insight

Partly Cloudy, Though the View is Better Up Here: AAM’s 2025 Outlook

January 23, 2025

Download PDFMarket Outlook – Tim Senechalle, CFA | Chief Investment Officer

Economic Outlook – Marco Bravo, CFA | Senior Portfolio Manager & Leah Savageau, CFA | Senior Fixed Income Credit Analyst

Fixed Income Outlook – Elizabeth Henderson, CFA | Head of Fixed Income & Director of Corporate Credit

Private Placement & Commercial Mortgage Loan Outlook – Greg Ortquist, CFA | Senior Portfolio Manager

High Yield Outlook – Patryk Carwinski, CFA | Portfolio Manager

Convertibles Outlook – John Balsamo, CFA | Portfolio Manager

Equities Outlook – Peter Wirtala, CFA | Insurance Strategist

AAM’s 2025 outlook builds on our investment team’s views on the domestic economy, corporate fundamentals, supply/demand dynamics, and asset prices. Our overall optimism is tempered by risks related to domestic policy and fiscal pressures, geopolitical uncertainty, and market valuations. On the latter point, AAM’s investment team observes reduced risk premiums across bond markets and high valuations across portions of the equity market. It would be difficult for bond and stock markets to post a three-peat of realized performance in 2023 and 2024.

Higher interest rates, narrow spreads, and elevated equity prices provide an outstanding backdrop for rebalancing allocations to strategic targets and repositioning portfolios, avoiding sectors and issues mis-priced for potential longer-term risks. This discipline should allow us to pursue targeted opportunities today within public credit, securitized, and private capital markets as we continue to seek to deliver excess returns and strengthen the earning power of client investment portfolios.

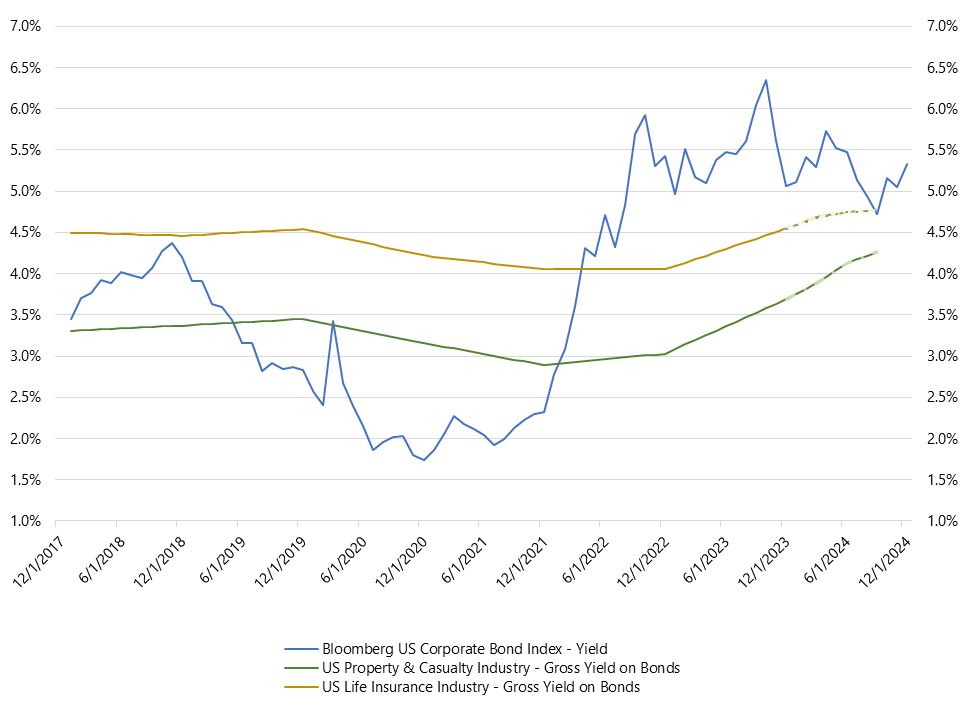

Exhibit 1: IG Corporate Bond & Insurance Industry Book Yield Trends

AAM’s research suggests that Life Insurance & Property/Casualty Industry book yields posted material increases last year, as illustrated in Exhibit 1. Our team’s view on the path for US Treasury yields and stable fundamentals leads us to anticipate that the year ahead will continue to be productive for insurance investors with further, material gains in book yield on the horizon. With narrow spreads across many markets, we believe our disciplined approach to capital deployment should not hinder this upward trajectory in earned yield and should position AAM to take advantage of opportunities if downside risks materialize.

