insight

Banking on Change: How a Second Trump Administration Could Impact the Banking Industry

December 16, 2024

Download PDFElections matter, and in the U.S., we are only starting to understand what the latest presidential election means for the banking industry. Unlike in Trump’s first campaign, financial regulation was not a prominent feature this time, and how the second Trump administration will approach the many issues impacting the sector remains to be seen. However, one thing is for sure: change is coming. Based on Trump’s first term and statements made during his second campaign, it is safe to assume that a de-regulatory approach will be a crucial underpinning. This report highlights three key areas where the new Trump administration’s approach could significantly impact the banking industry.

Basel III Endgame

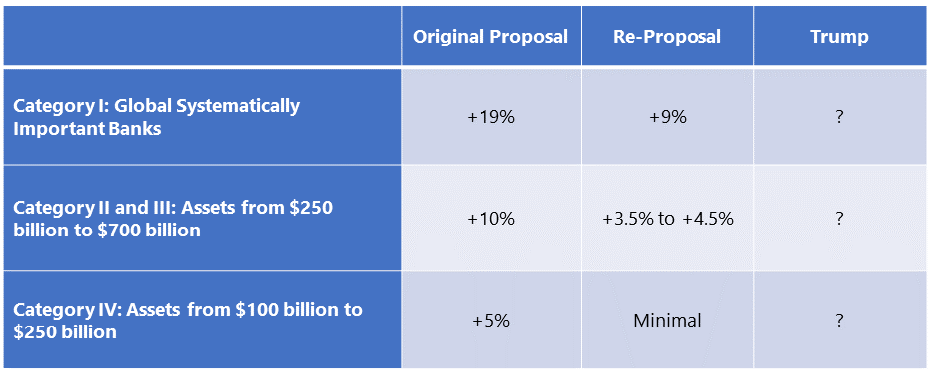

Initially proposed in 2023, the Basel III endgame is a regulatory framework designed to revise risk-based capital requirements for U.S. banks holding over $100 billion in assets. The original proposal aimed to increase aggregate capital requirements by 16%; however, on a relative basis, the largest banks would see a much greater impact (Exhibit 1). The proposal triggered intense opposition, with critics raising concerns about its potential to limit credit availability, disrupt capital markets, and slow economic growth, among many others1. In September 2024, U.S. regulators introduced a softer version of the rules, reducing the proposed capital increases by more than 50% for each banking category. We believe this adjustment reflected an effort to address industry and political criticisms while still achieving more robust financial safeguards. However, with the new Trump administration in power, significant changes to the re-proposal are expected, potentially diverging sharply from the September revision and the original 2023 framework. We believe the Trump administration will cut back on the scope of these rules and may be inclined to rewrite them completely. This means lower capital requirements for the banking sector, which should improve credit availability, reduce the cost of credit, and boost bank profitability.

Exhibit 1: Aggregate Capital Increases for U.S. Banks Under Basel III Endgame

Private Credit

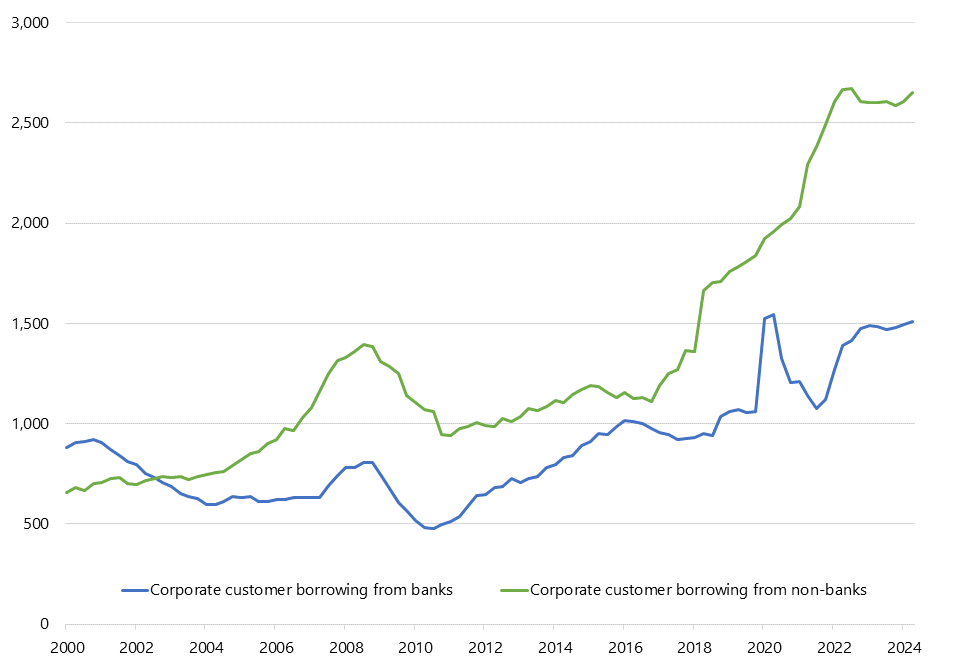

Private credit, defined by the Federal Reserve as lending by non-bank financial institutions, has experienced remarkable growth over recent years. A key driver of this growth has been regulatory developments enacted in response to the GFC, changing how the credit market functions. As banks were forced to derisk their balance sheets and reduce their role in financing riskier markets, such as leveraged lending, private credit stepped in to provide borrowers with stable funding and efficient lending processes2. Federal Reserve data shows that since the GFC, bank lending has fallen from 40% of all corporate borrowing in 2006 to 36% in 2024, while non-bank lending has grown significantly (Exhibit 2)3. Implementing the Basel III endgame was widely expected to encourage more borrowing from the private credit markets to the detriment of bank market share. However, with regulations in flux under the new Trump administration, the opportunities may prove less robust for private credit, leaving banks in a more favorable position to provide lending.

