SECOND QUARTER MUNICIPAL BONDS UPDATE

Market Recap

The quarter started with general concerns related to both contagion risks from destabilization within the regional banking sector and with the path of interest rates tied to the Federal Reserve’s tightening of monetary policy. Volatility in rates continued with 2- and 10-year rates moving higher by 87 and 37 basis points (bps) to end the quarter at 4.9% and 3.84%, respectively. For the municipal market, the Bloomberg IG Tax-Exempt Index and the Bloomberg Taxable Muni Index produced results for the quarter of -.102% and -.433%, respectively1.

Sector Resilience to Challenging Technicals

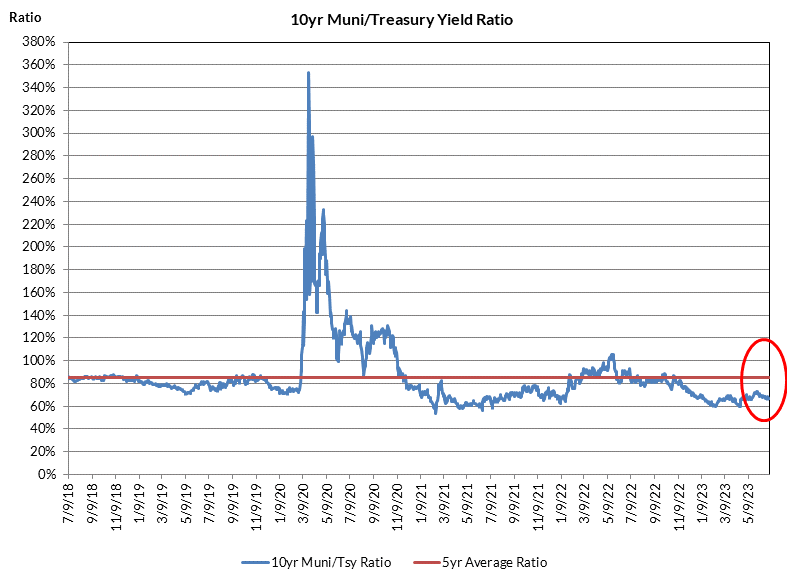

Tax-Exempts faced an almost perfect storm of weakening technical forces due to a resurgence in mutual fund outflows on higher-rate concerns and slowing of reinvestment flows. Additionally, further headwinds were tied to selling pressure due to both expensive relative valuation levels for the sector versus taxable alternatives and bank-related selling tied to the bank failures of Signature Bank and Silicon Valley Bank. The liquidation in municipal securities from these banks during the quarter amounted to ~$7 Billion, with the majority of these assets in the tax-exempt sector2.

Most of the headwinds related to the weakening technicals occurred between mid-April to the end of May, where 2 and 10yr tax-exempt rates increased by 80 and 50bps, respectively. Relative underperformance was particularly acute, with tax-adjusted spreads to Treasuries during this period widening by 75 and 56bps in 2 and 10yrs, respectively. However, over the last month of the quarter, technicals improved significantly on very strong June 1st reinvestment flows of coupons/calls/maturities, along with a very manageable new issue calendar that led to tax-adjusted spreads in 2 and 10yrs to tighten by 67 and 30 bps, respectively3.

For taxable munis, bank selling pressure was also evident. The market cleared ~$2.3 billion in taxable municipal securities across the FDIC bid list activity and the liquidation that occurred across the First Republic Bank holdings, as well. The sector absorbed the increased secondary supply activity and spreads actually contracted sharply during the quarter. After reaching their widest point of the year at the end of the 1st quarter, ‘AAA’ spreads in 3, 5, and 10yrs moved tighter by 31, 29 and 28 bps, respectively, by the end of the 2nd quarter4.

