insight

Convertible Securities Offer Opportunities in an Overlooked Asset Class

January 27, 2021

Download PDFThis paper was originally published in the latest issue of Inside Medical Liability Magazine and is republished with credit to and with the consent of Medical Professional Liability Association (MPL). AAM is a proud Advantage Level Affiliate Partner of the MPL Association.

Before the COVID-19 pandemic, medical professional liability (MPL) insurers faced rising payouts because of increasing jury awards and falling premium volumes due to a consolidating customer base. The pandemic created fresh concerns and uncertainty for MPL insurers with the potential for increased future claims due to COVID-related issues as well as the thousands, if not millions, of elective healthcare procedures put on hold.

Today, these concerns, along with the potential for increased earnings volatility, mean that MPL insurers must closely monitor and manage surplus volatility arising from their investment portfolio.

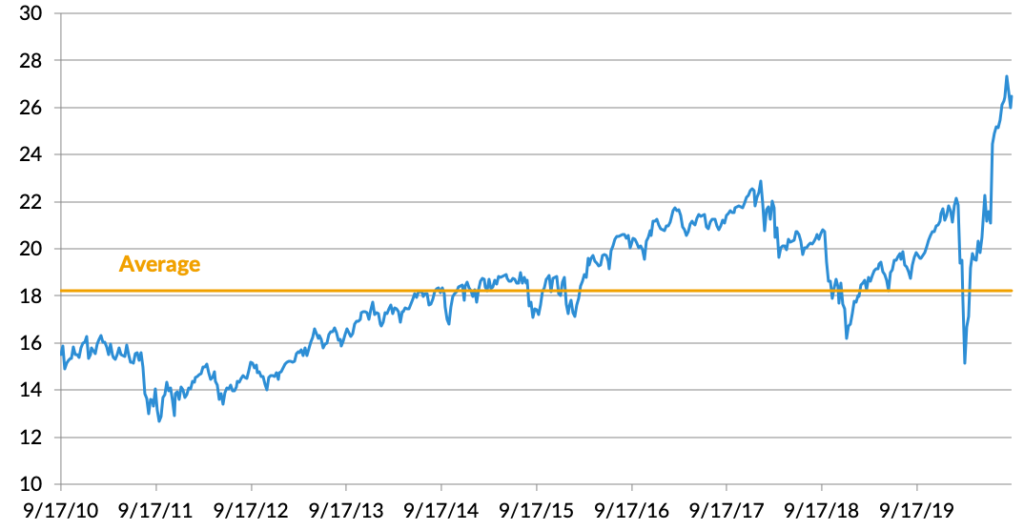

Rising MPL payouts stem, in part, from a phenomenon known as “social inflation,” which refers to a cluster of factors resulting from increased litigation, plaintiff-friendly legal decisions, and larger jury awards. Due to social inflation, MPL loss ratios for the first three quarters of 2019 reached their highest level since 2005.1 To hedge against social inflation, MPL insurers have historically held a portion of their investment portfolios in equities. According to S&P Global Market Intelligence, MPL insurers, on average, held 17.5% of their total cash and invested assets (33.5% of surplus) in equity securities as of year end 2019.2 As of early October 2020, equity markets were trading near all-time highs at the same time that equity valuations appeared stretched from a price/earnings perspective. Consequently, insurers with exposure to equities should consider the potential impact that increased equity volatility and potential for market corrections may have on their earnings and surplus. Figure 1 illustrates that, as of Sept. 15, 2020, the P/E ratio of the S&P 500 was 46% above its 10-year average.

Figure 1: S&P 500 Price/Earnings Ratio

Within the fixed-income markets, investment yields are low and likely to remain that way for an extended period of time. The Federal Reserve seems poised to keep rates near zero well through 2023.3 The average yield for an investment-grade corporate bond with a five-to-10-year maturity is currently only 1.8%.4 Equity market volatility may very well increase as we head into the later parts of this year due to the COVID-19 pandemic and the results of the U.S. elections. An investment strategy that provides equity market exposure with a focus on downside protection may offer solutions for insurers seeking additional yield and capital appreciation.

