The use of private label products has become a very important secular trend for many industries. For the most part, consumers probably aren’t even aware they are buying a private label product. The next time you buy a dozen eggs at the grocery store or a new dress shirt at the local department store, the odds are good that you just bought a private label product. In this article, we go into depth about this topic while exploring the opportunities and threats for those companies that compete for your dollars on a daily basis.

Today’s private label products are far superior to those black and white labeled generic products familiar from the 1970’s. Private label products, otherwise known as store brands or retailer brands, can be found at a wide variety of retailers. Some private label products, which includes everything from pet food to aspirin, are much more obvious than others. The major improvement in packaging was the first step in the success of private label. Also, over the years, the quality has improved drastically making private label products a significant competitor to branded products. The performance of private label products is now more a function of price and consumer confidence. In general, the popularity of private label has been a big help to retailers’ bottom line while creating an additional challenge to name brand producers who need to recover expensive advertising and marketing costs.

Who Makes Private Label Products?

Private label products are made by several types of manufacturers. Some large brand manufacturers use their excess capacity and expertise to produce private label products. These products may be sold into foodservice venues or retail locations. For example, Hormel Foods sells a line of private label food products which includes canned meats, desserts, bouillon, and sugar and salt substitutes. This is in addition to the company’s Dinty Moore, SPAM, Lloyds, and Jennie-O branded goods (www.hormelfoods.com). Some retailers own their production facilities. About 40% of the private label products that Kroger sells are produced at the company’s own manufacturing plants which consists of 18 dairies, ten deli and bakery plants, five grocery product plants, three beverage plants, two meat plants, and two cheese plants. Finally, there are exclusive manufacturers of private label goods. These types of companies range from small, focused, or regional to large and diversified. With about $4.5 billion of annual revenues, Ralcorp is the largest private label food manufacturer in the U.S. This compares with revenues of $52 billion for Kraft which is the largest branded food manufacturer in the U.S. All of these manufacturers have the same high standards as the branded producers. They use similar equipment, similar ingredients, undergo a similar testing and quality analysis, and abide by the same set of FDA regulations.

Buying Private Brands is Good for Consumers & Retailers

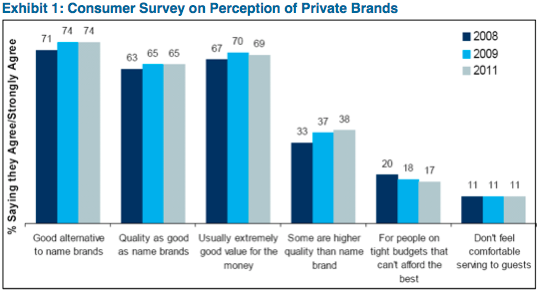

When it comes to taste, it’s very difficult to tell the difference. There have been several surveys published which illustrate consumers’ growing satisfaction with the private label product quality. Exhibit 1 shows the results of one such survey completed by The Nielson Company.

It was the lower price point that got consumers more interested in private label food during the last economic recession. It has been the improved product quality and value proposition that has kept consumers coming back for more. Traditionally, private label products have focused on the low-end price point. Now, some retailers will offer private label products across multiple price points including a premium line. This has made it more difficult for the brand manufacturers to differentiate themselves.

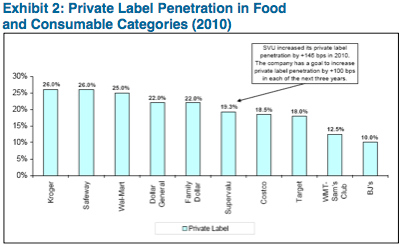

The private label trend has been positive for many retailers. Those retailers that sell private label goods make a significantly bigger margin on those sales. According to Steven A. Burd, CEO of Safeway, generally, food retailers make a 25% gross margin on branded product sales compared to a 35% margin on private label sales. That’s a significant source of additional profitability for a competitive business such as food retail. The use of private label products also gives the retailer the flexibility to more easily align a specific customer need with a specific product. For example, a grocery store in Chicago could make an observation that customers like their salsa very spicy and made with a specific kind of hot pepper. That change could be made quickly, especially if that grocery store had its own manufacturing facility for its private label salsa product. As a result, that store has improved its sales, enhanced its profitability, and improved its customer loyalty. Private label penetration in food has been increasing. For some retailers the sale of private label products can account for as much as 26% of unit sales and 20% of dollar sales.

Source: Company Reports, Citi Investment Research and Analysis

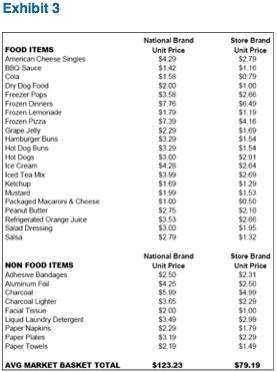

The cost savings for the typical consumer is large. The Private Label Manufacturers Association performed a pricing study that compared a basket of brand name products to a basket of private label products. The result was a 35% savings (See Exhibit 3).

