Market summary and outlook

The Investment Grade (IG) Corporate bond market (per Bloomberg Barclays Index) continued its strong performance in the second quarter, delivering a 5% total return given the Treasury rally, with spreads tightening only 4 basis points (bps). The IG market outperformed the S&P Index, which returned 3% and High Yield (per Bloomberg Barclays Index) 2%.

Risk assets have rallied this year around investor expectations for more accommodative central banks and benign outcomes related to trade agreements and geopolitical issues. Over the past couple weeks, more hawkish Fed commentary, increased risks of a hard Brexit and a prolonged trade war with China have caused spreads to widen and market volatility to increase. The Treasury curve continues to signal a recession is likely in the near term, although credit remains widely available. That was reiterated in the Senior Loan Officer Survey released this week as well as by the bank CEOs in second quarter earnings calls. The availability of capital keeps the credit cycle alive.

IG corporate credit spreads are tight on a historic basis, reflecting very strong demand for USD bonds, as yields dropped in the first half, especially overseas. The supply of USD corporate bonds has been less than expected, as lower growth and heightened uncertainty has resulted in less capital spending and reduced appetite for increased debt leverage. While companies continue to repurchase shares and pursue acquisitions, it has been largely with free cash flow and within boundaries set by the rating agencies. We expect that behavior to continue, although the risk of bad behavior (i.e., debt funded share repurchase and/or M&A activity) increases as debt yields fall. We note an increasing number of IG companies have dividend yields that materially exceed their cost of debt.

For the second half of 2019, we expect central banks to remain dovish and economic growth to remain positive in the U.S. That is supportive for IG credit. The risks to the downside are largely growth related, factors that would increase the probability of a recession in 2020. Credit risk premiums for low quality and/or cyclical credits would likely widen more significantly, and more liquid sectors would see spreads widen as investors move into safe haven securities.

With lackluster valuations today and the expectation for late cycle spread volatility to continue, we are taking advantage of opportunities to optimize portfolios. The duration of the Corporate IG market has extended; therefore, with low credit spreads and volatility expected to remain elevated, there is little room for error in total return portfolios and with Treasury yields and spreads this low, fewer compelling income opportunities for yield buyers. Security selection and the ability to execute on investment ideas are critical in this late cycle environment.

Performance summary – 2Q2019 reflected investor unease

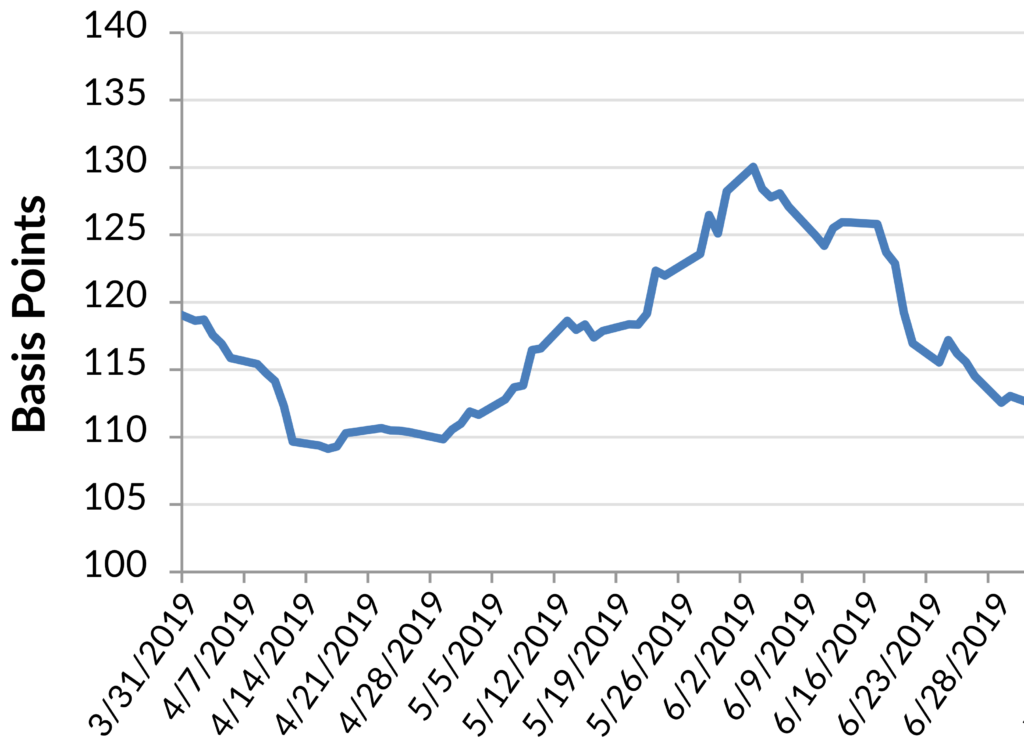

Volatility picked up in the second quarter with trade related concerns. Spreads tightened In June after the market was comforted by dovish messages from the ECB and the Fed along with a fairly benign G20 summit. Economic data also came in weaker than expected in the second quarter, which once again, was interpreted as good news to the market.

