insight

AAM Corporate Credit View: January 2012

January 26, 2012

2012 Outlook

Overview

Performance in 2011 departed from our outlook of positive excess returns largely due to the heightened systemic risk emanating from Europe, causing a flight to quality rally. In 2012, we expect spread volatility will continue, as Europe remains in the headlines, affecting economies in Asia and the U.S. Although not what we expect, a fracturing of the European Union (EU) is certainly a possibility with some economists[1] using it as their base case. We anticipate investor concern will reignite, stemming from weaker than expected economic growth, debt restructurings (Greece, Ireland, Portugal) and resistance to more austerity.

| We are selectively positive on Corporate credit given our expectation for ECB support and low defaults in the U.S. | Our base case is that the EU remains intact after debt monetization by the European Central Bank (ECB) due to the high direct and indirect costs to Germany and France of a departure; however, we do not believe this intervention will be immediate. Therefore, we are expecting spread volatility to be similar or higher than 2011. We recognize company fundamentals are very strong and the U.S. economy continues to grow albeit at a low rate. That said, the downside risk (which is largely political) and overall vulnerability of economic growth coupled with high sovereign debt levels tempers our optimism. We are selectively positive on investment grade Corporate credit and are avoiding Europe, growth challenged sectors and low quality credits. Our view is the market is fairly valued, and risk adjusted income is particularly attractive in higher quality BBB cyclical Industrials, pipelines, domestic banks, and REITs. Although fundamentals may have peaked last year, we believe the uncertainty associated with Europe will cause most management teams to remain cautious when deploying capital and committed to a strong and liquid balance sheet. |

From a technical standpoint, our views are mixed. Although we expect a healthy new issue calendar and dealer inventories of corporate bonds are low, investors have increased their overweight to U.S. corporate credit[2] and the cost of liquidity associated with the Volcker Rule could be significant. We are less bearish on long duration Corporate bonds than this time last year due to the spread widening and slight steepening of the credit curves (10 year to 30 year spread basis widened by approximately 10 basis points), but we continue to prefer the intermediate part of the curve due to the anticipated market volatility and current spread levels.

The Corporate Market Underperformed in 2011

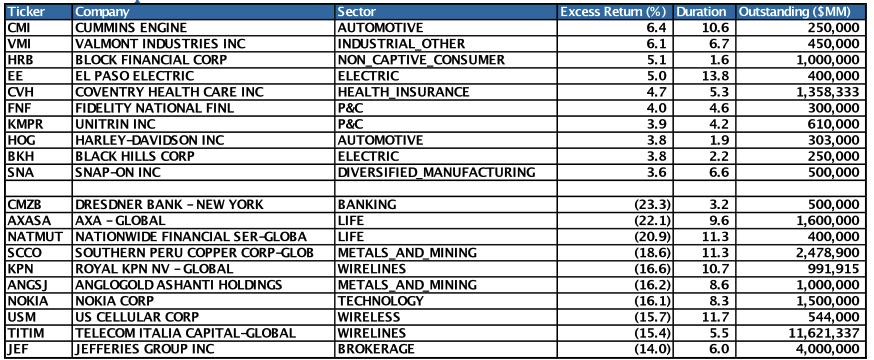

| Spreads underperformed in 2011 due to the flight to quality rally as a result of increased systemic and political risk. | Despite the domestic economy and company fundamentals performing as we had expected in 2011, heightened systemic and political risk resulted in a flight to quality with 5+ year Treasury yields falling over 100 bps, and investment grade credit spreads widening 78 bps. Financials underperformed more defensive Industrial and Utility sectors, and longer duration securities performed exceptionally badly, -846 bps of excess return vs. the market’s -367 bps (defined by Barclays Capital U.S. Corporate Index). The differential between BBB and A-rated Industrial credits widened from 74 bps at year-end 2010 to 121 bps, which is wide of its 98 bps historic mean and reflective of the differential in mid-2009. Generally, European financial and infrastructure credits underperformed domestic peers, exemplified by the spread differential (“basis”) between European and domestic banks, widening from 104 to 143 bps per the Credit Suisse LUCI Index. As shown in Exhibit 1, performance did not rest on the macro call alone. The Metals and Mining industry is a good example of credit selection. While Southern Peru Copper, Anglogold (shown in Exhibit 1), and Commercial Metals (which was downgraded to high yield, falling out of the investment grade market) underperformed significantly, BHP Billiton and Rio Tinto outperformed the market. |

