insight

Where Risk Meets Reward: Exploring the Efficient Frontier for Insurance Companies

July 7, 2025

Download PDF“Every investor needs to understand where they are on the efficient frontier — and more importantly, whether their current portfolio actually belongs there.”

— Roger G. Ibbotson

Insurance companies face unique challenges in asset allocation due to their liability-driven investment objectives, regulatory constraints, and the critical need to manage surplus volatility. Traditional investment strategies often emphasize conservative, low-volatility assets, but recent volatility in interest rates, inflation, and capital markets has challenged these assumptions. As a result, insurers are seeking more sophisticated approaches to optimize their portfolios. This paper explores efficient frontier modeling to enhance portfolio construction for insurers.

Modern portfolio theory is based on the efficient frontier, which was first proposed by Nobel Laureate Harry Markowitz in 1952. It determines the set of ideal investment portfolios that balance risk and return. Portfolios that offer the lowest risk for a given expected return or the highest expected return for a given level of risk are considered. Plotting predicted returns (y-axis) against risk (x-axis) graphically results in a curved line. Portfolios below this curve are considered sub-optimal because they give either too much risk for their return or too little return for their risk level. The curvature arises from diminishing marginal return to risk, where each incremental risk unit yields progressively smaller return gains. Portfolios on the frontier achieve efficiency through diversification, which reduces overall risk by combining assets with low covariance, ensuring no other portfolio can surpass their risk-return profile. This framework can enable investors to align portfolio construction with their risk tolerance while maximizing potential returns.

Because insurers differ widely in their internal investment expertise and may lack a clear view of their risk tolerance or return objectives in isolation, we’ve found that starting with their current asset allocation, or if funding a portfolio with cash – a preliminary asset allocation, is often the most effective way to frame the conversation. By integrating both industry benchmarks and insurer-specific financial characteristics, the preliminary allocation serves as a starting point for exploring investment risk and return tradeoffs.

After inputting the current or sample allocation into the model, an efficient frontier is constructed by applying incremental variations to a selected optimization factor. These factors may include a return target, expected yield, risk based capital level, surplus downside limit, etc. The model can also be customized to company specific limitations. For example, the insurance company’s state of domicile may have statutory limits on specific assets classes. These can be incorporated into the parameters of the model so the resulting asset allocations are investable for the insurance company.

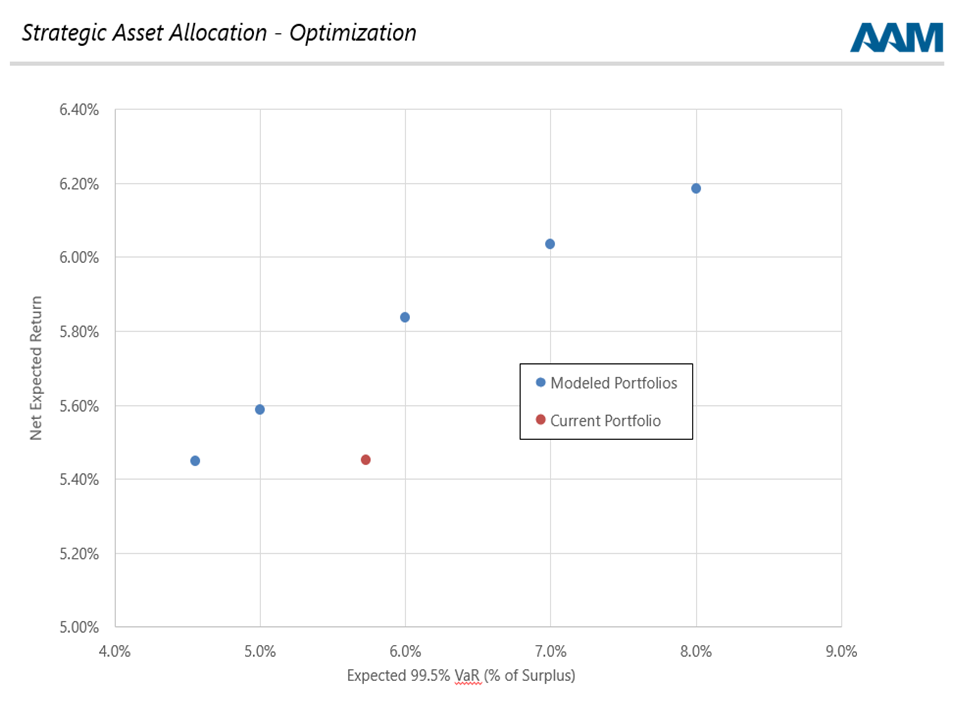

Once the results are generated, comparisons can be made based on the asset allocations of the current portfolio versus the modeled results. The model uses a 99.5% Value-at-Risk (VaR) relative to surplus as the investment risk measure for asset allocation, indicating the potential loss of statutory surplus in a 1-in-200 market value decline. This type of downside event would be equivalent to the market movements during the 2008 Global Financial Crisis or the COVID Crash in March of 2020. In the example below (Exhibit 1), a modeled portfolio with the same expected return can be created with approximately 33% less surplus volatility. Alternatively, a portfolio on the efficient frontier with the same surplus volatility could produce an expected return 35 basis points higher. The output from the model allows an insurance company to easily determine the trade-offs for different portfolio allocations.

Exhibit 1

Source: AAM Asset Allocation Model. Asset assumptions as of 5/5/2025. Results shown are deemed hypothetical, not guaranteed, and are not the result of actual trading. Hypothetical portfolio characteristics are based on a variety of factors and assumptions. Please see Hypothetical Performance Disclosures at the end of the page for important additional details, including definitions of underlying indexes. Expected returns and volatilities derives from current yield of indices, historical index returns, index volatilities, and correlations on indexes corresponding to each asset class. Expected net returns reflect the deduction of expected fees. There is no guarantee the above results will be achieved. Investing involves many risks, including the possibility of losses. The efficient frontier is not based on an actual account. Past performance is not indicative of future results.