Economic Outlook

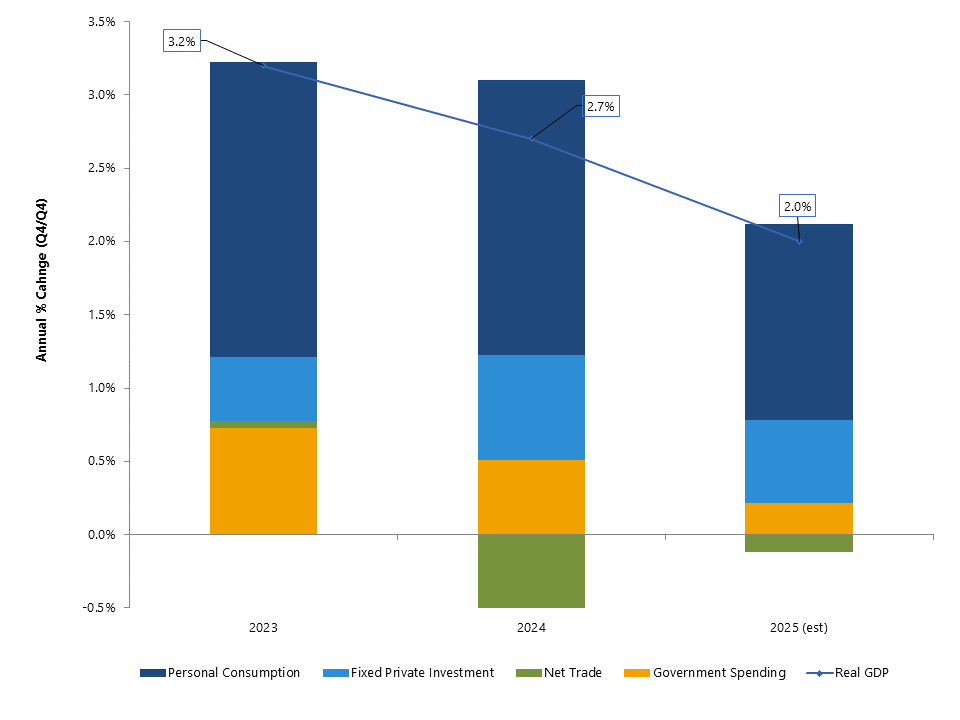

AAM’s U.S. economic outlook for 2025 centers around three key themes: i) a resilient economy, ii) sticky inflation, and, iii) a cautious Federal Reserve. With an average annual growth rate of 2.9%1 over the last two years, U.S. GDP growth is expected to moderate only slightly in 2025 to 2.0%2 (Exhibit 2). Two key drivers of growth this year are improved consumer and business sentiment and a healthy labor market, both of which should be supportive to spending and investment. We see the potential for a trade war and tighter financial conditions as key downside risks to growth for 2025. On balance, AAM views the risks to GDP growth as skewed to the upside and we expect an above-consensus increase in GDP for 2025.

Exhibit 2: Contribution to GDP Growth

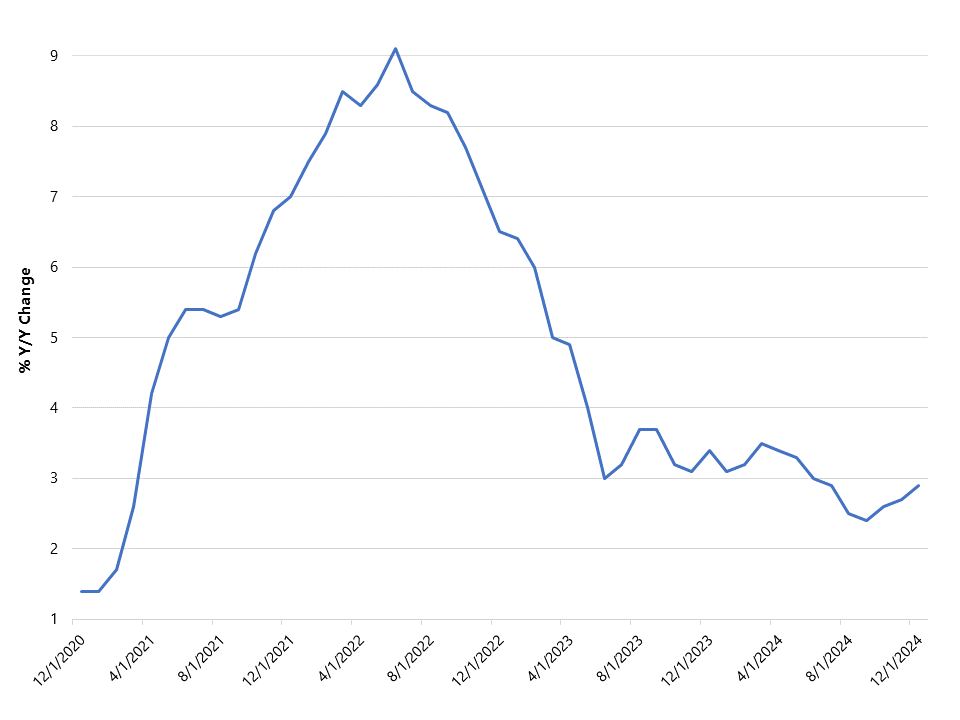

After peaking at 9.1% in 2022, the Consumer Price Index (CPI), a measure of consumer inflation, has trended lower and last year averaged 3.0% (Exhibit 3). CPI is expected to continue moving lower and forecasted to average 2.5%3 for 2025, remaining above the Fed’s 2% target. We see the risk of higher tariffs, a reduced labor force, and continued strong demand for services as reasons why inflation may not decline as quickly as the consensus is expecting. Downside risks include slowing wage growth, a strong U.S. dollar, and increased AI driven productivity. Our call is for inflation to remain “sticky” and expect an above-consensus increase in CPI for 2025.

