insight

Streamlined Asset Allocation For P&C Insurers with the AAM Risk Score

December 22, 2021

Download PDF“Everything should be made as simple as possible, but not simpler.”

– Albert Einstein

We believe asset allocation is one of the most crucial pillars of investment success, and arguably can be the largest determinant of long-term risk and return. As investment managers for the insurance industry, AAM has designed and managed successful asset allocation strategies for our clients for many years. Recently we recognized a pair of growing priorities in how Property & Casualty (P&C) insurers approach this topic:

-An increased focus on Enterprise Risk Management (ERM), translating to a need for a holistic approach to asset allocation that integrates investment risk with the overall riskiness of the firm, and has the flexibility to measure and report risk and return in a way that aligns with the firm’s preferred risk budgeting approach

– Since insurers vary in their level of internal investment experience and may have a limited sense of their investment risk tolerance or return objectives “in a vacuum”, we found it was often helpful to provide a preliminary asset allocation integrating both industry norms and the insurer’s unique strengths and weaknesses. This provides a starting point for discussing investment risk/return tradeoffs, and can be either approved and implemented as-is or modified with additional parameters derived from these discussions. In short, it’s often easier to have constructive discussions about investment risk with an example on the table, rather than grappling with the topic ex nihilo.

Given these points, we developed a new approach to generating asset allocation strategies that incorporates a variety of financial strength and volatility measures to reflect an ERM perspective, while also allowing us to generate modeled allocations in an efficient, streamlined way that caters to clients with 1) limited available time or investment experience to dedicate to identifying an appropriate investment risk/return appetite, and/or 2) a preference to see a candidate allocation for context, that can then be either directly implemented, or iterated as many times as necessary.

This approach is based around a measure we call the AAM Risk Score. This is a simple tool that incorporates key measures of insurer profitability, volatility, and leverage, in an attempt to properly offset non-investment enterprise risks with a suitable level of investment risk. It’s used to model an appropriate level of stress-case investment loss tolerance, a level that can then be applied to our Asset Allocation Optimization to produce a corresponding allocation that incorporates our latest projections of risk, return, and correlations of different asset classes.

Defining the Risk Score

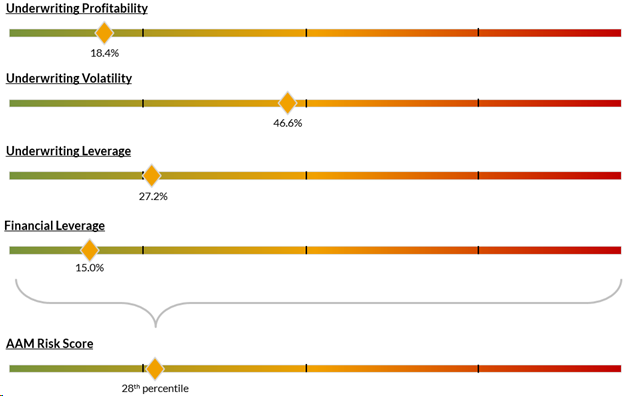

Simply put, the AAM Risk Score integrates a variety of non-investment risk metrics, normalized against a collection of business line peers. It is expressed as a percentile score of riskiness (lower = less risky) vs a group of dozens or hundreds of insurers writing similar lines. This graphic illustrates the four categories of risk metric for a sample P&C insurer, and their integration into a single unified score:

This insurer’s data reflects strong underwriting and low leverage, though with underwriting volatility close to the peer median. This combination results in a low Risk Score at the 28th percentile of the peer group, which implies an above-average capacity to bear investment risk.

The subcomponents of the Risk Score were carefully chosen from a much longer list of financial ratios for the degree to which they all directly influence an insurer’s business risk with a minimum of overlap, while also being clear and intuitive to describe and understand. We believe the resulting composition strikes a prudent balance between analytical rigor, and focused simplicity.