Exhibit 1: OAS Volatility Increased in 2Q2019

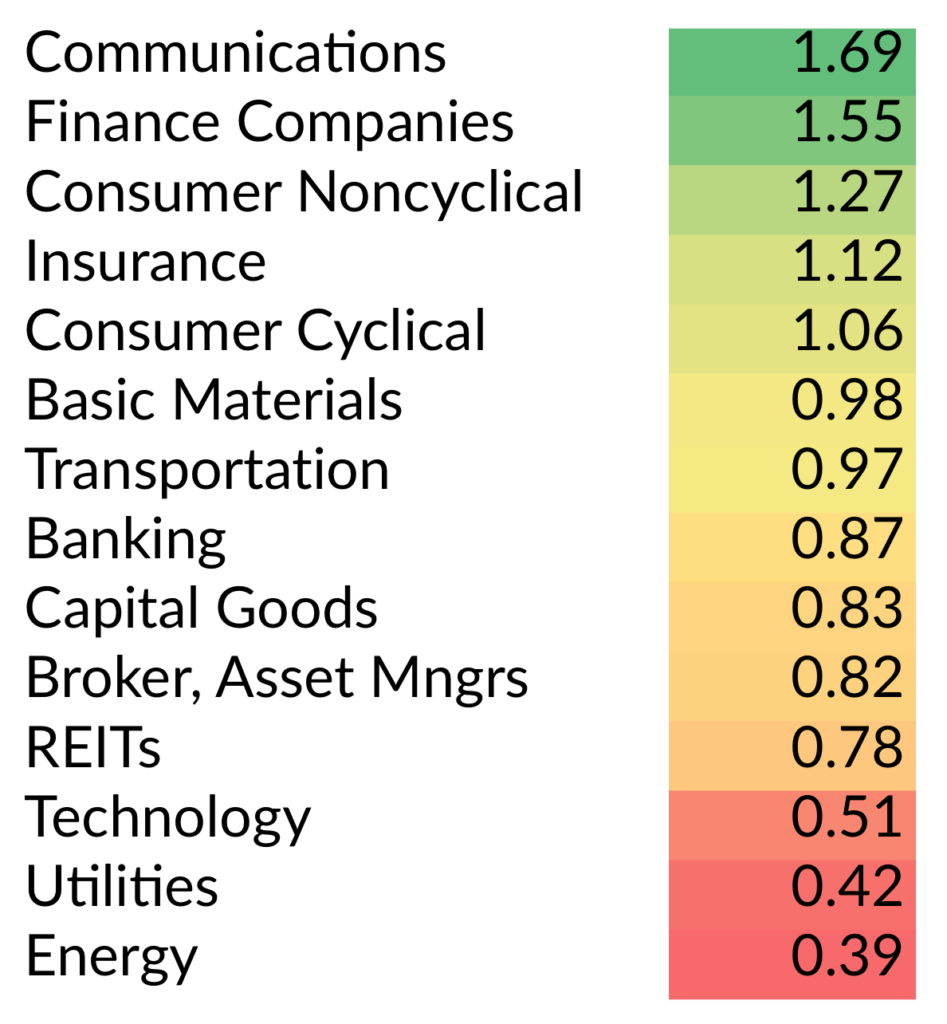

In the second quarter, merger and acquisition activity picked up and a number of weaker IG credits reported disappointing results, causing idiosyncratic risk to rise vs. the basis rally in the first quarter. Energy, Technology and Utilities underperformed in the second quarter vs. more domestically focused sectors with more stable cash flows such as Communications and Consumer Non-cyclicals. The relative value of BBB rated corporate bonds was little changed in the second quarter, and we took advantage of spread widening especially in new issues and secondary offerings in credits we expect will improve fundamentally.

Exhibit 2: Excess Returns 2Q2019 (%)

Fundamentals become challenged in a low growth environment

Unlike the period in 2011-2013 when U.S. economic growth and interest rates were low, fueling a rebound in 2014-2015, the domestic economy is more mature and China appears less willing to stimulate its economy. Stimulus thus far has been very targeted since it has much to balance, chiefly its debt as well as its currency in the midst of trade negotiations. This week is an example of sensitivities around not only the actions taken but the uncertainties and unintended consequences regarding those actions.

