Two critical meetings took place in the first week of December that were expected to influence both demand and supply of crude oil in the upcoming year. The G20 meeting in Argentina and, more specifically, the Saturday night dinner between U.S. and Chinese leaders addressed the threat of trade disputes between the two largest economies in the world, and thus oil demand. The meeting between Presidents Trump and Xi ended with an agreement that the US would postpone a planned escalation of tariffs to March 1 and China agreed to resume purchases of agricultural and other goods. This “pause” in a trade war should result in very limited change in oil demand from either country, at least until March 1, 2019, when the two countries evaluate any progress made.

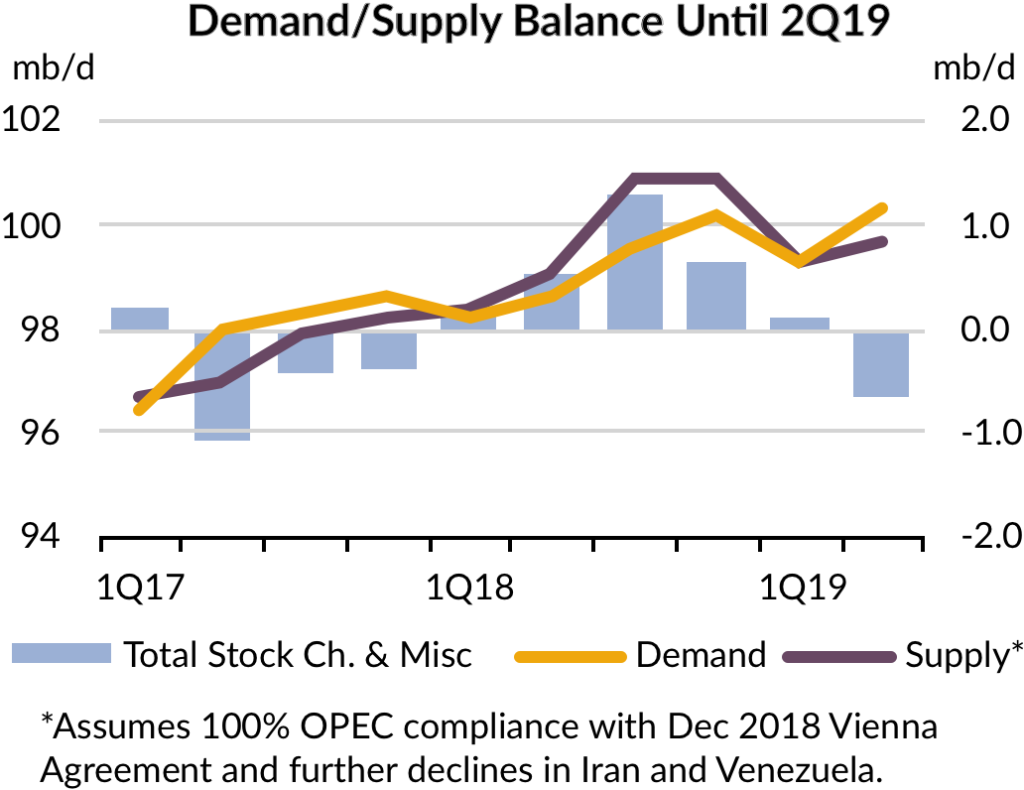

The second meeting of great importance to the oil industry was the semi-annual OPEC meeting. On December 7th, the 14 members of OPEC and Russia decided to reduce production 1.2 million barrels per day from October levels. As a result of this cut in production, Canada’s recent announcement of a short-term 0.3 million barrel per day cut, and the actual implementation of Iranian sanctions in 2Q19, we believe supply and demand should be better balanced in 2019 than in the last quarter of 4Q18, and we should not have a repeat of 2016. In short, the two meetings worked out reasonably well and better than many observers expected.

Fundamentals should not change much in the energy sector

Given the IMF’s current worldwide economic outlook of around 3.7% growth and a suppressed crude supply outlook, oil prices are expected to be in the $50 (WTI) -$60 (Brent) per barrel range in 2019. This commodity price outlook combined with increased capital spending discipline, should contribute to stable fundamentals in the energy sector, particularly for independents, integrateds, refiners and midstream companies.

Exhibit 1

However, we have little conviction that the fundamentals will remain as they are. The outcome of the U.S./China trade dispute will affect oil consumption or, at the very least, the market’s perception of expected consumption. Equally challenging is attempting to forecast how political decisions will influence crude supply in the coming year – actions made by US/Saudi Arabia/Russia/Iran will have as big an influence on supply and short-term crude prices as the trade dispute will have on demand and long-term crude prices.

