Second quarter earnings season is coming to a close with over 90% of firms having reported results. Overall, the quarter was better than expected from an earnings standpoint while sales came in within expectations. As Table 1 reflects, Health Care, Financials and Technology reported better than expected sales and earnings growth while sales growth was slower than expected in other sectors that lag in a recession.

| Table 1 | ||

| Positive Surprise/ Negative Surprise (x) | Sales | Earnings |

| All Securities | 1.0 | 2.0 |

| Utilities | 0.4 | 1.9 |

| Materials | 0.4 | 1.7 |

| Industrials | 0.4 | 1.9 |

| Consumer Staples | 0.6 | 3.2 |

| Telecom Services | 0.6 | 2.2 |

| Energy | 0.6 | 1.2 |

| Consumer Discretionary | 0.8 | 2.2 |

| Health Care | 1.4 | 2.3 |

| Financials | 1.9 | 1.7 |

| Information Technology | 1.9 | 2.9 |

| Source: Bloomberg |

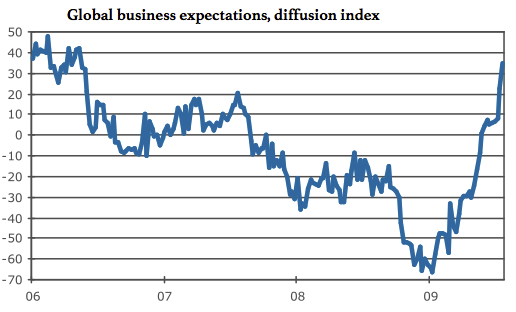

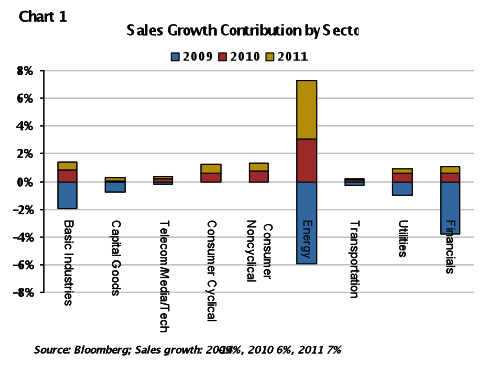

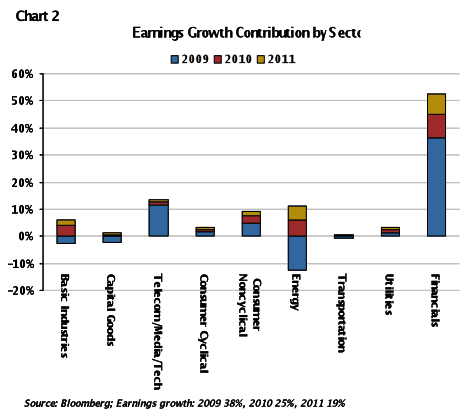

We expect sales growth to improve next year, as the domestic economy benefits from the Federal stimulus, business investment, and overseas demand and growth (namely Asia and Brazil). Firms will benefit from the operating leverage when sales return, driving earnings growth. This is consistent with a more traditional recession and recovery (i.e., “business led” where inventories are found to be bloated and then worked down). Based on the U.S. government’s actions thus far, we believe the transition to the consumer will be gradual but this certainly is a risk considering the mounting deficit.