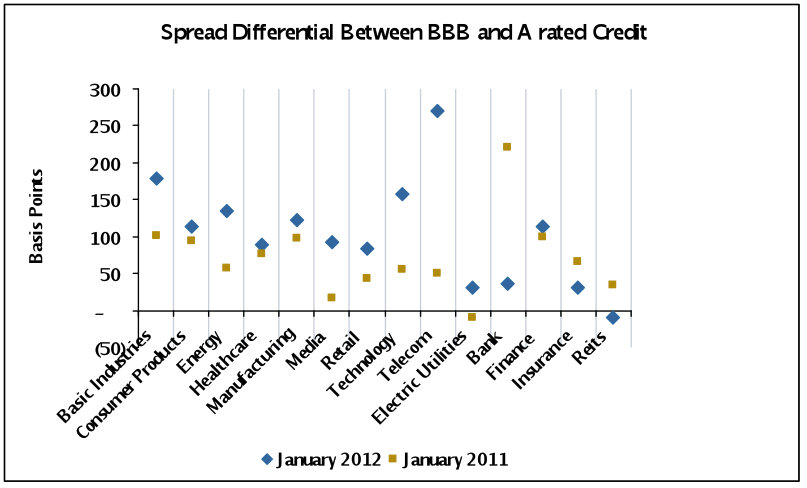

Despite the domestic economy and company fundamentals performing as we had expected in 2011, heightened systemic and political risk resulted in a flight to quality with 5+ year Treasury yields falling over 100 bps, and investment grade credit spreads widening 78 bps. Financials underperformed more defensive Industrial and Utility sectors, and longer duration securities performed exceptionally badly, -846 bps of excess return vs. the market’s -367 bps (defined by Barclays Capital U.S. Corporate Index). The differential between BBB and A-rated Industrial credits widened from 74 bps at year-end 2010 to 121 bps, which is wide of its 98 bps historic mean and reflective of the differential in mid-2009. Generally, European financial and infrastructure credits underperformed domestic peers, exemplified by the spread differential (“basis”) between European and domestic banks, widening from 104 to 143 bps per the Credit Suisse LUCI Index. As shown in Exhibit 1, performance did not rest on the macro call alone. The Metals and Mining industry is a good example of credit selection. While Southern Peru Copper, Anglogold (shown in Exhibit 1), and Commercial Metals (which was downgraded to high yield, falling out of the investment grade market) underperformed significantly, BHP Billiton and Rio Tinto outperformed the market.

Exhibit 1: Top and Bottom Performers in 2011

Source: Barclays Capital, AAM (Note: Duration and Excess Returns are market value weighted averages of year-to-date figures; Credits included in the Barclays Capital U.S. Corporate Index as of 12/31/11)

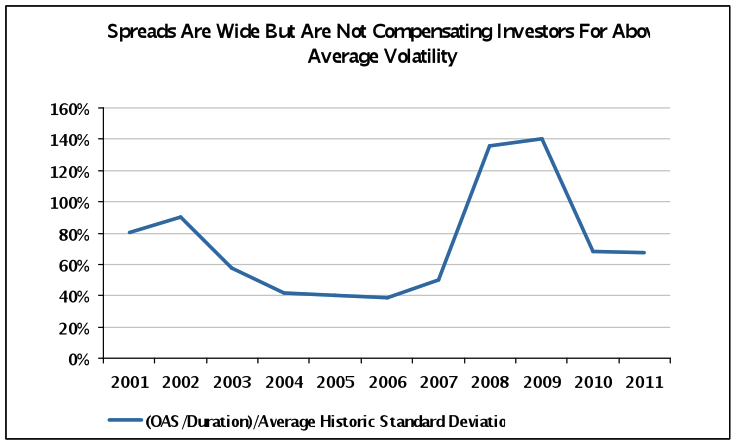

Spreads are Wide but Volatility is High

Spread volatility increased significantly in 2012, 40 bps vs. 13 bps in 2010. That said, 38 bps is the average over the last decade. As shown in Exhibit 2, the market is expecting the current rate of volatility to continue. While this is our base case, we believe there is a greater probability that volatility will be higher in 2012. Fiscal problems in Europe and the U.S. remain unsolved while GDP growth rate expectations are fairly dismal, and emerging markets are cooling. Positively, if the year is benign, we could see systemic risk premiums decrease a considerable amount (one third of the market OAS[3]) especially in Financials.

