insight

AAM Investment Accounting Update – Year End 2016

January 19, 2017

INVESTMENT ACCOUNTING CHANGES

EVERY INSURANCE INVESTMENT OFFICER NEEDS TO KNOW

2016 Statement and statutory accounting changes

Quarterly and Annual Filings

[toc]

Schedule D Part 1 Guidance (2016-02BWG)

In December 2015, the Statutory Accounting Working Group issued a document to provide guidance on how to complete the description, issuer, issue, and capital structure information on Schedule D Part 1. In February 2016, the document was modified and added to the Annual Statement instructions. For Annual 2016 Schedule D parts 1 through 6 will have electronic only columns for Issuer, Issue, and ISIN to create consistency across the schedules. The electronic only column on Schedule D Part 1 for the Capital Structure Code was reduced to 4 categories shown below:

1. Senior Secured Debt

2. Senior Unsecured Debt

3. Subordinated Debt

4. Other

Effective Annual 2016.

Schedule D Part 1A Section 1 and Schedule D Part 1B (2015-25BWG)

For Schedule D, Part 1A, Section 1 (annual) and Schedule D, Part 1B (quarterly), the reference to “non-rated” was removed from the instructions and clarification instructions were added for Footnote “d” of Schedule D, Part 1A, Section 1 and Footnote “a” of Schedule D, Part 1B. The footnotes should include the total book/adjusted carrying value amount of securities reported in Schedule DA and Schedule E, Part 2 for the current statement filing by NAIC category.

Effective Annual 2016.

Foreign Codes (2016-06BWG)

The number of foreign codes on Schedule D have been reduced from 12 to 4 (see below) and the foreign code matrix has been removed.

A. For Canadian securities issued in Canada denominated in U.S. Dollars

B. For those securities that meets the definition of foreign provided in the Supplemental Investment Risk Interrogatories and pays in currency other than U.S. dollars

C. For foreign securities issued in the U.S. and denominated in U.S. dollars

D. For those securities that meet the definition of foreign provided in the Supplemental Investment Risk Interrogatories denominated in U.S. dollars (e.g. Yankee bonds, Eurodollar bonds)

Effective Annual 2016.

Bond Characteristics (2016-07BWG MOD)

The Schedule D Part 1 Annual Statement Instructions have added clarification to the Bond Characteristics Code column. If bonds have more than one characteristic, then the characteristics should be separated with a comma. If none of the characteristics apply, then leave it blank. The new bond characteristics are below:

- Bonds that are callable at the discretion of the issuer and the call price will never be below par based on a specified formula for the payoff amount generally referred to as a “make whole call provision.”

- Bonds that are callable at the discretion of the issuer and the call price will never be below par with a specified payoff amount based on a fixed schedule.

- Bonds that are callable at the discretion of the issuer at a price that can be less than par.

- Bonds in which the timing of payments of principal, as well as the amounts and timing of payments of interest can vary based on a pool of underlying assets or an index. This should include agency and non-agency residential mortgaged-backed securities (RMBS); some commercial mortgaged-backed securities (CMBS); as well as similar Loan-backed or Structured Securities. This excludes those flagged with #1, 2, or 3.

- Variable coupon bonds where the interest payments vary during the life of the transaction, but NOT as is typically based on a fixed spread over a well-established interest rate index such as LIBOR, prime rate or a government bond yield. This includes coupons that vary based on the performance of indices that are not interest rate related such as equity indices, commodity prices or foreign exchange rates. This also includes coupons where the spread to the index is not fixed for the entire life of the transaction. This excludes basic floating rate and adjustable rate notes with fixed spreads over an interest rate index.

- Terms that may result in principal (or initial investment) not being repaid in full for reasons other than a payment default by the issuer or defaults within a pool of assets underlying a Loan-backed or Structured Security. (This includes Insurance-Linked securities such as catastrophe bonds, Interest Only Strips (IOs), mortgage-referenced transactions or other issuer obligations that are not actually backed by a pool of assets but where the obligation to pay is tied to an index or performance or a pool of assets).

- Bonds where the issuer’s obligation to make payments is determined by the performance of a different credit other than that of the issuer, which could be either affiliated or unaffiliated. (These securities are often referred to as credit-linked notes. This does not include Loan-backed or Structured Securities).

