AAM’s Fixed Income View – First Quarter 2024

Summary

Positive market sentiment continued in the first quarter, as economic activity surprised to the upside around the globe1. The improved fundamental outlook coupled with higher yields continued to drive demand for investment grade (IG) fixed income from all investor types – retail, insurance, pension, foreign. The net supply of new debt remains historically low in most IG markets, and is likely to get even tighter later in the year as issuers would rather avoid the fourth quarter due to election-related uncertainty.

As we start the second quarter, we are seeing increased rate volatility having more of an impact on stock prices as valuations have to adjust to the higher discount rate, but IG spreads have largely been immune. With a stable-to-improving economic outlook and a Federal Reserve and other central banks biased to cutting vs. raising rates, the fundamental back-drop remains constructive. We expect markets to materially re-price if the Fed changes its rate-cutting posture or of course, some unexpected event occurs. That level of uncertainty is not reflected in risk premiums. However, we view that “bear case” as a low probability event in the near term.

The market has largely converged with AAM’s outlook at the start of the year. We generally see less value in corporate and municipal bonds today, and we see more value in structured products, including CLOs. Given our underweight to agency mortgage backed securities (MBS) and their underperformance to start the year, we are in a position to add.

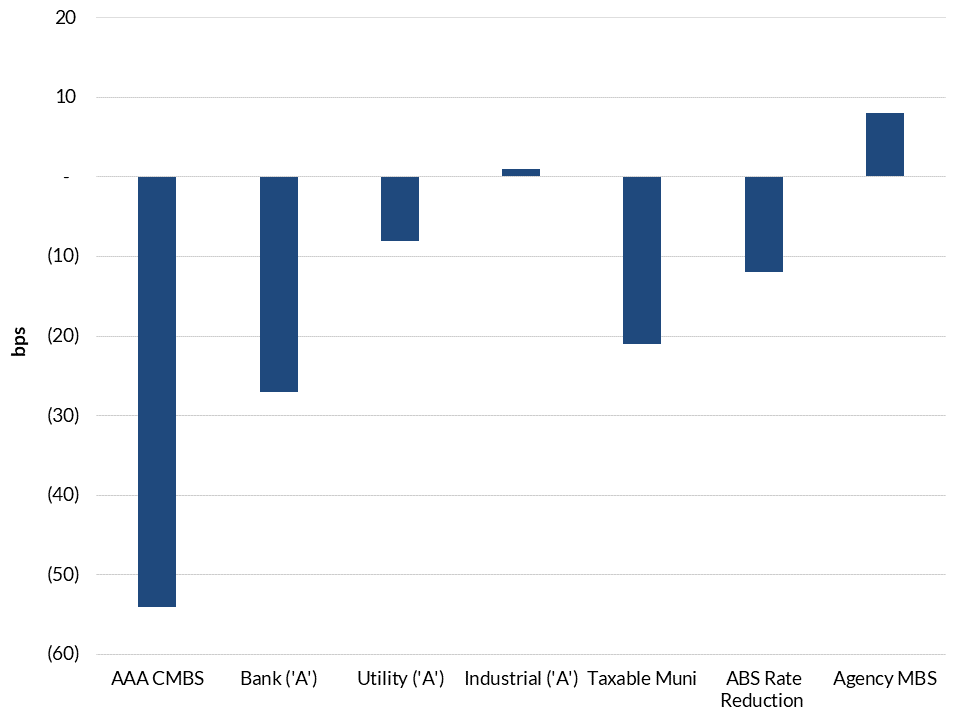

Exhibit 1: Change in OAS

Corporate Credit – Outperformed in the first quarter; AAM sees less value in this sector

IG corporate fundamentals are in great shape, and the near term outlook remains positive. Credit cycles can often be marked by the pace of growth of debt vs. EBITDA or free cash flow. As organic growth becomes difficult, companies engineer shareholder return through debt-funded share buybacks or mergers/acquisitions (M&A). This activity often leads to wider credit spreads due to anticipated negative rating action, new debt supply, among other reasons. We are not close to this point on average, as most companies expect to generate earnings growth this year organically due to revenue growth and margin expansion. Free cash flow/Debt is at or near a cycle high and that strength underpins tight credit spreads, especially given the breadth across industries. We expect FCF to remain strong in 2024, with EBITDA growing at a faster rate than capital spending (and likely debt). Rising interest costs will continue to dent FCF modestly.

The outlook for demand and a relatively moderate level of net supply is as supportive for spreads as it’s been in years. Our expectation continues to be for the OAS to remain in a tight range around 90-110. There is still value in sectors such as Banks and Utilities and select BBB Industrials, and there is more value in the short-to-intermediate parts of the curve. There is value in the new issue market with positive concessions vs. secondary offerings, and we expect that to be a primary driver of performance going forward.

Structured Products – CMBS, CLOs and ABS outperformed while Agency RMBS continued to lag; AAM sees value in this sector

The commercial mortgage backed (CMBS) market had a great start to the year with non-agency and BBB tranches outperforming2. Investors deployed cash that had been on the sidelines for this sector, as there was very little to buy before these deals were announced. We expect continued volatility related to the headline risk in this sector, as higher-rates-for-longer keeps cap rates elevated, and fundamental and refinancing challenges remain in areas like office. There is value in this sector but one must be selective.

The asset backed market (ABS) also performed well. As was the case in the corporate sector, new ABS debt issuance was heavy yet well received by investors, looking to add high quality yield. Rate reduction securities outperformed autos and credit cards. We expect new issue to return to trend, and the sector to perform well given that spreads are wide vs. municipal and corporate bonds. The strong demand in this sector has resulted in spread compression in the more esoteric areas of the market, making credit work and relative valuation analysis increasingly important. CLOs continue to offer value at the senior level.

Last but not least, the agency residential mortgage backed (RMBS) sector lagged US Treasuries in the first quarter with modestly negative excess returns3. While bank demand was more supportive and net issuance was lower than expected with housing supply tight, spreads widened modestly. Since discount coupons are trading to full extension, excess returns will be more volatile. We continue to find agency and non-agency RMBS securities attractively priced, as technicals are more supportive with higher interest rates and minimal supply of new mortgages.

Municipal Credit – Spreads tightened as supply remains tight; AAM sees little value in this sector

The tax-exempt market has historically exhibited very strong performance over the first couple of months of the year, driven in large part by seasonally-driven positive technicals. Case in point this year, relative valuations are now very close to the most expensive levels in their history. Expected technicals in the market currently support relative valuations based on projections for new issue supply and redemptions/reinvestment flows for the year. However, there could be a surge in unexpected issuance that could impact the market in the form of increased call activity. For taxable munis that were issued in the low yield environment of 2020 and 2021, the current elevated rate levels have pushed those prices into deep discounts, and issuers are finding extremely compelling interest cost savings in buying back this discounted debt and refinancing it in the tax-exempt market4.

For more municipal sector details, please see Greg Bell’s latest market commentary.

1 Bloomberg (Citi Economic Surprise Index – Global)

2 Bloomberg Aggregate Index

3 Bloomberg Aggregate Index

4 The Bond Buyer, AAM, BEA

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.