MARKET SUMMARY AND OUTLOOK

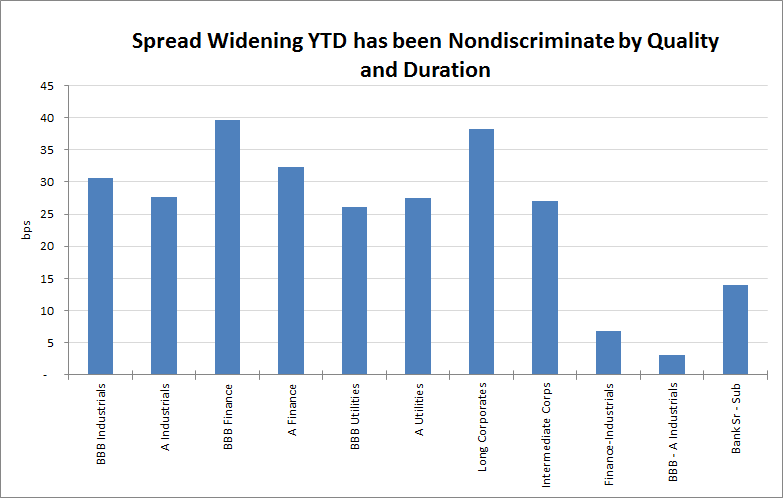

The Investment Grade (IG) Corporate bond market (per Bloomberg Barclays Index) delivered a lackluster -1% total return in the second quarter 2018, with spreads widening 14 basis points (bps). The IG market underperformed the S&P Index which returned 3.4% and high yield (1%). As trade tensions escalated and the USD strengthened, Emerging Markets (debt and equity) underperformed. Corporate bonds with longer maturities underperformed with demand increasing for shorter maturity bonds given the flattening of the yield curve. Spread widening was fairly even across credit ratings, with ‘BBB’s slightly underperforming ‘A’s. Financials outperformed Industrials.

A solid earnings season and optimistic outlook was overshadowed by headlines regarding Italy, trade wars, and M&A in addition to a continuation of weak market technicals. Demand from foreign investors and funds for IG bonds remains lower vs. last year, and supply remains an overhang with higher than expected new issue supply and dealer inventory levels.

One of our credit cycle indicators is raising a cautionary flag given the flattening that has occurred in the Treasury curve. While many are quick to say “it’s different this time,” we understand the curve itself has an effect on investment behavior and economics, which eventually causes risk to reprice. An inverted yield curve is a more serious signal, but one should not ignore a flat curve even though it may take some time for credit spreads to reprice. Looking at points in history when the curve is flattening, spreads are on average about 40 bps wider than the subsequent year.

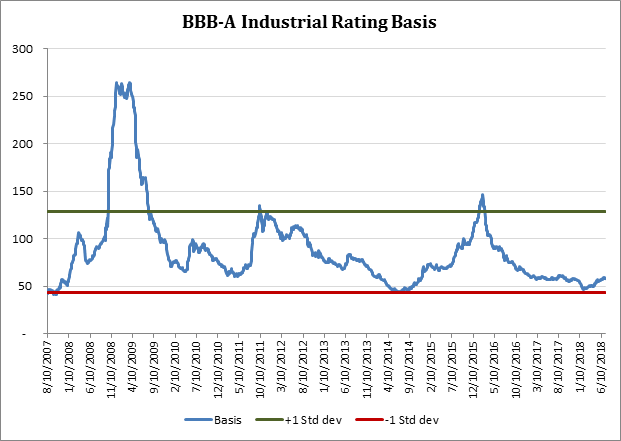

We expected very pedestrian performance from the IG market this year given the OAS at year end 2017 of 93 bps. While spread volatility has remained fairly low year-to-date (11 bps YTD), the potential for spread widening is higher over the intermediate term. We believe there will be attractive entry points as a result of the increased size of the debt markets, higher debt leverage of companies at this point in the cycle along with the structural changes in the market. Despite starting this year in a fairly defensive position, we are taking the opportunity to reduce our BBB exposure to increase flexibility when spreads widen materially. Historically, spreads for BBB rated credits widen twice the rate of A/higher rated credits.

