THIRD QUARTER MUNICIPAL BONDS UPDATE

Market Recap

During the quarter, the Federal Reserve cut the federal funds rate by 50 basis points (bps) in mid-September. The Treasury market rallied on the news and finished the quarter with substantial yield declines of 111bps and 62bps in 2yr and 10yr maturities, respectively1.

Although the municipal market also produced solid returns for the quarter, both the taxable and tax-exempt sectors underperformed Treasuries. Taxable muni yields fell almost in line with Treasuries, but ‘AAA’ yield spreads did widen modestly by 2 and 3bps in 10 and 30yrs, respectively, while 3 and 5yr spreads tightened by 6 and 8bps, respectively. However, the tax-exempt sector was weighed down by a significant increase in the new issuance supply cycle that resulted in the sector only seeing yield declines of 81bps and 24bps in 2 and 10yrs, respectively2. Returns for the Bloomberg IG Tax-Exempt Index and the Bloomberg Taxable Muni Index produced positive results for the quarter of 2.7% and 5.4%, respectively3.

Supply Conditions Remain Elevated

New issue supply continues to be one of the biggest challenges for the municipal market this year. On a year-to-date basis, supply year-over-year is up 35% to end the quarter at $380.4 Billion. The two major categories for issuance, refinancings/refundings and new money for infrastructure, both continue to be major catalysts for the elevated new issuance cycle. As we’ve noted in prior quarterly commentaries this year, the elevated taxable rate environment, combined with relatively low tax-exempt yields, are producing historically low 10yr muni-to-Treasury yield ratios that have hovered between 56% and 70% for most of the year. By comparison, this range looks very favorable relative to the 10yr average of 86%4. That has been a major impetus for providing compelling refinancing opportunities for issuers who have produced a year-over-year increase of 91% for this category. Additionally, the relatively low tax-exempt yield environment has also allowed for the attractive funding for infrastructure spending that has resulted in a year-over year increase of 19% in bond issuance. The current pace of new issuance is expected to remain elevated, as issuers try to clear the market with their deal flow prior to November in order to avoid any election-related market volatility. However, as long as the relatively-low tax-exempt rate condition exists, we could see issuance remain at very elevated levels for the balance of the year5.

