insight

Remain Disciplined: AAM Corporate Credit View Fall 2016

October 17, 2016

We are in the late stage of the credit cycle and anticipate an increase in credit rating downgrades to put pressure on spreads for investment grade issuers. These negative fundamentals are partially offset by strong market technicals. We advocate remaining defensive and selective while maintaining the flexibility to take advantage of opportunities that we expect will arise over the near-to-intermediate term.

[toc]

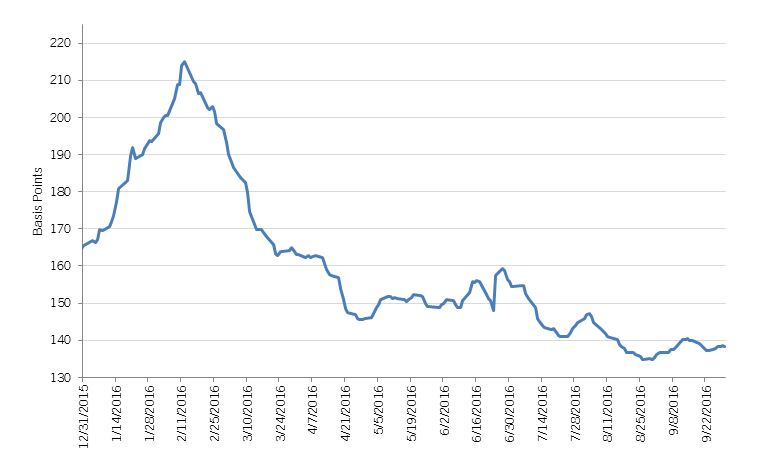

The Investment Grade Corporate bond market delivered a 1% total return in the third quarter, tightening 18 basis points (bps), as defined by the Bloomberg Barclays index. Risk assets outperformed, as the S&P Index increased close to 4% in the third quarter, and high yield returned approximately 5%. Investors largely shrugged off oil price volatility, heavy new debt issuance, weaker than expected economic data, and a lackluster earnings season. China’s stimulus, dovish monetary policy and resilient economic growth have likely supported risk assets and commodity prices. Energy and Basic Materials have been significant outperformers this year due to higher commodity prices.

Exhibit 1: U.S. Corporate Investment Grade Option-Adjusted Spread (OAS)

Source: Bloomberg Barclays, AAM

For spreads to tighten meaningfully next year, fundamentals need to improve and market volatility needs to remain low. The cost of equity continues to surpass the cost of debt, incentivizing companies to reduce their equity base to drive growth. We expect this to continue until the cost of debt reprices, which will not likely come unless the probability of a recession increases and the market grows more concerned about future growth prospects. We recognize that in general, favorable market technicals, not broad credit fundamentals, have been the primary driver of tighter spreads. Thus, we remain disciplined as we build corporate bond portfolios.

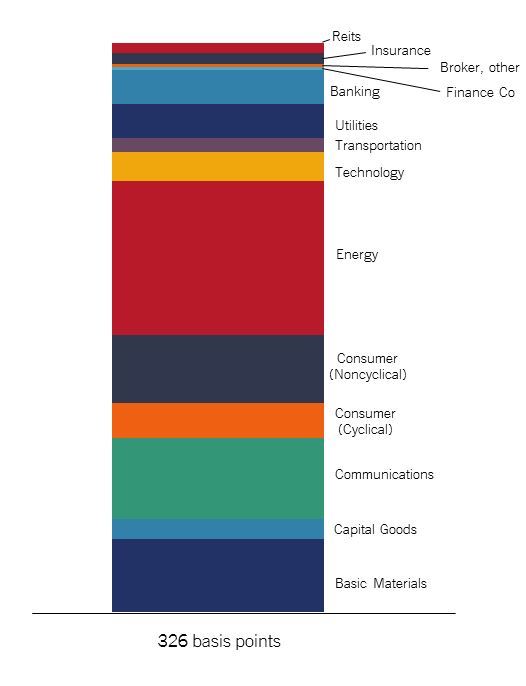

Performance Summary Year-to-Date

Performance has been fairly widespread among the non-financial corporate bond sectors year-to-date. Energy and Basic Materials rebounded strongly and would have driven returns even higher if $33 billion of debt had not been downgraded to high yield in January and February of this year. Longer maturity corporate bonds have outperformed year-to-date given overall spread tightening and the demand from yield focused accounts, especially in Asia. Financials have lagged because of the prospect of lower rates for longer and the rally in commodity based sectors. Lastly, shorter maturity corporate bonds have underperformed in recent months in part due to money market reform in the US. The imposition of a floating NAV for institutional Prime Money Market Funds (MMF) has resulted in an outflow from these funds. As a result, issuers that had previously relied on CP issuance to Prime MMFs to fund working capital needs have instead tapped the corporate bond market in the 2-3 year space, thus pressuring this part of the corporate curve.

