NAIC Update

This memo summarizes the key investment accounting updates from the NAIC and FASB, which may impact insurance companies. These updates should be taken into consideration when preparing the 2013 annual statement.

Risk-Based Capital (RBC) – Life

The RBC formula for commercial mortgages in good standing has been updated and the Mortgage Experience Adjustment Factor (MEAF) has been eliminated. The new calculation involves segregating loans into different risk cohorts based on their debt service coverage (DSC) and loan-to-value (LTV) and each risk cohort has a specific RBC charge. Insurers with high quality loan portfolios can expect a reduction in their related RBC as a result of the updated calculation. See below for the categorizations and factors:

Office, Industrial, Retail and Multi Family Loan-to-Value

| Loan-to-Value | |||||||

| Debt Service Coverage | <55% | 55% | 75% | 85% | 100% | 105% | >105% |

| <0.95 | CM2 | CM3 | CM3 | CM4 | CM4 | CM5 | CM5 |

| 0.95 | CM2 | CM2 | CM3 | CM3 | CM4 | CM4 | CM4 |

| 1.15 | CM2 | CM2 | CM2 | CM2 | CM3 | CM3 | CM3 |

| 1.50 | CM1 | CM1 | CM1 | CM2 | CM3 | CM3 | CM3 |

| 1.75 | CM1 | CM1 | CM1 | CM2 | CM2 | CM2 | CM2 |

| >1.75 | CM1 | CM1 | CM1 | CM2 | CM2 | CM2 | CM2 |

Source: NAIC

Hotels and Specialty Commercial

| Loan-to-Value | |||||||

| Debt Service Coverage | <60% | 60% | 70% | 80% | 90% | 115% | >115% |

| <0.90 | CM4 | CM4 | CM4 | CM4 | CM5 | CM5 | CM5 |

| 0.90 | CM3 | CM3 | CM3 | CM4 | CM3 | CM3 | CM3 |

| 1.10 | CM3 | CM3 | CM3 | CM4 | CM4 | CM4 | CM4 |

| 1.45 | CM2 | CM2 | CM3 | CM3 | CM3 | CM3 | CM3 |

| 1.85 | CM1 | CM2 | CM2 | CM2 | CM2 | CM3 | CM3 |

| >1.85 | CM1 | CM2 | CM2 | CM2 | CM2 | CM3 | CM3 |

Source: NAIC

| Risk Cohort | Factor |

| CM1 | 0.009 |

| CM2 | 0.0175 |

| CM3 | 0.0300 |

| CM4 | 0.0500 |

| CM5 | 0.0750 |

Source: NAIC

It is also important to note that the updated RBC instructions require insurers to maintain specific information (49 different data elements) about each loan. Each of the required data elements are described in detail in the Life RBC instructions.

Annual/Quarterly Filings

Asset Valuation Reserve (AVR) (2013-19BWG)

Mortgage Loan factors associated with the Default Component and the Equity and Other Invested Asset Component have been updated. These changes were a response to the removal of the Mortgage Experience Adjustment Factor. More changes are expected in 2014, which should make the AVR consistent with the 2013 Life RBC changes. The updated factors are noted below:

|

MORTGAGE LOANS |

Basic Contribution | Reserve Objective | Maximum Reserve |

| Farm Mortgages | 0.0035 | 0.0100 | 0.0130 |

| Commercial Mortgages – All Other | 0.0035 | 0.0100 | 0.0130 |

| In Good Standing with Restructured Terms | 0.0035 | 0.0100 | 0.0130 |

Schedule BA / AVR

Additional categories have been added to the Schedule BA and AVR:

- Working Capital Finance Investments – previously this asset class was considered non-admitted; see below for more information regarding SSAP 105 – Working Capital Finance Investments (2012-38BWG).

- Joint Ventures, Partnerships, and Limited Liability Companies with characteristics of Mortgage Loans (affiliated and unaffiliated) – this “characteristics of Mortgage Loans” subcategory was added so there would consistency with the securities classified as Fixed or Variable Interest Rate Investments that have Underlying Characteristics of Mortgage Loans (2013-02BWG).