It is clear that companies exposed to Europe and China are facing greater revenue pressure and continued weakness is driving forward estimates lower. From a tariff and cost perspective, while mid-to-large U.S. companies have been able to navigate this headwind by moving production out of China and/or eliminating jobs in these soft economic regions, small companies have had more difficulties. Until the uncertainty related to trade falls, revenue and capital spending outlooks should remain pressured especially for small companies. We note loan demand from small companies has weakened since the second half of 2018 despite accommodative lending standards. Moreover, sectors like Materials and Technology have been more volatile given their exposure to China and Europe. From a credit perspective, after the 2016 downturn in commodity prices, Materials companies improved their balance sheets and are in the process of being upgraded by the rating agencies. Conversely, since 2016, BBB rated Technology companies have done less especially given the cash flow volatility in a recession, making them more vulnerable.

While not as strong as last year, domestic oriented companies have largely reported good results in the second quarter, as the consumer continues to spend and service related firms remain relatively healthy. According to Bloomberg and AAM data, revenue growth for North American firms geared towards the consumer or commercial sectors is estimated to be 5-7% for 2019 and 2020, with EBITDA growth rates expected to be higher as margins are forecasted to expand. Industrial related firms are expected to grow a little less at 3-5%. The weakness for North American firms is reflected in capital spending, which is expected to grow modestly this year (except for industrial firms) but turn negative in 2020.

Take advantage of spread volatility

We are reminded that IG spreads have widened post the financial crisis for mainly one reason, increased recession risk (e.g., 2010-2012, 2015-2016, 2018). We believe the best case scenario for the IG market in the second half is for domestic growth to remain around 2%, allowing the Fed to remain dovish. That environment should allow spreads to remain range bound in the 100-150 bps range. We believe the downside risks are mainly (1) slower than expected growth or (2) an unexpected macro shock. We note our signals for economic concern remain “yellow” with the Treasury curve flashing “red” while lending conditions remain “green.” Importantly, management commentary about the economy and forecasts for the second half while softer have not been overly bearish. That has been helpful in predicting recessions in the past.

If rates were to surprise to the upside due to stronger growth prospects (including a resolution to the China trade conflict), which at this point appears unlikely in the second half, spreads should be supported by yield sensitive investors especially since yields overseas are very low. According to Bank of America, the US currently pays 89% of all global investment grade yield despite accounting for roughly half of the $55T global IG bond market. In addition to strong foreign investor demand this year, fund flows have been strong year-to-date with the prospect of low rates, only second over the last ten years to the very strong inflows in 2017. Mutual funds and foreign investors have been the primary drivers of demand for IG corporate credit over the years, absorbing the increased supply.

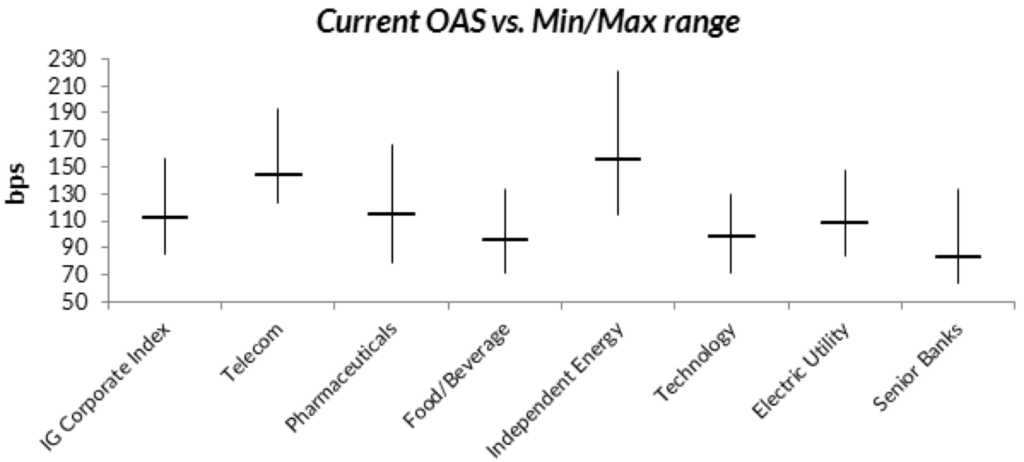

Spreads have fallen below our expected range for this year even with the spread widening over the last week. We are not forecasting a recession in the near term; therefore, we continue to invest in corporate credit. However, valuation is lackluster so security selection remains important. We continue to advocate taking advantage of the volatility in spreads, adding credits we favor fundamentally on spread widening and reducing risk when spreads tighten, especially for credits that exhibit a higher level of spread volatility. As shown below, since the beginning of 2018, we have seen spreads widen 50-100 bps in periods of volatility.

Exhibit 3: Current Spreads at Mid/Low End of a Volatile Range

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.