2023 Review

The OAS of the Bloomberg Corporate Index1 was volatile in 2023, with a high of 163 and low of 104 at month-end November. Primary factors driving this were banking sector-related uncertainties and expectations related to future cuts in interest rates by the Federal Reserve. As we move closer to the end of the year, credit spreads have tightened as investors expect the Federal Reserve to cut rates meaningfully in 2024 as inflation cools, avoiding a recession and achieving the “soft landing” that has been widely discussed.

The consumer remained a driving force, largely responsible for the stronger-than-expected economic growth in 2023. Based on AAM’s review of financial statements from over five hundred non-financial companies2 for the same period, credit fundamentals remain strong albeit modestly weakening in 2023 after peaking in 2021. EBITDA3 margins declined, and debt leverage increased while EBITDA covered interest expense thirteen times vs. fifteen to start the year. Companies spent less cash flow on repurchasing shares and acquisitions while spending more on capital. Capital spending increased as a percentage of revenues in sectors related to commodities and technology while others continued to spend at historically average rates.

There were a few events in 2023 that were notable. First, after many years of zero investment grade defaults in the U.S., there were a number in 2023 (i.e., Silicon Valley Bank, First Republic, Signature Bank of New York and Silvergate). While the overall US speculative grade default rate increased to 5.2% in November4, the majority were distressed debt exchanges5 whereby investors agreed to restructure their loans (e.g., reducing the interest rate, extending the maturity date) to avoid a bankruptcy process. This was supportive for the economy, as companies avoided layoffs and business closures. Lastly, companies issued less 30-year debt in 20236, expecting interest rates to fall in the near term. This coupled with strong demand for yield resulted in spreads tightening on longer-dated bonds towards historic minimums.

2024 Outlook Summary

Supportive macroeconomic outlook

AAM’s expectation is for GDP growth to be modestly positive in 2024, inflation to decline while remaining above 2%, and for the Federal Reserve to lower rates 3-4 times. That is a constructive environment for risk assets, but as we have seen in 2023, sentiment can change very quickly. While not our base case, a hard landing remains possible. Therefore, we are watching for signs such as a rapidly deteriorating consumer, lower inventory order rates, issues in the finance/banking sectors, and/or fallout from lower than expected commercial/residential real estate values not to mention ongoing geopolitical risk.

Modest weakening in credit fundamentals

At a more micro level, we expect consumers to spend at a lower rate than they did in 2023, but we do not see emerging problems with the consumer outside of some deterioration at the sub-prime level. We expect government programs to remain supportive for various industries and inventory de-stocking to be largely behind us. Excluding financial companies, we are forecasting revenue growth in the mid-single digit range and EBITDA to grow at a faster rate than revenues in 2024, allowing margins to expand after years of contraction. However, we expect EBITDA interest coverage to continue to fall as interest rates remain elevated, and we expect debt leverage to increase in consumer-related sectors, among others. After suppressed activity, we expect companies to pursue mergers and acquisitions (M&A) in 2024, and we believe more cash flow will be spent on buying back shares. Importantly, although we expect fundamentals to weaken in 2024, we do not expect significant credit rating action which would result in spread widening for the market.

In the Finance sector, we expect late cycle trends to emerge whereby banks increase provisions for bad loans and margins remain challenged as it takes some time for the curve to normalize. Issuers that have been challenged in this rate environment like REITS and regional banks will need to access the market to refinance debt at a time of continued uncertainty, providing an opportunity to invest selectively. We expect this as early as January. Finally, while we expect most finance companies to continue to work with borrowers to restructure loans with ample funds on the sidelines, we do not expect this to be without its challenges. The Finance sector is expected to remain a primary area of risk in the market in 2024, trading wider than it has historically vs. Industrials.

Supportive technical environment

Regarding market technicals, we acknowledge several factors that we expect will be supportive for corporate spreads. First, we project gross new debt issuance for 2024 will be around $1.2 trillion, which would be a little lower than 2023. The bigger positive is net issuance, which is gross debt issued minus redemptions. Expectations are for this to be 24% lower in 2024 vs. 20237. Historically, that is a large decline. That said, the rally in rates and credit spreads late in 2023 increases the likelihood for long-dated issuance and debt financed M&A. Therefore, we expect net issuance to surprise to the upside vs. Wall Street forecasts. At a sector level, we expect Financials (especially US Banks and REITs) to issue more debt relative to 2023 versus non-Financials. On the demand side, we expect retail, yield-oriented, and foreign investor demand for corporate bonds to remain strong.