- Guaranteed State Low Income Housing Tax Credit and Non-guaranteed State Low Income Housing Tax Credit – the State Low Income Housing Tax Credit category has been split into guaranteed and non-guaranteed. This change makes the reporting of the Federal Low Income Housing Tax Credits consistent with the State Low Income Housing Tax Credit (2012-34BWG). Investors will note a reduction in the AVR and RBC factors.

| 2013 AVR FACTORS | |||

| ALL OTHER INVESTMENTS | Basic Contribution | Reserve Objective | Maximum Reserve |

| Class 1 Working Capital Finance Investments | 0.0000 | 0.1000 | 0.1000 |

| Class 2 Working Capital Finance Investments | 0.0000 | 0.1250 | 0.1250 |

| INVESTMENTS WITH THE UNDERLYING CHARACTERISTICS OF MORTGAGE LOANS | |||

| Farm Mortgages | 0.0030 | 0.0100 | 0.0130 |

| Commercial Mortgages – All Other | 0.0030 | 0.0100 | 0.0130 |

| In Good Standing with Restructured Terms | 0.0030 | 0.0100 | 0.0130 |

| LOW INCOME HOUSING TAX CREDIT INVESTMENTS | |||

| Guaranteed State Low Income Housing Tax Credit | 0.0003 | 0.0006 | 0.0010 |

| Non-guaranteed State Low Income Housing Tax Credit | 0.0063 | 0.0120 | 0.0190 |

Schedule D

- Certain exchange traded funds (ETF’s) noted in the Purposes and Procedures Manual of the NAIC Securities Valuation Office can now be reported as preferred stock on the Schedule D Part 2 Section 2. Previously these ETF’s would have been reported as common stock and therefore had higher RBC and AVR charges (2013-01BWG).

- An additional Bond Characteristic (7) was added for Mandatory Convertible Securities (2013-01BWG).

- A new Foreign code was established “G” for securities issued in Canada that are denominated in U.S. dollars.

- A new electronic column has been added to all detail investment schedules to include Legal Entity Identifiers (LEIs). The LEI system is not fully operational; therefore some securities may not have a LEI. The reporting of LEI’s is only required if they are available (2012-30BWG)

- Additional Schedule D “Codes” have been established for Federal Home Loan Bank (FHLB) Capital Stock and securities pledged as collateral to FHLB. These codes are noted in the Investment Schedules General Instructions, within the Annual Statement Instructions (2013-23BWG).

Note 17C Wash Sales (2012-35BWG)

The illustrative footnote, which is electronically captured, was modified so that wash sales of unrated securities, preferred stock or securities other than bonds can be captured in the disclosure.

Note 5A Mortgage Loans (2013-14BWG)

An aging analysis of past due mortgage loans aggregated by type (Farm, Residential Insured, Residential All other, Commercial Insured, Commercial All Other, and Mezzanine) was added. Also, disclosures related to investments in impaired loans should be aggregated by type. The required format is presented in the instructions.

Note 5D Loan-backed and Structured Securities (SAPWG-2013-15)

The CUSIP level disclosure of other-than-temporary impairments (OTTI’s) has been clarified to only require the disclosure of OTTI’s that have been recorded in the current reporting period.

Note 21C / 5H Restricted Assets (2013-16BWG)

Disclosures related to Restricted Assets have been expanded and moved from Note 21 to Note 5. The expansion of the disclosure is primarily focused on investments in the Federal Home Loan Bank.

Statutory Accounting Guidance

SSAP No. 26 – Bonds, Excluding Loan-backed and Structured Securities (SAPWG 2013-01 and SAPWG 2013-21)

SSAP No. 26 has been updated to require mandatory convertible securities to be reported at the lower of fair value or amortized cost during the period prior to conversion. It is also important to note that the SVO is rating these securities as 6S; the “S” subscript is an indication of “other non-payment risk.” Prior to 2013 the NAIC Securities Valuation Office (SVO) had designated these securities as common stock.

Guidance has been added to SSAP No. 26 to clarify that make-whole call provisions should not be taken into account when calculating the effective yield and amortization under the required yield-to-worst method.

SSAP No. 43R – Loan-Backed and Structured Securities (SAPWG 2013-16)

Clarification has been added so that insurers are not required to purchase the prior year’s CMBS or RMBS modeling results for newly acquired securities. This will keep insurers from having to purchase stale modeled data for the purpose of preparing the quarterly filings.

SSAP No. 105 – Working Capital Finance Investments (SAPWG 2013-10)

This new SSAP was adopted at the NAIC Fall Meeting and is effective January 1, 2014. It allows Working Capital Finance Investments to be admitted assets if they meet the following conditions:

- The program is rated by the SVO.

- The maturity of supporting receivables cannot exceed one year.

- The program must provide an annual independent report on controls at a service organization related to or an annual audit of the internal controls of the consolidated group of which the finance agent is part, which does not note any material weaknesses related to servicing.

- The obligor must waive defenses to payment and confirm the amount and a due date.

NAIC Securities Valuation Office

Egan Jones has been added to the list of Credit Rating Providers. Its ratings can therefore be used when determining filing exempt NAIC designations.