There are several benefits of using an efficient frontier model to analyze an insurance company’s portfolio allocation. A model provides a systematic, quantitative framework for balancing risk and return. It encourages diversification, which is especially valuable for insurers managing large, multi-asset portfolios. Models can also be tailored to include insurance-specific constraints and objectives.

While an efficient frontier model is a useful tool, as with any model, there are limitations. Models rely on accurate estimation of returns, risks, and correlations, which may change over time. They assume normal distribution of returns and rational investor behavior, which may not always hold in practice.They do not directly account for extreme events or tail risks unless extended with additional modeling.

In an increasingly complex and volatile investment environment, insurance companies must go beyond traditional asset allocation strategies to remain competitive and financially resilient. Efficient frontier modeling offers a disciplined, data-driven approach to portfolio construction that aligns with insurers’ unique objectives and constraints. By quantifying the trade-offs between risk and return, and incorporating regulatory, surplus, and yield considerations, this methodology can enable insurers to make more informed, strategic decisions. While no model is without limitations, incorporating efficient frontier analysis into the investment process enhances transparency, fosters deeper understanding of portfolio dynamics, and supports performance-oriented outcomes. In financial markets where risk and reward are constantly shifting, leveraging this framework helps insurers navigate uncertainty with greater confidence.

Hypothetical Performance Disclosures

Expected returns, volatilities, and correlations on modeled portfolios are derived from current yields, historical returns, volatilities, and correlations on indexes corresponding to each asset class, are net of expected fees (including 3rd party and ETF fees where applicable), and include reinvestment of interest and dividends.

Indexes corresponding to the indicated asset classes are as follows:

- IG Bonds – Int Duration / Bloomberg Intermediate Aggregate. This is a broad-based flagship benchmark consisting of investment grade, USD-denominated fixed-rate taxable bonds with maturities <10yrs

- IG Bonds / Bloomberg Aggregate. This is a broad-based flagship benchmark consisting of investment grade, USD-denominated fixed-rate taxable bonds

- Convertible Bonds / Zazove IIG Composite. This is a composite of managed USD-denominated convertible bond portfolios with an objective of achieving equity-like returns over a full market cycle with lower downside volatility. The portfolios can invest in BB3 or better securities while maintaining an overall weighted averaged credit quality of BBB3 or better

- Equity – Domestic / Russell 3000. This is composed of 3000 large US companies, by market cap, representing approximately 98% of the investable US equity market

- Equity – EAFE / MSCI EAFE. This is a free-float-weighted equity index covering issuers in non-US developed markets in Europe, Australasia, Israel, and the Far East

- Equity – Emerging Market / MSCI Emerging Market. This is a free-float-weighted equity index covering large- and mid-cap issuers across emerging markets. It represents approximately 85% of investable equities in each country

- HY Bonds – ICE BofA BB-B US Cash Pay Constrained Index. This includes US high yield corporate fixed income securities rated BB1 – B3 based on an average Moody’s, S&P, and Fitch, with a maximum of 2% exposure to any single issuer

- Bank Loans / Credit Suisse Leveraged Loan. This index represents tradable, USD-denominated senior secured non-investment-grade loans

- These indexes may not be available in the future and cannot be directly invested in. Actual client portfolios do not invest directly in indexes and therefore may have different results than those shown

Expected returns are hypothetical 5yr annualized future projections commencing at the indicated “asset data as of date” using the asset weightings shown, and do not reflect the performance of any actual portfolio. They have been reduced by investment management fees. Actual results may vary from projections and there is no guarantee the indicated returns will be achieved. Investing involves many risks, including the possibility of losses. Past performance is not an indicator of future results. Hypothetical performance does not reflect investment decisions made in real time or the effects that actual trading, market or economic conditions would have on the investment decision making process. It is important to note that the expected performance shown demonstrates how a portfolio may perform in the future. There are frequently sharp differences between hypothetical performance projections and the actual results subsequently realized. Hypothetical performance projections are presented for illustrative purposes only

Expected yields represent weighted average annualized expected periodic receipt of contractual principal and interest, and expected amortization of purchase premium/discount from the indicated “asset data as of” date over the life of the underlying securities. Expected yield does not reflect potential for market value fluctuation. Actual results may vary.

99.5% VaR metric is the projected investment return in scenario approximately 2.58 standard deviations below expected mean return. Actual results may vary.

AAM Risk Score is a composite measure of enterprise risks, incorporating percentiles of 5yr Avg Combined Ratio, Standard Deviation of 5yr Combined Ration, NPW / Avg Surplus, and Invested Assets / Surplus relative to the indicated peer group on an equal-weighted basis and normed to a 0-100 scale (100 indicates highest enterprise risk).

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Any opinions and statements contained herein of financial market trends based on market conditions constitute our judgment. This material may contain projections or other forward-looking statements regarding future events, targets or expectations, and is only current as of the date indicated. There is no assurance that such events or targets will be achieved, and may be significantly different than that discussed here. The information presented, including any statements concerning financial market trends, is based on current market conditions, which will fluctuate and may be superseded by subsequent market events or for other reasons. Although the assumptions underlying the forward-looking statements that may be contained herein are believed to be reasonable they can be affected by inaccurate assumptions or by known or unknown risks and uncertainties. AAM assumes no duty to provide updates to any analysis contained herein. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.