Summary

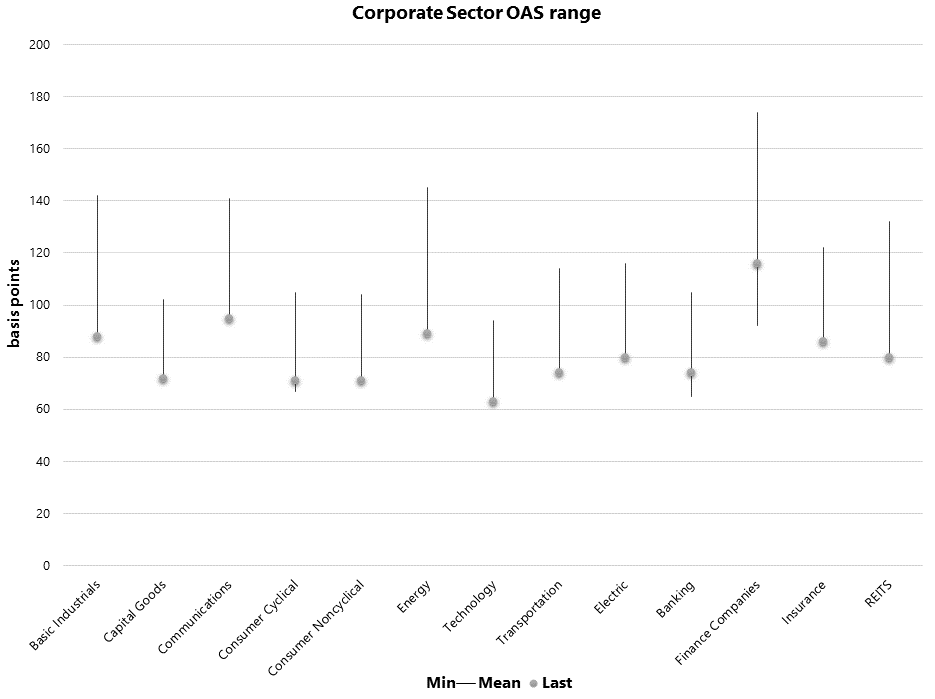

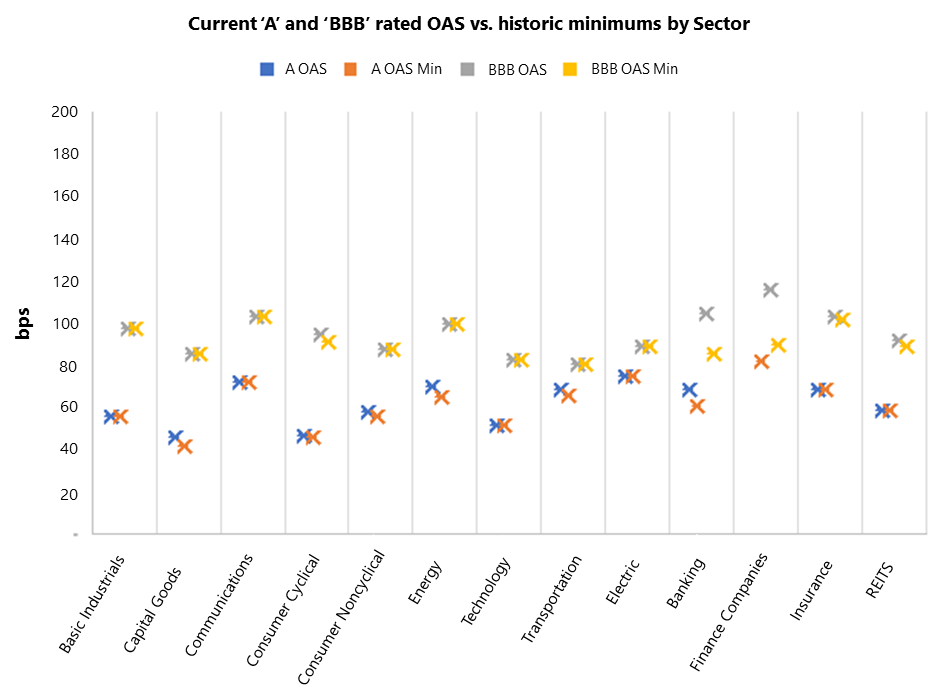

After a better-than-expected 2024, AAM’s outlook for the Investment Grade Corporate market is mixed. We expect the corporate market OAS to trade in a range of 80-100 bps, which reflects a constructive outlook for the economy and market technicals with elevated uncertainty regarding policy and political matters. With a current OAS1 of less than 80 bps and with most sectors trading at their historic minimum levels (see Exhibits 1 and 2), we expect modest to negative excess returns in 2025. ‘BBB’ rated credits should generally outperform higher quality, lower yielding credits unless economic growth disappoints.

