insight

Florida Homeowner’s Update – Winter 2016

February 2, 2017

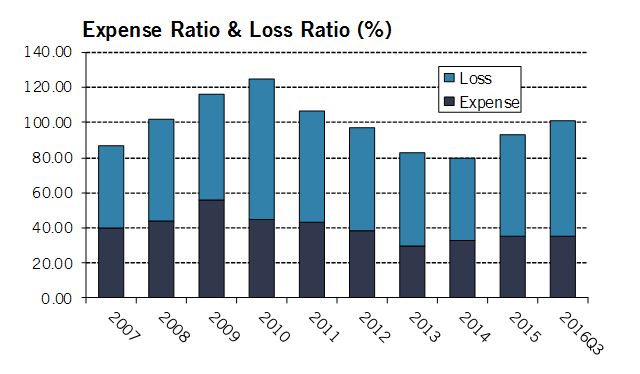

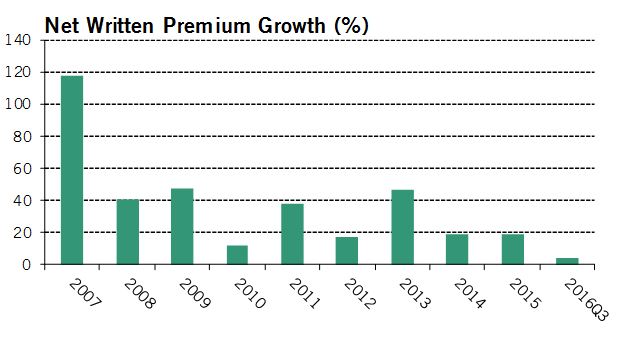

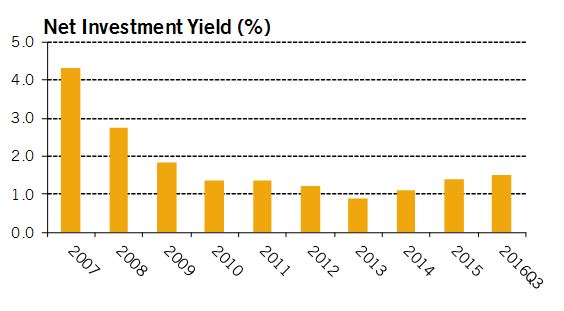

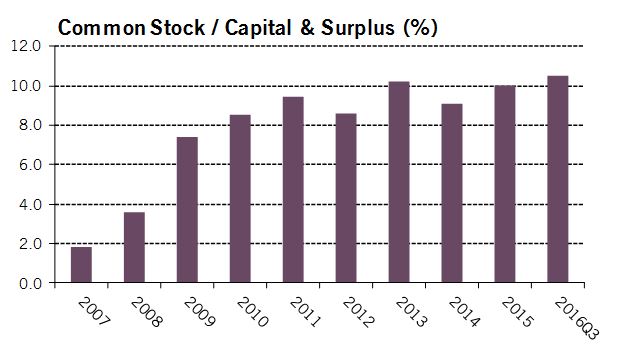

AAM’s Florida Homeowners Aggregate (“FHA”) experienced a moderate increase in catastrophe-related underwriting losses during 2016, resulting in a Last Twelve Months (LTM) combined ratio exceeding 100 for the first time since 2011. Total premium volume continued to grow, but at a significantly reduced rate compared to recent years. Meanwhile, underwriting leverage reversed its recent downward trend, posting the highest level since the 2013 peak. On the investment side the decline in investment yields seems to have finally bottomed out, with the unfortunate implication that portfolios have been fully turned over into the low prevailing rates of recent years. Exposure to common stock investments remain at record high levels (measured as a % of surplus), while cash holdings remain at a relatively low 21% of invested assets, down from 46% as recently as 2012. In this report we will review these and other developments in the Florida homeowners market, and look ahead to important developments in the coming year.