Source: Private Label Manufacturers Association

Why Buy Brands?

So, for basically the same basic product at a lower price, why would anyone buy the branded alternative? One reason, is brand loyalty. Consumers know what they like and most don’t have time to stop and look at alternatives while shopping. Also, shopping for certain brands instills a certain sense of nostalgia that you don’t get from private label products. Also, the top brand manufacturers are typically very good at coming out with new, innovative products. A couple of examples include the new Heinz Dip and Squeeze ketchup package, and Kimberly Clark’s new Kleenex Cool Touch. You won’t get leading edge products from private label manufacturers. Finally, many cultures use branded products as status symbols. Products like Nike shoes and Coach purses are well recognized brands that help define one’s status. This has been a relatively new development for emerging markets as certain socioeconomic groups improve their wealth. This is positive for the branded manufacturers as they continue to push into countries such as China, Russia, and India.

Private Label Performance

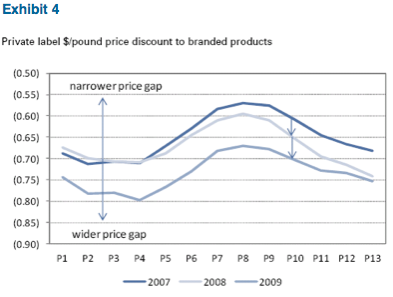

It’s interesting to take a look at the performance of private label products over the past five years. Exhibit 4 shows the price gap widened from 2007 through 2009.

During this period of time private label market share was increasing at a steady rate. This was due to a combination of three things: lower prices versus brand products, improved quality of private label products, and falling consumer confidence. As we exited the recession toward the end of 2009, consumer confidence started to come back.

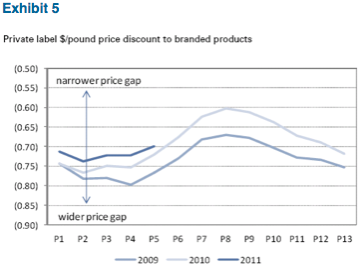

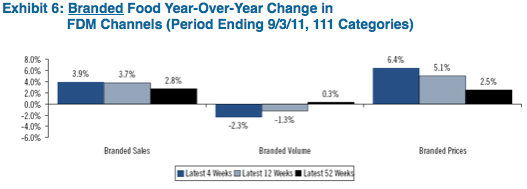

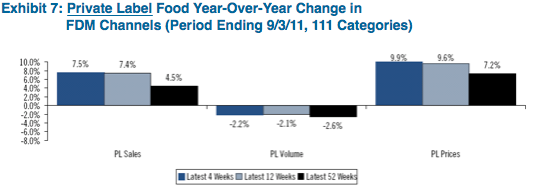

Exhibit 5 shows the price gap closing from 2009 through 2011. Brand manufacturers began to invest more heavily in “price” (lower prices of their products), in effect reducing the incentive for consumes to switch to cheaper private label products. As a result, branded goods regained volume market share. As shown in Exhibit 6 and 7, the battle seems to have come to a stalemate as the price gap has shrunk and consumer confidence has waned. For the latest four weeks ending September 3, 2011, branded prices have increased 6.4% resulting in a loss of volume of 2.3%. Private label prices increased by 9.9% resulting in a similar volume loss of 2.2%.

Private Label and Credit Research

We carefully consider the threat of private label when assessing the fundamental strength of a credit. It’s very helpful to know how a company is positioned relative to private label competition. In general, those companies that have focused on growing their private label presence have benefited with better profitability. Private label brands such as American Rag and Ink are sold at Macy’s and altogether represent about 20% of sales which is up from less than 5%. Among other things, when researching branded food manufacturers we are careful to consider a company’s diversity of product categories in addition to its market position in those categories. A company with a narrow product focus and weak market position is at greater credit risk. In food manufacturing, there are certain categories that have a much bigger competitive threat from private label. These categories, such as cheese, nuts, and milk tend to be more commodity like in nature. For these reasons we favor large, well diversified, food companies such as Kraft, General Mills, and Kellogg. On the retail side, we like companies that are strong operators, benefit from a specific niche or secular trend, and take advantage of attractive private label opportunities. These credits include Home Depot, CVS, Kroger, and Nordstrom.

What’s Next?

Going forward, we expect private label products will continue to be a formidable threat to branded manufacturers. Branded manufacturers will need to enhance innovation and focus on the way they market their products as they compete for shelf space next to grocery stores’ private label products. Retailers will continue to increase their proportion of private label product as a means to improve profitability and enhance the consumer’s shopping experience. In the future, it should be interesting to see how the industry adapts given this private label dynamic. After all, just look how far we’ve come since those days of black and white labels.

Michael J. Ashley

Vice President, Corporate Credit

For more information, contact:

Joel B. Cramer, CFA

Director of Sales and Marketing

joel.cramer@aamcompany.com

Greg Curran, CFA

Vice President, Business Development

greg.curran@aamcompany.com

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Utilities: Affordability Takes a Prominent Role in an Active Political Year

February 9, 2026