insight

Utility Bill Inflation is Back: Balancing Growth, Reliability and Affordability in the AI Era

September 2, 2025

Download PDFIntroduction

While the AI boom has generally been a positive development for the utility industry, its insatiable appetite for power is not only driving unprecedented capital spending but also putting upward pressure on electricity prices. Rising monthly utility bills have caught the attention of consumers and are increasingly at the forefront of the minds of political leaders and regulators. According to CPI data released by the Bureau of Labor Statistics, the index for electricity prices increased 5.5% over the 12-month period ending in July 2025. This compares to a 2.7% increase for the all-items index. The utility industry has always been a balancing act between the often-competing objectives of growth, reliability, and affordability. The emerging strain on affordability is a trend worth watching.

Electricity Demand

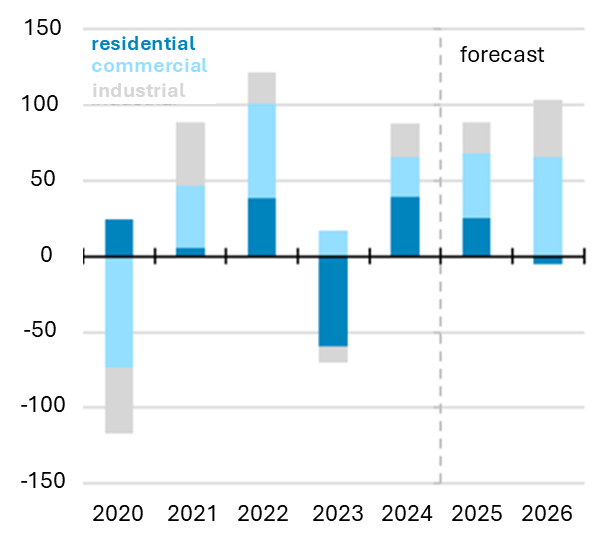

The utility industry is witnessing demand growth that hasn’t been seen in well over a decade. According to Energy Information Administration (EIA) data1, total electricity consumption increased 2.3% in 2024 and is projected to increase 2.2% in 2025 and 2.4% in 2026. This compares to relatively flat demand over the 15-year period prior to 2024. The increase is being led primarily by data centers, but also by electrification and reshoring-related manufacturing growth. Electricity sales to commercial customers, which includes data centers, are projected to rise 3.0% in 2025 and a further 4.5% in 2026. Electricity sales to industrial consumers are forecast to rise by 2.0% in 2025 and 3.5% in 2026. Residential electricity sales are forecast to rise more slowly at 1.7% overall in 2025, primarily because of cold weather at the beginning of the year. Electricity sales to the residential sector are expected to decline by 0.4% in 2026 as weather conditions normalize. The varying growth rates among sectors is expected to result in an interesting historical twist as electricity sales in the commercial sector are expected to surpass those in the residential sector in 2026, a first since the EIA started collecting the data.

Figure 1: Annual Change in U.S. Electricty Sales to Ultimate Customers

Billion kilowatthours (kWh)

Electricity Prices

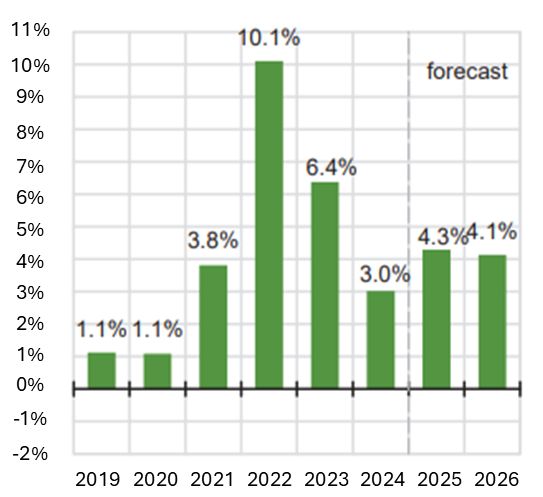

This demand surge is now exerting noticeable pressure on electricity prices. Based on EIA data1, residential electricity price inflation spiked in 2022 due to the pass-through of high natural gas prices, but then trended lower over the next two years. This declining trend has reversed course, and electricity prices are now expected to increase 4.3% this year. The recent volatility in electricity prices stands in sharp contrast to the years preceding the pandemic, which generally saw electricity price inflation at or below the overall inflation rate. Figure 2 illustrates this post-pandemic volatility in electricity prices.

Figure 2: Annual Growth in Nominal Residential Electricity Prices

PJM Case Study

PJM Interconnection (PJM), the largest Regional Transmission Organization (RTO) in the US, provides a valuable case study in the AI-related quest for power. As an RTO, PJM coordinates the movement of wholesale electricity and ensures grid reliability for more than 67 million people. PJM’s territory spreads across thirteen states, from Illinois to the East Coast, and includes the world’s largest data center cluster in Northern Virginia, as well as data center hotspots in Ohio, New Jersey, and Illinois.