Sector and security selection critical in a tight spread environment

We expect to end 2023 with the Corporate Index8 OAS inside of 100. That is well inside of the 10-year average of 124. Our expectation is for some degree of spread volatility, and we cannot ignore a recession probability that remains elevated by historic standards given the tightening in financial conditions9. Since the Corporate OAS is reflecting a less than 10% probability of that occurring, it is vulnerable to widening. Our base case reflects a soft landing; hence, we expect the OAS to remain in a tight range of 90 to 120.

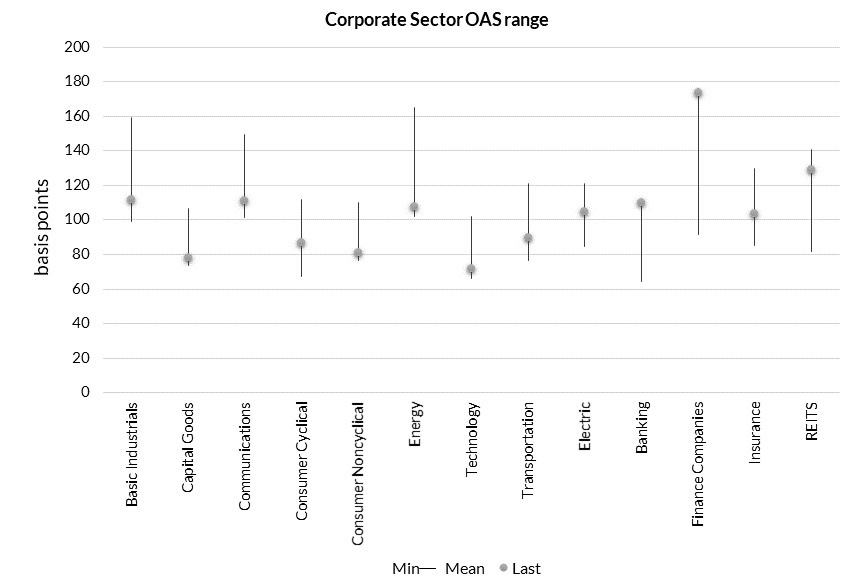

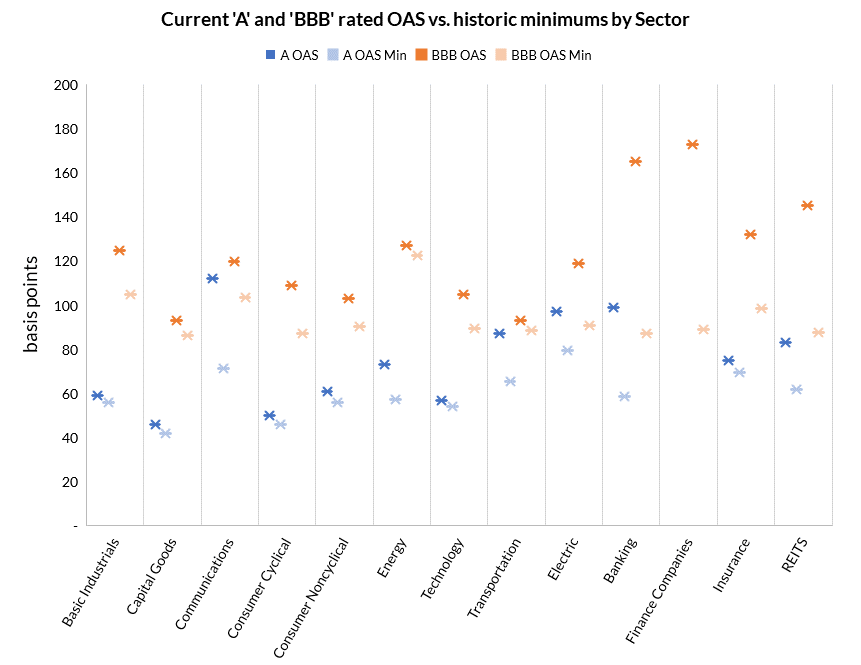

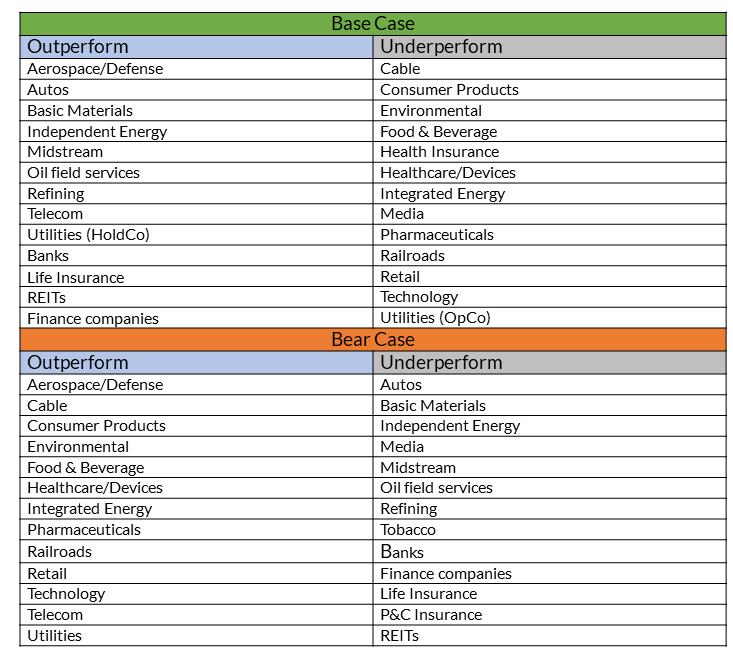

Given tight credit spreads, we are looking for value in sectors that still look attractive. Exhibits 1 and 2 break down the Corporate Index OAS10 by sector. These illustrate which sectors look tight/cheap by comparing the current OAS with the sector average, minimum, and range over the last eight years. Exhibit 2 goes a bit further by separating ‘A’ rated bonds from ‘BBB’s. A few noteworthy observations can be made. The first is that the broader Finance and Utility sectors still look wide. The second observation is that BBB rated bonds have more room to compress vs. single-As. This is not only the case in Finance and Utilities but also in some Industrial sectors as well. At a broad sector level, we favor intermediate and shorter Financials, BBB Industrials, and Utilities. We highlight our more detailed sector level performance expectations in Exhibit 3, providing our fundamental analysis in the commentary that follows.

We prefer the new issue market given trading costs and new issue concessions, especially when looking further out the curve. We expect to see opportunities in the new issue market related to M&A in the less cyclical industries like Pharmaceuticals, Technology, and Food & Beverage.