Exhibit 2

Source: Barclays Capital U.S. Corporate Index, AAM

Source: Barclays Capital U.S. Corporate Index, AAM

| Spread volatility is expected to remain high and defaults to increase in Europe. | One would assume in an environment of rising volatility, especially tail risk, yields would increase to compensate investors. That did not happen for U.S. credit. The very strong fundamentals of domestically domiciled companies and the containment of risk in Europe kept defaults very low in the U.S. (1.5%[4]) and recoveries better than average, yielding a very low loss rate (0.6%). Defaults are expected to increase in 2012 in the U.S. (4.8%) albeit remaining lower than the historic average[5]. Europe should see another year of higher defaults, remaining very vulnerable to bank deleveraging since the banks have provided the majority of credit vs. the public capital markets in the U.S. Moreover, European firms are more leveraged and face lower growth prospects. Therefore, it will be evident in 2012 if the two markets can decouple as many market pundits are expecting. We believe it is very difficult for significant deleveraging to occur and not affect other economies world wide. China, for instance, was a primary beneficiary of the bank expansion in the European Union and the United Kingdom. |

Supply of Spread Product is Expected to Decrease (Again) in 2012

| We expect corporate supply to fall slightly from 2011 levels. | The new issue market for investment grade corporate issuers was active in 2011, but lower than 2010 with gross issuance $630 billion vs. $659 billion. Financial issuance decreased in 2011 due to deleveraging that continued in the U.S. and the buyer’s strike that occurred for European financials in the second half of the year. Industrial issuance was up in 2011, generally related to increased share buyback and merger and acquisition (M&A) activity as well as the continued pre-funding of maturities. Despite the high level of systemic risk and volatility, M&A was up in 2011 ($2.3 trillion globally vs. $2.2 trillion in 2010), and acquisition premiums remained in the low-mid 20% range per Bloomberg. Domestically, corporate fundamentals, liquidity in particular, are very strong, and with low interest rates and weak growth, heightened M&A activity is to be expected. |

The new issue market for investment grade corporate issuers was active in 2011, but lower than 2010 with gross issuance $630 billion vs. $659 billion. Financial issuance decreased in 2011 due to deleveraging that continued in the U.S. and the buyer’s strike that occurred for European financials in the second half of the year. Industrial issuance was up in 2011, generally related to increased share buyback and merger and acquisition (M&A) activity as well as the continued pre-funding of maturities. Despite the high level of systemic risk and volatility, M&A was up in 2011 ($2.3 trillion globally vs. $2.2 trillion in 2010), and acquisition premiums remained in the low-mid 20% range per Bloomberg. Domestically, corporate fundamentals, liquidity in particular, are very strong, and with low interest rates and weak growth, heightened M&A activity is to be expected.

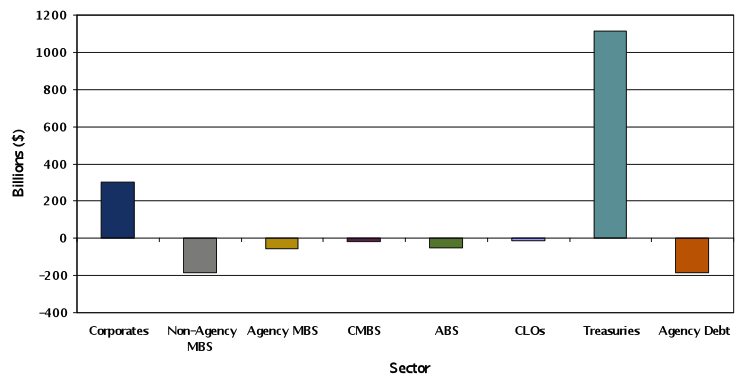

We expect 2012 new issuance of investment grade corporate bonds to be $545 billion gross, $250 billion net of redemptions, slightly less than 2011 levels. Since coupon payments for investment grade corporate securities are expected to be $240 billion[6] in 2012, and net supply is expected to be negative for all other spread sectors (Exhibit 3), technicals should be supportive in 2012. We have witnessed increased issuance from European industrial issuers in the high yield market this month. Although less likely in the investment grade market, it could provide an upside to our estimate.