Exhibit 3: Consumer Price Index

Complicating the outlook for both economic growth and inflation are policy shifts in the U.S. under the new Trump administration. These are expected to prove crucial not only for the trajectory of the U.S. but also for the global economy. Threats of tariffs, a core feature of Trump’s campaign trail, have implications for global supply chains, particularly if trade tensions escalate. Trade policy and tariffs, combined with potential changes in immigration policy and looser fiscal policy, have led to concerns regarding U.S. inflation. These concerns will likely support a stronger dollar and rising U.S. dollar borrowing costs, with significant implications for developing countries with large amounts of dollar-denominated debt. Foreign policy, another core feature of Trump’s campaign trail, is also set to change under the new administration. Though the path of foreign policy is still highly uncertain, it could include pressure to increase defense spending from NATO partners in Europe and allies in Asia, adding to fiscal strains abroad.

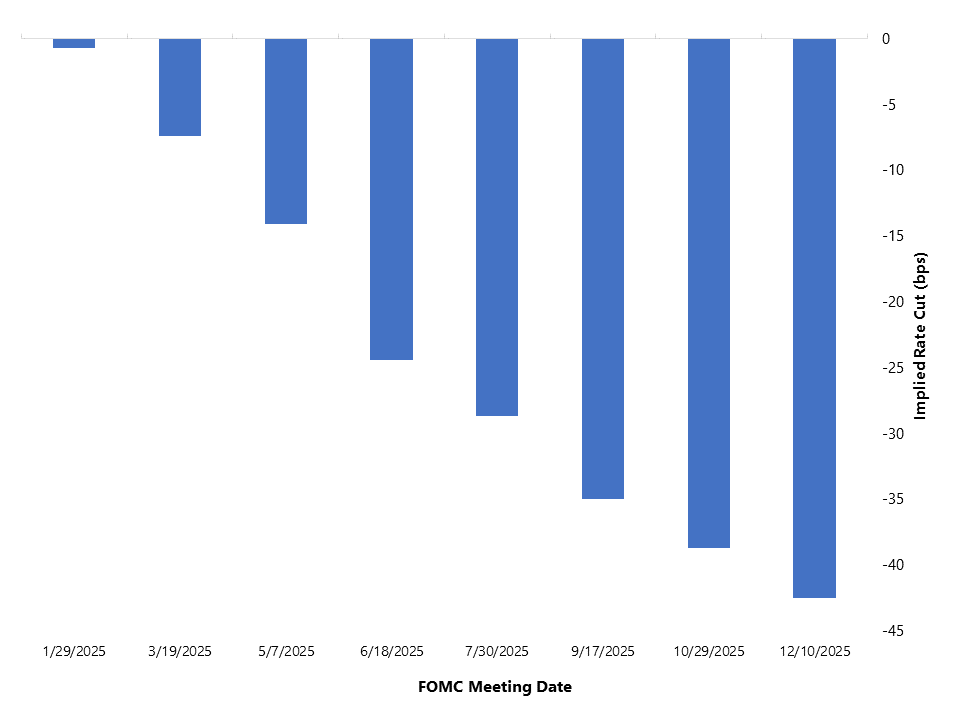

Sticky inflation and uncertainty surrounding the potential impact of Trump’s policies make assessing the likely path for the Fed’s interest rate policy more challenging. At their December meeting, the Fed’s forward guidance was calling for 50 basis points (bps) of total rate cuts for 2025. Minutes from that meeting suggest the Fed will be taking a “careful” approach to further rate cuts and markets are currently pricing in less than 50 bps of cuts. With the Fed still viewing monetary policy as “restrictive,” we believe even a slight moderation in inflation will give them enough leeway to continue cutting rates, and our call is for 50 bps of rate cuts in 2025. With the Fed cutting rates, we expect Treasury rates to end the year down modestly from current levels, with the benchmark 10-year Treasury ending the year in a range of 4.0% to 4.5%.

Exhibit 4: Fed Funds Futures Market Implied Rate Cuts

Fixed Income Outlook

Summary

AAM’s fixed-income team has a mixed outlook across various sectors. With spreads starting the year at historic tights in most sectors, we prefer investing in more defensive, liquid securities.