Exhibit 2: Corporate Borrowing from Non-Banks Surpasses Bank Borrowing

Borrowing from banks and non-banks, 2000 to 2023 (US$ billions)

Bank Consolidation

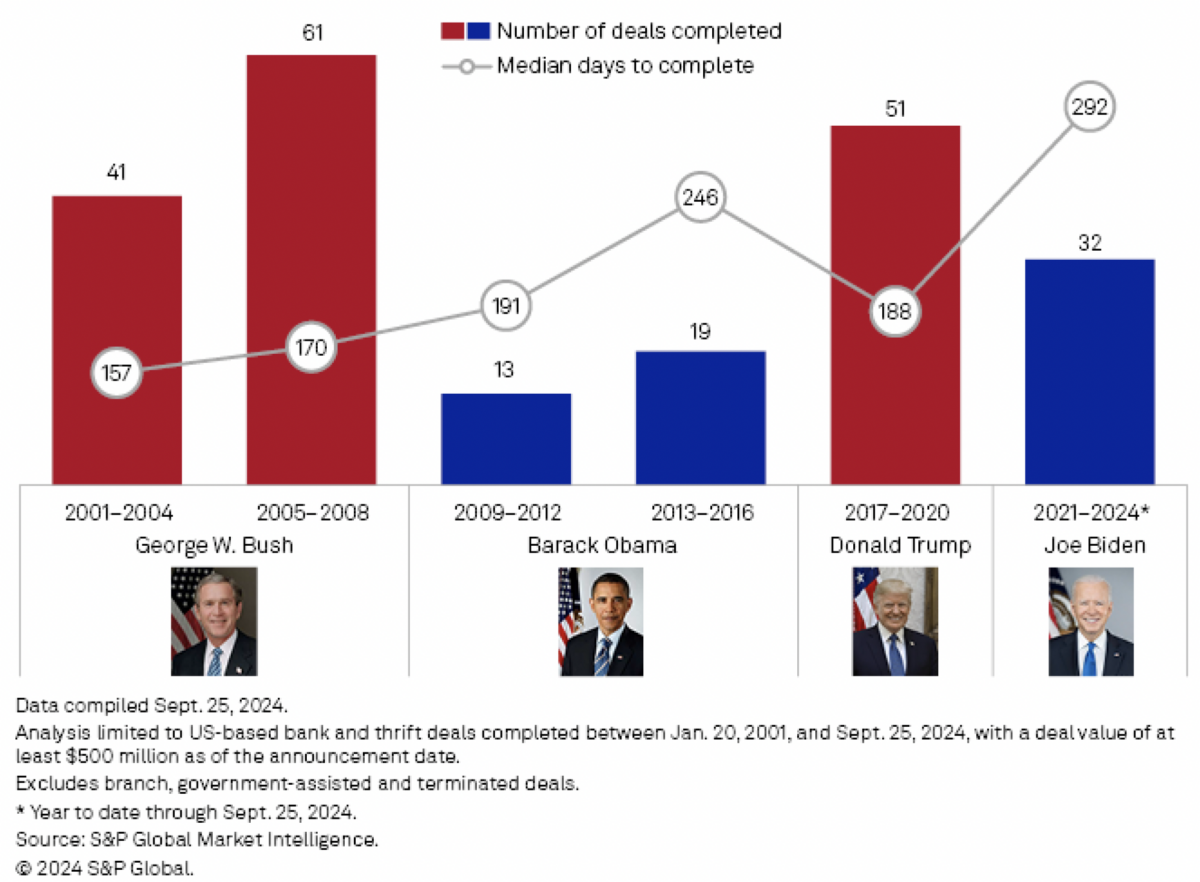

Bank mergers and acquisitions (M&A) activity slowed significantly under the Biden Administration (exhibit 3), influenced by economic and regulatory factors. High interest rates, fears of a looming recession, and weakened equity valuations created a less favorable economic environment for consolidation. The administration’s emphasis on anti-trust issues placed additional scrutiny on M&A deals4. However, the aftermath of three regional bank failures in 2023 seemed to intensify this regulatory scrutiny, with greater consideration regarding financial stability5. This heightened stringency provided another layer of complexity for banks considering mergers, contributing to the subdued M&A activity during this period. The incoming administration’s approach to bank mergers appears poised for greater receptivity than in prior years, suggesting a more lenient regulatory stance. However, the populist rhetoric championed during the Trump-Vance campaign6 injects potential complexities, particularly regarding consolidating large institutions or cross-border banking deals. This dual dynamic—business-friendly policies tempered by populist skepticism—may result in a selective and nuanced regulatory environment for mergers and acquisitions that likely favors smaller institutions within the banking sector.

Exhibit 3: Completed US Bank M&A Deals Since George W. Bush Administration

1 The banking agencies received nearly 425 comment letters in response to the proposal. Latham & Watkins reported that in a review of 356 comment letters, over 97% either opposed the proposal and/or called for a re-proposal or expressed significant concerns with it.

3 Federal Reserve Bank of St. Louis, “Nonfinancial corporate business; Depository institution loans N.E.C.; liability, level,” accessed December 5, 2024; Federal Reserve Bank of St. Louis, “Nonfinancial corporate business; other loans and advances; liability, level,” accessed December 5, 2024.

4 In July 2021, the Biden administration issued an executive order demonstrating renewed interest in antitrust enforcement, specifically mentioning the Bank Merger Act of 1960.

5 In September 2024, the Federal Deposit Insurance Corporation (FDIC) and the Office of the Comptroller of the Currency (OCC) issued formal statements of policy on reviewing transactions under the Bank Merger Act (BMA), each providing new guidance on transactions that merit greater financial stability scrutiny.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.