Translating to Investment Risk Tolerance

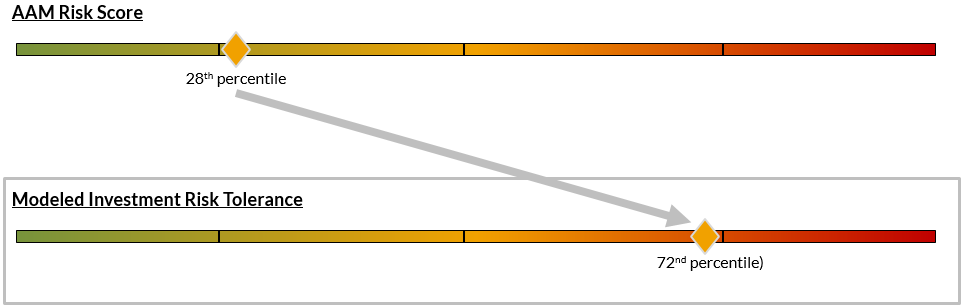

With the Risk Score in hand, the next step is to identify an appropriate level of investment risk to offset the insurer’s other risks. Following the ERM principle of balancing riskiness across different activities, the lower the Risk Score (which, recall, incorporates everything except investment risk), the higher the presumed tolerance for investment risk, and vice versa:

Here we see that for our sample P&C insurer, low overall non-investment risk translates into above-median potential to tolerate investment risk.

Ultimately all companies are unique and many insurers may prefer to be more or less aggressive with their investments based on their preferences and return objectives. Others may not have a particular pre-existing view about how risky their portfolio should be, and providing a modeled risk tolerance rooted in industry norms can clarify the question and lead to constructive discussions about whether to implement the results as-is or make adjustments using the context established by the model.

We generally use 99.5% Value-at-Risk (VaR) / Surplus as the primary investment risk measure for asset allocation purposes. This indicates the amount of statutory surplus that would be lost in a 1-in-200 market value decline. We believe this measure captures the essential risk posed by assets such as equities or high yield bonds: the potential for periods of rapid market value declines (as seen in early 2020), which encompass both attendant mark-to-market impact on surplus, and consequent potential for forced sales at distressed prices to cut losses. It also aligns intuitively with the 1-in-200 Probable Maximum Loss, which many of our clients use as an important measure of underwriting tail risk. For reference, the 72nd percentile Investment Risk Tolerance value in the graphic above corresponds to a 99.5% VaR / Surplus of 9.74%, i.e. our model suggests this insurer should be able to tolerate a surplus loss of 9.74% in an investment stress scenario. This value will come up again momentarily.

We believe risk asset exposure should be set at a level where periodic stress scenarios will be tolerable in their impact on surplus, allowing the insurer to ride out the decline without selling and fully participate in the subsequent recovery. In fact, a well-designed rebalancing strategy may recommend additional investment during periods of market decline. Risk models of volatile assets can never perfectly account for all potentialities, but VaR is a widely accepted and easy-to-conceptualize measure that strikes a prudent balance between sophistication and transparency.

Producing an Asset Allocation

There are two main types of ingredients to an asset allocation optimization:

1) Asset assumptions, including returns, yields, volatilities, correlations, and also more nuanced characteristics like risk-based capital impact, liquidity, accounting treatment, etc.

2) Investor goals and tolerances, including optimization for total return vs. yield (or some combination of the two), GAAP vs. STAT accounting focus, surplus volatility tolerance, taxable realized gain tolerance, etc.

While the math of performing an optimization when all parameters have been fully defined is straightforward, the nuance all lies in those definitions. Optimizations are usually highly sensitive to initial assumptions, and minor changes in those assumptions can often produce very different portfolio recommendations. We believe there are several principles an optimization must follow to be useful and plausible:

– Asset return and volatility assumptions should reflect both current market conditions and long-term history across market cycles, recognizing that this often requires judgment and compromise

– Similarly, return expectations should be multi-year average expected returns. Short-term return expectations on volatile assets are too inherently speculative to drive important strategic decisions

– Volatility and correlation assumptions should recognize that for many assets, “normal” vs. “stress” behaviors are very different things. There is little real diversification benefit to holding two assets that are “normally” just 60% correlated but always experience their worst declines simultaneously

– Stress-case loss (again, modeled as 99.5% Value-at-Risk) is a more suitable measure of downside risk than e.g. standard deviation of returns, as this reflects the reality that risky asset exposures aren’t constrained by “normal” volatility, but by specific drawdown events

Taking these points into consideration, we conduct an asset allocation optimization using the investment risk tolerance determined by the Risk Score as the primary limiting parameter. We can add additional limitations as well depending on how much information we have about the company’s goals: target or minimum yield levels, limitations on realization of taxable gains, limitations on RBC impact, etc. As stated above, the result is an asset allocation that is customized to balance investment risk against a holistic view of insurer operating risk, and can either be implemented as-is or serve as a first iteration and datapoint for further discussion about management objectives and preferences.