Strong corporate fundamentals and a constructive outlook for the domestic economy support sectors with credit risk, like Asset-Backed Securities and Corporate bonds. Our expectation for less rate volatility is supportive for rate-sensitive sectors like CLOs and Mortgage-Backed Securities (MBS). The Municipal market is expected to have stable credit fundamentals, with state and local governments experiencing revenue growth and maintaining healthy budget reserves. This is reflected in very tight spreads in that market. Similarly rich, the tax-exempt sector may face performance challenges due to supply technicals and potential legislative changes.

From a valuation perspective, we see spreads as largely unattractive in Corporate bonds, with the OAS trading in a range of 80-100 bps. Although spreads are very compressed vs. higher-rated peers, ‘BBB’ rated credits are likely to outperform higher-quality credits again in 2025 unless economic growth disappoints. Various sectors face different prospects in 2025: Basic Materials depend on tariffs and China stimulus, Communications and Technology sectors may benefit from consolidation, while Healthcare and Energy sectors are vulnerable to policy changes under the new Administration. Utilities and Financials are expected to remain active market issuers, offering investors more value.

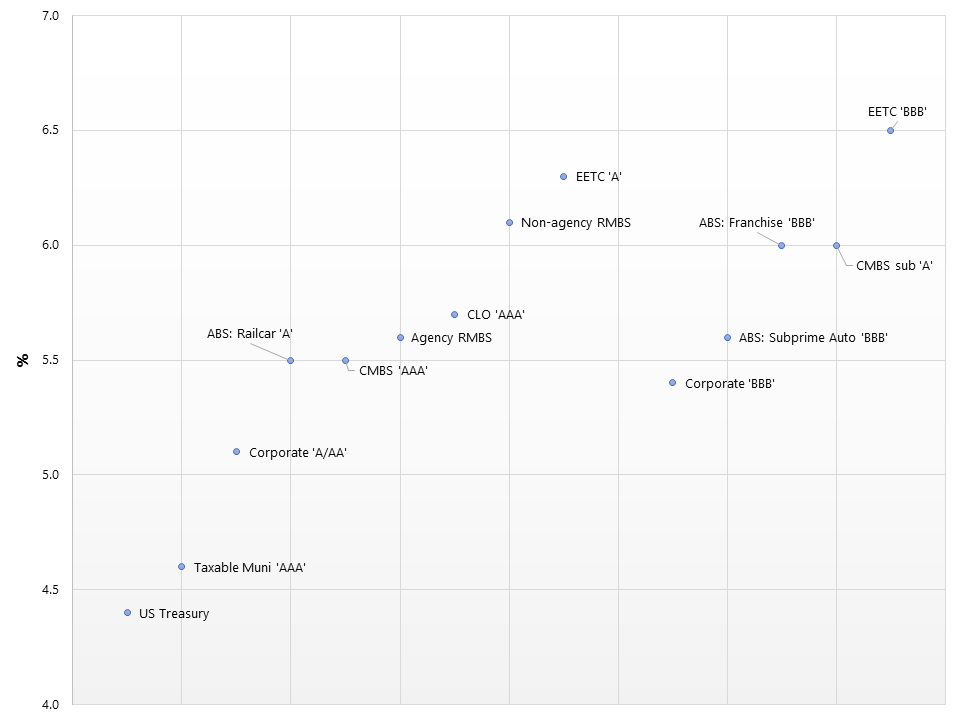

Relative to the last decade, fixed-income yields are compelling, with investment-grade assets providing investors with yields up to 6.5% without taking much duration risk, as Exhibit 5 shows. We expect to take advantage of the additional spread in new issue markets and spread widening when uncertainty increases. While many investors believe the Trump administration will be sensitive to decisions that would negatively impact markets, there are risks that behaviors and/or outcomes are not as the administration plans. Therefore, as the market recalibrates based on the outlook for economic growth and inflation, we will strive to deploy capital in an effort to take advantage of opportunities.

Exhibit 5: 5-year Yields

Corporate Bond Outlook

Summary

AAM’s forecast for the Investment Grade Corporate market in 2025 is varied. The Corporate market OAS is anticipated to oscillate between 80-100 basis points (bps), indicative of a positive economic outlook and market technicals, albeit with significant uncertainties related to policy and political factors. Modest to negative excess returns are projected, with ‘BBB’ rated credits expected to outperform higher-quality, lower-yielding credits unless forecasted economic growth is below expectations. Utility and Financial sectors resistant to event- and policy-related risks are preferred. Enhanced CEO confidence and a dynamic M&A landscape, particularly in Media, Energy, Banks, and Consumer Non-Discretionary sectors, are anticipated despite policy ambiguities. The primary risk to spreads is a weaker-than-expected economic outlook.

For the full Corporate Bonds outlook, click here.

Structured Products Outlook

Agency MBS

The Agency MBS market underperformed relative to other fixed-income sectors in 2024 but is expected to improve in 2025 due to a steeper yield curve and reduced interest rate volatility. Increased bank demand is predicted, potentially tightening mortgage spreads.