- Mandatory convertible bonds. Bonds that are mandatorily convertible into equity, or, at the option of issuer, convertible into equity, or whose terms provide for payment in the form of equity instead of cash.

- Other types of options solely at the discretion of the issuer that could affect the timing or amount of payments of principal and interest, not otherwise reported in 1-8.

Effective Annual 2016.

Note 5 – Restricted Assets (2016-12BWG MOD)

The disclosure for Restricted assets was renamed “Gross Admitted and Non-admitted Restricted” and a column was added for “Total Non-admitted restricted assets.”

Effective Annual 2016.

Note 5 – 5* Securities (2016-14BWG MOD)

A new disclosure has been added for 5* Securities. The disclosure will include a comparison of the annual reporting period to the prior annual reporting period and will include the following:

- The number of 5* securities

- Investment type

- Book adjusted carrying value

- Fair value

Effective Annual 2016.

SVO Identified Funds (2016-18BWG MOD)

As part of the Investment Classification Project to clearly identify securities, Bond Mutual Funds and Bond Exchange Traded Funds that are approved to be reported as bonds on Schedule D Part 1 and DA Part 1, will have a separate reporting category section called “SVO Identified Funds”. The new category lines are as follows:

- Exchange Traded Funds – as Identified by the SVO

- Bond Mutual Funds – as Identified by the SVO

With the addition of the new category, the column 3 code {*} for Bond Mutual Funds and {#} Exchange Traded Funds have been removed from Schedule D Part 1.

A new section for SVO Identified Funds was added to the Schedule D Part 1A Section 1 along with a new column for “No Maturity Date.”

Effective Annual 2016.

General Interrogatories (2016-22BWG)

The General Interrogatories Part 1 question regarding investment managers and broker dealers has been modified to highlight the extent of an insurer’s use of investment managers. This includes identification of all investment managers, advisors, broker/dealers, and individuals making investment decisions on behalf of the insurer. The new requirements are below:

- Both Internal and External

- Affiliated or Unaffiliated

- % of investments handled

Effective Annual 2016.

Removal of the Class 1 List from the P&P Manual (2016-05) and Movement of Money Market Mutual Funds (2016-33 BWG)

- Effective October 14, 2016, under regulations recently adopted by the U.S. Securities and Exchange Commission (SEC), institutional prime money market funds are required to report a floating net asset value (NAV) instead of a stable net asset value (NAV). The money market mutual funds included in the NAIC’s Class 1 List in Part Six, Section 2 (b) (ii) of the Purposes and Procedures Manual (P&P Manual) fit the SEC definition of institutional prime funds. Therefore, such money market funds can no longer report stable NAV and accordingly will no longer be eligible for bond treatment under statutory accounting. For this reason, the Class 1 List has been removed from the P&P Manual. For Annual 2016, all money market mutual funds will be considered short-term and be reported on Schedule DA. The former Class 1 money market mutual funds will be renamed to “All other money market mutual funds” and accounted for under SSAP No. 30—Investments in Common Stock (excluding investments in common stock of subsidiary, controlled or affiliated entities). There will be no change to the accounting for the money market mutual funds on the ‘NAIC U.S. Direct Obligations/Full Faith and Credit Exempt List’ that are accounted for under SSAP No. 26—Bonds, excluding Loan-backed and Structured Securities. Going forward, effective Annual 2017, all money market mutual funds will be reported on Schedule E Part 2.

Statutory Accounting Updates Adopted for 2017

Prepayment Penalties and Presentation of Callable Bonds (2015-23)

After much discussion and review, there are revisions to SSAP No. 26—Bonds, excluding Loan-backed and Structured Securities and SSAP No. 43R—Loan-backed and Structured Securities to clarify the amount of investment income and/or realized capital gains/losses to be reported upon disposal of an investment. Below is a summary of the revisions:

- Prepayment penalties or acceleration fees should be reported as investment income when received.

- The amount of investment income should be calculated as total proceeds less par value.

- The amount of realized gain/loss should be calculated as the difference between book adjusted carrying value and par value.

A new disclosure will be added to Note 5 that will require the reporting entity to identify the amount of investment income generated as a result of a prepayment penalty and/or acceleration fee, such as with a make-whole call. This update will be effective January 1, 2017 with prospective treatment. Since some companies are already using this method, early adoption is permitted.

