The higher interest rate environment post-2022 has created investment opportunities for P&C insurers that few have capitalized on so far. Historically P&C insurers have primarily focused on high-grade bonds and equity, which have admittedly performed very well together as the broad Russell 3000 returned an annualized 14.1% for the last 16 years. But with equity valuations scraping all-time highs and the 10yr Treasury yield close to the highest it’s been since the early 2000’s, now is an excellent time for P&C companies to consider diversifying into additional asset classes they may not have previously considered. Few assets have been less-loved by the industry than commercial mortgage loans (CMLs), but we believe that the reasons for this have become less relevant in today’s environment. CMLs can improve portfolio yields and diversification for P&C insurers, with surprisingly few downsides.

The Absent Asset

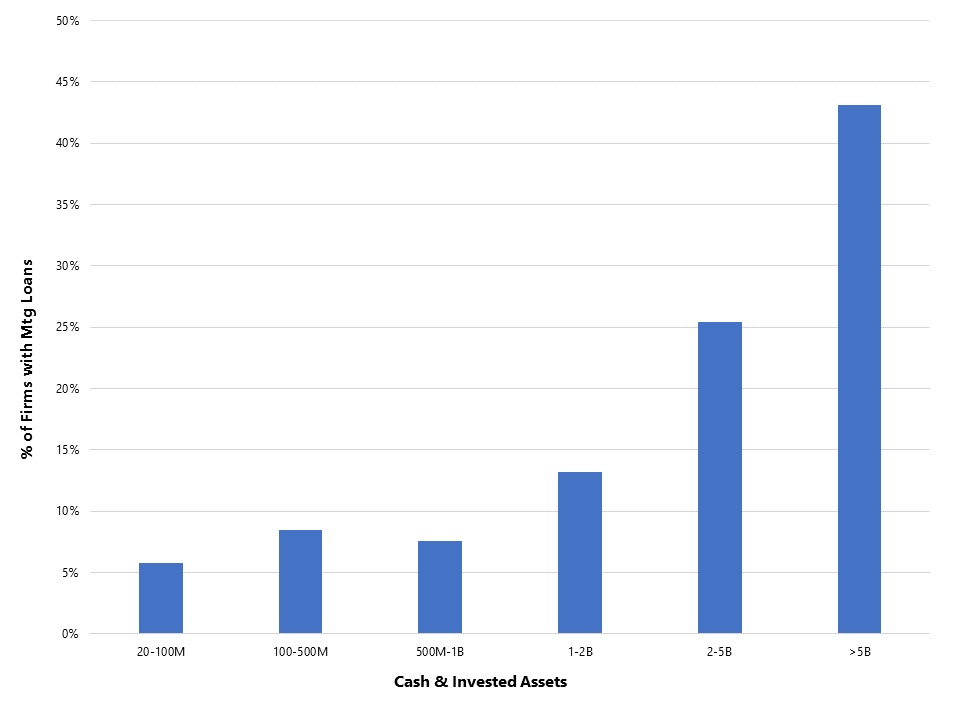

At 12/31/24 mortgage loans made up just 1.3% of P&C investments. Out of 770 companies with invested assets >$20M, just 88 (11%) had any exposure to the sector. These holdings are concentrated among the largest insurers: of 113 companies with invested assets >$2B, 39 of them (35%) had holdings.

Exhibit 1: The Largest P&C Insurers Hold Most of the Mortgage Loans

Why do P&C insurers avoid mortgage loans? Several reasons:

- RBC Charges: Unlike Life companies, who can carry mortgage loans at RBC charges comparable to IG bonds if their credit metrics are sufficiently strong, P&C companies carry all mortgages at a flat 5% charge, far higher than the 1-2% applied to most IG bonds.

- Liquidity Risk: Mortgage loans primarily represent a source of liquidity risk, as they are generally intended to be held to maturity. Many P&C insurers have liquidity needs driven by weather and other unpredictable factors, making them wary of locking up segments of their portfolio in assets that can’t be readily converted to cash.

- Low Historical Yields: Prior to 2022 yields on non-core fixed-income assets were frequently not very compelling, and P&C insurers prudently focused on a simple split between IG bonds for stability and income, and equity for surplus growth. If IG bonds yield 2.5% with good liquidity and favorable capital charges, equity is consistently returning 10-25%/yr, and mortgage loans yield 3% with low liquidity and a higher capital charge, it’s not hard to see why few insurers would give them a second look.