The strong demand for yield and lack of new debt supply drove spreads for the 30-year part of the curve to historic minimums. Typically, an investor would want more spread to compensate for the longer duration. But in 2023, this “credit curve” flattened. In fact, the 10s-30s11 credit curve inverted. Our expectation is for this to start to normalize in 2024; therefore, we prefer the intermediate part of the maturity curve. But we expect technical support for the long end will continue due to the lack of long duration yield in other markets.

Exhibit 1: Sector Relative Value

Source: AAM, Bloomberg Corporate Index from 09/30/2015-12/14/2023 (monthly)

Exhibit 2: Sector Relative Value by Credit Rating

Source: AAM, Bloomberg Corporate Index from 09/30/2015-12/14/2023 (monthly) using current OAS and minimum OAS for A and BBB rated corporate bonds in each sector

Exhibit 3: Performance Expectations by Sector for 2024

Sector Fundamental Outlooks

To summarize, we expect improved financial performance for most industries in 2024 vs. 2023. That said, we expect continued challenges in Utilities, Autos, Media, and Banks with Energy facing a higher level of uncertainty.

Basic Materials

The theme for 2023 was “destocking” as supply chains recovered and operated with leaner inventories. This destocking started in late 2022 and created a recession-like environment for many markets within the Basic Materials sector. This was particularly true for upstream commodity producers, and this weak environment persisted longer than expected. The year also started with optimism that a China reopening would provide a tailwind for raw material producers. Again, this optimism faded throughout the year as China’s rebound was disappointing.