ABS

Asset-Backed Securities (ABS) are projected to offer stable cash flows and minor spread tightening of approximately 5-10 bps in 2025. Issuance is forecasted to remain substantial, with esoteric issues likely to perform better than lower-yielding generic securities.

CMBS

Commercial Mortgage-Backed Securities (CMBS) exhibited strong performance in 2024, and optimism persists for 2025 despite refinancing challenges. Spreads are projected to tighten further as property valuations stabilize.

CLOs

Collateralized Loan Obligations (CLOs) achieved strong returns in 2024 as rates remained elevated and spreads compressed. Despite anticipated rate cuts in 2025, CLOs remain attractive due to their higher overall yields. Further narrowing of spreads is expected.

For the full Structured Products outlook, click here.

Municipal Outlook

Taxable Munis

Taxable munis are viewed as fairly valued in comparison to ‘A’-rated corporate Industrials, with no strong impetus for further spread tightening. Favorable supply technicals and stable credit fundamentals bolster the sector’s defensive profile.

Tax-Exempt Munis

Tax-exempt munis face potential challenges from new issuance and political uncertainties. While appealing to retail investors, institutional investors may find them less attractive. The possible extension of the Tax Cuts and Jobs Act and the risk of changes to the tax-exemption status for specific sectors add to the sector’s uncertainties.

For the full Municipal Bonds outlook, click here.

Private Placement Outlook

Given our economic outlook for 2025, we expect fundamentals to remain strong across most sectors of the private placement market, supportive of low defaults and subdued rating downgrades. With our preference within the Corporate bond market for ‘BBB’ rated issuers, this should bode well for private placements, as ‘BBB’s represent about two-thirds of the market.

The technical backdrop should remain supportive. 2024 expected volume was $92.9 billion, an increase of 24% from the previous year. Supply was met with strong demand as the life insurance industry easily absorbed the supply, and most new issues were well oversubscribed. Supply is expected to be similar to last year, with continued strong demand. Private credit spreads, like public corporate bonds, are tight on a historical basis, but the pickup in spread to public corporates (the illiquidity spread) has remained attractive.

This additional yield, a constructive fundamental outlook, and the benefits of diversification and covenant protection give us an attractive view of the sector.

Exhibit 6: Private Spreads

Commercial Mortgage Loan Outlook

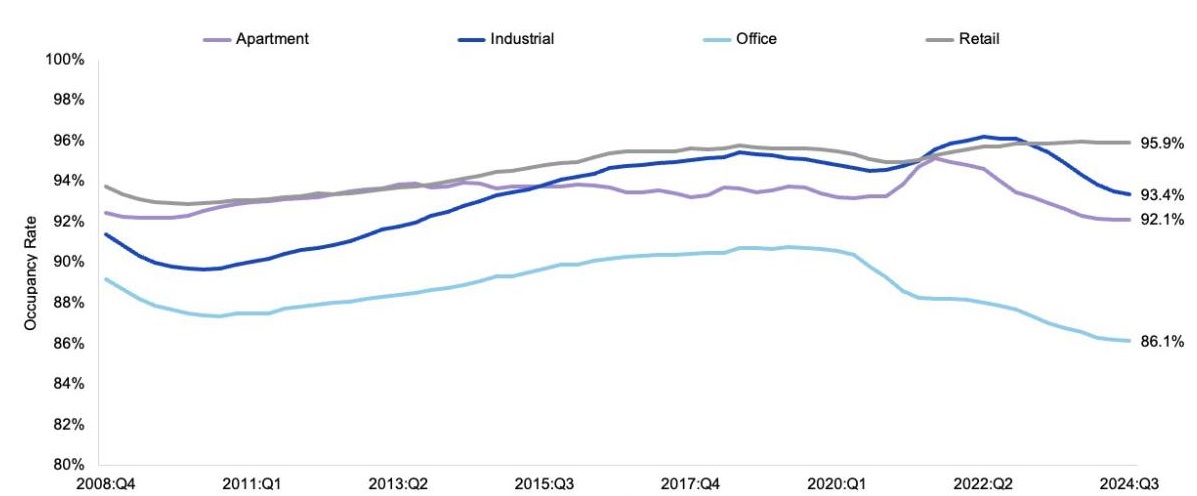

Commercial real estate market fundamentals overall are relatively good to start the year. A strong economic backdrop should benefit most commercial real estate asset classes, tempered by higher interest rates. The Multi-Family segment should have a strong tailwind as there has been limited new supply, and higher interest rates encourage renting versus buying. The Industrial property market is expected to decline but with still supportive NOI levels. Data centers are expected to continue a rapid growth phase with the emergence of cloud computing and AI needs. Retail markets are expected to remain mixed, with the best-performing grocery-anchored suburban properties. Office properties will likely see a continuing softening in valuations until occupancy rates stabilize. There are continued challenges to refinance many office properties with higher interest rates, most pronounced in large cities.