In July, PJM announced the clearing price from its most recent capacity auction. Capacity auctions set payments to owners of generation facilities as an incentive to build new capacity or keep existing capacity in operation. These payments are instrumental in maintaining system reliability and are in addition to the revenue earned from the actual generation of electricity. The most recent auction, for the 2026/2027 planning year, hit the price cap of $329.17/MW-day. If it weren’t for the cap, the price would likely have been closer to $389/MW-day. The new level compares to $269.92/MW-day from last year’s auction and a low of $28.92/MW-day two years ago. Under the new auction price, annual capacity payments will total $16.1billion and result in bill increases of 1.5% to 5%, according to PJM.

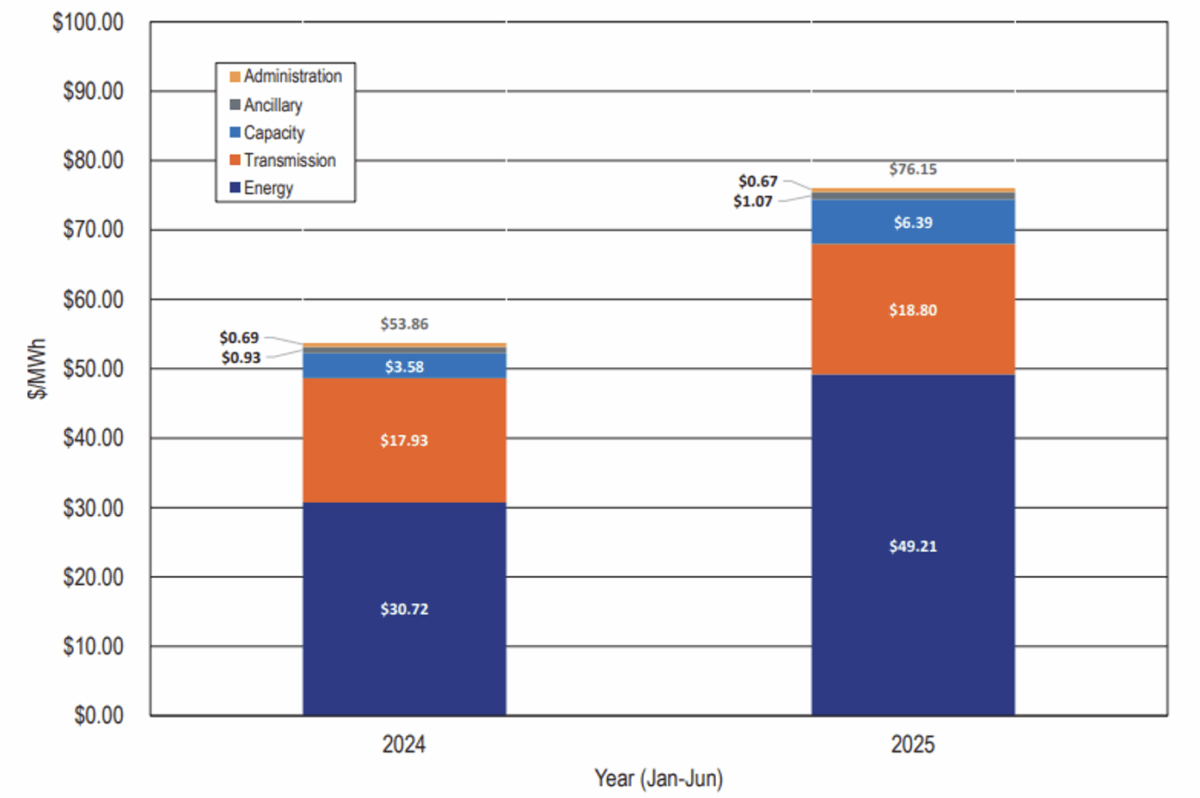

Capacity payments are just one component of the overall wholesale cost of electricity in PJM. The larger components are the actual production and transmission of electricity, both of which are also increasing at a rapid rate. Over the first six months of 2025, energy accounted for 64.6% of the overall wholesale cost while transmission accounted for 24.7% and capacity accounted for 8.4%2. While capacity payments appear relatively small, it is important to note that the planning year for PJM begins in June and the higher prices from the previous two capacity auctions are just now taking effect.

Figure 3: Total Wholesale Cost per MWh by Category

Conclusion

The AI boom continues to present both opportunities and challenges for the electric utility industry. After more than a decade of minimal growth, the industry is experiencing a new era of robust demand. While this is an overall positive development, it’s not without some drawbacks. Fortunately, the situation has not gone unnoticed by regulatory bodies, and we are seeing the development of proactive laws and regulations in multiple jurisdictions across the country. These jurisdictions are generally welcoming economic development associated with data center growth, while simultaneously seeking ways to put guardrails around this growth to protect the average utility customer. Despite these efforts, the utility capex boom is expected to continue putting upward pressure on monthly residential utility bills. There remains a tricky balancing act between economic development, reliability, and affordability.

1 U.S. Energy Information Administration, Short-Term Energy Outlook, August 2025

2 Monitoring Analytics, LLC, State of the Market Report for PJM, August 2025

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.