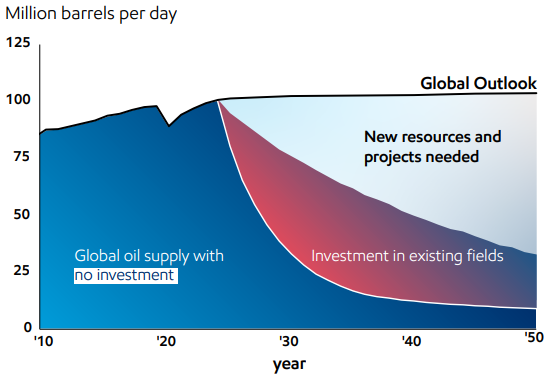

One of our favorite energy blogs, RBN Energy, posted some startling information last week that caught our attention. It was that Electric vehicle (battery electric and plug-in hybrid) sales in China made up more than 50% of the total vehicle sales in August. This is up from just 7% in 20201! As a result, gasoline consumption in China is now expected to plateau at 4 million barrels per day over the next year and then gradually decline throughout the rest of the decade according to JP Morgan. Meanwhile, total oil demand in China is expected to plateau at 17 million barrels per day in 2026 and remain at that level through the end of the decade. This is a secular moment in the oil market as increased Chinese demand accounted for approximately 50% of total crude oil consumption growth since 2004 (Figure 1). If China is not the positive catalyst for oil demand as it has been for the past two decades, should we be concerned that oil prices will decline?

Figure 1: Cumulative Crude Oil Demand Growth since 2002

While oil prices will always fluctuate with different economic conditions and geopolitical concerns, we believe the long-term fundamentals remain sound and supportive of prices above $65 per barrel. Our view is based on three items: demographics, depleting resources and the marginal cost of supply.

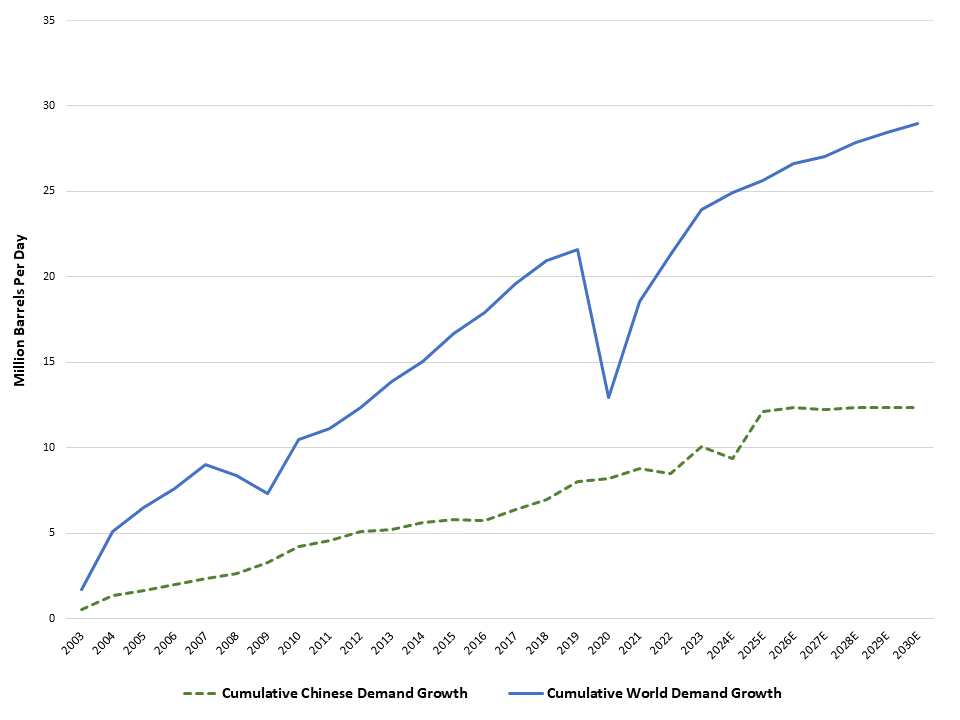

The demographic part of the equation is pretty straightforward – worldwide population is growing, particularly in countries that are likely to increase their energy per capita in the coming years. According to the United Nations, the worldwide population is currently about 8 billion people and is expected to grow by nearly 1 billion people within the next 10 years. Moreover, the majority of that population growth is expected to come from non-OECD (Organization for Economic Co-operation and Development) countries, where energy per capita is low relative to OECD countries such as the U.S. and Germany. We expect those countries to seek economic prosperity and better living standards, which means more oil consumption (Figure 2). India in particular, with its large and growing population is expected to see oil consumption growth of more than 3 million barrels per day by 2035.