Exhibit 7: CRE Fundamentals: Property Type Occupancy Rates

With the recent increase in rates, the composition of the Commercial Mortgage Loan (CML) supply outlook for 2025 is uncertain as many borrowers opt for floating rate issuance and shorter terms. Insurance demand for CMLs is strong, and for loans that get done, yields of 6.50 – 6.75% for CM1/CM2 quality are near a 15-year high. We are constructive on CMLs and favor the Multi-Family, Industrial, and Data Center property types.

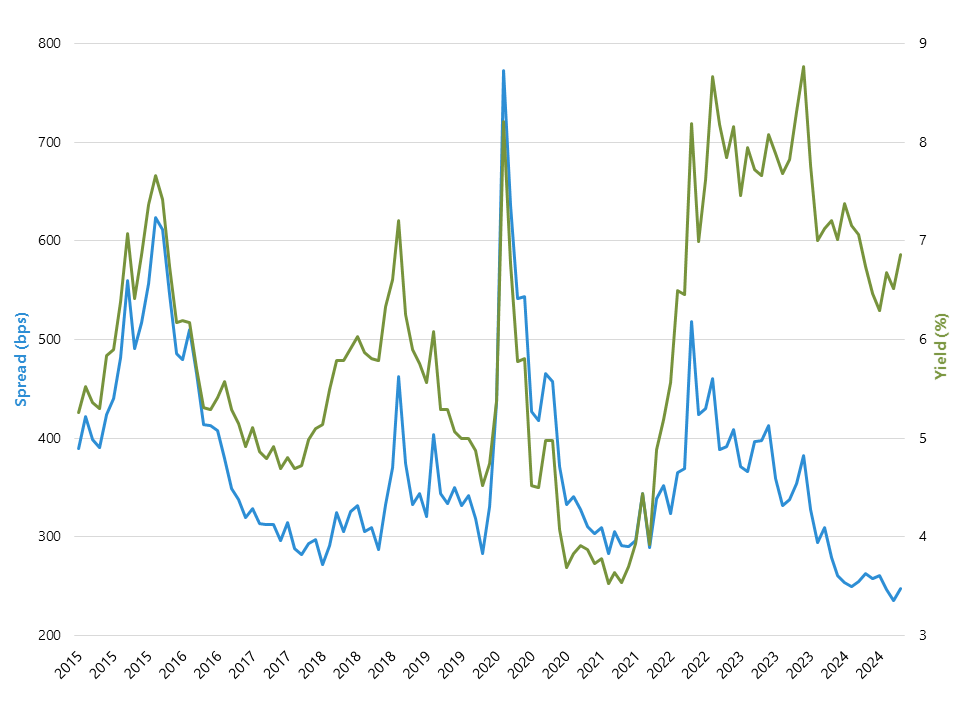

High Yield Outlook

The high-yield sector finished 2024 on a strong note, with the Bloomberg U.S. High Yield Corporate Index returning +8.2% and the Bloomberg U.S. Leveraged Loan Index returning +8.8% for the year. The asset class earned its carry, as spread tightening (47 bps for bonds and 39 bps for loans) was a lesser contributor to performance. We start 2025 with high yield spreads at rich valuations, at their tightest levels in 15 years. While the relative value of the asset class is unattractive based on these measures, investors continue to enjoy yields in the 7-8% range.

Net issuance in high yield, which has been below expectations, is expected to pick up in 2025. High yield duration is shorter than in recent history, with upcoming refinancing expected to be skewed towards higher-quality issuers. The market may see some widening if investor demand softens, as the strength in demand has been supportive of spreads.

Fundamentals are very strong, with 53% of the market in the ‘BB’ rating category. Higher interest rates make debt leverage less attractive for companies, and a strong economy has allowed companies to reduce debt with cash flow. While defaults are low, liability management exercises have been picking up and are something to monitor. Sectors with domestic industries with potential deregulation benefits are expected to perform better versus ones with exposure to imports and/or that have benefited from immigration. Nevertheless, spreads fully reflect strong technical and fundamental dynamics, leaving the potential for some widening in 2025. Those pockets of volatility will likely represent better entry points for those investors looking to add to the asset class.