Exhibit 3: 2012 Net Supply Estimate All Spread Product

Source: Barclays Capital, JPMorgan

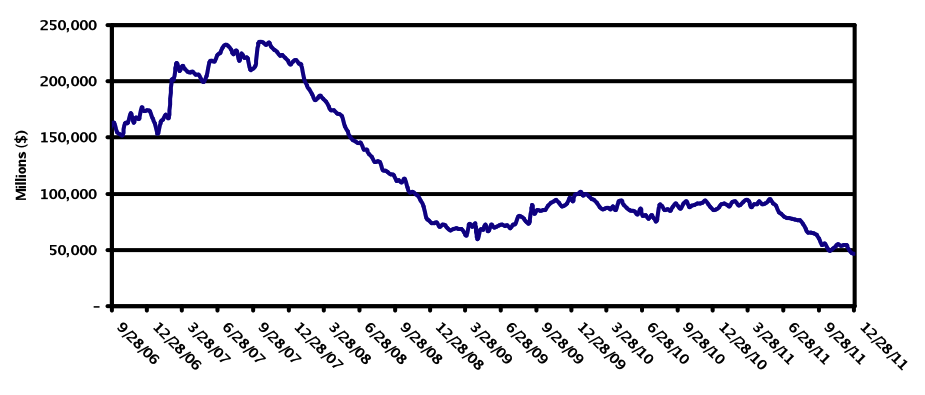

In addition to falling new issuance, secondary supply has continued to contract with primary dealer corporate bond inventory falling to levels not seen since 2003 (Exhibit 4). We wrote about this dynamic in early 2011[7], explaining the regulatory and structural changes. Market volatility increased mid-year, forcing dealers to reduce positions further. JPMorgan estimates that dealer inventory is now less than 1% of the investment grade market vs. the peak in 2007 of 10%.[8] The reduction of liquidity is a real challenge for large asset managers and insurance companies. Importantly, for asset managers who are able to access both markets, a trader must consider the following when buying or selling bonds: liquidity, amortization of high dollar prices, and curve placement (due to the very steep Treasury curve) to name a few. The uncertainty relating to the Volcker Rule is material, reducing liquidity and widening bid-ask spreads.

Exhibit 4: Dealer Inventory of Corporates With a Maturity of Greater Than One Year

Source: Bloomberg, AAM

Sector Outlooks

Banks – Fair (Prefer U.S., Avoid Europe)

The Bank sector is left facing unresolved macro-political headwinds in 2012. The dual uncertainties of political/regulatory risk in the United States and sovereign crisis in Europe completely overshadow a continued strengthening of underlying fundamentals. These persistent macro-political risks, as well as our more cautious outlook for economic growth in 2012, have led us to lower our sector view to “Fair” from “Attractive.” We continue to prefer strong domestic banks and avoid those in Europe and Asia. Furthermore, while the regulatory reforms enacted over the past two years have the potential to transform the sector into a much more stable, utility-like sector, the high-beta characterization of the sector was affirmed in 2011 and should be assumed to continue over the intermediate-term.

Real Estate Investment Trusts (REITs) – Attractive

This sector is largely domestic, benefitting from the economic recovery, low interest rates and lack of new construction. We have preferred apartment and central business district (CBD) office REITs vs. retail, healthcare, and warehouse. While economic uncertainty in the second half of 2011 has weighed on spreads, fundamentals for the sector are much stronger than they were heading into 2008. REITs have materially improved liquidity, balance sheet leverage, occupancy and net operating income over the past three years, making the sector more attractive on a stand alone basis, and leaving public REITs much better positioned vs. private real estate owners as new properties become available. While heavy recurring funding needs are an ever present concern for the sector, most REIT issuers have successfully entered/renewed credit lines on favorable terms over the past six months, and liquidity availability is reasonable relative to maturity and operating needs over the next twelve months. We believe this sector offers attractive value especially versus lower yielding CMBS and BBB cyclical Industrials.