Exhibit 2: U.S. Contributors to IG Corporate Excess Returns YTD 2016

Source: Bloomberg Barclays Index (as of 9/30/2016), AAM

Credit Fundamentals Remain Lackluster

Credit metrics did not improve in the second quarter. Revenue growth (for non financials, excluding commodity related firms) was flat while EBITDA grew a modest 2%. This is not expected to change much in the third quarter, as reflected by analyst estimates. Debt growth at 7% continued to outpace EBITDA growth, as share buybacks accelerated. Shareholders continue to reward firms for using their balance sheets to buyback shares. Other credit metrics deteriorated as well, including cash interest coverage and cash as a percentage of debt.

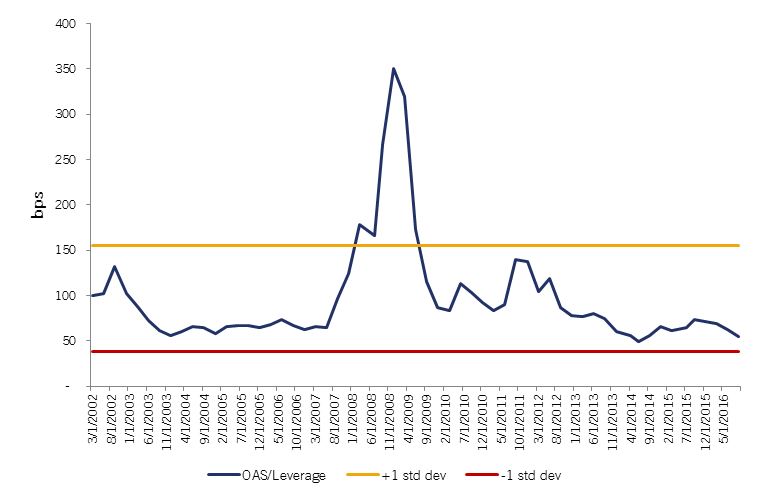

Option-Adjusted Spread (OAS) per unit of debt leverage is nearing a historically low point. To approach the median (77), OAS needs to widen 55 bps which is about 60% of a one standard deviation move. Otherwise, fundamentals would need to meaningfully improve. This theme is consistent in U.S. high yield as well as European credit. Unless the cost of debt rises (or the cost of equity falls), we do not expect companies to change their behavior radically as it is in the best interest of shareholders to continue to de-equitize unless growth prospects improve.

Exhibit 3: Median OAS/Debt Leverage

Source: Bloomberg Barclays, CapIQ using median figures for IG non-Financials as of 6/30/2016, AAM

Regarding growth prospects, economists are not expecting global growth to accelerate much next year, with global GDP expected to increase from 2.9% in 2016 to 3.1% per Bloomberg estimates.

| GDP Estimates | 2016 (%) | 2017 (%) |

| United States | 1.5 | 2.2 |

| European Union | 1.8 | 1.4 |

| China | 6.6 | 6.3 |

| Japan | 0.6 | 0.8 |

| Latin America | -1.7 | 1.7 |

| United Kingdom | 1.8 | 0.7 |

Source: Bloomberg (Economist estimates) as of 10/12/2016

M&A Still Preferred Over Capital Investment

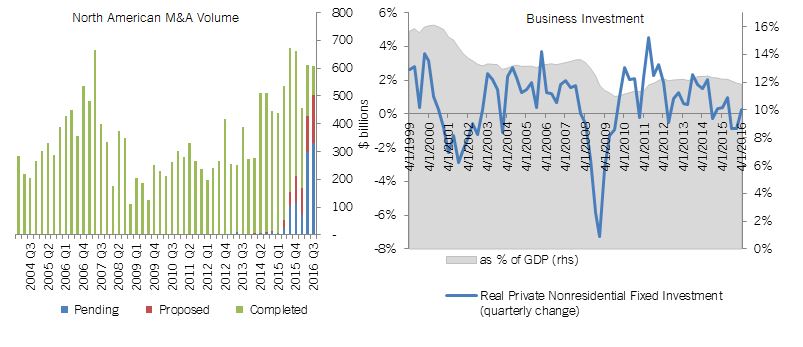

Companies continue to use debt and cash to fund acquisitions versus increasing capital expenditures despite increased resistance from regulators and the U.S. Treasury. Reduced investment spending as a percentage of GDP has been driving productivity lower.

