insight

Full Recovery from Volatile Start of the 2nd Quarter Elusive for the Municipal Market

July 15, 2025

Download PDFSECOND QUARTER MUNICIPAL BONDS UPDATE

Market Recap

After one of the more volatile periods in recent memory roiled investment markets at the start of the 2nd Quarter, market uncertainty related to “Liberation Day” reciprocal tariffs pressured tax-exempt yields to sell off as much as 92 basis points (bps). That resulted in 10yr municipal/Treasury ratios to reach a two-year high of 89% on 4/7/251.

This volatility also extended to the Taxable municipal market. In addition to the tariff-related uncertainty, the Trump administration’s freeze/cuts to the funding levels for research initiatives at higher education institutions resulted in 10yr ‘AAA’ spreads for the sector to widen by 35bps during April2.

Headwinds to Recovery

During April, a 90-day pause was enacted to the “Liberation Day” reciprocal tariffs that helped generate a return to more orderly market flows by the end of the quarter. Although that better tone extended to both the tax-exempt and taxable muni markets, developing headwinds remained a challenge keeping the sectors from a return to relative valuations levels exhibited at the beginning of the year.

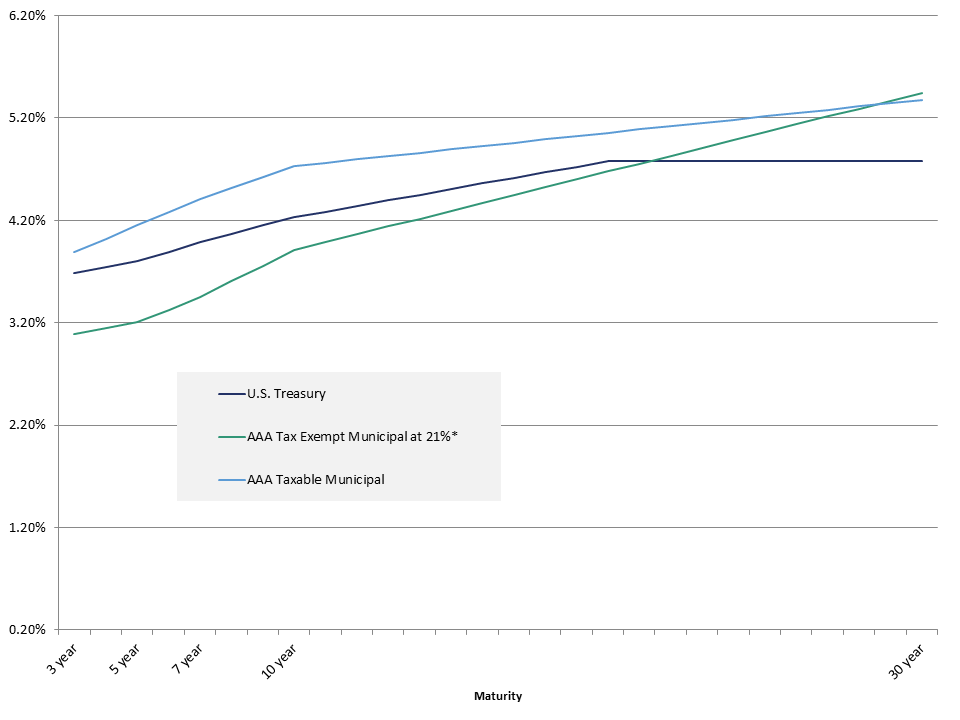

Tax-exempt municipal/Treasury ratios, which started the year at 66.9%, finished the quarter at 77%. Most of the sluggishness in recovery for the sector has been attributed to the substantial weakening in technicals, with new issue supply running ahead of last year’s record levels by 14%3. These challenging supply levels, combined with the typical seasonal weakening in April and May reinvestment flows, have both contributed greatly to the weaker relative valuation levels for the sector. To a lesser extent, we could see this weaker technical bias extend into the 3rd quarter. Reinvestment flows of coupons/calls/maturities are expected to improve substantially during the 3rd quarter; however, there are expectations that new issue supply could average over $50B per month from July through November, with August potentially producing $58B, which would be a new record for this month4. Although we view the weaker technical backdrop as keeping the relative valuation metrics elevated for the tax-exempt sector, for institutions subject to a tax rate of 21%, the tax-adjusted 10yr yields continue to provide a substantial yield disadvantage of 85bps relative to maturity-matched taxable munis at the end of the 2nd quarter5.

In looking at the taxable sector, although the elevated rate environment is expected to keep most issuers meeting their funding needs via the tax-exempt market, taxables are expected to see more issuance. The Trump administration’s recent research funding cuts/freezes to universities, along with the enactment of an 8% endowment tax on the wealthiest higher education institutions, have both contributed to an elevated need to access funding from the taxable markets to mitigate the policy-related funding challenges6. The market has already absorbed a number of ivy-league school related bond issuance and the market is expected to see more issuance over the balance of the year as policy uncertainty remains a concern. Although 10yr spreads for the sector have contracted by 24bps since mid-April, in our view, current spreads remain at attractive levels. The longer end of the market remains the most attractive, where ‘AAA’ rated yield spreads to ‘A’ rated low-beta industrial corporate yields produce a z-score of over 2 standard deviations relative to the 5-year average7.

Outlook: We Remain Constructive on the Taxable Muni Basis

Over the balance of the year, underlying credit fundamentals are expected to remain steady. State and local revenues through the end of the first quarter continue to produce aggregate growth rates of over 5% on a year-over-year basis8. These solid growth levels have also contributed to states maintaining total balances (i.e., combination of general fund and budget stabilization funds) at the end of the quarter at over 25.2% of projected Fiscal 2025 expenditures. Although it’s down from the record levels of 2023, it’s still approximately 2x’s pre-pandemic levels9. If the economy does face a tariff-induced slowdown over the balance of the year, the municipal market’s reserve levels appear resilient enough to absorb the potential fiscal stress. Consequently, we are maintaining a constructive view on the taxable muni market on both fundamentals and relative valuation. However, for insurance company portfolios, we continue to view both the tax-exempt market’s weak supply technicals and substantial tax-adjusted yield disadvantage to the taxable markets as a focal point to reduce the basis for the tax-exempt sector.

Exhibit 1: Market Yields as of 6/30/2025

*Tax-exempt rates are tax-adjusted using a factor of 1.1996

1 Bloomberg, Refinitiv

2 Bond Buyer, Bloomberg, AAM

3 Bond Buyer

4 BofA

5 Refinitiv, AAM, Bloomberg

6 Morgan Stanley, Bond Buyer

7 AAM, Bloomberg

8 U.S. Census Bureau

9 NASBO

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.