Performance Summary Year-To-Date

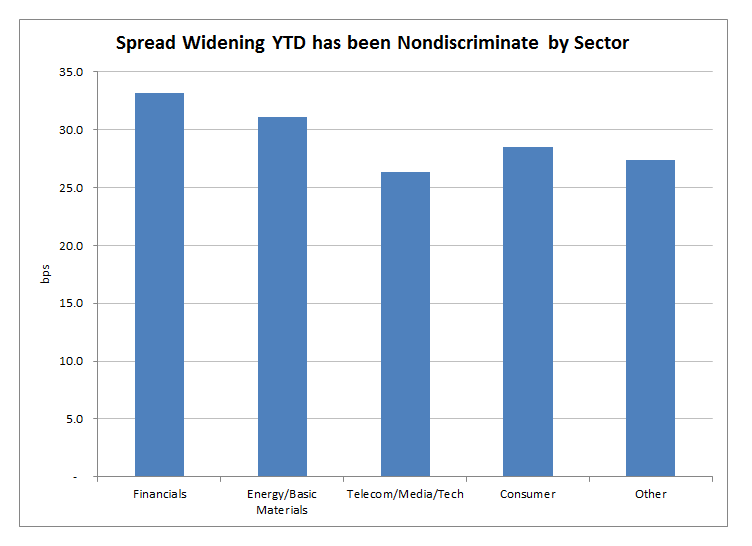

Spreads widened in the second quarter, with OAS 14 bps wider for the market index. The widening related to: (1) headlines associated with mergers and acquisitions (M&A) in sectors such as Telecom, Cable and Media (2) weaker technicals, specifically related to higher than expected new issue supply and dealer inventories particularly on the long end, impacting longer duration sectors such as Railroads and Life Insurance and (3) headlines related to Italy, impacting the Bank sector, subordinated bonds in particular. Sectors that outperformed included: Energy, Consumer related sectors, and more defensive sectors such as Capital Goods and Utilities. Despite these nuances, spreads are wider for all sectors year-to-date.

Credit Market Fundamentals

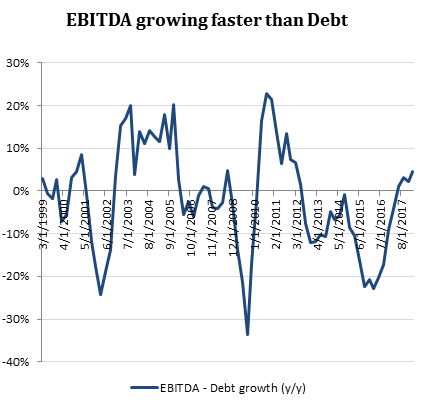

Stronger worldwide growth continued to benefit EBITDA growth in the first quarter of the year, allowing firms to slightly deleverage as it outpaced the growth rate of debt.

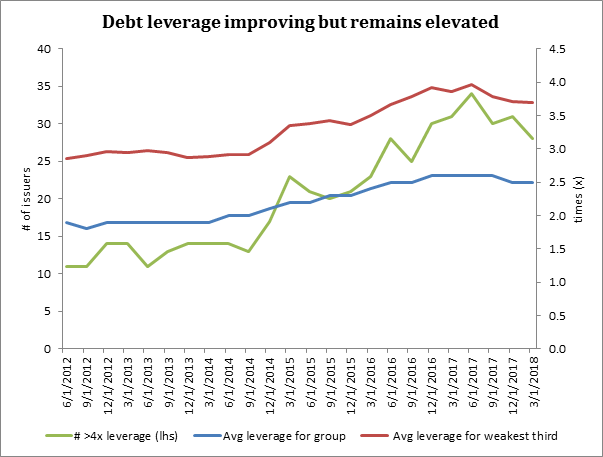

While the number of issuers with very high leverage (i.e., >4.0x) has fallen from the peak in mid 2016, it remains elevated as does leverage for the group as a whole. While we had expected leverage to improve this year, we believe that may be postponed in light of debt funded M&A. We expect deal activity to remain elevated in growth challenged sectors like Media, Healthcare, Food & Beverage, among others which represent about 20% of the market.

Market Opportunities

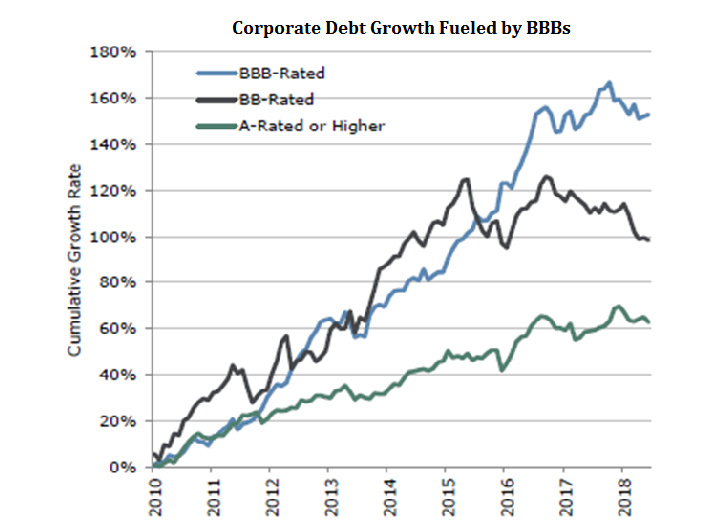

The IG market has more than doubled in size and a lot of that growth has come from BBB rated securities, as the exhibit below shows.

Given the lack of risk premium for BBB rated securities, the level of debt levearge previously discussed and likely pause in fundamental improvement due to leveraging M&A concurrent with late cycle indicators (namely flattening of 2s-10s Treasury curve), we are using this opportunitiy to reduce risk in the Corporate Credit sector, namely BBBs.

_____________________________________________________________________________________________________________________________________________

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.