Figure 2

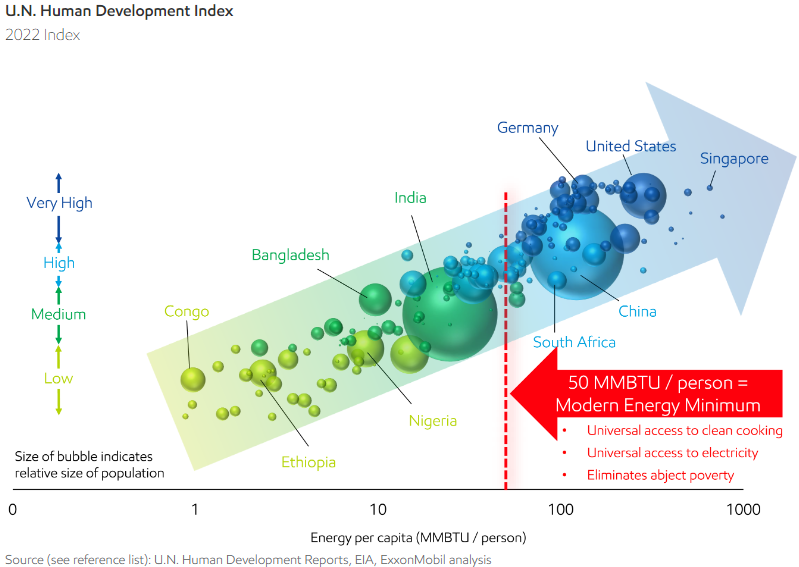

The depleting characteristics of crude oil fields is also supportive of oil prices. As oil fields age, they produce less oil, which is known as a decline curve. The International Energy Agency and others have long believed the decline curve was about 8% per year – meaning that a field producing 100,000 barrels per day at time zero, would produce 92,000 barrels per day one year later if no resources were devoted to that field. However, as more oil is coming from unconventional shale sources, companies like ExxonMobil are stating that its decline rate is closer to 15%. In a world supplying about 100 million barrels of oil per day, this means that with no new investment, global oil supplies would fall by 15 million barrels per day in the first year alone (Figure 3). Moreover, OPEC suggests that investment requirement to offset that decline curve and a modest amount of growth by 2050 will require $17.4 trillion (or about $700 billion per year). Industry is currently spending about 40% below that level. Ultimately, this should be supportive of oil prices.

Figure 3

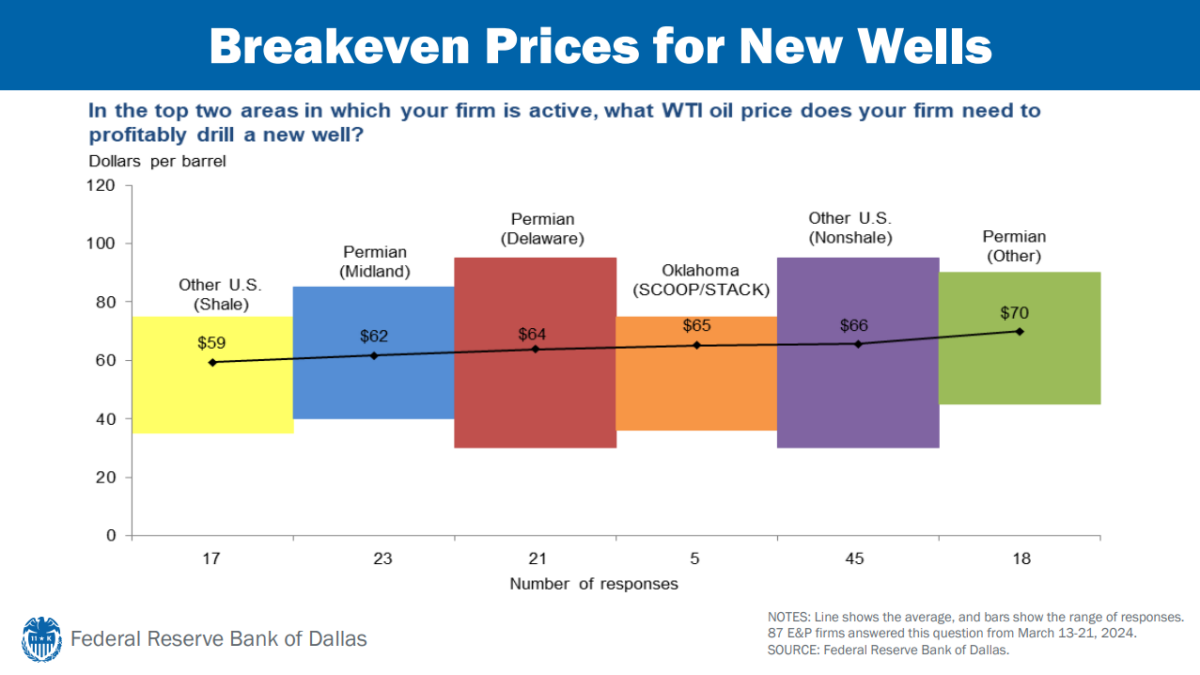

Finally, we believe that the first region to reduce its production in the face of weaker oil prices will be the highest cost shale producers in the U.S. The rationale is that these shale wells are short cycle – that is shale wells have shorter lead times between drilling and production relative to more conventional drilling in the Middle East or South America. Based on a survey of 87 firms conducted by the Federal Reserve Bank of Dallas, the breakeven price for new wells in the U.S. is between $59 per barrel and $70 per barrel (Figure 4). Below these prices, the oil companies are not earning a return on its new wells and would reduce drilling new wells within a quarter. Shortly thereafter, we would expect to see reduced supply from Oklahoma and North Dakota, regions that collectively produce about 2 million barrels per day.

The rapid adoption of electric vehicles is ending the two-decade expansion of gasoline consumption in China. However, we still believe fundamentals are supportive of $65 oil. The population continues to grow and is likely to consume more per capita over the next decade, which is positive for demand. Supply growth in the intermediate term will be challenging due to higher decline curves than historically experienced. Finally, the cost of the marginal supplier is in the mid-$60’s, which should sustain prices.

Figure 4

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.