GAAP Updates

Classification and Measurement

In January 2016, the Financial Accounting Standards Board (FASB) issued Financial Instruments – Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities (ASU 2016-01). The FASB has been working on this project for over 3 years and ultimately has issued guidance that does not significantly change the existing classification and measurement model. It is effective for public entities fiscal years and interim periods beginning after December 15, 2017. For non-public entities, it is effective for fiscal years beginning after December 15, 2018 and interim periods within fiscal years beginning after December 15, 2019. Below is a summary of the key components:

- The current classification model will remain in place, except for equity securities.

- Equity securities, including funds that are invested in debt instruments, will be measured at fair value through net income, with the following two exceptions:

- Equity securities that qualify for Equity Method accounting

- Equity securities that do not have readily determinable fair values may qualify for the “practicability exception” and therefore will be measured at cost, less any impairments, plus or minus any price changes observed from an orderly transaction.

- The new standard establishes qualitative indicators to consider when determining if an equity security that is, accounted for under the “practicability exception” is impaired and would therefore be written down to its estimated fair value. These qualitative indicators include:

- A significant deterioration in the earnings performance, credit rating, asset quality, or business prospects of the investee

- A significant adverse change in the regulatory, economic, or technological environment of the investee

- A significant adverse change in the general market condition of either the geographical area or the industry in which the investee operates

- A bona fide offer to purchase, an offer by the investee to sell, or a completed auction process for the same or similar investment for an amount less than the carrying amount of that investment

- Factors that raise significant concerns about the investee’s ability to continue as a going concern, such as negative cash flows from operations, working capital deficiencies, or noncompliance with statutory capital requirements or debt covenants.

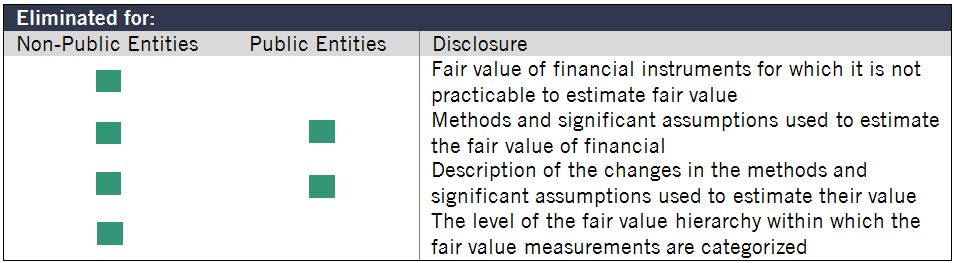

- Eliminates some fair value disclosures found in ASC 825-10-50-10 related to financial instruments not measured at fair value:

- Requires entities to present financial assets and liabilities separately by measurement category (available-for-sale, trading and held-to-maturity) and form (securities, loans, and receivables).

- Clarifies that entities should evaluate the need for a valuation allowance on a deferred tax asset related to available-for-sale securities in conjunction with other deferred tax assets.

Bifurcation of Embedded Derivatives – Contingent Put and Call Options

In March 2016, the FASB issued Derivatives and Hedging (Topic 815): Contingent Put and Call Options in Debt Instruments (ASU 2016-06). This standard outlines a four step approach (see below) to determine if an embedded contingent put or call option should be bifurcated from its host and accounted for separately. When evaluating a contingent put or call option, one shall not take into account the event that triggers the contingent option. Assume a bond contains an option where the investor can put the bond at 101 when the Dow Jones Index breaches 20,000, the feature related to being able to put the bond at 101 would be assessed in the four step process. The feature related to the Dow Jones Index breaching 20,000 would not be assessed. In practice, entities had reviewed both of these components, which led to reporting variations and ultimately led the FASB to issue this clarification.

Four Step Method:

Step 1: Is the amount paid upon settlement (also referred to as the payoff) adjusted based on changes in an index? If yes, continue to Step 2. If no, continue to Step 3.

Step 2: Is the payoff indexed to an underlying other than interest rates or credit risk? If yes, then that embedded feature is not clearly and closely related to the debt host contract and further analysis under Steps 3 and 4 is not required. If no, then that embedded feature shall be analyzed further under Steps 3 and 4.