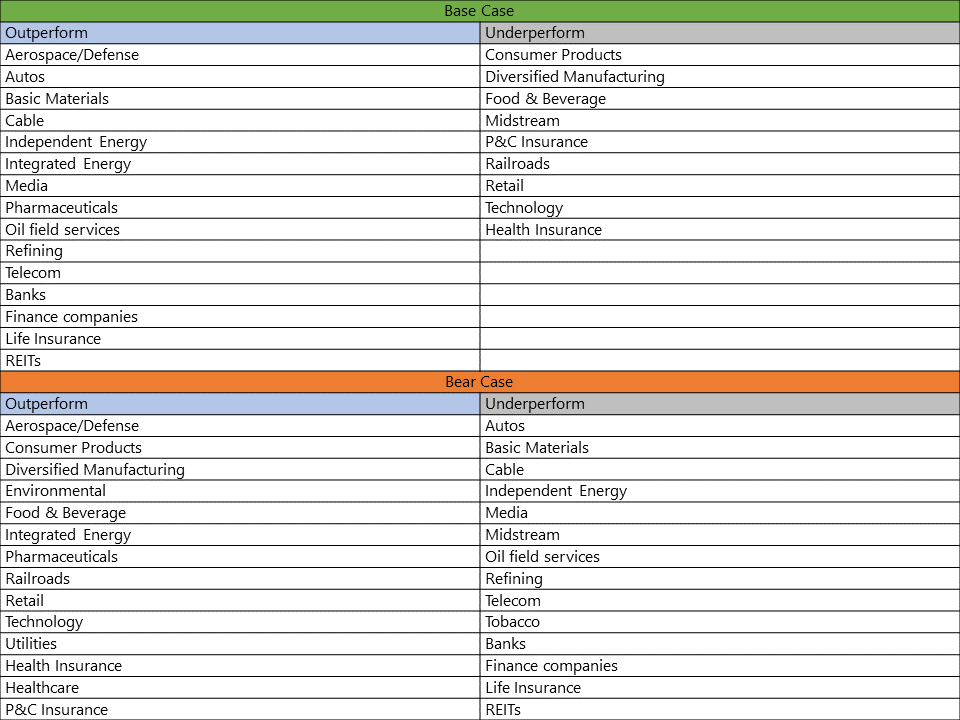

We favor most financial sectors as well as industrial sectors that are more immune to event-and policy-related risks such as tariffs. Spreads reflect an incoming Administration that is expected to be market-focused; therefore, a bear-case scenario would reflect actions that would threaten earnings growth or increase Treasury volatility. We expect improved CEO confidence in 2025 despite policy uncertainty due to the strong likelihood of deregulation, an extension of the TCJA2, high equity prices and the expectation for lower yields next year as the Federal Reserve cuts rates. This should lead to an active merger and acquisition (M&A) environment, particularly for sectors such as Media, Energy, Banks, and Consumer Non-Discretionary. Security selection is expected to drive performance in many of these sectors.

Exhibit 1: Sector Relative Value

Exhibit 2: Sector Relative Value by Credit Rating

Market Technicals

Our corporate market technical outlook remains favorable for next year. New issue supply is expected to be similar to 2024, leading to less net issuance as coupon income should absorb approximately two-thirds of the net issuance3. AAM’s expectation is for Treasury yields to remain within a 50-bps range around current levels. That is supportive for yield buyers in addition to relative value-oriented buyers like pension funds that may look to rebalance after strong equity returns. If front-end yields fall more than expected, we expect to see money market outflows which could be supportive for short-tenured corporate bonds. That said, if yields were to fall more than expected, especially in the intermediate-to-long end, we would expect corporate spreads to widen. Hence, we expect Treasury volatility will be a key determinant of spread direction.

Exhibit 3: Performance Expectations by Sector for 2025

• Base case: GDP growth of approximately 2%, 10-year UST in range of 3.75-4.25%, new issue supply $1.5T, modest tariffs implemented over time for China and Europe, extension of the TCJA, immigration reform in line with historic levels, China stimulus, deregulation

• Bear case: weaker than expected GDP and/or earnings growth, heightened rate volatility (measured by the MOVE Index)

Corporate Sector Outlooks

The following outlines AAM’s fundamental outlooks for sectors in the Corporate market.