For the most part, the market looked through this fundamentally weak period and basic material bond spreads performed well. Most companies used the post-COVID commodity boom to shore up balance sheets and were in a solid position when commodity prices collapsed. With solid balance sheets, new debt issuance has been limited. This supported spreads despite a generally weak operating environment for basic material companies.

The outlook for 2024 is much brighter as 2023’s loss could prove to be 2024’s gain. While demand in many end markets remains soft as we approach year-end, destocking should be nearing an end. With many supply chains operating with lean inventories, a significant rebound in demand is not needed to provide a tailwind for commodity sensitive companies. Should the economy avoid a downturn, solid demand could provide a positive surprise. As always, China is a wild card and could have a significant impact on commodity prices in either direction.

The Chemical sector is a mix of upstream companies that are more exposed to weak commodity prices and downstream specialty chemical companies that benefit from lower raw material costs. The post-COVID commodity boom favored the upstream companies, but the pendulum swung to favor the downstream companies in 2023. We expect a more stable and consistent environment in 2024.

The stability of the Paper sector (primarily corrugated containerboard) was tested as the COVID related boom and bust cycle created significant supply/demand swings. Throughout 2023, the industry continued to deal with excess capacity as weak volumes persisted longer than expected. That said, box shipments appear to have found a bottom and are poised to show growth once again in 2024. Containerboard and boxboard grades within the paper sector are highly consolidated and producers have historically exhibited rational pricing behavior. This has led to strong and consistent free cash flow generation. The industry still needs to rationalize some excess capacity, but we think the stability of the sector will return in 2024.

Despite a soft commodities backdrop in 2023, Metals and Mining bond spreads performed well due to strong balance sheets and limited debt issuance. We expect a similar story in 2024 but ultimately base metal prices will follow the strength or weakness of the global economy. Scenarios such as a recession in the U.S. or successful stimulus in China create dramatically different paths for base metals, which seem to be walking a fine line between the two extremes. The electrification of everything has created a well-known long term demand story for copper but the price of copper has been rangebound as soft economies, particularly in China, have so far kept a lid on prices. Copper was expected to be in surplus through 2024 but recent supply disruptions have raised the possibility of tighter than expected conditions.

Capital Goods and Transportation

We believe we are close to seeing the bottom of the freight cycle with U.S. rail traffic down 3.1% year to date in 2023. The Railroad industry has experienced the challenges and benefits of full employment. Difficulty with hiring and short-term job cuts left companies with lower service levels and less profitability. The industry continues to build back its workforce with the expectation of higher volumes resulting in better top-line growth and wider margins. Longer term, we expect the industry to gain market share and continue to improve on its technology and intermodal opportunities. Large-scale M&A is extremely limited, and we expect the industry to remain capital intensive. We expect a similar amount of issuance this year and would take advantage of new debt issuance given a relatively illiquid secondary market.

We expect solid global defense spending into 2024 and 2025. We have two major conflicts developing in the world that highlight the importance of substantial defense budgets across developed nations. Improved supply chains and employment have helped the commercial aircraft business catch up with the growth of record, high order backlogs. We see some opportunity for fundamental improvement in 2024 in the Aerospace & Defense sector with the two largest issuers, RTX & Boeing, focused on debt reduction. Large-scale M&A is limited although small to medium size transactions requiring debt funding are expected. We expect issuance to look like last year with the expectation of debt funded share buybacks occurring at the exceptionally large defense contractors.

Communications and Technology

Telecommunications outperformed in 2023, as most issuers are BBB rated with longer duration bonds. Companies also issued less new debt in 2023 due to management teams’ focus on strengthening credit fundamentals. We may finally be entering a new era whereby free cash flow-to-debt improves due largely to a decline in network investment (capital spending, spectrum auctions) as margins stabilize. Significant merger and acquisition (M&A) activity in North America should be muted given consolidation that has taken place, but in Europe, an uptick is possible if there is a supportive ruling from the European regulator. Regardless, we expect companies to look to sell assets as they shed underperforming/sub-scale businesses or raise cash to reduce debt. That is likely the primary spread catalyst for 2024. Notably, we expect Dish Network to restructure its debt vs. selling assets, but this is a significant wild card.

