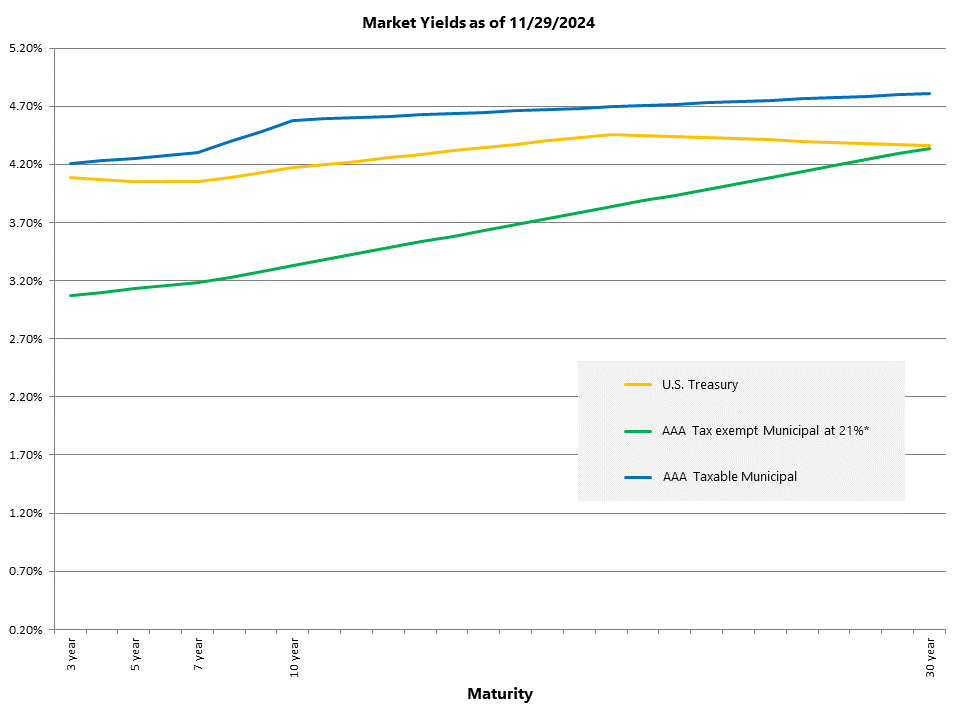

Our outlook for the Municipal market in 2025 is mixed. While we continue to view tax-exempt investments for institutional investors as a costly option relative to taxable alternatives, taxable munis hold some value for these investors. Most of this value is attributable to an expected muted volatility and defensive profile relative to the other taxable sectors.

Looking at the Taxable sector, we view the entire yield curve as expensive. On a year-to-date basis, ‘AAA’ taxable muni spreads to Treasuries in 3, 5, 10, and 30 years have tightened by 24, 25, 20, and 14 basis points (bps), respectively. With those moves, the sector is very close to its 10-year minimum in spreads versus Treasuries, and we don’t see the impetus for further tightening in 2025. However, we view the muni ‘AAA’ spreads relative to ‘A’ -rated Corporate Industrials as more fairly valued, with current spread levels between the sectors mainly in line with long-term averages1.

While we generally do not have a strong conviction bias for more spread tightening relative to Treasuries or Corporates, we feel the defensive attributes of the Taxable Muni sector are in place to provide a muted volatility profile for the industry in 2025. As in 2024, market technicals are again expected to be favorable for the year. New issuance for 2025 is expected to remain quiet, with supply essentially unchanged from 2024’s expected $42 billion2. The sector will likely continue to absorb another heavy round of call activity. Both tender offers and calls tied to Build America Bonds remain at economically attractive levels for issuers due to both the elevated rates for 10-year Treasuries that currently remain over 4% and relatively low tax-exempt rates that are at compelling enough levels to fuel refinancing of taxable muni bonds. The attrition of the underlying basis for the sector, combined with the low supply condition, should continue to provide a level of scarcity value, supporting valuations at their current spread levels3.

Another factor that should provide additional support for the municipal market is the stable outlook on the sector’s underlying credit fundamentals. State and local governments saw revenue growth year-over-year of 5% through FY 20244. While the expectation is for revenue growth to moderate into 2025 to levels closer to 3%, state budget reserves are at very healthy levels, with aggregate total balances of combined rainy day and general fund balances expected at 23% of operating expenditures for FY 2025. Although that number is unchanged from FY 2024 and down from a high of 37.9% and 37.4% in FY 2022 and FY 2023, respectively, it is 67% higher than pre-pandemic levels5. We view that number as a very healthy budget reserve level and should provide budget stability if economic growth slows substantially from current levels in 2025.

