insight

AAM Corporate Credit View: September 2010

September 2, 2010

Is It Really That Bad?

Earnings season is almost over and while the data was positive overall, management commentary coupled with weaker than expected economic data disappointed the markets, sending equities and Treasury yields lower. Corporate spreads were mixed with intermediate-to-longer duration bond spreads widening while short duration spreads tightened. Similarly, cyclical and other economically sensitive sectors generally underperformed. The Corporate market, as measured using Barclays Corporate Index, posted -66 basis points (bps) of excess return for the month, pulling down the excess return year-to-date to -48 bps. We expect this volatility to continue in the second half of the year. Since 1989 when the U.S. GDP growth rate was between 0% to 2%, the Investment Grade Credit market posted positive excess returns. We expect the same in 2010, although sector and credit selection is critical, as the credit market should continue to differentiate and assign greater risk premiums to sectors and credits that face challenging growth prospects either due to the economy or idiosyncratic issues.

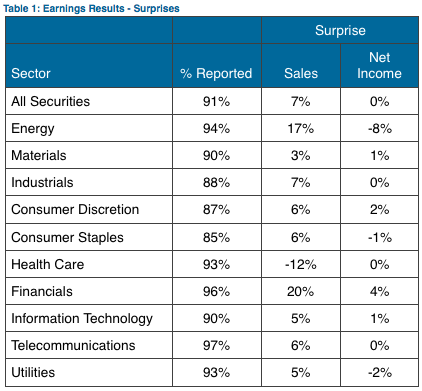

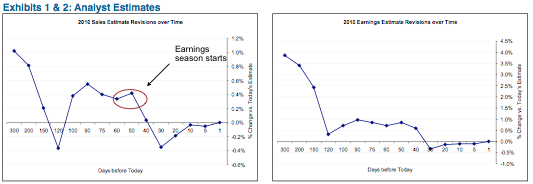

Since last month’s Corporate Credit View was dedicated to Financials, this month’s will focus on Industrials and Utilities. Despite a quarter of better than expected results (Table 1), analysts were busily revising their estimates down for Industrials and Utilities for 2010 (See Exhibits 1 and 2). Even Western Europe surprised on the upside both for the second quarter and the forecast for the second half of the year.

We attribute these negative revisions to the worse than expected economic data that continued through August, notably imports, jobless claims, and home sales. Economists revised GDP forecasts down for the second quarter and the second half of 2010 and increased the probability of a double-dip recession, now approximately 25%.

CEOs from bellwether companies, Cisco and WPP PLC, voiced their concerns about the uncertain state of the economy and how that may affect their businesses, as customers make changes to their purchasing decisions. They were not alone, as the number of companies sounding a more cautious tone increased. Most have been cautious but not pessimistic and the lack of job creation, capital spending, and inventory re-stocking reflect this outlook. For example, retailers in general have tempered their full year guidance. Most of the companies who are reporting better than expected earnings have done so because of improvements with expenses rather than sales, as same-store sales have slowed in the second quarter versus the first quarter. Inventories have increased, which could lead to heavier promotion and potentially lower margins in the third quarter. Our cautious outlook for the economy and the consumer in particular leads us to invest only in category leaders, which includes high quality discounters such as Walmart and Target.

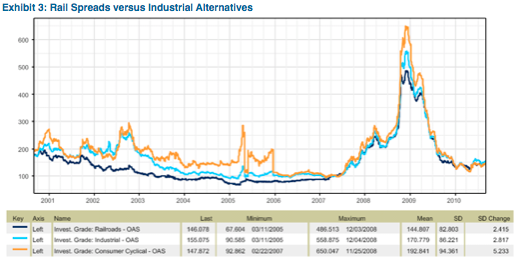

Despite a slowing Manufacturing sector, we saw continued improvement in the Rail sector. Every rail company beat estimates in the second quarter of 2010 and management commentary was constructive. Pricing and productivity enhancements are driving margins, and volumes are supporting the improvement in sales versus last year. We heard from most management teams that the economic recovery is in place even though it would probably be best described as only modestly growing. If volumes remain on the current trajectory, we could see an uplift to earnings estimates for the second half of 2010, accompanied with more aggressive share repurchase activity. This would be notable since rail loadings reflect customer decisions made six to nine months in the past, or in the case of third quarter 2010 results, the period of time when Europe garnered significant attention. Despite the Rail sector’s exposure to the broad economy, we consider the more diversified rail operators (i.e., Union Pacific (UNP), Burlington (BRK), Norfolk Southern (NSC)) viable investment alternatives in a low growth environment given strong competitive advantages versus other shipping modes and steady cash flow generation. We believe Rail spreads are attractive versus cyclical sectors, as they are about flat to each other and Rail spreads are less volatile (Exhibit 3).

