insight

Market Volatility Leads to Attractive Entry Point for Taxable Municipals

April 14, 2025

Download PDFFIRST QUARTER MUNICIPAL BONDS UPDATE

Market Recap

Market volatility tied to tariffs was the overriding theme driving rates during the first quarter. The Trump administration’s wide-ranging tariffs increased probabilities for a global recession, and, as a result, Treasury rates fell across the curve. During the quarter, 2- and 10-year Treasuries fell by 36 and 37 basis points (bps), respectively. After the administration’s ‘Liberation Day’ reciprocal tariffs were announced on April 2nd, Treasury rates in 10yrs fell by an additional 21bps to end the week at 4%1.

Credit Concerns are Developing

After the Trump administration’s activities and headlines related to tariffs and spending cuts, the municipal market felt the impacts of its agenda that resulted in a weakening bias in its relative valuation profile. We are also watching the developments related to the current administration’s Department of Government Efficiency (DOGE) related cuts in federal spending tied to research spending, and potential cuts to federal aid to states and local governments. Cuts to higher education in the form of a 15% cap on indirect research expenses and targeted cuts to institutions for not adhering to diversity or protest-related guidelines have already reverberated through the higher education sector in the form of wider spreads. Potential cuts to states in the form of reductions in appropriations for Medicaid as a potential source of ‘pay-for’ for the extension of the Tax Cut and jobs Act is also something that we are watching closely. Federal Medicaid funding makes up approximately 35% of state revenues and a drastic cut in this revenue source could generate budget imbalances. Additionally, the potential for tariff-war related negative impacts on the overall economy could also create dislocations in their fiscal condition. Although we believe that states, with budget stabilization funds at 14% of expenditures coming into the fiscal year, are at healthy levels to help absorb some of these potential fiscal challenges, we could see relative valuations come under pressure to weaken further. Within the higher education sector, the cuts in research funding and other targeted cuts are also creating challenges within that sector that have resulted in proactive cuts in spending, including announced hiring freezes and job cuts across institutions. We continue to monitor the situation and remain very selective across these sectors, and we’re retaining an up-in-quality bias across our investment targets2.

Relative Valuations have Weakened

The ensuing volatility in rates during the quarter produced a substantial softening in relative valuations across the municipal market. The tax-exempt sector was already exhibiting a weakening bias prior to the rate volatility due to a softer technical cycle going into March. The combination of slower reinvestment flows and a surge in new issuance that’s currently outpacing 2024’s record levels by 14%, resulted in 10yr maturity tax-adjusted spreads to Treasuries (21% corporate rate) to widen by 48bps during March. For the quarter, this spread widened by 60bps to end the quarter at -30bps. Muni-to-Treasury ratios in 10yrs reached a 2-year high of 77.65% during March before ending the quarter at 77.5%. With new issue supply expected to remain elevated and trend to a second consecutive year of record levels, we believe relative valuations for the sector could continue to weaken further3.

Taxable Municipals are Attractive

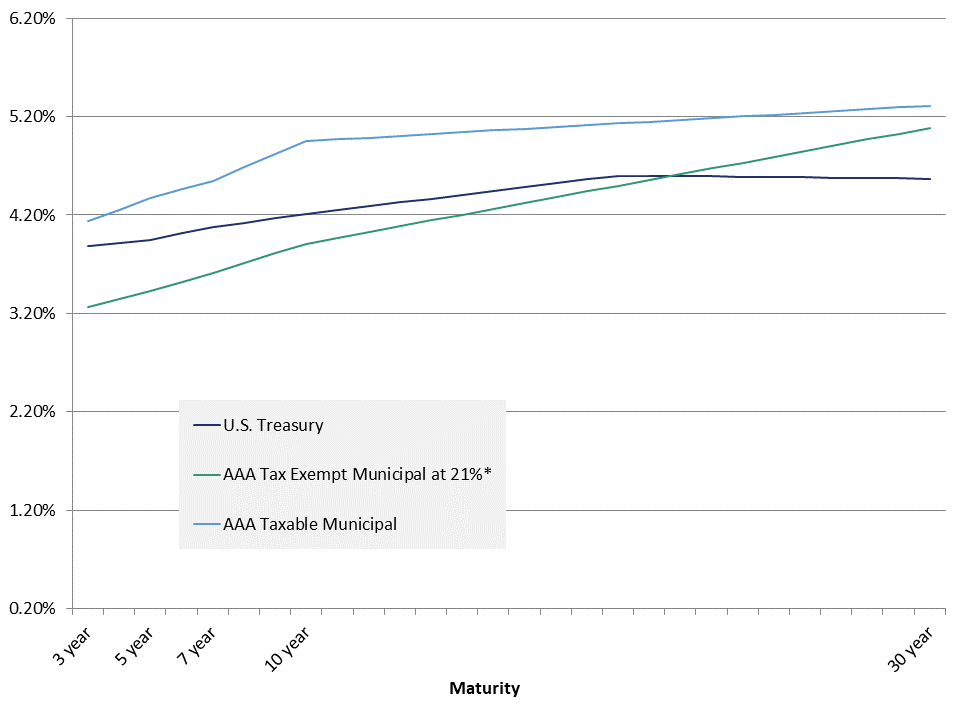

The weakening in relative valuations also extended to the taxable muni sector. The headline risks tied to higher education funding cuts and the tariff-related concerns have been more acutely felt within the 10yr and longer area of the taxable muni yield curve. Spreads on names like 10yr Harvard University have widened from an offered-side of 35bps in mid -February, to trading wider by as much as ~33bps by the end of the first quarter. As of this writing, the ‘Liberation Day’ tariff announcement has generated more market volatility since quarter end and spreads have moved considerably wider. Spreads in maturities from 5yrs to 30yrs have been pressured wider by 22 to 36bps since mid-February, and we view this widening and current spread levels as a compelling entry point to add to the basis. However, for tax-exempts, although the sector has weakened substantially during the first quarter, the tax-adjusted spread levels for tax-exempt assets remain well-through taxable spreads, and we continue to call for a reduction in that sector via a sector rotation to taxable alternatives across the yield curve4.

Exhibit 1: Market Yields as of 3/31/2025

*Tax-exempt rates are tax-adjusted using a factor of 1.1996

1 Bloomberg, Bond Buyer

2 AAM, NASBO, Bond Buyer, BofA

3 AAM, Bloomberg, Refinitiv, Bond Buyer

4 AAM, Bloomberg

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.