Market summary and outlook

The Investment Grade (IG) Corporate bond market (per Bloomberg Barclays Index) returned to positive territory in the first quarter, delivering a 5% total return, with spreads tightening 34 basis points (bps). The IG market underperformed the S&P Index, which returned 14% and High Yield (per Bloomberg Barclays Index) 7%. Worldwide equity markets are very optimistic, while the Treasury market continues to reflect caution. Which market will prove to be correct?

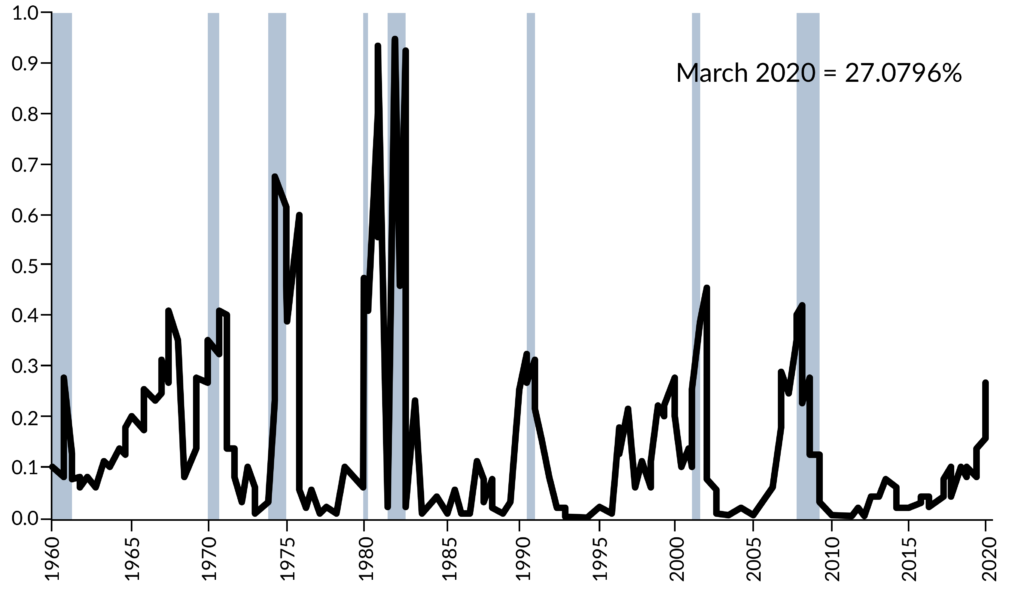

Risk premiums have fallen this year in the equity and credit markets. Investors expect: (1) the Fed to be more apt to cut rates, (2) a China trade agreement and resumption of growth, driving a second half 2019 earnings recovery and (3) the avoidance of a hard Brexit and/or European recession. The Treasury curve reflects the expectation for lower growth, predicting a 27% probability of a recession next year per the NY Fed (see Exhibit 1).

Corporate spreads have tightened more than we expected for the year. We remain comfortable investing in the sector given improved financial conditions and our outlook for 2%+ GDP growth. However, lackluster valuation and our expectation for heightened volatility and margin pressure causes us to build liquidity and flexibility to add at more attractive levels.

Exhibit 1: Probability of US Recession Predicted by Treasury Spread* – Twelve Months Ahead (month averages)