The FHA’s average loss ratio rose from 57.8 in 2015 to 66.0 for the LTM period ended 9/30/16 (all income statement items in this report are on an LTM basis, to compensate for significant seasonality effects present in this market). The first three quarters saw a modest increase in catastrophe losses, though expenses were largely flat. These figures do include the effects of Hurricane Hermine (the first hurricane to make landfall in Florida since Wilma in 2005), but exclude the impact of Hurricane Matthew, which struck the southeastern US in October and was the twelfth costliest storm ever in that region per National Oceanic and Atmospheric Administration (NOAA) calculations. Fortunately, Matthew ultimately caused much lower losses than initially feared and makes a good field test for the reinsurance and risk management programs of the many FL homeowner start-ups that have emerged in the past 10 years. Unfortunately, it will also likely lead to increased assignment-of-benefits activity, pending legislative relief for this ongoing issue in the Florida market. Between the effects of Matthew and the possibility of unfavorable reserve development in Q4, it appears that the recent era of relatively benign loss activity may finally be drawing to a close.

Premium growth declined for the LTM period, coming in at just 4.5% after consistently posting double-digit growth for many years. Although start-up activity remains robust as Citizens continues to shed premium, competition has intensified and placed downward pressure on prices in some markets. Meanwhile, the aforementioned assignment-of-benefits controversy has had a chilling effect on impacted markets, as private insurers grow wary of opening themselves up to lawsuits from contractors for denial of claims. Citizens’ CEO Barry Gilway commented in a September interview with the Sun-Sentinel that “Markets are shutting down in South Florida. New business has no place to go but us (sic). It would not be a smart decision on the part of a CEO to pick up South Florida business until we’ve got legislative remedies for [assignment of benefits].”

Premium growth declined for the LTM period, coming in at just 4.5% after consistently posting double-digit growth for many years. Although start-up activity remains robust as Citizens continues to shed premium, competition has intensified and placed downward pressure on prices in some markets. Meanwhile, the aforementioned assignment-of-benefits controversy has had a chilling effect on impacted markets, as private insurers grow wary of opening themselves up to lawsuits from contractors for denial of claims. Citizens’ CEO Barry Gilway commented in a September interview with the Sun-Sentinel that “Markets are shutting down in South Florida. New business has no place to go but us (sic). It would not be a smart decision on the part of a CEO to pick up South Florida business until we’ve got legislative remedies for [assignment of benefits].”

Anecdotal evidence also suggests that this practice is spreading into other parts of the state, suggesting that further declines in the rate of premium growth may be in the cards if nothing is done. This topic remains hotly contested between insurers and the litigators filing claims against them, and is likely to be examined by the Florida legislature during the upcoming session. Meanwhile the FHA’s retention ratio remained flat at about 48% of gross premium, virtually unchanged from the level of the past 3 years. Reinsurance pricing has been heavily pressured by the low claims activity of the last several years, and if 2016’s increased losses reverse this situation, it may create incentives for insurers to re-assess their reinsurance programs accordingly.

The average net yield on the FHA’s investments increased marginally during 2016, though the overall level remains largely flat since 2010. This reflects the impact of the FHA’s relatively short-duration bond investments (~70% of holdings in maturities of 5 years or less) and high cash holdings, both driven by a need for ready liquidity in case of sudden uptick in claims. Although it is welcome to see investment yields stable rather than declining, this is largely due to the fact that older investments predating the post-crisis low rate environment have mostly rolled off of insurers’ books, suggesting that even when rates do increase it will take a period of years for portfolio yields to fully adjust as lower-yielding bonds roll off. The rise in rates in late 2016—driven by expected higher inflation and the possibility of multiple Fed rate hikes in 2017—brought some relief, but also reduces the liquidity of existing holdings by moving bonds into an unrealized loss position.