Basic Materials

The primary themes in Basic Materials in 2024 were China and the seemingly endless search for consistent demand growth, which followed similar paths. At the start of the year, there was optimism that the Chinese economy was accelerating, leading to a decent tailwind for commodities. This optimism faded when it became clear that the Chinese economy was weaker than initially expected. The Chinese government eventually responded with various stimulus programs. Still, most commodity prices remain close to the lows for the year as markets continue to wait for signs of sustained economic improvement in China.

Demand (most acutely in Chemicals) across the Basic Materials space followed a similar path. The year began with optimism that de-stocking was over and demand would return. By the time the third quarter arrived, many companies faced the reality that the second-half rebound would not happen and were forced to reduce earnings guidance. Generally, the year did not live up to the optimistic expectations for the Basic Materials sector as we entered 2024.

Looking across subsectors, fundamentals did not follow a uniform path. Paper (primarily corrugated containerboard) started to show signs of stabilization, and modest pricing power returned. Chemicals had some pockets of solid demand but generally bounced along the bottom with no sustained demand strength. Metals and Mining followed the path of the China story, but companies in this subsector remain typically in solid shape and have navigated the soft commodity environment relatively well.

For the most part, the market looked through this fundamentally weak period, and basic material bond spreads performed well. Excess returns for the Basic Materials sector were in line with the overall corporate market, with both Paper and Metals and Mining outperforming. Chemicals underperformed as fundamentals did not live up to expectations. Most companies used the post-COVID commodity boom to shore up balance sheets and were in a solid position when commodity prices collapsed. With solid balance sheets, new debt issuance has been limited. This supported spreads despite a generally anemic operating environment for basic material companies.

The outlook for 2025 essentially comes down to a balancing act between tariffs and China stimulus. Both base and precious metals sold off as the initial excitement of China stimulus wore off and weakened further following Trump’s election. The weakness was due to concerns over the negative impact of tariffs on the global economy and the strengthening of the US dollar. President-elect Trump has threatened significant tariffs on imports from China and other countries, which could lead to retaliation and a headwind for the global economy. For now, we believe an extreme outcome is unlikely and assume the global economy can avoid a significant slowdown. Should these issues be resolved positively, then a solid rebound in demand could provide a positive surprise.

The Paper sector is somewhat immune to global politics and has a relatively more stable outlook. Chemicals and base metals are more intimately tied to the global economy and China. If the outcome of tariff negotiations is worse than expected, then these subsectors will struggle. Given generally tight spreads across the sector, we have a bias towards the relative stability of the Paper sector.

Capital Goods and Transportation

Rails – Given solid service levels, we expect favorable pricing and volume growth in 2025 to yield revenue growth in the mid-single digits with possible market share upside. Growth is likely to be in the high single-digits, with earnings benefiting from more limited labor issues and cost savings plans. The downside risk to growth is the ramifications of additional tariffs in China and possibly (although we consider unlikely) Canada/Mexico. This could be offset by more robust manufacturing growth in the US and greater use of coal, given the expectation of lower environmental regulations. Debt leverage and liquidity remain solid.

Aerospace/Defense – We expect that the backdrop under the Trump Administration will be positive for the major US defense contractors. President-elect Trump has historically supported the modernization of our military, the “Buy American” mentality, and enhanced positioning versus countries such as Russia and China. In addition, we expect growth in commercial aircraft to remain strong globally, especially in emerging markets. We expect high single-digit revenue growth and low double-digit EBITDA growth in this sector. Away from Boeing, we expect cash flow to be strong and credit measures to remain solid.

Diversified Manufacturing – Major economic indicators continue to show manufacturing in a contraction mode. Depending on which survey is analyzed, manufacturing activity has been flat to down for some time. A less restrictive interest rate and added growth from mega-sized, regulatory-driven infrastructure products could help fuel longer-term growth. We expect continued M&A and equity-driven asset sales, which we would view as credit-adverse events. We expect top-and bottom-line growth in the low-single digits, likely closer to zero.

Communications and Technology

Cable and Media – After years of forecasting M&A in the Media and Cable sectors, 2025 may finally be the year. The upcoming regulator is expected to be more M&A-friendly, and companies are better positioned to negotiate. We expect consolidation with larger-scale M&A to be more likely than asset transactions, regardless of what companies have said thus far. In Cable/Media, despite wide spreads reflecting high yield risk, we do not expect fallen angels in 2025 (beyond Paramount, which S&P has already downgraded) although the risk is elevated. Debt issuance is expected to be flat vs. 2024, with risk to the upside due to M&A. With one of the widest spreads in the market, we expect this sector will outperform but security selection, in particular the performance of Warner Brothers Discovery, will be an important driver.