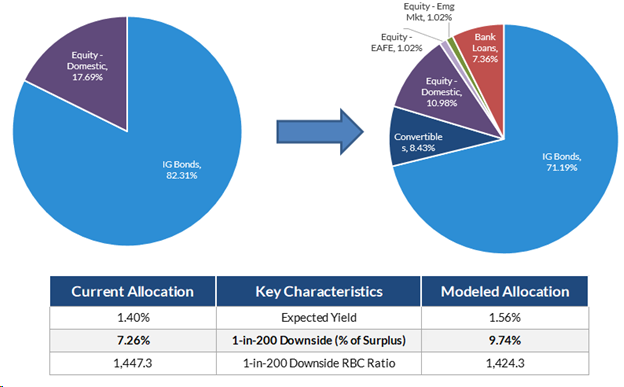

The graphic below illustrates how the identification of an appropriate level of downside risk tolerance can drive an asset allocation optimization that aims to maximize returns while accounting for impacts on book income, RBC ratio, and other factors. Specifically, we recognize the 1-in-200 Downside / Surplus figure (which is just another way to describe 99.5% VaR) of 9.74% identified above; this value was a key input into the optimization that produced the modeled allocation below:

Conclusion

Like any modeling exercise, this process includes assumptions and uses past data as a proxy for estimating future performance, of both insurer operations and financial market returns. But it has the advantages of being fast, convenient, transparent, and simple. We have found this Streamlined Asset Allocation process a valuable tool for many insurers who want to re-evaluate their asset allocation strategy but have limited pre-existing ERM parameters and objectives defined. In particular we find it useful not only for generating strategic allocations, but also for encouraging Investment Committees and Boards of Directors to discuss and define their tolerance for investment risk, and integrate it fully into their ERM programs.

As the name implies the Streamlined process can be run quickly, and typically only requires statutory financial data that AAM already has access to. If you would like to see the recommendations this model produces for your business, please contact your Portfolio Manager if a current client, or the AAM Business Development Team if interested in learning more.

Data Sources & Notes

Risk Score calculation: For illustrative purposes only. All data sourced from S&P Global Market Intelligence. Percentile scores reflect Sample Co relative position to a peer group of 100 business line peers with minimum 3yr operating history, invested assets from $10M – $5B, and risk asset exposure >3% of surplus as of 12/31/20

Modeled Asset Allocation: Historical asset data sourced from Bloomberg as of 11/30/21 and AAM Asset Allocation Optimization Model. 1-in-200 Downside is projected investment return in scenario approximately 2.58 standard deviations below expected mean return. Balance Sheet & RBC Ratio data obtained from S&P Global Market Intelligence as of 12/31/20. There is no guarantee expected results will be achieved. Investing involves many risks, including risk of potential losses.

The attached material is provided to you on the understanding that as a sophisticated person, you understand and accept its inherent limitations and will not rely on it in determining to engage AAM. The investment strategy and themes discussed herein may not be suitable for investors depending on their specific investment objectives and financial situation. Before making a decision to invest a prospective investor should carefully review information respecting AAM and consult its own legal, accounting, tax and other advisers in order to independently assess the merits of an investment.

This document is for informational purposes only and does not constitute an offer or solicitation of an offer, or any advice or recommendation, to purchase any securities or other financial instruments, and may not be construed as such. The material in this presentation is directed only at entities or persons in jurisdictions or countries where access to and use of this information is not contrary to local laws or regulations.

Reproduction or use of these materials for any other purpose or by or for any individuals is strictly prohibited. The information contained in this presentation has been obtained from sources that AAM believes to be reliable, but AAM does not represent or warrant that it is accurate or complete. The views in this presentation are those of AAM and are subject to change, and AAM has no obligation to update its opinions or the information in this presentation. Neither AAM, nor any of their respective officers, directors, members, or employees accepts any liability whatsoever for any direct or consequential loss arising from any use of this presentation or its contents.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.