Exhibit 8: HY Bond Spreads & Yields

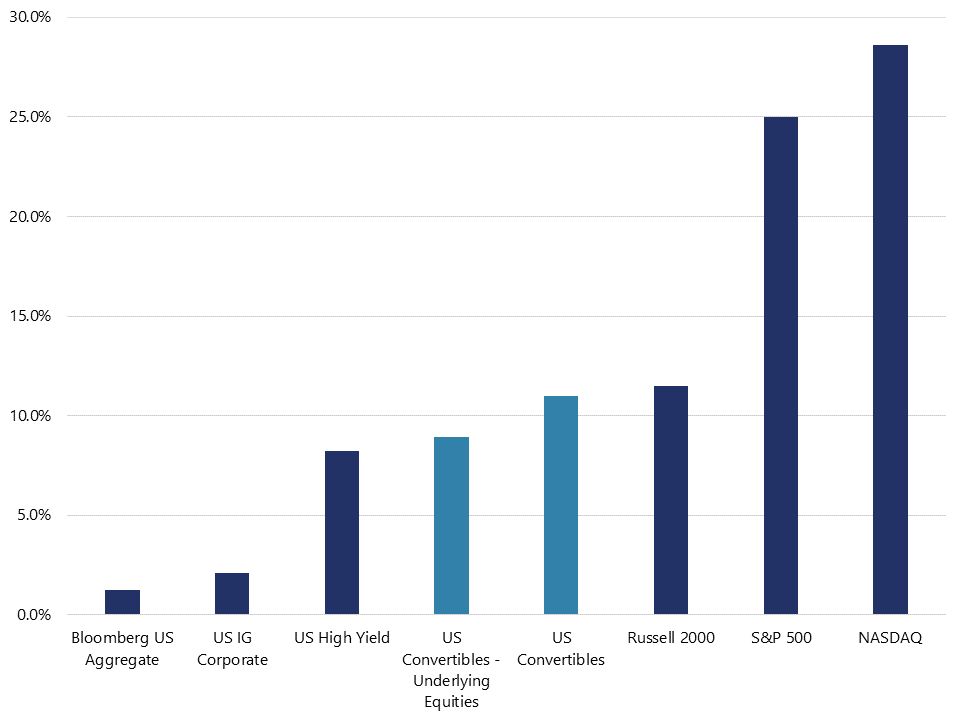

Convertibles Outlook

After a slow start out of the gate, Convertible bonds finished the year strong, with the Bloomberg U.S. Convertible bond index returning 11.0% (Exhibit 9). While outperforming other fixed-income classes, the asset class unsurprisingly trailed the Nasdaq and S&P 500 due to the convertible market’s lack of mega-cap tech exposure. However, equity-driven price appreciation was still a key driver of convertible performance, along with strong issuance and higher coupon income. Furthermore, the sector and issuer concentration were performance drivers, as the Information Technology, Industrial, and Communication Services sectors accounted for more than half of the year’s total return. In contrast, the top 20 issuers were responsible for ~61% of the year’s total return4.

Exhibit 9: 2024 Total Return

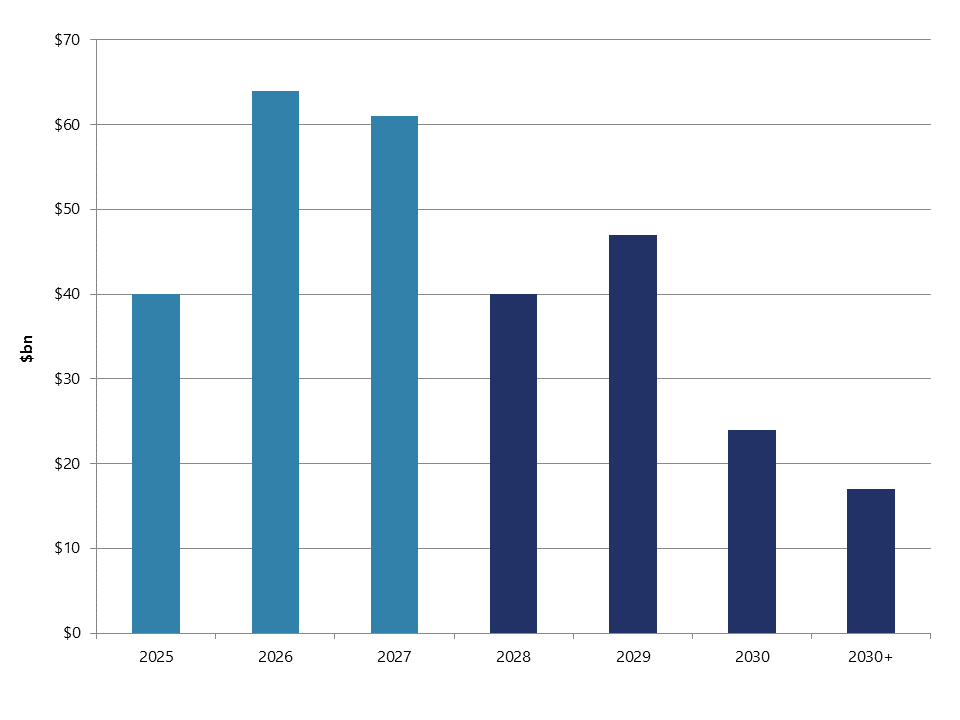

New issuance in the convertible market surged in 2024 as $83 billion came to market across 107 deals. We believe 2025 is set up to be another heavy supply year driven by an upcoming maturity wall and the lower borrowing cost associated with convertible issuance. According to Barclays Research, 56% of the convertible universe matures over the next three years (Exhibit 10) and will drive significant refinancing activity. In addition, we expect companies to continue to take advantage of the lower borrowing costs in the convertible market by issuing low-coupon convertible debt over the straight debt market. However, about a quarter of last year’s issuance came from crypto-related issuers and Chinese ADRs, which could leave overall issuance vulnerable if that trend reverses.