Telecommunications – Spreads have outperformed after a quiet year of net new issuance and tender offers as many companies were deleveraging. This is one of the few Industrial sectors that is more biased toward a positive outcome from potential policy changes. As a result, the spreads of the sector are historically rich compared to other Industrial sectors. With secular changes in Communications pressuring growth, we expect management teams to pivot to inorganic solutions as soon as their balance sheets allow. This is the case for European and US companies, with Canadian companies needing to deleverage to retain their ratings. We expect the Telecom sector to perform in line with or slightly better than the corporate market overall but likely underperforming other ‘BBB’ rated sectors.

Technology – We entered the year with high expectations for a turnaround. However, non-AI enterprise and consumer IT spending has remained cautious. This did not stop the sector from reaching historic spread tights as optimism for AI adoption, driven by strong demand for AI services, boosted both the industry and credit quality, driving rating upgrades. Businesses are automating workflows using AI-powered tools, increasing efficiency and reducing costs. As AI continues to be a focal point, we are witnessing an expansion in spending to support projects advancing from proofs of concept to full-scale implementations. Upgrades to data centers and refresh cycles for edge devices such as smartphones and PCs are expected to drive broader growth into next year. We also expect software firms to start monetizing AI, driving higher growth in the sector. With strong balance sheets entering the year, we expect the industry to increase the level of M&A even with the threat to break up big tech. Exposure to China and tariff escalations also remain a concern to spreads at these rich levels. As geopolitical tensions rise, we anticipate increased spread volatility that may create attractive entry points throughout the year.

Consumer

Food/Beverage – This sector will be challenged to grow sales given intense competition and weakening consumer spending. We expect costs to increase (tariffs, marketing/advertising), including capital spent on product innovation. Lower relative costs for commodities should help margins in 2025. Essential themes include healthy and convenient meals and lower priced, private label competition. Mid-to-large-sized M&A transactions are expected for companies to add exposure to higher growth areas. Beverage companies typically have better brand positioning and more favorable cost structures. We expect that serial cost restructuring plans will continue while relatively low levels of leverage should remain despite generous dividend and share repurchase plans. We expect low-single-digit top-line growth and mid-single-digit earnings growth.

Retail – Our view is that, while consumers remain in good shape, spending is trending down towards a more normal range. Solid wage growth and relatively low unemployment are major consumer health drivers. We expect online spending to continue to gain market share. Higher growth in expenditures for services versus goods should continue. Shoppers remain value-seeking with a continued pause in discretionary and larger-scale purchases, especially those related to their homes. Industry exposure to tariffs is less dramatic than in the past, given the greater spread of sourcing away from China, but this could be an issue for some retailers if tariffs exceed our base case. Currently, the supply chain is healthy but could become problematic if the increase in pull-forward inventory built from telegraphed tariffs begins to create bottlenecks. Retailers offering the best “value” will be the most successful, leaving those more priced-focused and specialty-based retailers more challenged in our view. We expect top and bottom-line growth in the low to mid-single-digit area.

Autos – The past year can be characterized as a return to normal for the US auto industry. The lean inventories and strong pricing environment in the post-COVID years are history, and we are once again focusing on issues such as incentives, inventory levels, residual values, and consumer credit conditions. While these issues are not yet setting off alarm bells, some are at least flashing warning signs. The concerns are not uniform across all issuers, and some manufacturers (OEMs) have been more disciplined than others. Dealer inventories, for example, have returned to levels consistent with pre-pandemic levels, but certain OEMs have allowed inventory to expand beyond a reasonable level. This has already led to isolated production curtailments to bring inventory back to a manageable level.

While the domestic US market remains somewhat stable, troubles have been surfacing across the globe. This is particularly true for European manufacturers, who are facing the dual headwinds of weak demand in Europe and a changing landscape for European OEMs in China. Chinese manufacturers are producing better vehicles that are becoming more technologically attractive to the Chinese consumer, and many legacy OEMs are struggling to adjust. This is particularly true with European auto manufacturers, historically generating significant profits from China. This changing landscape led to significant guidance cuts from most European-based auto manufacturers in the third quarter.

With one month to go in 2024, S&P Global Mobility forecasts global light vehicle production down 1.9% in 2024. North America is expected to decline slightly (1.9%), while Europe will decline more precipitously (-5.5%). China is a relatively bright spot, with growth of 2.4%. China has invested heavily in battery and EV capacity and is now dealing with overcapacity. This has led to a sharp drop in the price of EVs in China, which have become cost-competitive with traditional internal combustion engine (ICE) vehicles. New energy vehicles (including battery and hybrid electric vehicles) now account for more than half of all cars sold in China.