Outlook: Relative Valuations Favor Longer Taxable Munis

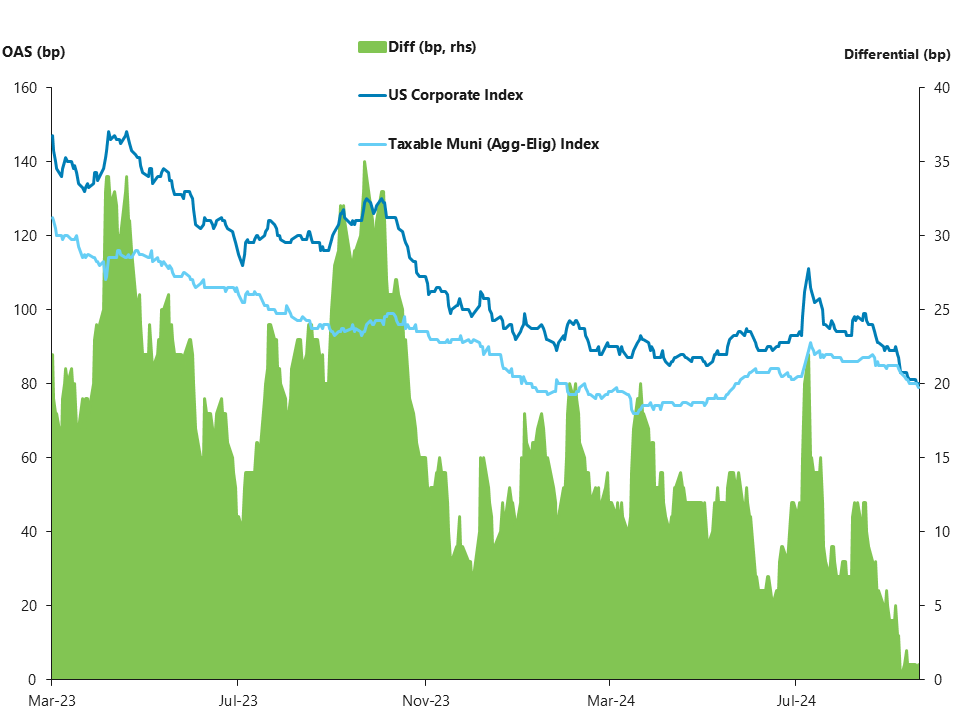

While we remain net sellers of taxable munis 7yrs and shorter on expensive spread relationships to Treasuries, our opinion has turned more constructive on taxables 10yrs and longer. In looking at the Bloomberg Agg index option adjusted spreads (OAS) for corporates, since their year-to-date peak of 111bps on 8/5/24, spreads have collapsed by a substantial 28bps to a spread of 83bps on 10/7/24. Taxable muni spreads over that same time horizon have remained relatively stagnate, with the taxable muni Bloomberg Agg-eligible component OAS falling by 10bps to a spread of 82 bps. That spread relationship between the two sectors of only 1 bps encapsulates the underperformance of taxable munis during the quarter, but also highlights the relative attractiveness of the sector versus corporates6.

Exhibit 1: Taxable Munis Spreads Attractive Relative to Corporates

In drilling down into maturity buckets across the yield curve, that attractiveness for taxable munis is the most pronounced in the 10yr area. While AAM observes 10yr spreads for ‘A’-rated, low-beta industrials at 58bps, the ‘Aaa’ taxable new issue deal for Columbia University priced at 57/10yr at the beginning of the 4th quarter. Additionally, secondary trades on high-‘AA’ names like Northwestern University maturing in 12yrs traded as wide as 75bps spread to 10yr Treasuries. We view these examples of tactical trading prospects to buy high-grade taxable municipals at spread levels comparable to A-rated corporates as a compelling opportunity to add to the basis for the taxable muni sector7.

In the 30yr area, although we don’t find high-grade spreads in that part of the curve to be as attractive as corporates, the spread relationship for ‘AAA’ taxable munis to ‘A’-rated industrials of -27 bps is well-north of long-term averages of -39bps, and only 2bps away from the 1yr wide of -25bps. This longer-term spread relationship produces a positive 1.1 z-score versus the 10yr average. Although the spreads here are not as compelling an entry point as in the 10yr area of the curve, we believe the tactical move here is to maintain our existing exposure to the sector in the long end of the yield curve until we see normalization in spreads between corporates and taxable munis8.

For tax-exempts, we retain our posture of reducing exposure to the sector for insurance company portfolios. Over the course of the last quarter, tax adjusted spreads (21% corporate tax rate) have widened by a substantial 18 and 33bps in 5 and 10yr maturities, respectively, due to the supply-driven weaker technical conditions. Even with this underperformance, tax-adjusted spreads to Treasuries in these maturities at the start of the 4th quarter were at an anemic -99 and -66bps, respectively, and at these levels, the sector remains a prime source of funding for taxable alternatives across the yield curve9.

Exhibit 2: Taxable Munis: Compelling Alternative to Tax Exempts

*21% Corp Rate Tax-Adjusted at a Factor of 1.1994

1 Bloomberg

2 Bloomberg, Refinitiv, AAM

3 Bloomberg, Barclays

4 Bond Buyer, Bloomberg, Refinitiv

5 Bond Buyer, Bloomberg, Refinitiv, AAM

6 Bloomberg, Barclays, AAM

7 Bloomberg, AAM

8 Bloomberg, AAM

9 Bloomberg, Refinitiv, AAM

Utility Bill Inflation is Back: Balancing Growth, Reliability and Affordability in the AI Era

September 2, 2025