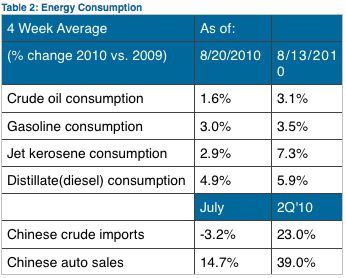

In the Energy sector, second quarter results were a mixed bag, and we expect them to remain murky in the second half of 2010. Generally speaking, the independent and integrated companies produced strong second quarter 2010 results due to increased production as well as higher commodity prices. The contract drillers and service companies, however had weak quarters due to the moratorium in the Gulf of Mexico and reduced demand from Latin American countries. In the second half of the year, we expect cash flows to be flat to slightly weaker for most of the Energy sector. Particularly vulnerable are those companies that are levered to natural gas, which has suffered due to abundant supply and weaker industrial demand. Absent a hurricane in the third quarter, natural gas prices are unlikely to rise meaningfully in the second half of the year. Contract drillers and service companies are likely to suffer weaker results due to uncertainty in the Gulf of Mexico, excess capacity created by the moratorium, and weaker natural gas prices. In terms of economic barometers, the following data points in Table 2 reflect positive, albeit slowing, demand domestically and continued strong demand from China, which is supportive for the Energy sector in the near-to-intermediate term and suggests a continuation of slow growth at a macro level:

The Utility sector posted modestly improved second quarter 2010 results behind strong weather-related demand in the northeastern part of the U.S. The results were partially offset by weaker pricing, which is the by-product of lower natural gas prices. Companies seem to be preparing for an improving environment, as their allowance for doubtful accounts have been trending lower. Most utilities expect demand to be up very modestly in the second half, as industrial demand remains tepid. Weak natural gas prices should also lead to lower prices, which will hurt the margins of the unregulated power producers. More than demand or pricing however, the biggest concerns identified by the sector were regulatory uncertainty regarding the now abandoned cap and trade regulation and the potential for increased taxes on dividends. We believe these concerns could lead to potentially lower capital spending and greater share repurchases. Regulatory and tax uncertainty were also cited as concerns by telecom companies, among others. We believe these are the main reasons why companies have been hesitant to spend or invest. Until this uncertainty is resolved, we expect these companies to remain hesitant to reduce cash or reinvest earnings. The approaching November elections only add to the difficulty of predicting the upcoming regulatory environment.

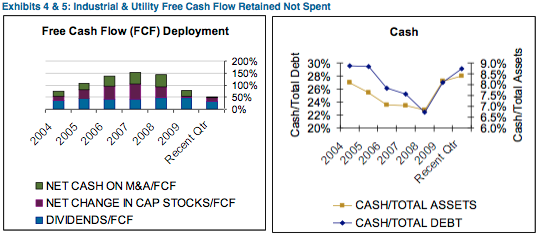

We like the backdrop the cash build (Exhibits 4 and 5) provides for the economy, and believe cash at the investor level has provided positive technical support for the Corporate bond market this year, especially for high quality Industrial and Utility credits. Unless the probability of a recession increases another 10+ percentage points, we expect this positive technical support to continue.

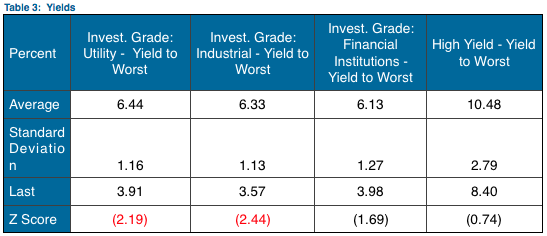

We remain constructive on the Corporate market, but as spreads for Utility and Industrial credits have generally marched tighter and Treasury yields have fallen, all-in yields for these two sectors are historically very low (Table 3). If spreads provide compensation for default risk adjusted for recoveries, the high dollar prices (which affects recovery rate) coupled with the uncertain economic outlook (which affects default rate) make spreads for these sectors particularly vulnerable to widening. We have reduced our exposure to more economically sensitive Industrial sectors (e.g., Media/Entertainment), redeploying the funds in non-Corporate sectors.

This information is developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as ‘AAM’), and their respective officers and employees. Any opinions and/or recommendations expressed are subject to change without notice.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.