The Cable and Media sectors outperformed in 2023, but performance was more idiosyncratic with three12 of fifteen issuers generating the outperformance. We expect another year of idiosyncratic-driven performance in 2024. This is because we expect increased M&A activity, affecting not only those involved but those left out. Disney is expected to finalize its acquisition of Comcast’s stake in Hulu, with Comcast using the proceeds to pursue M&A or repurchase shares. Coincidentally, Warner Brothers Discovery (WBD) can pursue a transaction after its Reverse Morris Trust lock-up period expires on April 8. 2024. Despite Paramount’s executives recently adopting a change-of-control related severance plan, we do not expect it will be involved in WBD/Comcast/Disney related M&A or any bondholder friendly M&A. Our expectation is for negative credit rating migration to continue for smaller networks like Paramount and Fox, as they lack the scale to compete, and advertising moves to new platforms. Away from television, we expect M&A activity (likely to be equity funded) in the Gaming industry. We expect the advertising agencies to remain internally focused as they compete in a lower-growth environment with elevated macroeconomic uncertainty.

Technology outperformed in 2023, with big tech providing the momentum to advance the sector tighter throughout the year. BBB credits performed better than expected during a cyclical downturn for the industry. The downturn was less severe than in prior cycles supported by the diversification outside of consumer tech into automotive, healthcare, communications, and industrial applications. In addition, software proved to be sticky and mission-critical for companies, while spending continued in the data center albeit at a slower pace. After moving past the cycle bottom, we expect to see a rebound in 2024 – the question is how strong will it be? Management teams have been cautious regarding their growth outlooks given the macroeconomic uncertainty and heightened geopolitical risk. However, we expect high single-digit revenue growth for the sector with growing optimism about the contribution coming from AI. We are seeing encouraging signs of a recovery in most markets as inventory levels normalize, prices firm and demand starts to return. Two of the most impacted areas, PCs, and smartphones, saw sequential growth in the most recent quarter, and we expect that growth to continue. Server demand is returning, and we are seeing stabilization in cloud growth supporting a better outlook for the data center. This bodes well for semis and wafer equipment manufacturers. Software companies are moving quickly to roll out new GenAI features that should continue to support growth in the segment. Regarding AI, we are in the preliminary stages of the technology generating revenue for the sector. Among all sectors, technology has the most measurable impact from AI, and companies that have provided commentary on the topic have indicated that demand appears to be accelerating rather than stabilizing. A shift in enterprise IT spending to support AI may cannibalize other areas of IT spending, but in the medium-to-long term we expect AI to provide incremental growth for the entire sector. We see 2024 as a transition year with capex starting to return to support secular trends and new technologies, underpinning a multi-year growth outlook and repositioning the sector for even stronger growth in 2025.

Consumer

The Pharmaceutical sector is relatively immune to macroeconomic and supply chain issues. Longer term, we expect secular benefits of new drug discovery, improved technology, increased human longevity, and the use of medicine over other forms of health care solutions will continue to make this a fundamentally strong sector. Weight loss drugs are dominating headlines and are already creating waves for other sectors (i.e., food, beverage, restaurants) and opportunities for those pharmaceutical companies trying to gain exposure. Credit metrics (margins, leverage) are among the strongest in the investment grade market. The sector is highly rated with characteristically tight spreads. We expect large-to-mega sized M&A deals to continue while being primarily funded with new debt. New debt issues seem to present good opportunities given their characteristics (i.e., size, new issue concession).

The Retail sector has enjoyed the COVID recovery with record consumer excess savings, a strong job market, and readily available credit. We believe the growth for the sector is beginning to get back to a normal 2%-3% trend as witnessed over the last several months. The sector has also benefited from improved supply chain costs and increased sales through online channels. Inventory levels have improved, which helps the sector better manage the use of promotion to clear off-season product and maintain or expand margins. For 2024, the focus will be on the health of the consumer and to what extent discretionary items, big ticket purchases, and luxury goods slow. Over half of the sector is made up of very high-quality credits including Amazon, Walmart, and Home Depot. We expect limited M&A and a similar amount of debt financed share buybacks in 2024 vs. 2023.