The ABCs of convertible bonds and markets

Convertible bonds are corporate bonds that pay interest and offer the potential to convert to shares of the company’s stock. While convertible bonds typically pay more in interest than corporate dividends, they usually provide a lower yield than a traditional corporate bond. The conversion feature of a corporate bond creates more potential for capital appreciation than traditional bonds. Convertible securities come in a myriad of structures but in their simplest and most common form can be converted into common stock at the option of the holder. This feature offers the upside potential of equities along with the yield and safety attributes of corporate bonds.

The convertible securities market is an often-overlooked niche of the investment world. At approximately $330 billion in size domestically, the market is often too small to attract large institutions yet too specialized and complex for smaller investors.5 Those characteristics offer attractive opportunities for investors with the focus and expertise to exploit inefficiencies inherent in this market.

These securities trade in dealer markets like traditional corporate bonds and the convertible price will reflect the value of the embedded- equity option as well as fixed-income attributes, which include credit, duration, and other attributes. Therefore, convertibles can trade at prices well below par as well as at multiples of par and their sensitivity to stock prices can vary dramatically. Active management is an important part of mitigating these risks in order to optimize a portfolio in the investor’s favor.

Benefits of convertible bonds

Convertible bonds provide investors exposure to equity markets while simultaneously reducing downside participation and risk. For MPL insurers, convertible bonds have additional benefits when considering statutory accounting principles and regulatory capital requirements. Since convertibles are treated as bonds and carried on Schedule D Part I, a significant portion of equity-market volatility is muted and has no impact on statutory capital.

In the course of a market cycle, exposure to equity markets through a balanced convertible strategy is positioned to outperform fixed income and produce capital gains while the interim price volatility is muted by the bond-like statutory treatment. Further, required capital within regulatory and rating agency capital models is substantially lower for convertibles when compared to equities. As illustrated in Figure 2, balanced convertibles can provide investors with equity upside participation along with downside protection.

Figure 2: The Convertible Price Curve

Strategies for managing convertible bonds

A goal of a convertibles strategy should be to achieve long-term returns similar to equities with substantially lower risk. Firms specializing in the management of convertibles achieve this by constructing high-quality, diversified portfolios of convertible securities with favorable risk/return characteristics. These portfolios will typically capture most- 65-75%- of significant upward movements in the stock market while participating in less than half of market declines. Through a typical stock market cycle this can result in favorable outcomes, including:

- Securing most of the market’s upside

- Limiting downside risk

- Capturing higher yields

This strategy is attractive to investors because it can offer a low-risk alternative to equities and a high-return diversification component to an overall fixed-income strategy.

Current market opportunities

The COVID-19 crisis has set the stage for a dramatic surge in convertible issuance. Since March 31, more than 130 companies have issued approximately $76 billion in convertibles.6 In comparison, there was a total of $60 billion in issuance for all of 2019, a 10-year high.7

A very diversified mix of companies have tapped the convertible market as a means to manage the economic implications of COVID-19. Many of these convertibles offer very attractive terms to investors.

The growth and improvement in the size, diversity, quality, and valuation of the convertible universe provides a unique opportunity for investors to consider an asset class they may have previously over-looked.

We believe the opportunity set and trading environment for convertibles is as strong as it has been in years. As MPL insurers face uncertainties from both an operating and capital markets perspective, companies should examine the risk/reward profile of convertibles as an attractive use of their risk budget. A balanced convertible strategy can benefit MPL insurers from reduced potential volatility of capital and improved regulatory capital requirements relative to equity investments.

References

- Tim Zawacki,“Signs of social inflation evident in highest-in-14-years med mal loss ratio” S&P Global Market Intelligence, Dec. 3, 2019: https://www.spglobal.com/market intelligence/en/news-insights/trending/k1_2svgbjbmiliptqnvxsq

- Based on Dec. 31, 2019, data of 108 P&C insurers writing at least 50% MPL business in 2019.

- Jeff Cox,“Fed sees interest rates staying near zero through 2022, GDP bouncing to 5% next year,” CNBC, June 10, 2020: https://www.cnbc.com/2020/06/10/fed-meeting- decision-interest-rates.html.

- Bloomberg Barclays Corporate Bond index: https://www.bloomberg.com/markets/ rates-bonds/bloomberg-barclays-indices. Accessed Sept. 24 2020.

- Barclays Capital,“Convertible Market Summary Statistics”: https://indices.barclays/ IM/12/en/indices/welcome.app.

- Ibid.

- Ibid.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.