insight

AAM Corporate Credit View: August 2010

August 4, 2010

Can We Still “Bank” on Economic Growth in the Second Half of 2010?

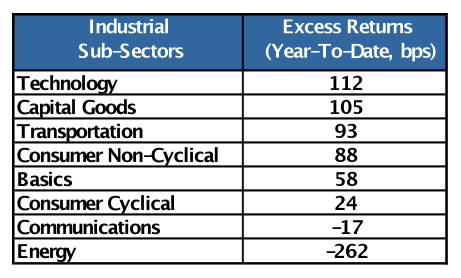

After a volatile three months, Corporate spreads tightened in July. Spreads ended the month 20 basis points (bps) tighter, generating 134 bps of excess returns per the Barclays Corporate Index. The Energy sector recovered some of the widening year-to-date, posting 259 bps of excess returns in the month. The Corporate Index is back in positive territory, generating 23 bps of excess returns year-to-date. Finance is outperforming with 41 bps of excess return vs. Utilities (+15 bps) and Industrials (+13 bps). Of the Industrial sub-sectors, those that are less cyclical are outperforming (Exhibit 1). This is what we had expected, consistent with a slow, fragile recovery.

Exhibit 1: Industrial Sub-Sector Performance

Source: Barclays

Source: Barclays

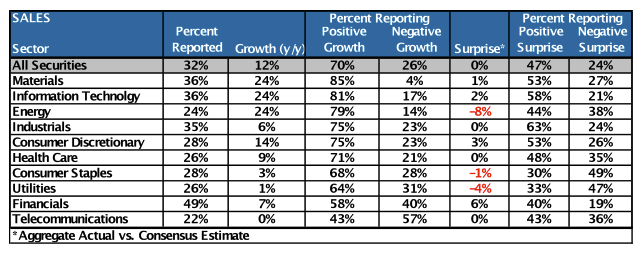

As the near term lift from the stimulus wanes, investors are combing through earnings reports to help forecast near term economic activity. Consumers need to keep spending and businesses need to hire more people. It sounds very simple. As of late afternoon on Friday July 30, approximately one third of companies had reported results. Of this set, sales growth was evident in most sectors relative to 2009 (Exhibit 2). We explained earlier this year that credit selection and investing in growth would be keys to outperformance (versus a down-in-credit quality strategy). Except for Energy, which is an idiosyncratic issue, there does appear to be a nice correlation between growing and/or defensive industries with excess returns.

Exhibit 2: Second Quarter 2010 Earnings Review (as of 7/30/10)

Source: Bloomberg

We began our earnings review with the banking sector. That sector is the first to report and the most efficient, as virtually all the large banks report in the first few weeks, including many of the European banks. We will concentrate on this sector in this month’s AAM Corporate Credit View, addressing Industrials and Utilities next month. That said, there is a common thread among all sectors, and that is the importance of top line growth to job growth. Therefore, while it’s nice to see earnings and sales growth in the second quarter, we are more sensitive to future periods and thus far, management guidance and commentary have been supportive of a continued slow, but growing economy.

The US banking sector generated stronger than expected second quarter 2010 operating results due to materially improved credit costs. However, the improvement in asset quality was somewhat overshadowed by questions about revenue sustainability as a result of shrinking balance sheets and the yet-to-be-quantified costs of the Dodd-Frank bill (financial regulatory reform).

Credit quality within bank loan books improved broadly, continuing a trend which began to manifest itself in the fourth quarter of 2009. In general, the large money center banks are about a quarter ahead of the regional bank sectors in the asset quality improvement cycle, primarily reflecting the differing make-up of their respective loan books. Commercial & Industrial and credit card portfolios led the way in terms of asset quality improvement, while commercial real estate and construction loans continued to deteriorate and home equity loan asset quality appears to have stabilized for the moment, but at an elevated level of credit costs. In a number of instances, operating performance benefited from reserve releases (somewhat surprising given still high non-performing asset levels), with such releases being most notable for the three large credit card issuers (JPMorgan/Bank of America/Citi). Although provisions, net charge-offs, non-performing assets and early stage delinquencies all fell materially for the sector, bank management teams have cautioned that credit costs are not likely to show the same rate of improvement in the second half of 2010 if the economy cools and unemployment remains high.

Offsetting the positive credit quality developments, there is growing concern over revenue sustainability as a result of loan book contraction, narrowing interest spreads and the potential impacts of financial regulatory reform. Banks are experiencing shrinking loan balances and muted credit demand as consumers de-lever and corporations conserve cash in the face of economic uncertainty. In addition, many banks continue to run-off portions of their loan books (e.g., subprime), which removes interest earning assets even as it removes asset quality issues. Interest income is also being squeezed by the extended period of low interest rates, particularly as higher yielding assets re-price. While this has been offset to some extent by a run-off of more expensive Certificates of Deposit sourced during the funding crunch, the absolute level of net interest income is likely to contract given the low absolute level of interest rates and narrowing interest spreads (this situation is mirrored in available-for-sale portfolios as well).

Finally, the impact of the Dodd-Frank bill, while impossible to quantify on a system-wide basis before required rule writing and implementation, is likely to negatively impact non-interest revenue in several areas. Within retail banking, lucrative overdraft fees and credit and debit card interchange revenue will be impacted, although, only JPMorgan and Bank of America have attempted to quantify the impact to date. In money center bank space, the impact of the Volcker Rule and derivative regulations were blunted somewhat in the conference process. The likely end result of financial regulatory reform on bank performance was best summed up by Jamie Dimon of JPMorgan, who noted that while specific revenue streams will no doubt be impacted, “mitigation” efforts to spread costs and recoup loss fee revenue through new charges/products will likely offset the impact of the bill on bank results over time.

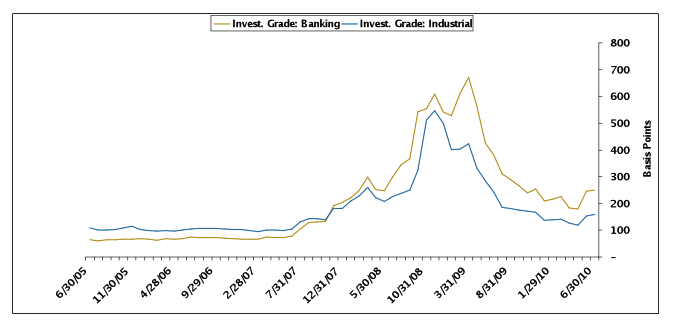

Overall, we would characterize the quarter as guardedly positive, particularly as we saw a continuation of the credit quality improvement trend that has been key to our overweight allocation to the banking sector. While questions about balance sheet, revenue and profit growth appear to be looming in investors’ minds, we would characterize this (for the moment) as more of an equity concern, given the still strong liquidity and capital positions of the sector as a whole. Going forward, the biggest challenge appears to be macroeconomic, as a slower rate of GDP growth in the second half of 2010 may cause credit improvement to stall (or even reverse). Since we are forecasting a slow, muted recovery, we are comfortable with the credit profiles of the money center banks, highest quality regional banks, and select international banks. We are investing defensively in this sector(i.e., high quality banks), believing the spread differential between banks and industrials is too wide (Exhibit 3). We realize that spreads will remain volatile until we get confirmation that credit trends will not reverse as a result of a double-dip recession or protracted slow economic growth.

Exhibit 3: Bank Spreads Remain Wide vs. Industrials

Source: Barclays

This information is developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as ‘AAM’), and their respective officers and employees. Any opinions and/or recommendations expressed are subject to change without notice.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.