With all that said, bond portfolios are in general prudently invested, with broad diversification across sectors, and duration and quality buckets. Exposure to tax-exempt municipal bonds have grown, with tax-exempt income growing from 6.9% of investment income in 2011 to 14.9% in 2015. Spreads on such bonds exploded higher after the election, and while they’ve reversed much of the move since then, the prospects for changes in corporate tax rates in 2017 suggest that more volatility lies ahead for this important investment sector.

The FHA’s average exposure to unaffiliated common stock investments rose slightly through 9/30 to 10.5%, the highest in recent years. While lower than the overall industry average, this is in keeping with the P&C industry trend towards increased equity exposure. The strong stock market returns since 2008 have greatly benefited insurers and helped to replace surplus lost in the financial crisis, though the combination of Fed rate hikes, a volatile political environment, and elevated valuation measures suggest that downside risks may finally be lurking below the surface after the seemingly unstoppable rally from the 2009 lows.

Although common stocks are the most common risk asset type held by P&C insurers, Florida homeowners companies prudently hold only about one-third of the exposure of the broader industry, as the elevated risk of concentrated underwriting losses in catastrophe lines is best offset by reduced exposure to relatively volatile investment categories. Conversely, FHA companies hold significant amounts of cash on hand for ready liquidity, with 9/30 exposure little changed at just over 20%. This figure has dropped significantly in recent years, from over 60% in 2007 to the current level. Reasons for such a reduction include improved risk and liquidity management programs, increased participation in the Federal Home Loan Bank (FHLB) system for short-term cash needs, and an attempt to increase investment income and offset low yields by putting idle cash to work during periods of low loss activity.

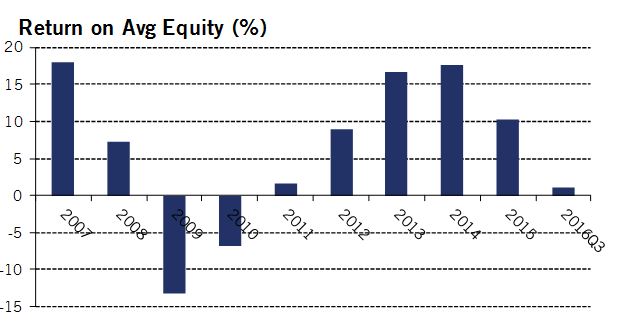

Between unfavorable loss experience and the ongoing low level of investment yields, the FHA achieved a return on equity of just over 1% for the LTM period through 9/30/16. Additional underwriting losses in Q4 may push this figure below zero for the calendar year, though strong equity market returns may partially offset such losses. The period from 2012-2015 was very strong for this industry, thanks to modest storm activity and a booming stock market. Now it appears these tailwinds are fading, and challenges like the assignment-of-benefits controversy and increased pricing pressure from the influx of market entrants could mean a period of lean years lie ahead.

Between unfavorable loss experience and the ongoing low level of investment yields, the FHA achieved a return on equity of just over 1% for the LTM period through 9/30/16. Additional underwriting losses in Q4 may push this figure below zero for the calendar year, though strong equity market returns may partially offset such losses. The period from 2012-2015 was very strong for this industry, thanks to modest storm activity and a booming stock market. Now it appears these tailwinds are fading, and challenges like the assignment-of-benefits controversy and increased pricing pressure from the influx of market entrants could mean a period of lean years lie ahead.

As always, a customized, diversified, and prudently balanced investment strategy is key to both supporting profitable underwriting through stable, predictable interest income, while also growing long-term surplus through strategic allocations to non-core asset classes. AAM has extensive experience advising Florida homeowners insurers on every aspect of investment strategy, and are available to provide a variety of complimentary analyses to companies interested in finding ways to refine and sharpen their portfolios.

AAM’s Florida Homeowners Aggregate is a collection of 28 Florida-domiciled P&C insurers writing primarily Homeowners coverage in the US Southeast region. All financial statement data is sourced from SNL.

Written by:

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.