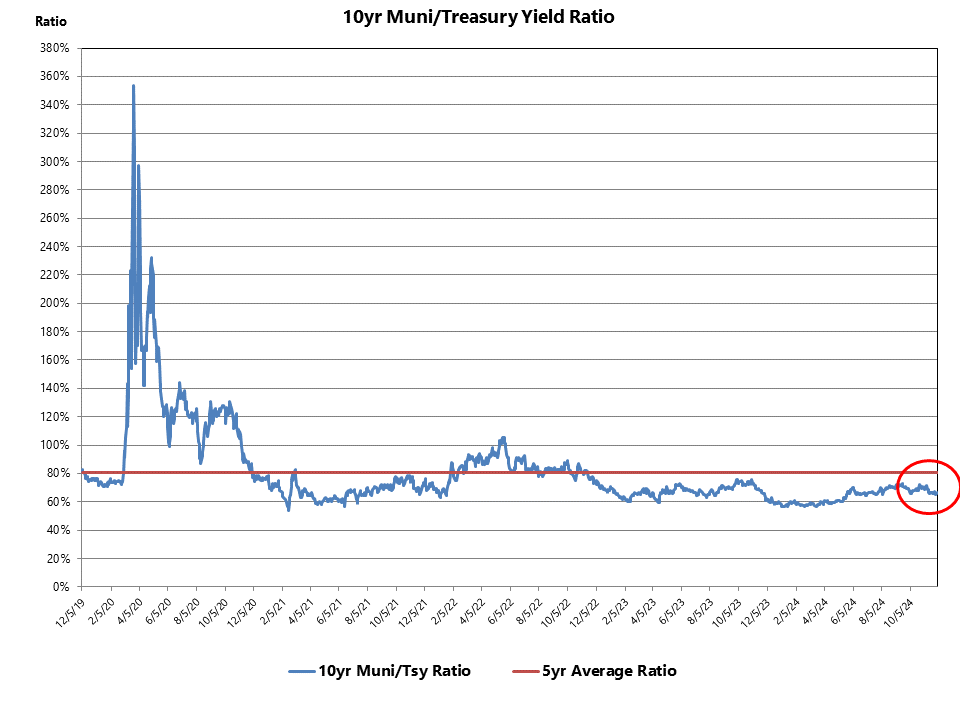

For the Tax-exempt sector, we view supply technicals for 2025 as a potential headwind for performance. In 2024, the industry saw substantial swings in relative valuation levels. Tax-exempt 10-year muni-to-Treasury ratios started the year at 58.7% on very strong seasonal technicals due to a heavy reinvestment cycle for coupons/call/maturities during the first two months. That favorable technical period pressured ratios to fall to year-to-date lows of 56% on 1/8/24. Since then, tax-exempts relative valuations have weakened as the market absorbed a record flow of new issuance on target to eclipse the record issuance of 2020’s $484 billion. After the market cleared seven months of average issuance of $48 billion per month from April to October, 10-year ratios would peak at 72.6% on 9/17/24. The weakening in valuation levels was partly due to expectations for extraordinary issuance in October, as issuers were expected to rush to the market to avoid any election-related volatility. Since then, relative valuations have improved, and, as of the end of November, 10-year ratios stand at 66.6%, equating to a tax-adjusted spread of -84bps for insurance companies taxed at the 21% corporate rate. While tax-adjusted spreads remain expensive for institutional investors, retail, or household investors subject to the highest marginal tax bracket, see a relatively attractive tax-adjusted spread level of 53bps. We view this spread level as a compelling entry point for these investors going into a favorable reinvestment cycle from December 1st through February 15th6.

Looking forward, we believe that many of the weaker technicals that defined volatility in the tax-exempt market in 2024 will primarily be in place for 2025. New issuance is expected to come in at $500 Billion, which is expected to match 2024’s overall issuance. As was pointed out in the Taxable Muni sector outlook, tax-exempt issuance to refinance taxable muni issuance continues to provide compelling economics for both tender offerings and calls related to outstanding Build America Bonds. Combined with current calls, these calls are expected to generate ~$140 billion in refundings. Additionally, financing of infrastructure spending is expected to remain heavy, and new money issuance for this category is expected to hit $360 Billion based on broker estimates7.

An area of concern that could provide a significant headwind to this issuance is the potential of sourcing funding for the extension of the Tax Cut and Jobs Act, which is due to expire at the end of 2025. There’s the possibility that the incoming Trump administration could target unallocated infrastructure money of ~$900 billion across the Bipartisan Infrastructure Law, CHIPs Act, and Inflation Reduction Act and claw back these dollars to be used as a source of funding for future tax cuts8. Additionally, in a further attempt at identifying sources of revenue for tax cuts, there are also concerns across the muni market that the tax exemption could be repealed or, at the very least, that specific sectors in the muni market could see their tax-exemption status repealed for sub-sectors like private higher education and healthcare9. We view these issues as creating a higher level of uncertainty to both new issuance levels and relative valuation metrics for the tax-exempt sector.

As we’ve noted in prior publications, with 10-year ‘AAA’ tax-adjusted spreads levels currently at -84bps, the tax-exempt market is unattractive for institutional investors taxed at 21%. We would view today’s levels going into favorable December to February technicals as an attractive exit point for the sector going into what may be a challenging political environment in 202510.

Exhibit 1: Tax-Exempt Relative Valuation Levels Remain Unattractive for Insurers

Exhibit 2: Taxable Munis: Compelling Alternative to Tax-Exempts

*21% Corp Rate Tax-Adjusted at a Factor of 1.1994

1 Bloomberg, AAM

2 Bond Buyer

3 AAM, JPM, Bond Buyer

4 Bureau of Economic Analysis

5 NASBO

6 Bond Buyer, Refinitiv, Bloomberg, JPM, BofA

7 Barclays, JPM, BofA, Morgan Stanley

8 JPM

9 Barclays, Morgan Stanley, JPM

10 AAM, Refinitiv, Bloomberg