An important theme that emerged in 2024 was one of capital discipline. The legacy auto manufacturers were slow to react when EV adoption took off a few years ago and were forced to announce aggressive capex plans to catch up to the ambitious EV growth forecasts. Even after spending billions to expand capacity, EVs are still generating significant losses for the legacy OEMs. Catching Tesla is proving more challenging than expected. Fortunately, the moderating EV sales growth trajectory has provided some relief to the legacy OEMs, allowing them to be more measured with their EV plans. We have already seen some EV expansion plans postponed or canceled. GM, for example, expects to produce 200,000 BEVs in North America this year. This compares to expectations of 400,000 units set back in 2022. The legacy ICE business continues to generate significant cash flows, and extending the runway is key to the credit profiles of these companies.

The incoming Trump administration adds additional uncertainty to the auto industry outlook. Between changes to environmental policy that could impact EV adoption and tariffs that could disrupt traditional supply chains, the auto industry faces a shifting landscape. Legacy manufacturers may welcome relaxed emissions standards, but tariffs could be both a blessing and a curse. Tariffs could be successfully used to protect US manufacturers from Chinese competitors, but significant tariffs on imports from Mexico and Canada would be very disruptive. Much of the North American manufacturing base is in Mexico, and tariffs would substantially increase the cost of manufacturing vehicles sold in the US.

Suppliers remain in a difficult position and are fighting a few headwinds. Companies with exposure to the European manufacturing base are particularly challenged. Anemic global production was already a headwind before the troubles with European OEMs surfaced in the third quarter. Europe has been one of the weakest markets globally, and European brands struggle to adapt to the changing Chinese market. Slowing EV adoption has become an additional headwind for suppliers. Many suppliers invested significantly in the EV transition only to find that EV growth was not meeting original expectations.

While an outright negative view of the auto industry is still not warranted, the industry enters 2025 with more uncertainties than it had a year ago. We find the US auto industry to be the relative bright spot globally and favor companies primarily exposed to this market. As long as the economy remains buoyant and tariffs are not overly disruptive, demand should be sufficient to maintain solid credit profiles. Companies exposed to the European manufacturing base are expected to remain challenged. Security selection is especially important in this sector.

Healthcare

Pharmaceuticals – Given the focus on consumer healthcare costs (drug prices), we expect this sector to remain in the headlines, especially considering the new political appointments. It’s difficult to say how much this will affect the big pharma companies in the investment grade market. Fundamentals for the sector are solid, with strong cash flow and high EBITDA margins. The growing use of medicines to treat medical conditions and a currently supportive environment for drug discovery are fundamentally supportive long term. Expected change from a regulatory perspective in 2025 under President-elect Trump should allow for additional M&A, although we have already seen quite a few large-scale transactions in the last couple of years. We expect high single-digit revenue growth and double-digit bottom-line growth.

Health Insurers – Cost trends in 2024 were worse than anticipated, with deferred care returning to higher acuity levels. Elevated utilization levels are expected to continue in 2025, and the outlook remains uncertain as insurers adjust pricing based on these emerging cost trends. Profit margins are likely to remain under pressure. This is particularly true for government businesses, which have less flexibility in pricing and face cost pressures as the incoming administration looks to extend the TCJA. Profitability recovery efforts for Medicare and Medicaid segments will extend into 2026 and 2027. In Medicare Advantage, we expect insurers to reduce benefits, while with Medicaid, insurers will have to renegotiate with states to reflect a higher-risk pool. In 2025, the commercial risk market remains unpredictable, with cost trends expected to increase beyond the rates that insurers may have negotiated with businesses. There is some potential for positive developments in the outlook, mainly if policies and rate actions support growth in Medicare Advantage; however, we believe it will take time for any legislative changes or rate adjustments to improve profitability significantly. While we are cautious about our outlook, with the underperformance in 2024, spreads are at wide levels compared to other corporate sectors. We see opportunities for outperformance, emphasizing credit selection. After a better year with labor costs under control, Providers also face an uncertain outlook, more so on the policy front. If cuts to Medicaid or the expiration of ACA-enhanced subsidies result in a higher uninsured rate, this would potentially reduce utilization and reimbursement levels, hurting balance sheets. We expect Labs and Distributors to continue to focus on inorganic growth, which will result in higher leverage. The upside is limited given richer valuations than the rest of the sector.

Energy

We expect fundamentals in the energy sector in 2025 to remain similar to 2024, which suggests stable credit profiles for issuers. Oil prices are expected to stay in the high $60 per barrel range, while gasoline and diesel are expected to be in the mid $3 per gallon range. We believe these prices reflect economic growth for the U.S. and the world in the 2%-3% range, stable employment, a weak manufacturing environment, and an ample supply of crude and refined products. Additionally, natural gas is expected to be slightly above $3 per million British thermal units, about 50% greater than the 2024 average. Typical weather patterns, increased electric utility-related demand, and more significant exports support higher natural gas prices.