Source: Bloomberg as of 4/2/2019

Performance summary

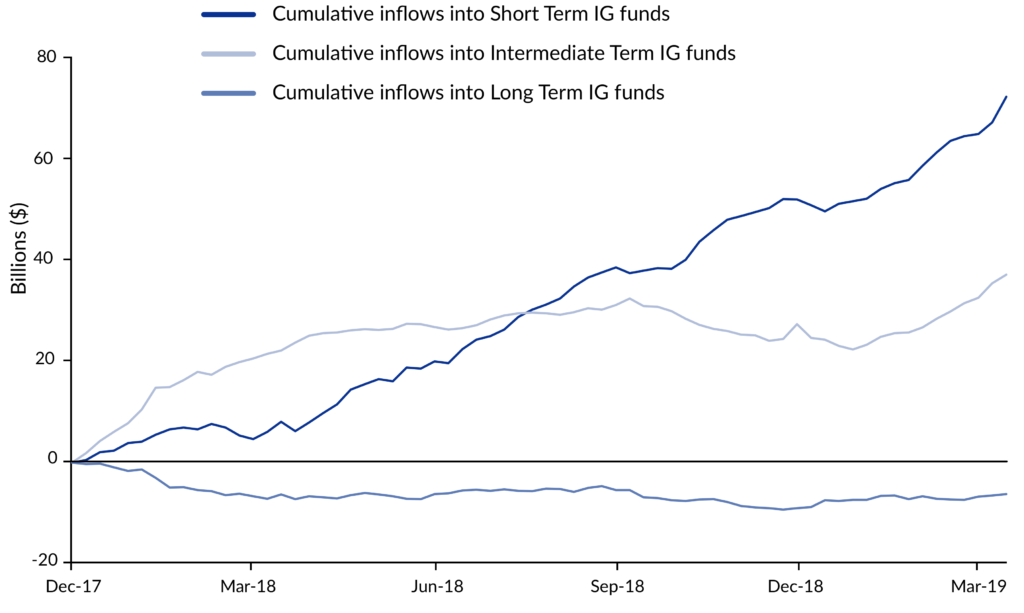

The year started with more attractive valuations and a heightened level of concern regarding economic growth (China in particular). Since that time, Chinese economic data has surprised to the upside and trade related tensions have eased. Importantly, the Fed has pivoted to a more dovish position, and US economic data seems to support that view. An outlook for lower yields and economic growth around 2% increased the demand for fixed income. As shown in Exhibit 2, shorter maturities have benefited, and credit curves have steepened.

Exhibit 2: IG Cumulative Flows Across Tenors

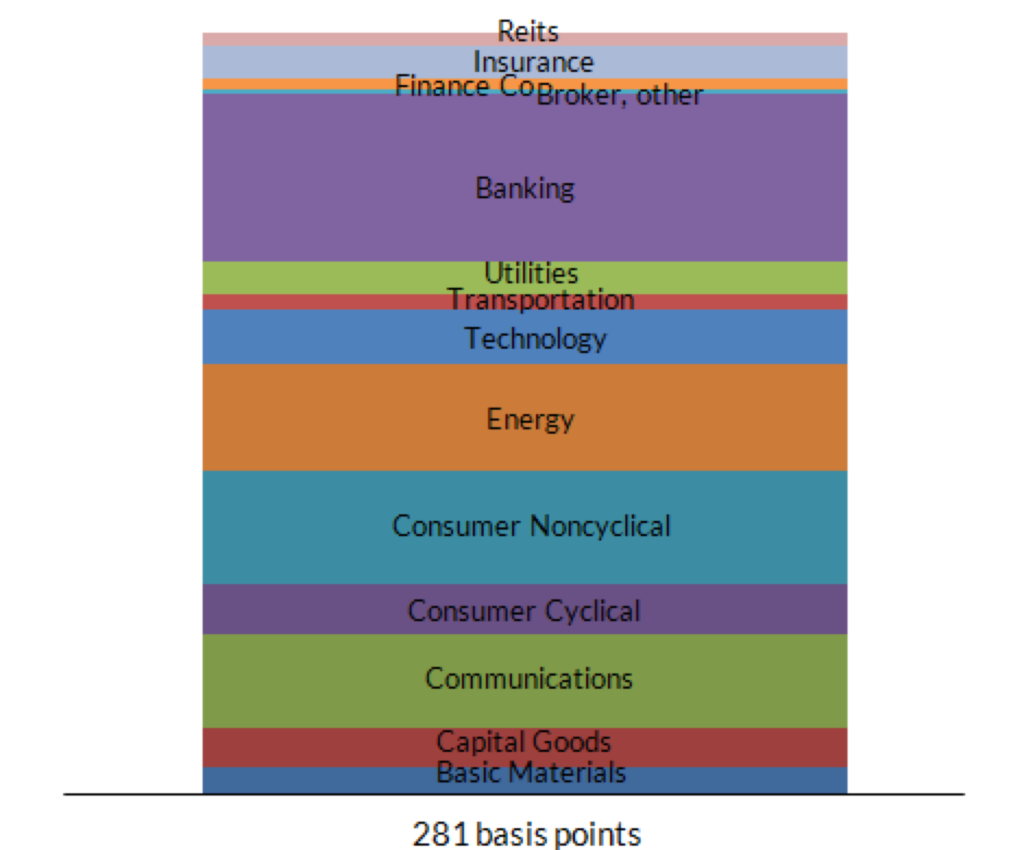

The Energy, Communications and Banking sectors outperformed, which we would expect in a high beta rally given the liquidity in these sectors. BBB rated securities also outperformed. The basis between BBB and A-/higher rated non-Financial credits has narrowed modestly but remains around its historic average which is fair. Debt issuance has tracked last year’s pace.