Insurance – Fair

Risks for life insurance companies increased last year, as equity volatility and systemic risk increased and the prospect for rising yields in the near term dimmed. Operationally, property and casualty companies performed worse than expected given the higher level of claims. This should normalize, increasing the prospect for improved pricing. Fundamentally, we continue to prefer the health insurance sector. Notwithstanding the new legislation, this sector is highly profitable with structural benefits. In this environment, we prefer only the highest quality companies and senior positions in the capital structure.

Basic Industries – Fair (Prefer Strong BBBs)

Chemicals – This sector has reduced its cyclicality by becoming more of a specialty products industry where pricing power is easier to maintain. It benefits from its limited exposure to Europe and growth from the U.S., Asia and Latin America. This coupled with the benefit of lower natural gas prices for North American chemicals allowed us to become more positive on the industry. The sector outperformed last year, and we view it as fairly valued with a risk adjusted income profile similar to the broad Industrial Index.

Metals/Mining – As mentioned earlier in the article, this sector is a combination of diversified and pure play companies; therefore, commodity price forecasts and geographic exposures (including an assessment of political risk) are important factors in the analysis. Metals prices were very high coming into 2011, and as they dropped, pure play companies underperformed. We prefer the diversified operators because of this volatility, and the reduced probability of balance sheet damaging, transformational acquisitions. Moreover, with China comprising approximately 40% of the demand for metals, its continued growth is critical. Spreads widened in 2011, taking into account the concerns about slowing economic growth especially in China. We expect this sector to remain volatile, preferring the higher quality, diversified operators.

Capital Goods (Avoid credits reliant on government funding)

Aerospace/Defense – This sector underperformed last year, as risk premiums were assigned to reflect the pressure on revenues due to the defense spending cuts forecasted which will impact credit metrics. We expect lower top line growth in addition to compressing margins from more competitive pricing to challenge management teams and increase event risk and shareholder friendly actions. Despite the spread widening, we remain negative on this sector, expecting downward rating migration.

Construction Machinery and Diversified Manufacturing – U.S. manufacturing remains solid as reflected by indications of expansion through favorable PMI (Purchasing Manufacturing Index) readings since 2009. Companies in both sectors are highly rated, and diversified, geographically and by end market. Weakness in Europe should be offset by especially strong growth in mining and agriculture. We expect companies to finance acquisitions conservatively to preserve their ratings due to the necessity of funding working capital. Spreads are tight relative to other Industrials, but we believe this is appropriate given the fundamental outlook and positive technicals (little issuance).

Communications (Prefer Media and high quality Telecom)

Telecommunications – This sector continues to converge with media and telecom operators becoming more interdependent. We remain negatively disposed to the European telecom operators due to ratings risk, revenue and margin pressure from economic malaise and pro-consumer regulatory changes, and compressing free cash flow as EBITDA remains flat or decreases while dividends are high and capital spending needs to increase. In North America, especially the U.S., we believe consolidation is imperative as there are too many operators for a maturing industry. We are only investing in the largest and strongest due to these structural challenges that will pressure fundamentals for all.

Cable – In 2012, we expect the cable operators to get more aggressive with marketing their broadband service and new video interface technology to help them retain customers. That said, we believe if the consumer remains weak, voice revenues will remain under pressure and we could see DVR and other premium services get canceled as new technology is utilized (e.g., internet/video on demand instead of DVR). Capital spending is not going up, and continues to fall slowly which is good for equity holders. That said, companies are looking to consolidate the industry, so that will be a use of free cash flow and balance sheet capacity. Accordingly, we don’t expect the cable companies to reduce leverage in 2012 but to remain within ranges consistent with their rating categories. Given the high degree of operating leverage, we are largely avoiding the sector until this uncertainty is reduced.

Media/Entertainment – Benefitting from the Olympics and elections in 2012, advertising growth is expected to exceed GDP growth. Even though media is a cyclical sector due to its reliance on advertising and is exposed to the consumer via products, film entertainment (movies, DVDs) and theme parks, the fees they collect for content provide a revenue stream that should be resilient in a soft economy. The media sector benefits from its low capital intensity, and as we saw in the last recession, companies increase their financial flexibility by slowing share repurchases and M&A. They have improved their balance sheets over the last five years, operating with more discipline from a cost perspective. We believe media companies are best capitalized as BBB entities, requiring financial flexibility to invest in content creation. Spreads widened last year, and with the favorable forecast for advertising, we believe the sector should outperform other cyclical sectors this year. That said, companies differ in regards to exposure to various segments of the media market. We prefer those that produce content for television and are geographically diversified (skewed towards growth markets) with strong brands. We are avoiding companies with exposure to “old media” like textbooks, newspapers, and radio due to the technology and secular changes taking place.