Exhibit 10: US Convertible Maturities ($bn)

The direction and breadth of underlying equity returns will primarily drive Convertible performance this year. AAM’s outlook is solid corporate earnings growth, which should be positive for convertible bonds’ underlying equity. If the Fed does cut rates consistent with AAM’s outlook, and longer rates fall as well, this should be a further tailwind for the asset class as growth-oriented companies benefit from lower borrowing costs. Finally, the implementation of the new Administration’s policies may produce equity volatility, which would likely have a positive impact on convertible valuations. Regardless of the environment, convertible bonds should continue to offer equity upside with downside protection, given their fixed income characteristics.

Equities Outlook

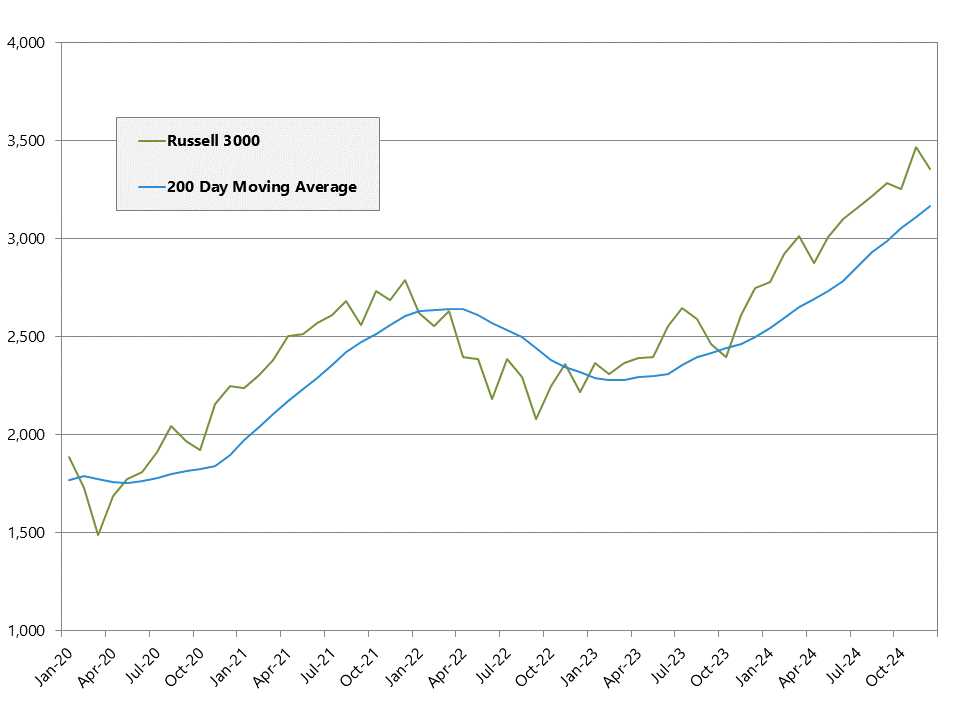

The outlook for US equity investors in 2025 presents a nuanced picture. On the one hand, the market continues to experience sustained positive momentum, with the broad Russell 3000 index having returned 55.9% over the last two calendar years and 180% since the Covid lows of 3/23/20 (an annualized rate of 24% for nearly 5 years!). This advance has been supported by strong earnings growth and a steady upward trend in GDP, coupled with investor enthusiasm for recent advances in Large Language Models (LLMs). This last has driven mega-cap technology companies to dominate the market, with the top four firms (Apple, Nvidia, Microsoft, and Amazon) making up 24% of the total market cap of the S&P 500, a nearly unprecedented level of concentration for an economy as diverse as America’s. Pullbacks have been so few and shallow in recent months that the S&P 500 never fell below its 200-day moving average in 2024, only the sixth time since 1990.

Exhibit 11: US Equity Enters 2025 With Strong Momentum…

However, this strong performance may indicate a more challenging environment for equity investors. By multiple valuation metrics (Price/Sales, Price/Book, Market Cap/GDP), the Russell 3000 is either at or very close to the most overvalued level in market history, as stock prices have run far ahead of the growth of corporate revenues or the underlying economy.

1 Source: Bureau of Economic Analysis, Q4 2024 GDP growth projected at 2.96% based on the Atlanta Fed GDPNow forecast

2 Consensus Estimate from Blue Chip Financial Forecasts (Jan. 2025)

3 Bloomberg Consensus Forecast (1/16/2025)

4 Barclays

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.