The past year was an eventful one for the North American Auto industry, highlighted by higher production as supply chains normalized. While the UAW strike temporarily interrupted this recovery, the industry survived the scare with relatively little disruption. With one month to go in the year, based on S&P Global Mobility’s estimate, it appears production will end up around 15.6 million units. This would be a 9.0% increase over 2022 but would also be the fourth year in a row of production below the pre-pandemic trend of over seventeen million units. While defining “normal” is difficult, it is reasonable to assume that the industry has underproduced by a few million units since the start of the pandemic.

An emerging theme to watch as we head into 2024 is one of capital discipline. Traditional internal combustion engine (ICE) production has been generating significant amounts of cash and much of this cash has been directed toward electric vehicle (EV) production. Weaker than expected demand for EVs has caused the manufacturers (OEMs) to rethink the pace at which this transition from ICE to EV happens. This EV investment is still happening but now at a slower and more deliberate pace. The offset to this capital discipline is the expected increase in the return of capital to shareholders. GM, for example, has announced a $10 billion share repurchase plan. The OEMs operate the manufacturing side of the business on a net cash basis and the willingness of management teams to operate with lower cash levels is something to monitor.

With a few more headwinds facing the North American auto industry, 2024 should be a more difficult year. That said, we view this as more of a return to normal and not a significant fundamental deterioration. Inventories and incentives are returning to levels more consistent with the pre pandemic environment. This should lead to a modest decline in pricing power. We also expect margins to decline as the additional UAW costs are absorbed. Finally, we continue to watch trends within the OEMs’ finance subsidiaries, which have been a significant source of cash over the past few years. While finance portfolios are still in decent shape from an historical perspective, declining residuals and rising delinquencies are likely to stress portfolio performance in 2024. All things considered, 2024 should be another solid year for the North American auto industry.

Energy

We believe fundamentals in the Energy sector are precarious due to supply. Total worldwide supply of crude oil remains very resilient despite capital discipline from Investment Grade Integrateds and Independents due to unexpectedly high production from Russia, Iran, and Venezuela, all of which easily circumvented U.S. sanctions in 2023. Additionally, megaprojects from Guyana and Brazil are now producing significant supply. While demand was better than expected in 2023, the oil market would have been meaningfully oversupplied were it not for the curtailments from Saudi Arabia throughout the year. If the U.S. and China economies grow less than expected next year (1.2% and 4.5%, respectively), we suspect oil demand will disappoint and Saudi Arabia may choose to defend market share over price, unlike how it managed 2023.

The environment for natural gas is not looking much better, at least for the first half of 2024. Demand has been weaker than expected due to a warm winter heating season so far and is expected to be weak in the first half of 2024 due to the effects of El Nino. Supply has remained healthy despite substantially weaker prices over the last six months due to strong production from the Marcellus shale and Permian basin. This combination has led to inventories that are bloated, currently about 15% above normal for this time of year. However, fundamentals for natural gas should improve in the back half of 2024 as two new liquefied natural gas export facilities (Corpus Christi 3 and Golden Pass) begin operations increasing demand by 1.5 billion cubic feet (about 1.5%).

The Integrated subsector of the Energy sector includes high quality constituents such as Exxon Mobil, Chevron, Shell, and Total Energies. Merger and acquisition activity has been elevated in 2023 (Exxon Mobil/Pioneer Natural Resources and Chevron/Hess) and we would be surprised if this activity does not continue with European Integrateds in 2024.

The Independent subsector has recently been a beneficiary of merger and acquisition activity, as the large Integrateds consolidate. There are now only a handful of takeout candidates, but we believe there could be more “mergers of equals” in 2024.

We suspect the Midstream subsector will experience elevated merger and acquisition activity compared to previous years due to an increasingly challenging regulatory environment for new pipelines, a desire to offer clients multiple endpoint options for different hydrocarbons and reasonable financial multiples.

Utilities

Despite starting the year with spreads historically wide versus long-term averages, utility bonds continued to underperform the overall Corporate Index in 2023 as the market favored less defensive sectors. The industry did catch a break in 2023 as lower natural gas prices led to less inflationary pressure on monthly bills. That said, there are still significant challenges that continue to face the industry. The primary challenge continues to be high capital spending, which has led to high debt issuance and consistent pressure on credit metrics. Issuance is expected to remain at an elevated level in 2024 and balance sheets will remain under pressure.

