Given the persistent low interest rate environment, investment managers require flexibility to employ strategies that maximize a portfolio’s income within the constraints of their clients’ mandates. A segment of the market that is often overly constrained is 144A private placement issues. While not all investors are qualified to purchase 144A issues, the expanded opportunity set in these issues makes a compelling case for increasing 144A limits for those that do.

What are 144A securities?

When a bond issuer offers a security to the investing public, the Securities Act of 1933 requires that the issuer register the bonds with the Securities and Exchange Commission (SEC). This process entails extensive documentation, review, and recurring disclosures. However, there is an exception for bonds issued under Rule 144A, which allows privately placed securities to be sold and traded to Qualified Institutional Buyers (QIBs) without SEC registration. QIBs are defined as institutions (not individuals), deemed to be an “accredited investor” under Rule 501 of the SEC’s Regulation D. To qualify as a QIB under Rule 144A, an insurance company must have a minimum of $100 million in unaffiliated invested assets on a discretionary basis. The exception for QIBs is made because they are viewed as having more resources and access to information versus smaller institutions. As such, it is inferred that they can make sound investment decisions despite potentially having less information and ongoing required reporting provided by securities registered with the SEC.

144A securities can be issued with or without registration rights. For those issued with registration rights, the issuer hasn’t filed for registration with the SEC but intends to do so within a specified time period after issuance. Once they are registered, the 144A securities are subsequently exchanged for newly created public securities. For those issued without registration rights, the securities will remain unregistered until maturity.

What are the benefits for an issuer of 144A securities?

From an issuer’s perspective, there are a number of advantages to issue bonds under Rule 144A. First, there is no required public disclosure of sensitive information, no SEC review process, and ongoing reporting requirements are reduced. Second, 144A issuance decreases the potential for liability under the Securities Act. Third, issuers can access the market more quickly since the process of registering a bond with the SEC can delay the timing of an issue. Finally, the issuers’ costs are lower as they are able to forgo pre-issuance registration, significant underwriting fees, and ongoing reporting post-issuance.

What are the benefits of buying 144A securities for QIBs?

With the advantages to the issuer being fairly straight forward, the primary benefit to the investor is access to a greater supply of bonds. Over the past decade, the amount of 144A issuance has accelerated at a much faster rate than public bonds. The outstanding issuance of investment grade 144A (excluding structured sectors: asset backed securities, commercial mortgage backed securities, and non-agency residential mortgage securities) since 12/31/08 has increased from $341B to $1,637B (380% growth) versus the Barclays Aggregate increase of $11,430B to $20,836B (82% growth).

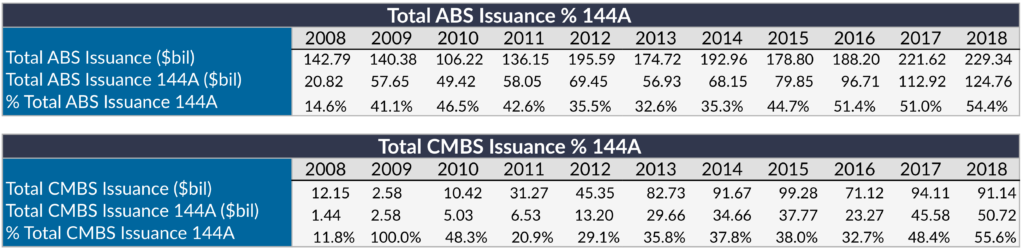

In the structured sectors, the growth of 144A issuance since the financial crisis has been even more pronounced. In the Asset Backed and Commercial Mortgage Backed Sectors, over half of the bonds in 2018 were issued under Rule 144A (Exhibit 1). In the Non-Agency Residential Mortgage Backed Sector, almost all of the securitizations in the past few years have been issued under Rule 144A.

Exhibit 1

A greater supply of bonds is the primary benefit of 144A issues to investors, but it’s not the only one. Underwriters of 144A structured securities typically provide more granular loan level data, which isn’t made available for public issues. This feature allows investment management research teams to better understand the characteristics of the underlying collateral, model cash flows, and predict deal performance.

While some 144A issues may offer a yield benefit, increasing the limit on 144A issued securities is not necessarily a yield enhancement strategy. In an acknowledgement from the market that public issues versus 144A are nearly identical, there is very little or no yield premium for a given issuer whether they come with a 144A versus a public transaction. Increasing 144A limits is really about expanding the opportunity set, particularly in the ABS, CMBS, and Non-Agency RMBS sectors. For example, the entire single property CMBS market and nearly the entire ABS market outside of prime auto deals and credit card transactions are 144A.

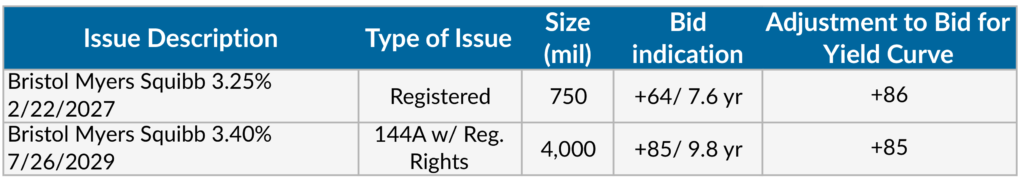

Given the pool of potential investors in 144A is limited to those with QIB status, it would be reasonable to assume that 144A issues are less liquid than public bonds. However, liquidity for both fully registered and 144A securities is impacted primarily by the specific issue characteristics which include issue size and credit quality. Bid side indications for similar tenor public and 144A bonds are generally the same. An example is shown in exhibit 2.

Exhibit 2

Conclusion

As 144A private placements become a larger component of the bond market, they warrant consideration as a greater percentage of portfolios for QIB investors. Constraining 144A to a small percentage of a portfolios’ holdings is an outdated restriction in today’s market, limits the investment options for managers, and doesn’t necessarily reduce a portfolio’s risk profile. If your investment guidelines have restrictions on the exposure to 144A issues, ask your investment manager about whether increasing those limits would benefit your portfolio’s diversification and opportunity set.

NAIC’s Updated Grid and Bond Designations: What Insurers Need to Know

January 20, 2026