Outlook Remains Constructive

Even with the sharp improvement in relative valuations across taxables and tax-exempts, the outlook remains constructive across both sectors. Supply technicals remains supportive of current valuation levels. New issuance of debt remains at depressed levels, with YTD issuance down 20% on a year-over-year basis through the end of the 2nd quarter. Muted refinancing activity continues to provide a significant drag on both overall issuance and on taxable muni supply. The elevated rate environment has contributed to overall refunding activity declining by 26%. Monthly taxable muni issuance, which was heavily influenced by refinancing of tax-exempt debt from 2019 to 2021 with an average of over $10 Billion per month, declined by 58% to $4.2 Billion in 2022. That average fell another 33% to $2.8 Billion for 2023, and with rates expected to remain elevated over the balance of the year, issuance from this segment should remain muted5.

Credit Provides Defensive Support

From a credit perspective, underlying fundamentals are also expected to provide support. State revenues that experienced sharp increases with growth rates of 16.5% and 16.3% in fiscal years 2021 and 2022, respectively, have contributed to record levels of reserve balances. Total balances incorporating budget stabilization fund and general fund balances reached a record of $399 Billion or 37.3% of general fund expenditures in fiscal 2022. Revenue growth is expected to moderate to declines of .3% and .7% for fiscal years 2023 and 2024, respectively, and that’s expected to reduce the reserve levels in fiscal 2024 to 22.8% of general fund expenditures. That remains a very healthy level and provides states with substantial levels of liquidity and budget flexibility going into a potential economic slowdown over the balance of 20236.

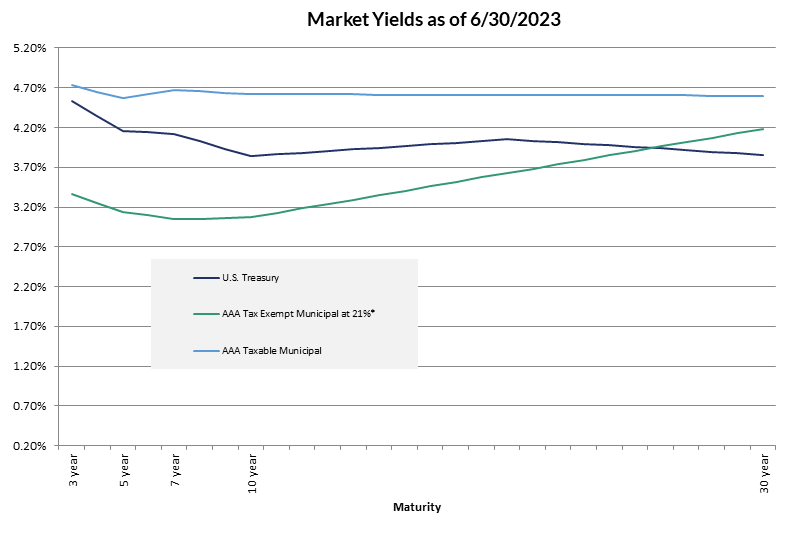

Relative Valuations Support Taxable Munis

Although taxable muni spreads have performed well during the 2nd quarter, we still view taxable muni spreads as attractive. As of this writing, 10yr ‘AAA’ taxable spreads versus ‘A’-rated low beta corporates are ~15 bps wide to historical relationships between the sectors. Spreads of taxable muni yields to tax-adjusted tax-exempt yields (21% corporate rate) are also very attractive, with yield advantages of 125, 136 and 151 bps in 3, 5, and 10yrs, respectively. For insurance company portfolios, we continue to advocate for a sector rotation out of tax-exempts and into taxable munis across the yield curve7.

Exhibit 1: Tax-Exempt Relative Valuation Levels

Exhibit 2: Taxable Munis: Compelling Alternative to Tax-Exempts

*21% Corp Rate Tax-Adjusted at a Factor of 1.19

1 Bloomberg, Barclays, AAM, Refinitiv

2 Lipper, Bloomberg, Bond Buyer

3 Bloomberg, Refinitiv

4 AAM, Bloomberg

5 Bond Buyer

6 National Association of State Budget Officers

7 AAM, Bloomberg, Refinitiv

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.