One issue that caught the market off guard this year was a renewed focus on wildfire risk. While not necessarily a new risk, a jury verdict against PacifiCorp in Oregon and the devastating fires in Hawaii brought the issue back into the market’s focus just as it was getting more comfortable with the risk in California. While wildfire risk is not consistent across all geographies, it is another example of extreme weather risks that already include hurricanes, heat waves and winter storms.

Balancing the ongoing energy transition with the often-competing goals of reliability and affordability creates a unique set of challenges for the Utility industry. These persistent challenges help explain why valuation metrics related to spreads continue to screen attractive across the curve. This keeps us comfortable selectively adding bonds/issuers in the sector, but the headwinds facing the industry keep us from officially moving to Attractive. Also, despite the challenges facing the industry, we continue to view Utilities as a defensive sector which should provide periods of outperformance if stress returns to the Corporate bond market.

Financials

REITs are entering 2024 on a positive trajectory as inflationary pressures continue to recede, and declining capital costs benefit real estate fundamentals. Slowing economic growth may weigh more acutely on certain subsectors, but less volatile capital markets will help ease refinancing concerns and improve price discovery as transaction activity picks up. Across the various sub-sectors, office REITs will continue to face the strongest headwinds as the need for office space remains uncertain. However, as financial conditions loosen, we expect many issuers will look to enhance their balance sheets by addressing debt maturities, improving occupancy, and reducing non-strategic assets. Away from office REITs, apartment REITs are expected to have another relatively strong year given the high barriers to homeownership, though increased supply may weigh on occupancy trends and net operating income (NOI) growth in certain regions. Retail REITs remain a bright spot in the sector as consumer spending continues to be strong and supply growth of retail space remains muted. However, weaker economic conditions trends may pressure regional malls and shopping centers tied to luxury and discretionary spending, while open-air, grocer- anchored centers will likely remain resilient. Healthcare REITs represent a strong picture as life-science and medical offices building trends are expected to remain stable, while senior housing will likely see fewer operator restructurings and continued improvement in occupancy and rental growth.

After a tumultuous 2023, we expect positive, albeit slowing economic growth combined with stabilizing interest rates to provide a more supportive macro environment for US banks. Heading into 2024, normalizing credit costs, modest loan growth, and rising funding costs will remain headwinds to profitability. However, as we move through 2024, we expect funding costs to inflect and for credit normalization and loan growth to stabilize as financial conditions loosen and economic conditions remain benign. Commercial real estate (CRE), particularly office, will continue to be the most challenged area of lending portfolios. This will elevate asset risk and capital concerns for smaller regional and community banks with substantial exposure to CRE, but larger regional banks and global systemically important banks (G-SIBs) will likely see a manageable impact to profitability if losses materialized given their lower CRE exposures.

US banks are expected to see stricter regulatory requirements in 2024 as regulators look to finalize several rules proposed following the bank failures earlier this year. If implemented as proposed, these rules will result in higher capital and risk management requirements for banks of greater than $100 billion in assets. The G-SIBs will still be subject to the highest requirements, but regional banks are slated to see more dramatic changes as regulators seek to eliminate the 2018 tailoring rules and harmonize the standards among the largest US banks. In preparation, we expect all in-scope banks to continue tweaking their business models, optimizing risk-weighted assets, and limiting share repurchase activity. However, smaller regional banks may turn to M&A to alleviate regulatory pressures amid a more supportive macro backdrop.

US bank issuance is expected to increase in 2024. After a sharp contraction in 2023, G-SIB issuance is expected to return to more normalized levels due to increased maturities, lower debt capital surpluses, and higher proposed capital requirements. Stable markets and lower interest rate volatility may provide upside to issuance plans as these banks look to support client needs in the capital markets. Regional bank issuance is expected to remain elevated in 2024, with funding needs driven by maturities and the anticipation of long-term debt requirements for regional banks of greater than $100 billion in assets. Like the G-SIBs, stable markets and lower interest rate volatility may provide upside to issuance plans as regional banks look to pull forward funding for long-term debt requirements or term out short-term funding.

Outside the US, Yankee banks face a mixed set of macro challenges marked by slowing economic growth, potential recessions, and tight financial conditions. However, with few exceptions, Yankee banks are entering 2024 on solid footing with improved profitability, strong capital positions, and ample liquidity. In most geographies, profitability is expected to plateau or weaken through 2024 as loan growth wanes and banks pass through more of the rate increases to depositors. Loan quality is also expected to deteriorate as elevated interest rates and core inflation weigh on borrowers’ repayment, but the pace of deterioration should be gradual as interest rates stabilize and some central banks prepare for rate cuts. Loan performance is expected to be weakest for banks with large concentrations to corporate lending, CRE loans, and variable rate mortgages. Many Yankee banks continue to operate with elevated loan loss reserves, which should help absorb any new impairment charges. Capital ratios are expected to decline modestly as banks look to increase shareholder distributions but will remain sufficiently above minimum requirements given the uncertain macro and geopolitical backdrops. Liquidity measures should tighten as deposit competition picks up and banks repay central bank borrowings, though lower loan demand and balance sheet growth will act as offsets. In some geographies, geopolitical tensions remain a key economic risk, while public finances and fiscal policy present a risk to sovereign yields and ratings. Yankee bank issuance is expected to decline modestly in 2024, with funding needs driven by maturities, but deposit outflows and balance sheet dynamics provide upside risks.

To round out financials, the Insurance sector fared better than expected this year, assisted by a resilient economy and higher levels of fixed investment income. Interest rates may have peaked, but they remain at levels that will continue to gradually improve investment returns with new money and reinvestment yields exceeding roll-off yields. For the sector, we expect slightly higher issuance driven by the Funding Agreement-Backed Note (FABN) market. Commercial P&C insurers have benefited from a multi-year period of premium rate increases but will need to keep the momentum going as cost inflation works its way into reserves to maintain margins. The impact of higher inflation has been evident on short-tail personal lines with elevated severity, especially in auto. Insurers are gaining traction in states where regulators have been slow to approve rate increases. Even as insurers earn in double-digit rate increases, we expect the industry will need to continue to file for rate to reach adequacy. The return to industry profitability may be a 2025 event with auto, while commercial lines will continue to deliver strong underwriting performance into next year. The sales environment for life insurers continues to be strong, especially in fixed annuities and Pension Risk Transfers (PRTs), but we are seeing more competitive spread products from other market participants like banks and asset managers. Next year, we expect the competitive environment to increase among annuity writers, but sales to remain supportive of growth. M&A will continue as insurers look to reduce earnings volatility and improve capital efficiency. While CRE-office exposure remains a concern, losses and capital impacts will be manageable. In a more supportive macro environment, insurers may look to return more capital next year, but we expect fundamentals to remain supportive of the sector. Health insurers are entering an election year, which will generate headlines and volatility regarding the direction of healthcare policy. The best election outcome for insurers maintains the status quo where legislation supporting Medicare for All or an ACA repeal and replace is unlikely to gain traction. Next year we expect medical cost trends to remain manageable as insurers increase premium rates to account for higher utilization and medical cost inflation. The shift of seniors into Medicare Advantage continues to provide additional growth opportunities for insurers. This should result in yet another year of earnings growth for the sector.

1 Bloomberg Barclays Corporate Index

2 Capital IQ for non-financial, non-utility and mainly investment grade companies

3 Earnings Before Interest Taxes Depreciation Amortization

4 Moody’s “Default Trends” 12/14/2023

5 “Distressed exchanges executed by PE-owned companies continue to make up the majority of defaulters”; Moody’s “US Corporate Default Monitor – Third Quarter” 10/31/2023

6 “The average tenor of new issues at 9.8yrs YTD is the lowest since 2011”; “2024 High Grade Bond Issuance Forecast” JP Morgan 11/14/2023

7 JP Morgan “US High Grade Credit 2024 Outlook” 11/21/2023

8 Bloomberg Barclays Corporate Index

9 50% per Bloomberg’s United States Recession Probability Forecast as of 12/15/2023

10 Bloomberg Barclays Corporate Index

11 10s-30s refers to the difference in spread between 30-year maturities and 10-year

12 Charter Communications, Meta, Warner Brothers Discovery as of December 5, 2023 per Bloomberg Index

Headline-Driven Uncertainty: How Geopolitics, Tariffs, and Affordability are Restraining U.S. Growth

January 13, 2026