Consumer Discretionary – Unattractive

Consumer Products – This is a mature sector with highly rated, diversified companies. Investors view it as one that is defensive despite the high level of event risk. Companies have benefited from growth in developing economies, and as global growth slows, we are concerned that it will result in leveraging M&A and/or shareholder friendly actions. That said, many companies rely on the commercial paper market to fund working capital, providing management with a real incentive to remain focused on their ratings (A1/P1 requires mid-A ratings at a minimum). Credits in this sector have very low yields, and we believe the risk adjusted income is not attractive relative to other investment alternatives.

Food/Beverage – Another defensive sector with similar characteristics and challenges as Consumer Products. Although commodity prices are down from their 2011 highs, we expect them to remain volatile and pressure margins if pricing gets challenged by consumers. We invest in companies that have recently entered into a large transaction, have significant advantages in terms of brand equity and/or are large and diversified with power over both suppliers and customers. Spreads are inside of the Industrial Index, appropriate in our view, but given our expectation of heightened event risk, we remain buyers on this new issuance.

Pharmaceuticals – This industry has performed very well with strong free cash flow and balance sheets. The patents associated with over $120 billion of branded drugs will expire between 2011-2015. This will pose a challenge for credits lacking diversification and/or a new product pipeline. Replacing lost revenue may result in another wave of M&A, which given already high credit ratings, will be largely debt financed. We prefer those companies that are diversified away from branded drugs and have solid pipelines. Similar to Food/Beverage, we take advantage of new issuance associated with large acquisitions, a trend we expect will continue in this sector.

Consumer Nondiscretionary – Fair

Retail – Holiday sales were better than expected, and luxury sales continued to be supported by a higher income demographic that that recovered more quickly from the recession. In 2012, we expect the consumer to remain cautious. Headlines and market volatility could cause the high end consumer to pause after an active year of spending in 2011. Lower commodity costs are likely to be offset from heavy promotion activity, resulting in very little margin expansion over last year. We expect companies that are underperforming (e.g., Lowe’s, Safeway) to seek shareholder return via debt financed activity. Our bias is to invest in the leaders in their respective categories (e.g., Walmart, Home Depot, Nordstrom’s, CVS), as low economic growth will be sufficient for these operators to perform well.

Energy – Fair to Attractive

Our more cautious outlook for economic growth and expectation for supply coming from Libya and shale offset by a reduction of supply from the Gulf of Mexico are main contributors to our outlook for oil of $85/barrel (WTI). Given this more pessimistic GDP outlook relative to 2011, we expect revenue and cash flow for Independents and Integrated energy companies to be weaker in 2012 versus 2011. Since our view differs from the market, we are taking advantage of the lack of differentiation among credits from a valuation perspective, investing in those we project will have positive free cash flow. Our more defensive bias causes us to prefer the Integrated sector, viewing valuations as attractive for large, diversified operators.

Future revenue and cash flow from the Oil Service sector is dependent on the capital spending of the Independents and Integrateds (collectively, the “Upstream”). Our less optimistic view of commodity prices results in a lower revenue projection for the industry. We are forecasting that Upstream capital spending will increase by 5% in 2012, rather than the 10-15% most are expecting. The reduction in revenue is manageable for most companies from a credit quality perspective. Therefore, despite our more pessimistic outlook, we are investing in the sector, preferring the higher quality oil field service companies (Schlumberger) and those focused on balance sheet improvement (Ensco). Spreads are compelling for the sector today versus Industrials due to the overhang related to the Gulf spill (affecting Transocean) and the lower credit quality nature of the sector (risk premiums increased for BBB Industrials especially deep cyclicals in 2011).

Technology – Unattractive

This sector has benefited from the economic recovery and investment from the business sector to increase productivity. We expect IT (Information Technology) spending to grow at a pace of 4% in 2012, slightly lower than 2011. Less discretionary items (storage, security, servers) should be in higher demand after spending on more discretionary items. We expect the trend of tablet replacement of PCs and data center outsourcing to continue, and for more companies to turn to the cloud for non-critical applications. The lack of risk adjusted income for low quality credits, keeps us investing defensively in this sector. We believe the downside risk is too great in challenged companies such as HP and Dell, preferring to invest in proven leaders with exposure to growth segments such as Oracle and IBM.