We believe two election-related issues will likely influence the energy sector in the near term: sanctions and tariffs. First, the new administration’s foreign policy toward Iran, Venezuela, and, to a lesser extent, Russia is likely to influence the oil supply through sanctions. Brian Hook, the former US Special Representative for Iran and Senior Policy Advisor to the Secretary of State, has reportedly been selected to lead the staffing transition effort for the Department of State. Additionally, Congressman Mike Waltz was chosen as the National Security Advisor. Both are advocates of significantly weakening Iranian oil exports/trade. Furthermore, Secretary of State-elect Marco Rubio has been a critic of Venezuelan President Maduro. We believe energy sanctions are likely to be reimplemented there, too. Collectively, those two countries are producing about 2 million barrels of oil per day more now than when Trump left office in 2021. Russia could see sanctions relief as part of a peace agreement with Ukraine, but its allies have ignored the Biden-imposed sanctions since its inception. Therefore, we do not expect near-term incremental supply from Russia if the toothless sanctions are relieved. Most importantly, from the supply side, OPEC has spare crude oil capacity to mitigate any sanction-related supply loss.

Secondly, the administration’s use of tariffs likely will influence oil prices and consumption. It is challenging to have a conviction on how much tariffs will affect oil demand other than to say it will be negative. The target countries, size, timing of the tariffs, and potential retaliatory actions make forecasting demand uncertain. Therefore, we are using conservative assumptions for demand growth. However, we believe the negative impact on oil demand from tariffs would exceed the positive impact on oil supply from sanctions.

Given our commodity outlook, capital allocation decisions are likely the biggest driver of changes in credit profiles in 2025. We expect M&A activity to remain robust as recent acquirers look to optimize their assets (particularly in the upstream) and others seek to expand their footprint (particularly midstream). Free cash flow discipline is likely to remain strong, but given widespread balance sheet strength, we foresee increasingly shareholder-friendly activity (i.e., more debt-funded transactions, share repurchases, and dividend increases).

Valuations for the energy sector are fair, but there are nuances between the different subsectors. Integrateds, the highest-quality energy issuers, offer the best value relative to other Industrial companies, and we believe they are attractive. Midstream, the largest subsector within Energy, offers the least value relative to Industrials and is quickly approaching unattractive levels. Independents, refiners, and oil field services are generally viewed as fairly valued.

Utilities

The dominant theme from the previous few years is expected to remain the same: high capital spending leading to high debt issuance and consistent pressure on credit metrics. Issuance is expected to stay elevated in 2025, and balance sheets will remain under pressure. The industry’s growth narrative has changed over the past year and has been supercharged by AI-related data center growth. The EIA projects US electricity consumption to increase 2.4% in 2024 and 1.74% in 2025. While this might not sound like much, this is significant for an industry with no growth over the previous 15 years. This step change in growth is considered a positive for the sector if managed correctly.

The incoming Trump administration is expected to usher in a new era to the regulatory regime in the US and the possibility of dramatic change. President-elect Trump has made clear that his intention is to eliminate certain features of the Inflation Reduction Act (IRA) and other environmental policies. While many of these features are easy targets, many are popular among his party, with significant benefits accruing to red states. We expect the elimination of specific features but not a wholesale repeal of the entire IRA. Repealing tax credits and changes to the corporate tax rate could hurt cash flow-to-debt metrics used by the rating agencies.

The Trump administration will review all aspects of environmental policy, and many changes could benefit the Utility industry. Relaxed environmental restrictions could, for example, make compliance more straightforward and cheaper. There are also a lot of transmission and power generation projects awaiting approval across the country, and accelerating the regulatory approval process could help address system reliability while meeting the needs of the AI boom. Finally, the Trump administration may usher in a much-needed federal nuclear policy that could lead to increased nuclear generation.

Utility companies have a variety of levers to pull to address the pressure on credit metrics, and these will be themes to watch in 2025. Utility equities performed well in 2024 and have rebounded from depressed levels. Although it is never popular with shareholders, issuing equity has become a more attractive option relative to a year ago. Hybrids became more common in 2024 and should continue to play a prominent role in balance sheet management in 2025. Finally, asset sales (both minority and whole) are an option that remains on the table.

The industry may be hyper-focused on the AI growth narrative or the shifting regulatory landscape. Still, as we were reminded during hurricane season, natural disaster risk has not gone away. A relatively quiet fire season made the wildfire issue less prominent this year, but the risk remains. Balancing the ongoing energy transition with the often-competing goals of reliability and affordability presents a unique set of challenges for the Utility industry.