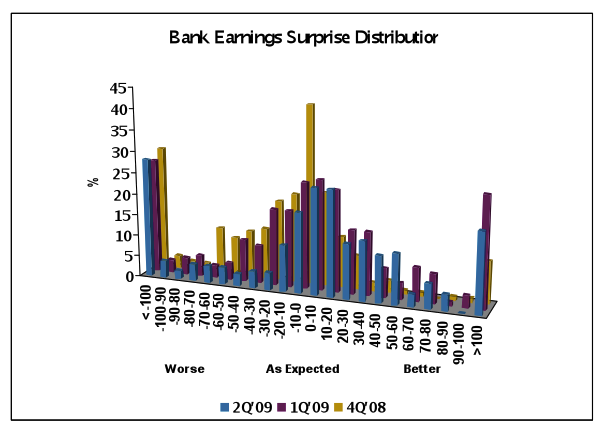

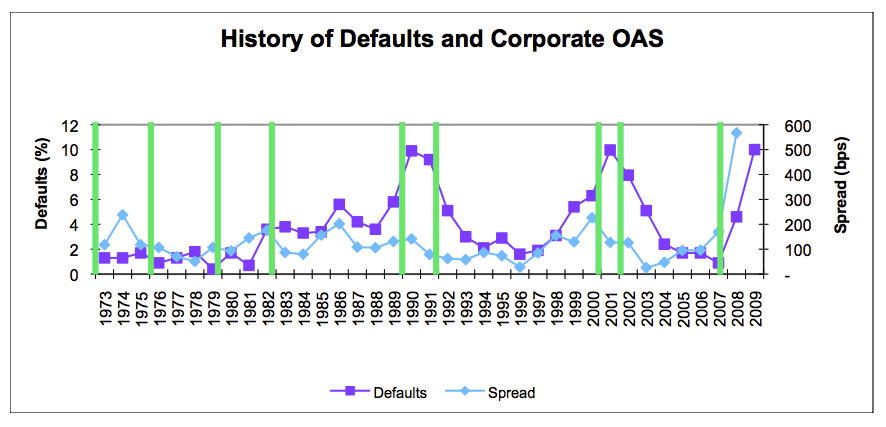

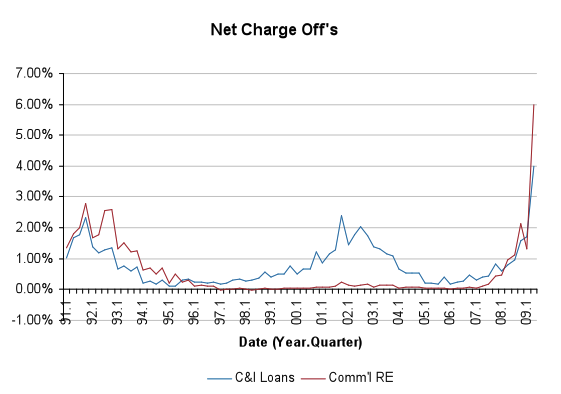

As reflected in the charts on the following page, it is evident that growth stems from the improvement in the Financial sector and cyclical sectors, namely Energy and Metals. While AAM’s sales and earnings estimates are slightly lower than the equity analyst estimates aggregated on Bloomberg (especially for banks and REITs), we remain constructive on Investment Grade Corporate bonds because we understand that spreads will remain firm and/or tighten in an environment of low growth. The key for fixed income investors is measuring downside risk – rating risk and default risk at the extreme. Earlier this year, that was very difficult given the government and economic related uncertainties, causing many analysts to assume the worst. Today, after benefiting from government related programs and actions, we are in a position to dismiss the worst case (depression, bank nationalization) and look forward. We believe consolidation will be critical in all sectors, as consumer leverage will not return and drive the growth it once did. Therefore, we remain committed to investing in companies that are market leaders and sectors like Energy that will benefit from the resumption of global growth.

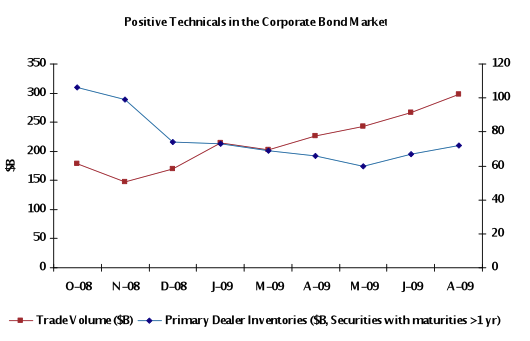

August was another positive month for excess returns (76 bps) with the Barclays Corporate Index OAS tightening 16 basis points. We do not expect issuance to be as strong in the second half of 2009, and new issue concessions have reverted to nominal amounts. For the remainder of the year, we expect excess returns to be driven by spread compression (e.g., Financials remain wide relative to Industrials) and carry more so than wholesale spread tightening. We remain constructive on the market and continue to believe that being overweight the benchmark Index, taking a very selective approach to credit and industry selection is the right strategy for outperformance.

This information is developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as ‘AAM’), and their respective officers and employees. Any opinions and/or recommendations expressed are subject to change without notice.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient.