insight

AAM Corporate Credit View: July 2012

July 16, 2012

Focus Will Be on the U.S. in the Second Half of 2012

- Volatility has Increased in the Corporate Bond Market But is Lower than 2011

- Expect a Lackluster Earnings Season

- Company Fundamentals Have Plateaued

- Performance for the Investment Grade Market in the Second Half of 2012 is Expected to be Subdued Relative to a Strong First Half

Investment Grade Corporate Bond Spreads Continue to React to Economic Concerns

Volatility has increased in the Corporate bond market, reacting to a more pessimistic worldwide economic outlook. European fears remain elevated, despite positive headlines around the last summit, and investors are questioning the growth trajectory of the U.S. for the second half of 2012. Company revenue and earnings estimates have been revised lower, and mergers and acquisition activity has slowed substantially. Positively, after a subdued May, investment grade and high yield companies, both domestically and internationally, issued new bonds. Concessions for these new issues became more attractive, reflecting the market uncertainty. Investors reduced their exposure to Corporates, and broker-dealer inventory remains very low relative to historic levels.

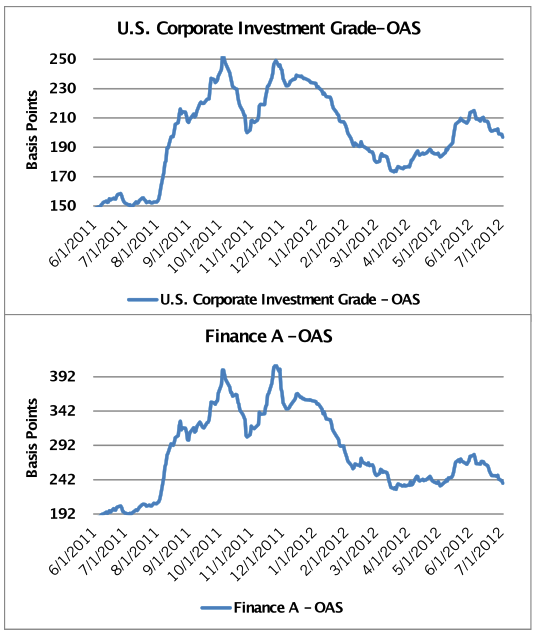

Exhibit 1

Sources: Barclays Capital, AAM

Since our last publication in mid May, Corporate spreads are relatively unchanged after widening in May and tightening in June. Investors earned 2.63% in addition to their return from Treasuries for Corporate bonds in the first half of 2012. The spread over Treasuries for the Corporate market is currently at its last twelve month average, trading in a 61 basis point (bp) range this year, less volatile than its 103 bps range over the last twelve months (Exhibit 1). The Financial sector has outperformed by a wide margin (582 bps of excess return over Treasuries per Barclays), followed by BBB Industrials (187 bps). Five to seven year securities have outperformed longer dated bonds (461 bps vs. 178 bps).[1]

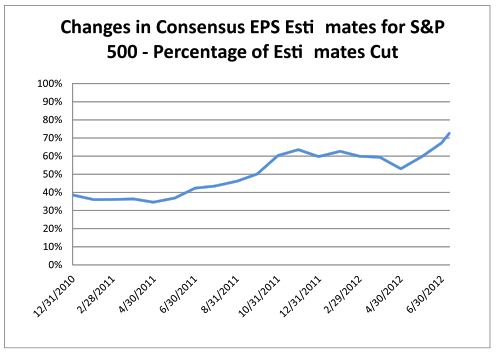

Earnings Season Is Expected To Be Lackluster

The second quarter earnings season will be a good indication of how companies are dealing with the more challenging economic and political conditions. We note that company issued financial guidance for the second quarter is the most negative since fourth quarter 2008, and more analysts have cut guidance for 2012 earnings per share (EPS) than during the crisis last year (Exhibit 2). The strengthening of the dollar has resulted in downward revisions to estimates as well as lowered economic growth expectations.

Exhibit 2

Sources: Bloomberg, AAM

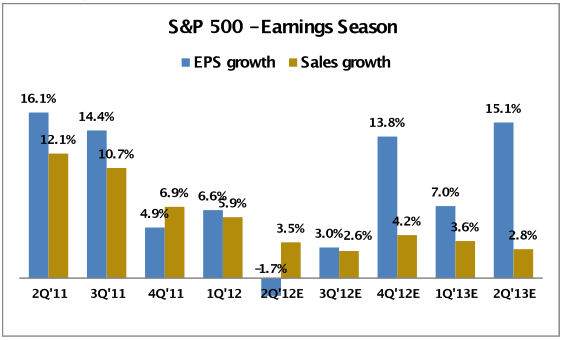

Revenue growth expecta-tions for the quarter are also the lowest since fourth quarter 2009. Margin compression is evident with revenue growth expected to exceed earnings growth after a period of margin expansion (Exhibit 3). Additionally, as shown in Exhibit 3, earnings expectations are quite high for the second half 2012 and for 2013, reflecting optimism regarding a resolution in Europe and worldwide growth. Lastly, we expect management to remain fairly guarded when communicating expectations for the second half of this year, which will not quell market fears of slower growth.

Exhibit 3

Sources: Bloomberg, AAM

At an industry level, companies are managing the expectation for slower growth differently depending on industry conditions. For instance, as we get closer to the election, analysts have been revising down capital spending estimates for Defense contractors for fear that proposed spending cuts will crimp growth in this sector. This slowdown continues into 2013 for the sector. On the other hand, the Railroad industry continues to show growth having managed through the major slowdown in coal usage that is such an important part of their business. Capital spending estimates continue to get revised higher even as GDP growth slows. This is a testament to the Rail industry and its secular advantages.

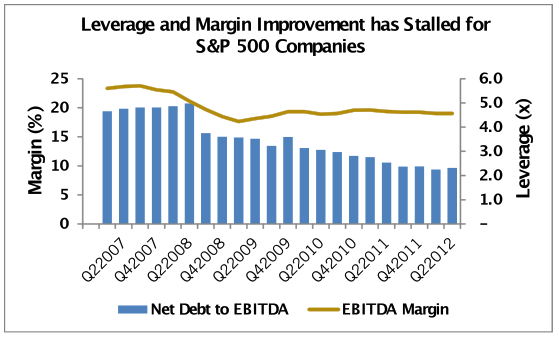

Fundamental Improvement Has Plateaued

From a bondholder perspective, the cycle of credit enhancement has ended (Exhibit 4). The current environment of low interest rates and market volatility makes it less compelling for treasurers to continue to build cash, looking instead to increase their shareholder remuneration. As growth continues to slow, we recognize the increased likelihood that leverage is used to generate returns for shareholders. For most companies, we expect that to occur within their rating levels. That said, we have seen increased shareholder activism, pressuring management to be more aggressive with their balance sheets. To date, companies that have split or sold assets have generally done so without rating implications and material spread widening. We believe the market is becoming complacent by failing to recognize the deterioration of asset and cash flow protection for bondholders. We are taking a more cautious stance towards sectors that we expect will be challenged from a growth perspective, specifically Food, Defense, and Consumer Products.

Exhibit 4

Sources: Bloomberg, AAM

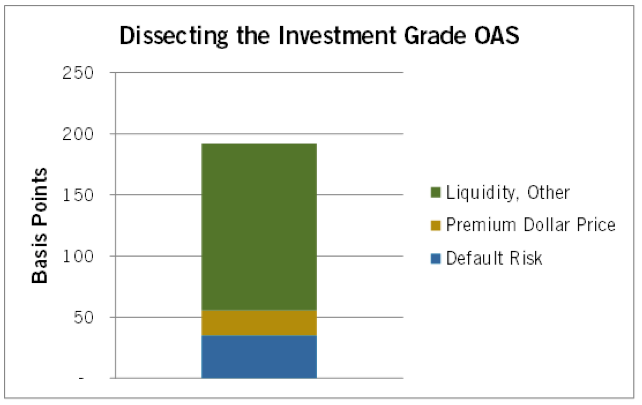

Due to the strong liquidity and deleveraging that has taken place, default expectations remain very low and as such, very little spread over Treasuries is required to compensate one for default risk in the investment grade market (Exhibit 5). We do not expect that to change in the near term unless an unexpected event occurs in Europe or the probability of a recession increases for the U.S.

Exhibit 5

Source: Default risk measured by Deutsche Bank (“2012 Default Study” April 16, 2012) using data from 1920, 10 year default period with 20% recovery; Barclays Capital Corporate Index as of July 13, 2012 used for total OAS and market price; AAM calculated market price premium as 1.5bps per bond point.

Macro Factors Will Continue to Drive Credit Spreads Over the Near Term with Particular Focus on the U.S.

Performing a regression analysis using economic and credit fundamental variables since 2009 to predict the Option Adjusted Spread (OAS) of the Investment Grade Corporate Index shows that approximately 80% of the variance in OAS can be explained by macro economic related variables. Adding more micro level variables (e.g., earnings revision ratio) increases this to approximately 93%. While we appreciate this relationship and apply a top down view to our credit analysis, we understand that at some point, credit spread volatility will be driven more by idiosyncratic vs. systemic risks.

Unfortunately, for the near term, we expect political and fiscal debates in the U.S. as well as events in Europe to drive spreads, keeping the market largely range bound around 200 bps. Our investment thesis remains unchanged, maintaining a more defensive Corporate portfolio. We continue to believe that Corporate bonds can produce positive returns over Treasuries in 2012; however, we do not expect the second half of the year to generate the level of excess return experienced in the first half (2.6% for the Barclays Capital Corporate Index). We anticipate a buying opportunity later in the year, when the risk of a U.S. recession increases.

Written by:

Elizabeth Henderson, CFA

Director of Corporate Credit

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

[1] Barclays Capital data as of July 6, 2012.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.