Energy constituents are better prepared to withstand commodity volatility

Because of our less than high conviction of future fundamentals, it is worthwhile to review the creditworthiness of the energy sector in the face of what we believe will be a volatile year in terms of both crude supply and demand. In short, we believe that the energy sector is in a stronger position to withstand commodity price volatility than it was in 2016. The credit profile of the Upstream (independents and integrateds) is healthy. The median debt/LTM EBITDA of 1.6x is nearly a full turn better than it was prior to oil’s collapse in 2016. The sector is also carrying about 10% less debt relative to production than it was two years ago. Midstream leverage is below 4.2x compared to 4.5x several years ago. More importantly, many constituents have simplified their corporate structure, reigned in distributions, reduced reliance on external funding, and are increasingly focusing on reducing the cost of capital. Refiners are as healthy as they have ever been, but make up a very small component of the index. The one subsector that has yet to fully recover from 2016 is the oil field service group as its customers, the Upstream, have been very disciplined in how it spends money. Similar to the refiners though, the oil field service sector makes up a small portion of the investment grade market, and its constituents are financially healthy.

Valuations are better but not yet attractive

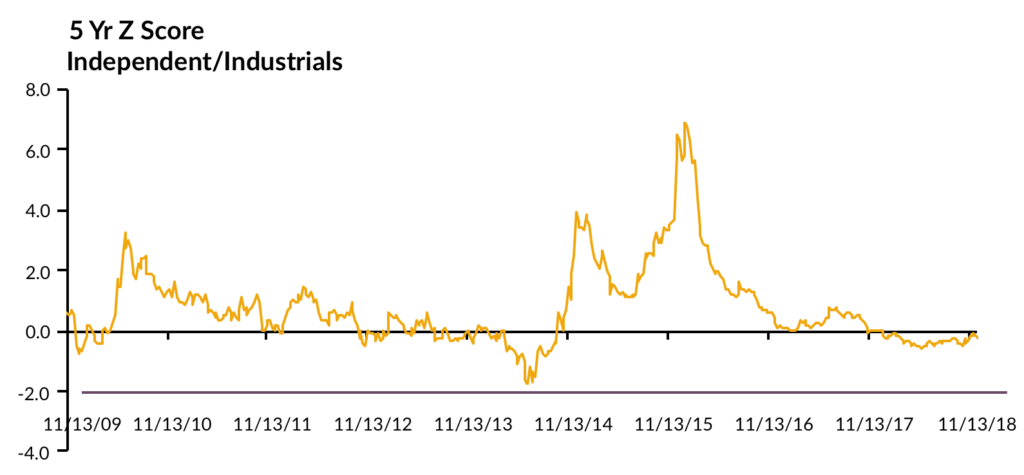

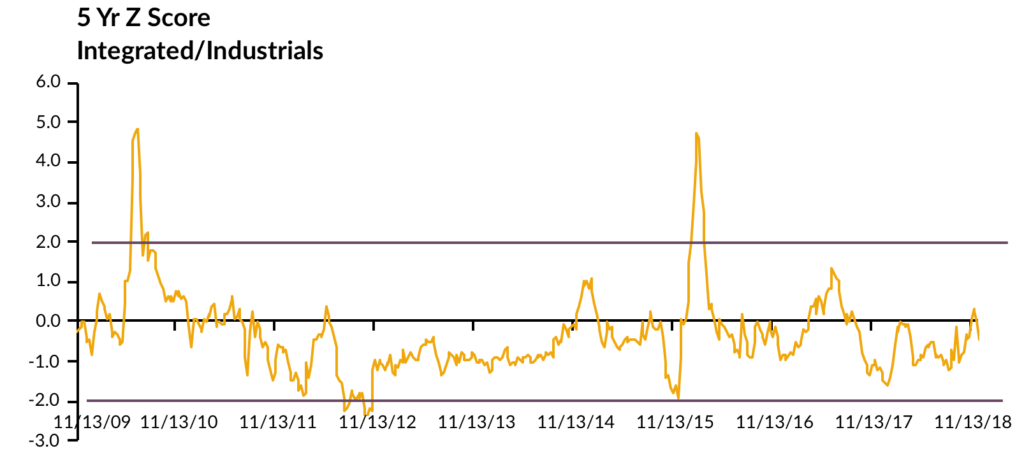

The weakness in oil prices and general risk-off mentality over the past quarter has contributed to the energy sector widening out by 50 bps, which compares with investment grade non-financials (“Industrials”) widening by 40 bps. Despite greater income opportunities for investors, we do not believe valuations are compelling enough to add to our existing exposure. As the charts below show, the relationships between the major energy subsectors and Industrials are all within 2 standard deviations of their long term mean. These values combined with low conviction on stable fundamentals demand that we exercise substantial caution when changing our energy exposure.

Exhibit 2

Exhibit 3

Exhibit 4

Looking ahead

In the upcoming quarter, we will monitor several items, which could change our views on fundamentals and valuations:

- Compliance within OPEC and Russia on the announced 1.2 million barrel per day production cut.

- Any deviations in negotiations between China and U.S. regarding 5G, intellectual property, tariffs and/or trade flows (automobiles, liquefied natural gas, soybeans).

- Acceleration in M&A (enterprise values to 2019 EBITDA should further stimulate an already active market).

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.