightened uncertainty.

Through diversification, portfolios become more resilient to sudden market shocks and extreme events, minimizing the impact of any single loss and supporting steadier, more reliable growth over time. Importantly, effective diversification is not simply a matter of adding more asset types, it is about thoughtfully building a mix of holdings with differentiated responses to economic and market conditions, thereby optimizing the risk-return profile.

Reviewing and adjusting asset allocation is essential, as risk exposures can shift and new opportunities or vulnerabilities may emerge over time. When diversification is implemented strategically, investors benefit from enhanced downside protection and the potential for improved risk-adjusted returns throughout changing market cycles. Reviewing asset allocation regularly, every 2–3 years or after major business changes, and having predetermined rebalancing protocols is crucial. Insurers must overcome the comfort of the familiar, embracing new asset classes to improve risk-adjusted returns to position portfolios for long-term success.

Despite the overhang of uncertainty, the economy has been remarkably resilient and, while slowing, is expected to continue to grow. This backdrop may bring a modest reduction in new money yields as the Fed continues to cut rates, but we anticipate continued improvement in book yields for bond portfolios and a favorable credit backdrop from strong fundamentals.

Conclusion

Eliminating uncertainty is impossible, but preparing for it is essential. By focusing on disciplined risk management, yield optimization, and strategic diversification, insurance companies can transform uncertainty into an opportunity for growth and resilience in a changing market.