Exhibit 3: Contributors to IG Corporate Excess Returns 1Q2019

Credit market fundamentals

We anxiously enter the first quarter reporting season, expecting weak first quarter results to be outweighed by optimistic outlooks. Sectors that were impacted by China trade tensions and/or economic deceleration are expected to rebound sharply in the second half (Materials, Technology). Consumer sectors are also expected to benefit as confidence improves. However, the trajectory of growth has shifted lower and wage pressures are rising. That earnings pressure coupled with low interest rates increases event risk. Companies that have pursued this have been rewarded by equity holders. We expect increased event risk to place more pressure on spreads in the upcoming quarters.

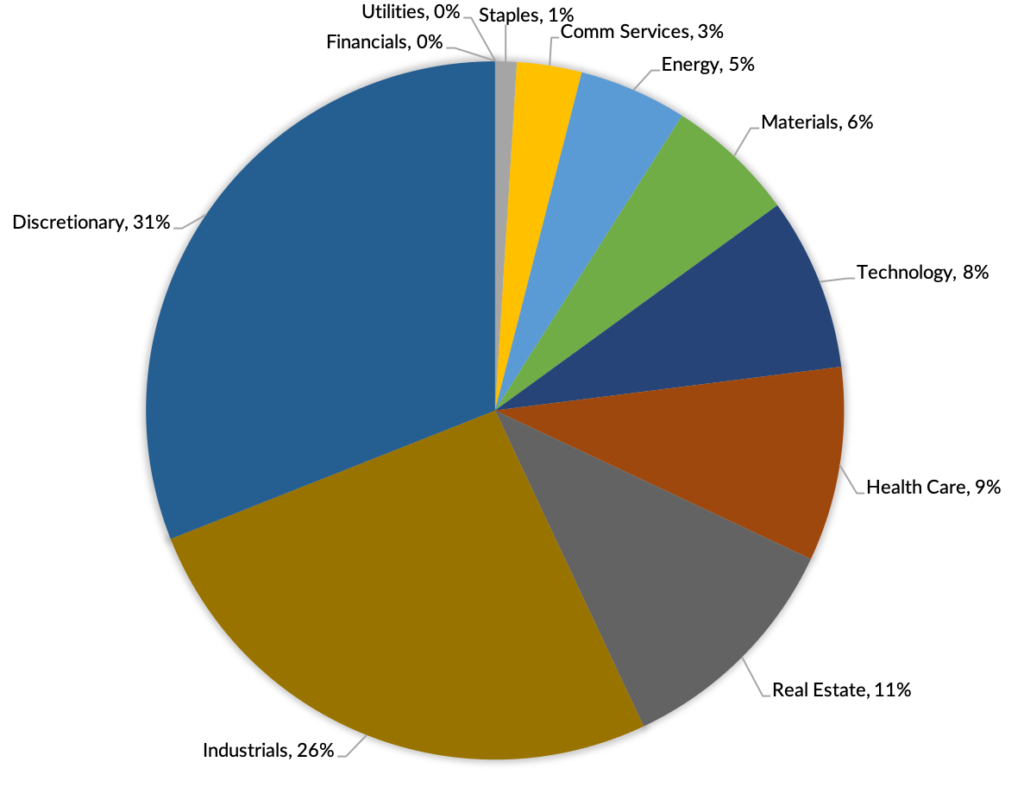

In regards to the expectation for an earnings recession in the first half of 2019, a number of factors are driving this. First, revenue declines are anticipated in sectors like Technology and Energy that are more closely tied to global growth and China in particular. Foreign exchange is a headwind for companies on a revenue and/or cost basis. Lastly, higher wages and labor costs are becoming more problematic. The unemployment gap (difference between actual unemployment rate and long-run natural rate) has been negative since 2017, placing pressure on wage growth. An increasing number of industries are experiencing above-trend wage growth (Morgan Stanley, “Wage Pressures: Risks from Labor Costs Rising,” 04/15,19) and citing labor as their most important problem (NFIB survey). This is an issue as top line growth slows. For fixed income investors, this is especially problematic given the degree of debt leverage at corporations. Despite this, we do not expect material deleveraging this year, and with this margin pressure, leverage may rise. Only those companies that are forced to reduce debt because of their very large capital structures will do so. The cost of debt is simply too low for the majority of companies.

Exhibit 4: Earnings Transcript Mentions of Labor Cost – 4Q2018 Breakdown

Source: Alphasense, Morgan Stanley Research as of 3/31/2019

Liquidity has fallen, with companies maintaining the lowest cash balance relative to debt since 2008. Repatriation was one driver of this, but the trend was not isolated to those companies. This may reflect the confidence companies have in the markets, or the pressure management teams face from activist investors. Debt leverage remained broadly stable in 2018 vs. 2017, as additional debt incurred due to M&A and share repurchases offset the reduction in debt driven by changes in the tax law or industry pressures. In regards to capital spending, we expect very modest growth this year and next. We expect this to largely track economic growth expectations.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.