Financials

We expect positive, albeit slowing, economic growth combined with lower short-term interest rates and the likelihood of a lighter regulatory framework to provide a more supportive macro environment for U.S. banks. Heading into 2025, we expect the recent rate cuts to lower funding costs, aiding profitability. However, as we move through 2025, we expect the potential for further rate cuts and more clarity over the direction of regulation to improve loan growth. Higher for longer 10-year yields present a crucial risk for the sector, impacting capital through unrealized losses in the securities portfolio and asset quality in commercial real estate (CRE) portfolios. CRE, particularly office, will continue to be the most challenging area of loan portfolios. Smaller regional and community banks with substantial exposure to CRE will continue to contend with asset quality risk and capital concerns. Given their lower CRE exposures, more significant regional and global systemically important banks (G-SIBs) will likely see a manageable impact on profitability if losses materialize.

Under the incoming Trump administration, U.S. banks are poised to experience a more lenient regulatory environment, reminiscent of the deregulatory trends during Trump’s previous term. We do not expect bank regulation to become a priority until the second half of 2025, with the administration focused on extending the Tax Cuts and Jobs Act (TCJA) and then the debt ceiling in the year’s first half. However, executive orders issued in the first quarter will likely outline broad objectives and priorities for regulatory changes and serve as a blueprint for regulatory action. Much like Trump’s first term, we expect these executive orders to direct the agencies to reassess capital adequacy standards, potentially easing requirements to stimulate lending and investment. For outstanding regulatory initiatives, such as the Basel III endgame, the Trump administration will likely seek to cut back on the scope of these rules or be inclined to rewrite them completely, leading to lower capital requirements for U.S. banks holding over $100 billion in assets. Regional banks may also see the pending Long-term Debt (LTD) rules get rewritten or potentially scrapped altogether, with new administration more partial to rules tailored based on size and complexity. Trump may also direct the agencies to reassess anti-trust policy as part of a broader deregulatory agenda. However, we believe business-friendly anti-trust policies may be tempered by populist skepticism, resulting in a nuanced regulatory environment favoring M&A activity among smaller banks over large banks.

U.S. bank issuance is expected to increase modestly in 2025. After rising to more normal levels in 2024, G-SIB issuance is set to grow modestly due to increased maturities and lower debt capital surpluses. Stable markets and lower interest rate volatility may provide an upside to issuance plans as these banks look to support client needs in the capital markets. In contrast, the potential for lower capital requirements may weigh on issuance. Regional bank issuance is also expected to increase modesty in 2025, with funding needs driven by maturities and the expectation for growth in risk-weighted assets. Importantly, given the uncertainties around the timing and implementation of LTD rules, our issuance expectations do not account for the build-out of LTD. Like the G-SIBs, stable markets, and lower interest rate volatility may provide upside to issuance plans as regional banks look to expand their balance sheets. In contrast, the potential for lower capital requirements may offset funding needs.

Yankee banks are confronting many macroeconomic challenges outside the U.S., including decelerating global economic growth, potential recessions, geopolitical tensions, and anticipated policy shifts under the new Trump administration. In response to these challenges, major central banks, except for the Bank of Japan, will likely continue monetary easing, supporting the operating environment for banks. Most Yankee banks remain on solid footing with strong capital positions and ample liquidity, and we expect this to remain the case through 2025 as banking systems outside the U.S. move forward with finalizing Basel III. Profitability will likely weaken through 2025 as banks contend with lower interest rates. However, pressure will be more acute in banking systems with large floating-rate loans. With easing financial conditions, loan growth may offset some profitability pressures, but tariffs and trade tensions present downside risks to demand. Asset quality deterioration is expected to be limited as rate cuts move through the economies and support borrowers. However, pockets of risk related to CRE, particularly in the office segment, may continue to experience stress. In some geographies, geopolitical tensions remain a key economic risk, while public finances and fiscal policy threaten sovereign yields and ratings. Yankee bank issuance is expected to align with 2024 levels, with funding needs driven by maturities, though balance sheet dynamics and the USD basis may provide upside risk.