Transportation – Attractive: Rails

The structural challenges associated with the airline industry continue, as exemplified by American Airlines bankruptcy last year, causing us to avoid the Airline sector. However, we do like the Railroad sector and have a very favorable view of fundamentals. The industry has benefited from the diversity of product moved on the railcars and ability to gain market share from competition given strong service levels, attractive rates, and regulatory changes. After the recession, the rails were able to accommodate increased volumes without increasing expenses. Credit metrics are the strongest they have been in five years. We expect revenue growth to remain strong in 2012 (6% (4% from pricing, 2% from volume)) vs. the 9% we expect in 2011, as economic growth slows, fewer legacy contracts are renegotiated and price increases are more difficult to implement. Spreads have widened and are attractive relative to where they have traded over the last couple of years. Compelling valuation and our positive fundamental outlook makes this an attractive investment opportunity.

Electric Utilities – Unattractive

We believe fundamentals for 2012 are neutral for electric utilities. We expect revenue and cash flow to be slightly weaker in the upcoming year based on flat demand, weaker electricity prices and slightly weaker margins. We expect demand to be flat based on domestic GDP growth of 1%-2% and flat weather related demand. Moreover, electricity prices are expected to be softer based on lower prices for both natural gas and Powder River Basin coal, the raw materials used to generate electricity. Margins are expected to be flat for regulated utilities, but slightly weaker for unregulated power producers due to weaker power prices and flat operating expenses. From a leverage perspective, we expect it to continue to creep higher as companies are unable to meaningfully reduce debt. Importantly, the regulatory environment is somewhat more certain than it was at this time last year.

Viewed as a defensive sector, the electric utility industry performed very well in 2011. Following the strong results of 2011, the Electric Utility OAS started 2012 at 89% of the Industrial OAS, which is substantially richer than its 1-yr and 5-yr averages, of 97% and 99%, respectively. This has been driven by strong demand for regulated operating company first mortgage paper, which tends to be rated in the single-A category. We prefer to take advantage of the discount currently offered by issuers at the holding company or unregulated operating company, and view the sector largely as unattractive on a risk adjusted basis.

Pipelines – Fair to Attractive

We believe the fundamentals for the pipeline segment are positive. Volumes of oil, refined products, natural gas and natural gas shipments are largely determined by domestic GDP, which should increase slightly. Notably, volumes of natural gas liquids should probably increase faster than GDP growth given the heightened demand from the chemical sector. We believe another positive fundamental is the expanding number of resource basins, which will lead to greater size and cash flow generating capability. Thirdly, we expect balance sheets to continue to improve because many large projects are now generating cash flows after numerous quarters under construction. The one somewhat negative item affecting Master Limited Partnerships (MPLs) is heightened M&A risk. We could see more mergers as the pipeline companies recognize the benefits of diversifying their operations. Spreads widened in 2011, due to the sector’s reliance on external sources of financing. On a risk adjusted basis, expecting volatility to remain high in 2012, we believe spreads are Fair. That said, there are attractive opportunities in our preferred MLPs (Kinder Morgan Partners (KMP), Enterprise Products Partners (EPD)).