Exhibit 4: (1) North America M&A Volume and (2) Business Investment

Source: St Louis Fed, Bloomberg, AAM

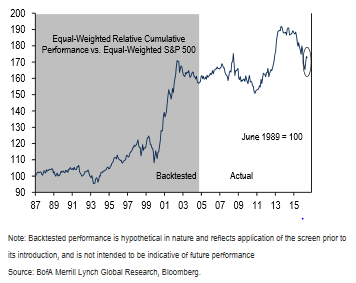

When analyzing 2017 capital spending estimates for the universe of investment grade companies, we expect spending next year to be approximately flat vs. 2016 on the aggregate with less than ten industries growing at a rate faster than (1) they did in 2016 and (2) the economy overall (2% assumed). While acquisitions have slowed since the peak in 2015, share repurchases have only accelerated. Given the relative performance of companies that have pursued this strategy, per Bank of America’s study, we would expect this behavior to continue.

Exhibit 5: Cumulative Stock Performance of Companies Repurchasing Shares Relative to the Market

Market Supply and Demand Technicals Remain Supportive

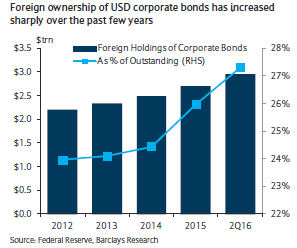

Unlike fundamentals, it is difficult to predict a change in technical related behavior. We note that while valuations look expensive relative to fundamentals, we believe it will take a major shock to increase credit spreads meaningfully in an environment where central banks are buying fixed income securities, reducing available supply. Demand continues to come from yield hungry foreign investors.

Exhibit 6: Foreign Ownership of USD Corporate Bonds

Investing in the Late Stage of the Credit Cycle

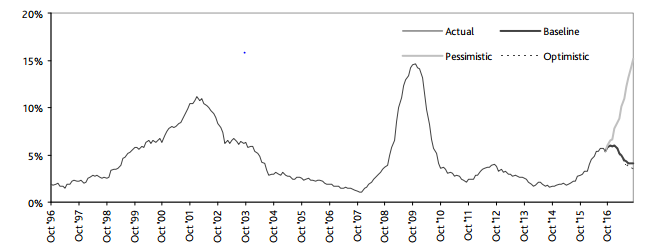

Defaults have increased this year largely due to commodity related issuers. We continue to monitor the contagion effects of weak economic growth and tighter credit standards. We expect the default cycle will be longer and recoveries lower than they have been historically given the (1) amount of debt outstanding is relatively high, (2) low level of interest rates, making it more difficult to lower the cost of debt via monetary policy, and (3) structural changes in the market post financial crisis affecting liquidity (and the ability to access the market for refinancing). That said, defaults are expected to decline over the near term with the improvement in commodity prices. Moody’s expects the U.S. default rate to be 5.9%, declining to 4.1% by third quarter 2017. But as its forecast indicates, the pessimistic rate rivals the rate in 2009.

Exhibit 7: Moody’s US Speculative-Grade Default Rates (Actual and Forecast)

Source: Moody’s “September Default Report” 10/10/2016

We are in the late stage of the credit cycle and anticipate an increase in credit rating downgrades to put pressure on spreads for investment grade issuers. These negative fundamentals are partially offset by strong market technicals. We advocate remaining defensive and selective with opportunities in intermediate maturity domestic banks, high quality short insurance and autos, electric utilities, M&A related new issuance (e.g., pharma), and select telecom/tower and energy credits. We want the flexibility to take advantage of opportunities that we expect will arise over the near-to-intermediate term, while investing in credits with more predictable cash flows that offer a yield advantage. We recognize the importance of earning sufficient income to not only satisfy the needs of our clients but to cushion the spread volatility that is likely to increase from a very low level over the last six months.

Written by:

Elizabeth Henderson, CFA

Elizabeth Henderson is a Principal and the Director of Corporate Credit at AAM with 19 years of investment experience. She joined the firm in 2002. Elizabeth graduated with Honors and Distinction from Indiana University with a BS in Finance and earned an MBA in Finance, Analytical Consulting and Marketing from Northwestern University’s Kellogg School of Management.

For more information about AAM or any of the information in the Corporate Credit View, please contact:

Colin T. Dowdall, CFA, Director of Marketing and Business Development

colin.dowdall@aamcompany.com

John J. Olvany, Vice President of Business Development

john.olvany@aamcompany.com

Neelm Hameer, Vice President of Business Development

neelm.hameer@aamcompany.com

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.