The Opportunity

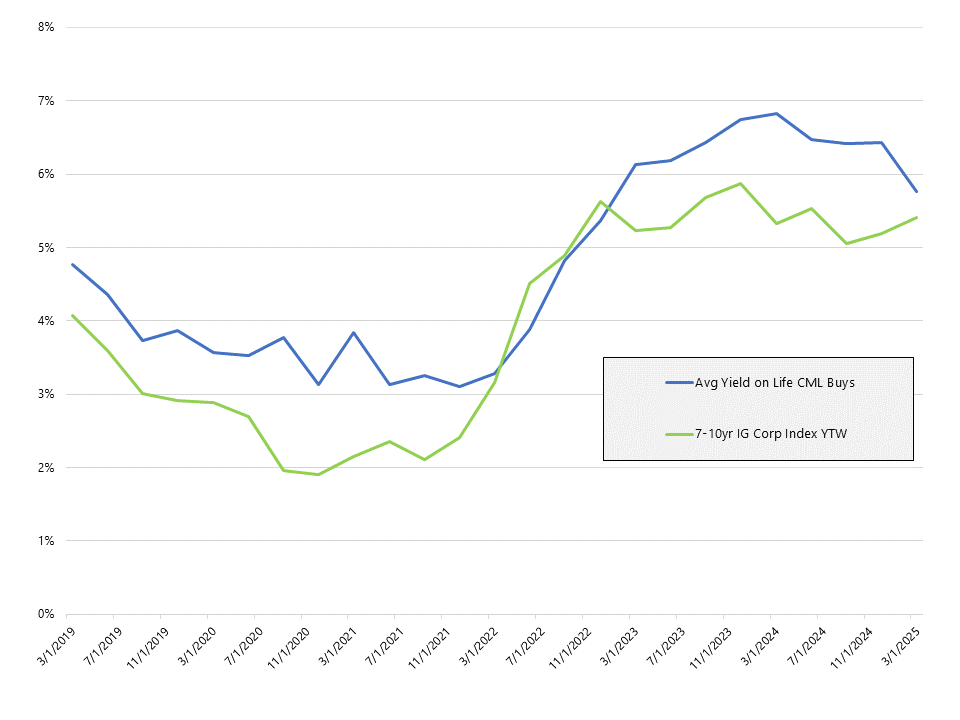

We can see the value CMLs offer today by reviewing the activity of Life insurers in the sector, as they have a much larger appetite for mortgages given their yield focus and more favorable RBC treatment. Looking at quarterly Life purchases of CMLs from 2018-2021, we see an average yield of 3.84% and an average spread of 80bps above 7-10yr IG corporate bond yields for that period (the vast majority of Life CML purchases are rated CM1 or CM2, which roughly correspond to IG bond levels of credit risk). It’s not surprising that a 3.84% yield didn’t draw much attention from P&C companies as equity markets soared double digits almost every year. However, from 12/31/22 through 3/31/25 the average yield of Life CML purchases jumped to 6.38%, an average spread of 98bps over 7-10yr corporates.

We can sum up the case for CMLs with a few points:

- They offer a significant yield advantage over IG bonds with IG-like credit quality/default risk.

- Notwithstanding unusually strong equity performance since the GFC (which has brought the market to unprecedented valuation levels by many metrics, raising questions about just how much further the rally can extend), 7-10% is still a widely cited range for estimated long-term annual equity returns. Compared to that a yield of >6% on CMLs, which have strong credit quality, are not mark-to-market, and provide consistent income rather than volatile total returns, starts to look very interesting.

- CMLs are a well-established asset class with a long track record, transparent and straightforward accounting, and a well-developed origination pipeline.

Exhibit 2: CML Purchase Yields Have More Than Doubled

The Objections

What about those reasons why P&C companies have avoided mortgage loans? Let’s take a closer look at them:

- RBC Charges: While it’s true that CMLs have higher RBC charges than IG bonds for P&C insurers, our research indicates that this makes little practical difference. CMLs fall under the R1 – Asset Risk Fixed Income category in the RBC calculation, and for the vast majority of P&C companies this is a relatively small and unimportant factor. Thanks to the covariance adjustment even significant changes to it typically have only a modest impact on the ultimate RBC ratio. We modeled out what the impact would be for 3 P&C insurers of varying sizes if they moved 10% of their invested assets from A-rated bonds to CMLs. For one firm the RBC ACL ratio fell by 1.5% (e.g. from 1,000 to 985), for the other two it fell by less than 0.5%. These are not material declines for the vast majority of insurers.

- Liquidity Risk: It’s true that P&C insurers need to manage liquidity thoughtfully and potential cash needs should be assessed before adding CMLs, but our research indicates that most firms could take more liquidity risk than they do (frequently “none”) without any issues even in a challenging underwriting year. Many P&C firms consistently produce positive operating cash flow and rarely have to sell assets to raise cash. Very, very few are subject to the kind of sudden, unpredictable cash needs where having even 5-10% of their portfolio in less-liquid assets (a realistic allocation size) would be intolerable, and these firms usually know who they are. Again, it’s necessary to review potential liquidity needs before buying illiquid assets (which we can help with), but after doing so most firms will likely see that this isn’t actually an obstacle for them.

- Low Historical Yields: We described above how mortgage yields have risen since 2022, to a level that represents a compelling risk/reward combo compared to other widely held assets. Diversifying is always prudent, and the confluence of a very long-in-the-tooth equity rally and a yield curve that’s still quite high compared to the last 20 years, makes fixed assets like CMLs look like an intriguing (if not downright urgent) opportunity.

Conclusion

In the investing world there’s often a “shiny new thing” that grabs headlines, whether crypto or AI or complex private credit structures. These can hold real value, but it’s also worth reconsidering whether older, more familiar assets may have outgrown the boxes we’ve put them in. CMLs have long been viewed as almost exclusively an asset for Life insurers, but in the current environment they can actually make a valuable addition to P&C portfolios as well, and not just for those measured in billions of dollars. If you’d like to learn more about the yield and diversification benefits of commercial mortgage lending, reach out to your portfolio management team (if a current client), or contact us at Marketing@aamcompany.com.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.