Step 3: Does the debt involve a substantial premium or discount? If yes, continue to Step 4. If no, further analysis of the contract under paragraph 815-15-25-26 is required, if applicable.

Step 4: Does a contingently exercisable call (put) option accelerate the repayment of the contractual principal amount? If yes, the call (put) option is not clearly and closely related to the debt instrument. If not contingently exercisable, further analysis of the contract under paragraph 815-15-25-26 is required, if applicable.

For public entities it is effective for fiscal years beginning after December 15, 2016, including interim periods within those fiscal years. For non-public entities, it is effective for fiscal years beginning after December 15, 2017 and interim periods within beginning after December 15, 2018. Early adoption is permitted.

Equity Method

In March 2016, the FASB issued Investments –Equity Method and Joint Ventures (Topic 323): Simplifying the Transition to the Equity Method of Accounting (ASU 2016-07). This amendment removes the requirement that entity retrospectively make financial adjustments when an available-for-sale or cost method investment subsequently qualifies for Equity Method accounting. The new guidance allows an entity to adjust the basis to account for the additional interest, if applicable, and recognize any OCI unrealized gain/loss in earnings. It is effective for all entities for fiscal years beginning after December 15, 2016.

Credit Losses/Impairments

In June 2016, the FASB issued Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (ASU 2016-13). This standard includes the current expected credit loss (CECL) method, which requires reporting entities to establish an allowance for credit losses that are expected to be incurred over the lifetime of the assets. At each reporting period, the allowance should represent Management’s current estimate of the expected credit losses. The estimate should be calculated after grouping the financial assets into pools based on their risk characteristics. If a financial asset cannot be grouped into a pool, it can be evaluated individually. The movement in this allowance would be recognized in income. Therefore, this model allows for an immediate reversal of credit losses recognized on assets that have an improvement in expected cash flows.

Although this standard includes most debt instruments, securities classified as available-for-sale (AFS) are not included in the CECL model. However, the credit loss guidance for AFS securities will be moved from Topic 320 to Topic 326, along with some targeted changes that are mentioned below:

- An allowance for credit losses would be calculated at the individual security level each reporting period. The allowance would be equal to the amount that amortized cost exceeds the present value of expected future cash flows. However, the valuation allowance for credit losses shall not exceed the unrealized holding loss.

- This approach allows for impairment losses to be reversed as credit losses or the impaired status evaporates.

- The requirement to consider the length of time a security has been underwater to determine if a credit loss exists would be removed.

- The requirement to consider additional declines in fair value or recoveries subsequent to the balance sheet date would no longer be required when estimating if a credit loss exists.

- An allowance for credit losses roll-forward disclosure will be required each reporting period

In addition to AFS securities, the FASB decided to remove the following financial assets from the proposal’s scope:

- Loans made to participants by defined contribution employee benefit plans

- Policy loan receivables of an insurance entity

- Pledge receivables of a not-for-profit entity

- Related party loans and receivables

ASU 2016-13 will be effective for public, SEC filing entities for fiscal years beginning after December 15, 2019, including interim periods within those fiscal years. For public, non-SEC filing entities, it will be effective for fiscal years beginning after December 15, 2020, including interim periods within those fiscal years. For all other entities, it will be effective for fiscal years beginning after December 15, 2020, and interim periods within those fiscal years beginning after December 15, 2021.

Statement of Cash Flows – Restricted Cash

In November 2016, the FASB issued Statement of Cash Flows (Topic 230): Restricted Cash (ASU 2016-18). This amendment requires entities to include restricted cash and cash equivalents with the cash and cash equivalents reported on the Statement of Cash Flows. In addition, the standard requires a reconciliation of cash, cash equivalents, and restricted cash reported on the Statement of Financial Position that agrees with the total cash, cash equivalents, and restricted cash reported on the Statement of Cash Flows.

ASU 2016-18 is effective for public business entities for fiscal years beginning after December 15, 2017, and interim periods within those fiscal years. For all other entities, the amendments are effective for fiscal years beginning after December 15, 2018, and interim periods within fiscal years beginning after December 15, 2019. Early adoption is permitted.

Written by:

Joe Borgmann, CPA, Director of Investment Accounting

and

Stacy Crook, Vice President Investment Accounting

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.