REITs are entering 2025 on solid footing as inflationary pressures continue to recede, economic growth remains strong, and transaction activity recovers. Higher yields for longer than 10 years are a key risk under the new administration and present a manageable headwind for much of the sector. Stabilizing valuations and stable-to-improving fundamentals across most property types will largely offset elevated funding costs, with issuance activity expected to increase by 50% from 2024. Across the various subsectors, office REITs are expected to remain under significant pressure in 2025, though improving leasing activity suggests the sector may be nearing a bottom. Increased office utilization is being driven by return-to-office mandates and job growth in key sectors, mainly financial and legal services in New York City. On the West Coast, the expanding AI industry has bolstered office demand, albeit often for smaller spaces. A business-friendly Trump administration could boost the sector, although concerns over the size of government may create challenges in certain regions. Overall, performance will likely vary, with New York City outpacing other areas and newer class-A buildings outperforming older, lower-quality properties. Apart from office REITs, rental housing REIT fundamentals are expected to improve modestly in 2025 after experiencing some national softness in 2024 due to new supply. Due to affordability issues in home ownership, continued demand should help support rents and occupancy trends in the longer term. Under the new Trump administration, mass deportations and tariffs could lead to inflation of labor and materials, which could weigh on new construction and development pipelines over the long term. Retail REIT fundamentals continue to benefit from strong consumer spending and muted supply growth. With occupancy trends near an all-time high, the pricing picture looks strong and supportive of external growth in 2025. Key near-term risks for the sector are a weakening consumer and higher prices via tariffs that trigger a slowdown in retailer demand. In that scenario, grocer and value-based retail-anchored centers will outperform regional malls and shopping centers tied to luxury and discretionary spending. Senior housing is a growth area for Healthcare REITs as the first baby boomers turn 80, increasing demand amid limited supply. Skilled nursing facilities may face challenges from potential Medicaid cuts, though reduced regulation on staffing might help. Life science facilities are navigating significant supply deliveries, with tenants becoming selective, favoring REITs with quality assets and capital for build-outs. Regulatory efforts on drug pricing may impact biotech tenants. Medical office facilities continue to be a source of stability in the healthcare sector, benefiting from a shift to lower-cost care environments.

Insurance – Interest rates remain higher for longer, and a benign credit environment and economic stability continue to support growth in the sector. For life insurers, we expect positive momentum to continue into 2025, setting the industry up for another strong year. Higher interest rates, a steepening yield curve, a positive economic outlook, and increasing demand for retirement solutions will drive strong demand for life and annuity products. With annuities, surrender activity remains manageable, and we expect some spread compression as crediting rates catch up. Favorable unemployment trends and manageable mortality trends remain supportive for group businesses. We expect consolidation trends to continue, resulting in higher levels of deal activity. As the economy improves, we anticipate increased interest from private equity firms in more capital-intensive products like variable annuities, UGSL, and LTC. A potential risk for the sector is the exposure to commercial real estate within the investment portfolio and unfavorable variable investment returns. We believe these risks are manageable, especially with interest rate cuts expected to relieve some pressure. Despite ongoing policy uncertainty, the expectation for deregulation and strong fundamentals position the sector well for outperformance in 2025. P&C Insurance enters the year at comparatively richer valuations than life, and the upside may be limited in 2025. We expect premium growth to be moderate while investment income increases as new money yields continue to exceed current book yields and insurers extend duration with the curve steepening. Commercial insurers experienced a slowdown in pricing momentum as the year ended, and we anticipate this trend will continue into 2025. The risk environment remains elevated, particularly with social inflation, and despite a slowdown in pricing, we expect underwriters to stay disciplined. Growth will be focused on small and middle market accounts and E&S and Specialty lines. Next year, personal insurers will shift towards competition as carriers prioritize growth with rates exceeding loss cost trends. However, we expect competition to remain rational as insurers continue to reach rate adequacy and target margins, and weather-related losses continue to drive catastrophe claims higher.

BDCs – A lighter-touch regulatory environment under the new Administration may shift lending from private markets back to traditional banks. The increased availability of bank lending would be a headwind to the sector, leading us to prefer BDCs with the scale required to source deals and raise capital as needed in an increasingly competitive landscape. Lower short-term rates could also improve asset quality at the expense of BDC earnings. However, the costs associated with the incoming Trump administration’s implementation of tariffs may offset the improvement in asset quality.

Aircraft Lessors – The worsening shortage of new aircraft, increasing demand for air travel, and aging North American Airline fleets will continue to provide supportive fundamentals over the next few years. Airlines needing aircraft have few other options outside of lessors due to the ongoing supply chain issues with Boeing and Airbus. These drivers offer pricing power to lessors and create a natural deleveraging environment due to limited opportunities for capital expenditures. In this environment, we favor aircraft lessors with sizable fleets that can capitalize on these fundamentals.

1 Bloomberg Corporate OAS as of 12/11/2024

2 Tax Cuts and Jobs Act

3 Barclays

Utilities: Affordability Takes a Prominent Role in an Active Political Year

February 9, 2026