insight

Rate Rally Reduces Attractiveness of Tax-Exempt Municipal Sector Ahead of Weaker Seasonal Technicals

October 27, 2025

Download PDFTHIRD QUARTER MUNICIPAL BONDS UPDATE

Market Recap

The municipal market produced strong returns for the 3rd quarter following the rate rally in the Treasury market. Treasuries rates in 10 and 30yr maturities fell by 8 and 20 bps, respectively, during September on the heels of weakening economic data that led to a more dovish monetary policy stance by the Federal Reserve. Returns for the Bloomberg Tax-Exempt Index Municipal Bond and the Bloomberg Taxable Muni Index produced positive results for the quarter of 3% and 2.5%, respectively1.

Tax-Exempts: Weaker Technicals Provide Headwinds Entering the 4th Quarter

For the tax-exempt sector, the record pace of new issuance continued to pressure relative valuations to weaker levels for most of the quarter, before the change in market sentiment pressured rates to lower levels. Mutual funds designated as long-term, were reporting weekly average outflows of $29M per week during the 8 weeks leading up to mid-August. However, after weaker economic data prompted the Federal Reserve to cut rates in September, overall fund flows turned sharply positive, producing inflows averaging over $1B per week through the end of September. The stronger demand profile for the sector resulted in tax-exempt rates to contract by 30 and 37bps in 10 and 30 yrs, respectively, during September2.

However, heading into the 4th quarter, the rally in tax-exempts has now produced expensive valuations versus historical levels. Municipal-to-Treasury yield ratios in 10, 20 and 30yrs are now 10, 3.3 and 2.7 percentage points, respectively, through their 8-year averages, and they do not look attractive going into softer technicals in October and November. New issue supply levels during these months are expected to produce ~$60B and $50B, respectively, while reinvestment flows from coupons/calls/maturities are expected to average $45B per month during this period3.

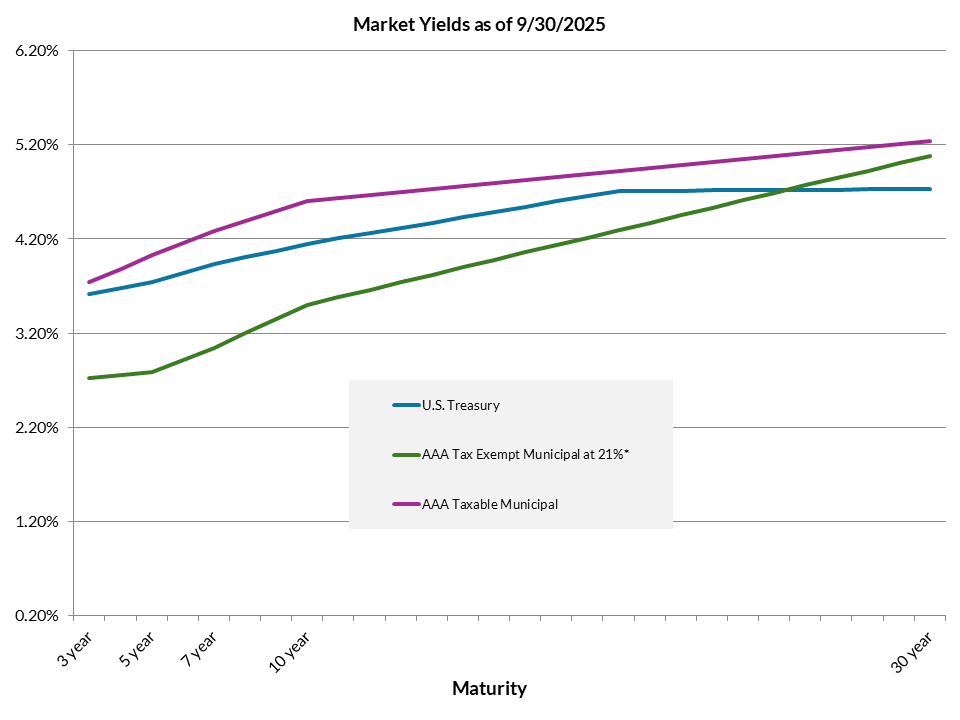

With the projected technical headwinds for the sector amid expensive valuations, taxable alternatives look favorable over the balance of the year. With the prospects for further federal funds rate cuts as the central bank moves closer towards further removing their restrictive policy and normalizing the fed funds rate toward their neutral rate target, the bias toward lower yields provides a compelling argument to maintain better duration and convexity structured assets in portfolios. Given the callable bias of the tax-exempt sector and its weaker convexity structure relative to non-callable bonds, we believe maintaining exposure to taxable alternatives should be a focus. Unless substantial dislocations develop in tax-exempts during the notoriously weak seasonal technicals during the 4th quarter, it should be advantageous to be underweight to that sector4.

Taxable Municipals: Pockets of Attractiveness Still Exist

Taxable muni performance lagged tax-exempts for the quarter, but still performed well and retained a fairly stable spread profile for most of the period. Spreads on ‘AAA’ issuers tightened across the yield curve in a range of 5 to 9 bps, with the 3yr and 30yr maturities performing the best. With this performance, spreads have now contracted from their mid-April year-to-date peak levels by 13, 29 and 23bps in 5, 10 and 30yr maturities, respectively5.

Although we believe that spreads for the sector should remain stable and rangebound around current levels over the balance of the year, there are opportunities for further tightening. One area of focus that we see is in the higher education sub-sector, which we believe still remains attractive. Political pressure on private higher education institutions and freezes/cuts in research funding has remained an issue throughout most of 2025. That politically driven headline risk has led this sector to widen relative to other sub-sectors within the municipal market and, as overall municipal market spreads have tightened, spreads on higher education debt remain elevated. Citing one example from the entire education municipal credit universe, spreads on ‘AAA’ rated university bonds, which were issued in mid-April as wide as 88bps spread to 10yr Treasuries, have since tightened by 45bps to being offered, as of this writing, at a spread of 43bps spread to Treasuries. However, similarly rated ‘AAA’ general obligation credits in 10yrs, have priced as tight as 15bps through current ‘AAA’ higher education offering levels. We believe this bifurcation in market spread levels between the higher education and general obligation sectors can remain an attractive entry point to add exposure to the strongest credits within the university space6.

From a credit perspective, although headline risk still remains a headwind for the sector going forward, we expect the stronger schools with exceptional demand and selectivity metrics to retain solid underlying credit fundamentals. While federal funding cuts and freezes have strained operations, decisive actions by higher education institutions so far this year have helped them navigate a challenging year. We expect that with a continued focus on spending restraint, hiring and salary freezes, and prudent balance sheet management, universities like Harvard and similarly rated universities are expected to retain financial stability amid potentially sharp revenue disruptions. As the shifting federal policy environment challenges continue to be addressed through legal challenges or direct negotiation with the Trump administration, spread performance for the sector should continue to normalize and further reduce any bifurcation in spreads compared to other similarly rated credits/sectors. Looking forward to the 4th quarter, we believe focus should remain on the taxable municipal sector, while looking to selectively add while reducing tax-exempt exposure7.

Exhibit 1: Taxable Munis: Compelling Alternative to Tax-Exempts

*21% Corp Rate Tax-Adjusted at a Factor of 1.1994

1 Bloomberg, Barclays

2 Bloomberg, Lipper, Refinitiv

3 BofA, Bloomberg, Lipper, Refinitiv

4 Bloomberg, Lipper, Refinitiv, AAM

5 Bloomberg, AAM

6 Bloomberg, AAM

7 Bloomberg, AAM

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.