insight

Energy Companies Can Withstand the Instability in Russia

August 5, 2014

The latest sanctions against Russia are just the most recent bout of volatility that energy companies have had to manage over the past quarter century. We believe these sanctions have teeth and that Russian oil production will be negatively affected. However, the investment grade companies with exposure in that country have very strong risk profiles. We would expect each company to be negatively affected by these sanctions, but not enough to meaningfully hurt their risk profile with the exception of BP.

Effect of Sanctions on Russian Economy

As part of the latest round of sanctions imposed on Russia for their occupation of Ukraine, the United States and Europe have banned exports of technology for use in Russian deep-water and in Arctic and shale oil exploration in the hope of negatively affecting the country’s economic engine. We believe that these latest sanctions on Russia will hurt its economy within 12 to 18 months. Our views are based on the likelihood that future oil production would almost certainly decline under these restrictions, which would curtail oil export revenue. This will eventually create significant problems for Russia, as oil and gas revenues accounted for 52% of federal budget revenues and over 70% of total exports in 2012.

We also believe that the sanctions will negatively affect a number of investment grade companies including BP, Weatherford, Shell and Schlumberger. However, the investment grade energy companies active in Russia are, for the most part, diversified enough to withstand stalled operations in that region without negatively affecting their risk profile or expected returns.

Below, we detail the latest sanctions, provide a brief on Russian oil production and the key participants in the Russian energy industry. We conclude by updating our opinions on companies which will be affected by the developments in Russia.

Details on the Russian Sanctions

On July 29, 2014, European Union (EU) Ambassadors approved the following sanctions that ban long term financing (of more than 90 days maturity) to state-owned Russian banks; ban arms exports to Russia; ban exports of dual use technology to Russia (civilian technology that has military uses); and ban exports of specified oil exploration and production equipment to Russia. The U.S. expanded similar sanctions as well.

The sanctions are scheduled to be released and implemented August 1, 2014 and will initially last for 12 months. However, after three months the EU will evaluate the Russian/Ukraine situation at which point the sanctions could be removed. The elimination of the restrictions reportedly would require unanimity from all 28 members of the European Union bloc.

Russian Producing Regions and Notable Participants

According to the Energy Information Agency, the fields in the Western Siberian Basin produce the majority of Russia’s oil. Production of oil in the region is dominated by Rosneft, the Russian state run oil company. Additionally, western energy companies, notably Shell and BP, have secured access to production in Western Siberia in recent years. BP and Rosneft recently began to explore for shale opportunities in Western Siberia along the Ural Mountains. The restrictions imposed by the EU and the U.S. are clearly targeted at stopping further activity here.

East Siberia has become the center of production growth for Rosneft. We believe the new sanctions would likely target production in this region as well. The start-up of the Vankor oil and gas field located south of Noril’sk, but north of the Arctic Circle in Exhibit 1 has been a significant contributor to Russia’s increase in oil production since 2010. Vankor was the largest oil discovery in Russia in nearly three decades and produces about 430,000 barrels per day.

Additionally, Gazprom, Royal Dutch Shell, Mitsui and Mitsubishi are involved in the development of Sakhalin Island oil resources on the east coast of Siberia: Sakhalin I and Sakhalin II. We believe that the recently announced sanctions would also curtail further production progress in this region.

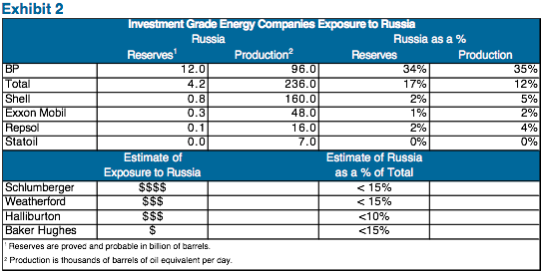

In Exhibit 2, we highlight some of the more affected investment grade energy companies. Exhibit 2 also provides a summary of investment grade energy companies’ exposure to Russia. Unfortunately, the oil service companies do not provide country level exposure. The figures for the service companies are AAM’s estimates based on available geographic data.

BP

BP has a 20% stake in Rosneft, which it acquired through the exchange of its investment in TNK (Tyumenskaya Neftyanaya Kompaniya, Tyumen Oil Company) in March 2013. Robert Dudley, CEO of BP, sits on the Board of Directors of Rosneft. We believe BP’s risk profile will deteriorate as much as any investment grade company from these sanctions.

ExxonMobil

ExxonMobil does not currently produce much oil or generate significant cash flow in Russia. However, in April 2012 it announced a very significant partnership with Rosneft to develop offshore reserves in Russia’s Arctic and Black Seas. The deal according to some estimates is worth up to $500 billion over several decades. We believe that progress in this joint venture will stall under the constraints. Notably, Donald Humphries, a former executive vice president of ExxonMobil sits on the Board of Directors of Rosneft.

Royal Dutch Shell

The Netherlands-based Shell is in a very precarious position given its reasonably large position in Russia, combined with the fact it is the Netherland’s largest company and that it lost three important employees in the Malaysia Airlines Flight 17 (MH17) tragedy. Only four months ago, Shell stated it remained committed to Russia despite the U.S. sanctions. Now, given how the conflict between Russia and Ukraine has affected the Dutch, it remains to be seen how the super major will proceed.

Total

After BP, Total has the most exposure to Russia. However, its exposure is primarily natural gas related, which does not seem to be included in the sanctions. Total has a 20% interest in the $27 billion Yamal liquefied natural gas project in Siberia. According to Total management, the impact of sanctions on the project was not yet clear. What is clear is that funding from western companies like Total to Russian natural gas projects like Yamal will certainly slow given the uncertainty there.

Weatherford

On August 1, 2014, Weatherford completed the sale of it Russian land drilling and workover operations to Rosneft for $500 million cash. With the conclusion of this transaction, Weatherford’s remaining Russian revenue base declined from 7% of total company revenue in the first half of 2014 to 3% on a pro forma basis.

Investment Grade Energy Companies Can Manage Volatility in Russia

Subsequent to the collapse of the Soviet Union, the oil patch in Russia has experienced the privatization of the industry, a jailed oil CEO and a coerced sale of a $55 billion joint venture to a state run company – essentially, lots of turmoil. The only western-based energy companies that can withstand this kind of unruliness are those that are very well-capitalized, diversified and liquid – basically strong investment grade companies.

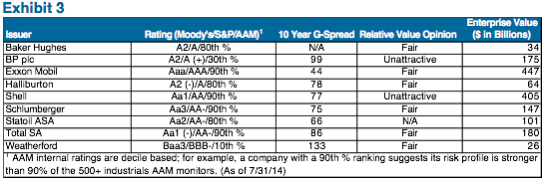

We believe the investment grade energy companies that are exposed to Russia will be able to manage disruptions caused by the sanctions. In fact, we do not expect any of the companies listed in Exhibit 3 to see a material change to their risk profile, with the exception of BP which will be negatively affected if the sanctions last more than 12 months.

Patrick J. McGeever

Senior Analyst, Corporate Credit

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.