Summary of Sector Views

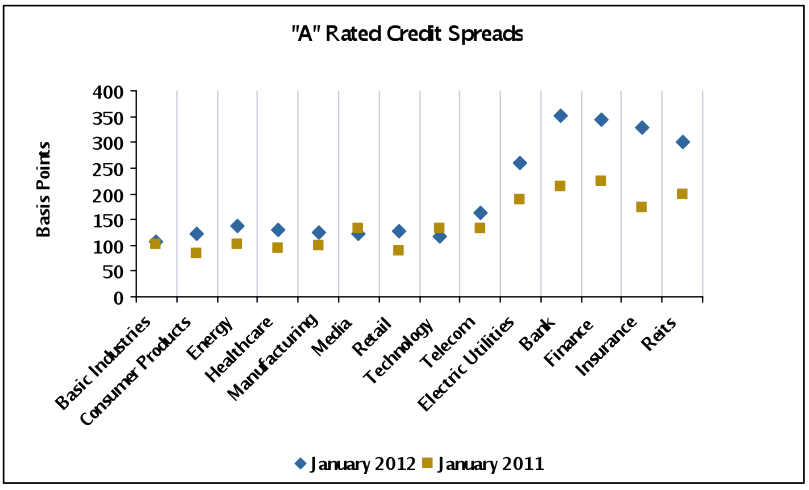

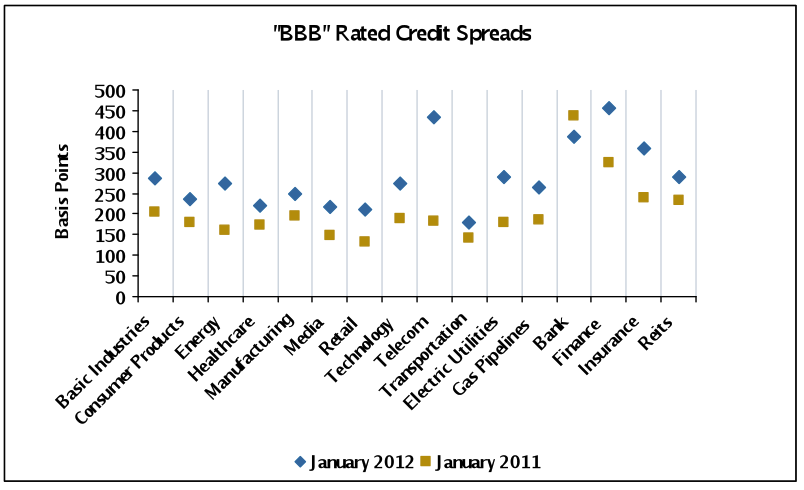

As shown in Exhibit 5, A rated Industrial credit spreads are slightly wider than one year ago with very little differentiation among sectors. Unlike last year when we had more pessimistic views on A rated retailers, consumer product companies, pharmaceuticals and media, after the spread widening that took place, valuations are more in line. We are more favorably disposed to the A rated Energy (Integrated) and domestic Telecom companies in the Industrial segment and continue to prefer domestic banks and Insurance companies within Finance.

Looking at Exhibits 5-7, especially Exhibit 7, it is evident that the basis between A and BBB rated Industrials widened due to the increased systemic risk and default risk in Europe. The spread widening in the Electric Utility, Telecom and Bank sectors was also due to the European credit spread widening. We noted the widening of the European and U.S. bank basis of 39 bps, and this was similar for European and domestic telecom (56 bps). Spreads have widened, especially for BBB issuers; therefore, the market is pricing in a level of uncertainty related to Europe and economic growth. Our expectation is for heightened volatility but with support from the ECB; therefore, we are investing defensively in the BBB rating category, preferring higher quality companies in cyclical sectors where the risk premiums are more significant. The same is true for Pipelines and REITs.

Exhibit 5

Exhibit 6

Exhibit 7

Source: Credit Suisse LUCI Index, AAM (Note: the Electric Utility Index is heavily weighted towards European issuers in the LUCI index); Data as of January 17, 2012.

Written by:

Elizabeth Henderson, CFA

Director of Corporate Credit

Michael Ashley

Vice President

N. Sebastian Bacchus, CFA

Vice President

Bob Bennett, CFA

Vice President

Patrick McGeever

Vice President

Hugh McCaffrey, CFA

Vice President

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

[1] Loynes, Jonathan, “European Economics Focus – How and When will the Euro-zone break up?,” Capital Economics, November 28, 2011.

[2] Melentyev, Oleg, Bank of America, “Jan ’11 Credit Investor Survey: Near term bullish,” 4.

[3] Shoup, Jason; Citi “US Credit Outlook 2012 Outlook: Another Year on the Edge”, page 8 (80 of 240 bps)

[4] Verde, Mariarosa; Fitch “US High Yield Default Insight – 2011 Review” page 1

[5] Goldman Sachs “High Yield 2012 High Yield Credit Outlook & Best Ideas” page 1, 12/13/2011.

[6] JPMorgan

[7] AAM Corporate Credit View – May 2011

[8] Beinstein, Eric, JPMorgan “Credit Market Outlook and Strategy,” 5.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.