At the Fall NAIC meeting, the Valuation of Securities Task force resolved that the new Structured Agency Credit Risk (STACR) security, issued by Freddie Mac falls under the scope of SSAP No. 26 – Bonds, Excluding Loan-backed and Structured Securities and needs to be filed with the SVO. The December 31, 2013 Purposes and Procedures Manual of the NAIC Securities Valuation Office will note that it is not filing exempt.

FASB Update

On May 26, 2010, the Financial Accounting Standards Board (FASB) issued a proposed Accounting Standards Update (ASU) related to Financial Instruments (Accounting for Financial Instruments and Revisions to the Accounting for Derivative Instruments and Hedging Activities). Since then, the FASB has been obtaining comments from U.S. stakeholders and working with the International Accounting Standards Board (IASB) to achieve convergence with IFRS 9 – Financial Instruments. The FASB has grouped this project into three topics: (1) Classification and Measurement, (2) Credit Impairment and (3) Hedge Accounting. Below are status updates for each of these topics at year-end 2013:

Classification and Measurement – Final document is expected for the first half of 2014

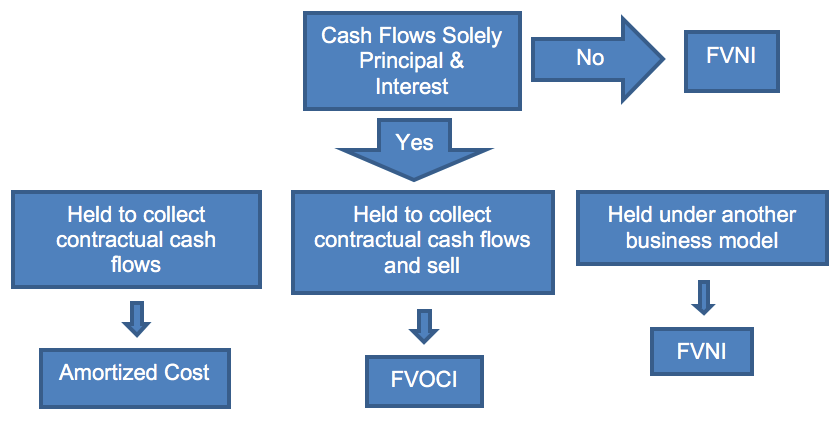

On February 14, 2013 FASB issued the proposed Accounting Standards Update, Financial Instruments – Overall (Subtopic 825-10) – Recognition and Measurement of Financial Assets and Financial Liabilities. The proposal included a “solely payment of principal and interest” (SPPI) model. Under the proposed ASU, one should first consider the characteristics of the cash flows associated with the financial instrument. An instrument can be classified as FV-OCI or Amortized Cost if the expected contractual cash flows relate solely to the receipt of principal and interest on the principal amount outstanding. If the instrument does not meet this test, it must be classified as FV-NI.

On December 18, 2013, the FASB tentatively decided to no longer move forward with their SPPI model. Further, the FASB decided to retain current guidance related to the bifurcation of embedded derivatives. Under this tentative decision, reporting entities can continue to bifurcate the embedded options within convertible securities and account for them as “trading” (fair value through net income), leaving the bond component to be classified as available-for-sale (fair value through other comprehensive income).

Credit Impairment – Final document is expected for the first half of 2014

On December 20, 2012 the FASB issued a proposed Accounting Standards Update, Financial Instruments – Credit Losses. The proposal requires reporting entities to establish an allowance for credit losses that are expected to be incurred over the lifetime of the assets. At each reporting period, the allowance should represent Management’s current estimate of the expected credit losses. The movement in this allowance would be recognized in income. Therefore, this model allows for an immediate “reversal” of credit losses recognized on assets that have an improvement in expected cash flows.

The proposed ASU also changes the way interest income is recognized on securities where the entity does not expect to receive substantially all the principal or substantially all of the interest.

If it is not probable that substantially all of the principal will be received, the entity should stop recognizing interest; all cash receipts should be applied to the carrying value of the security until it reaches zero. Any additional cash received should be applied to the allowance, thereby causing the recognition of income.

If it probable that substantially all of the principal will be received, but not substantially all of the interest. The entity can only recognize interest income as the related cash payments are received.

The proposed ASU also notes that an allowance for expected credit losses shall be established upon the acquisition of a purchased credit-impaired asset

Hedge Accounting

The FASB obtained comments in April 2011, but has not begun the re-deliberations.

Written by:

Joe Borgmann, CPA

Director of Investment Accounting

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.