[toc]

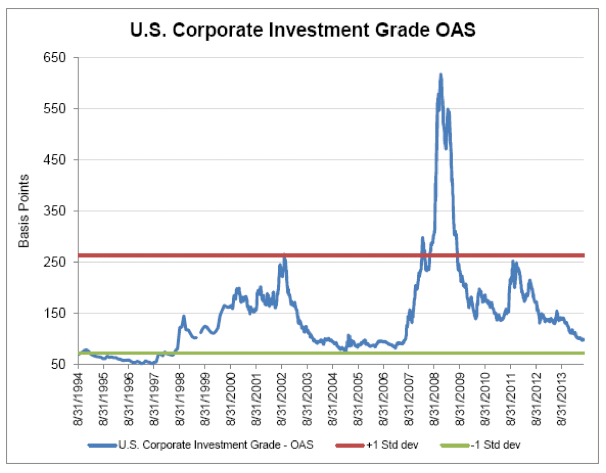

Volatility increased this quarter with investment grade credit spreads widening 16 basis points versus Treasuries in the second quarter. The main drivers of this widening included Greece, China, and increased merger and acquisition (M&A) activity. M&A activity in the second quarter was the highest in twelve years. We highlighted all of these issues in last quarter’s newsletter (The Top Five Issues That Will Affect Corporate Credit Spreads Today).

This quarter, we discuss the deterioration in investment grade credit fundamentals and what that means for investors when growth contracts and default risk increases. We believe this will become a critical issue over the near-to-medium term.

Credit Quality Deterioration

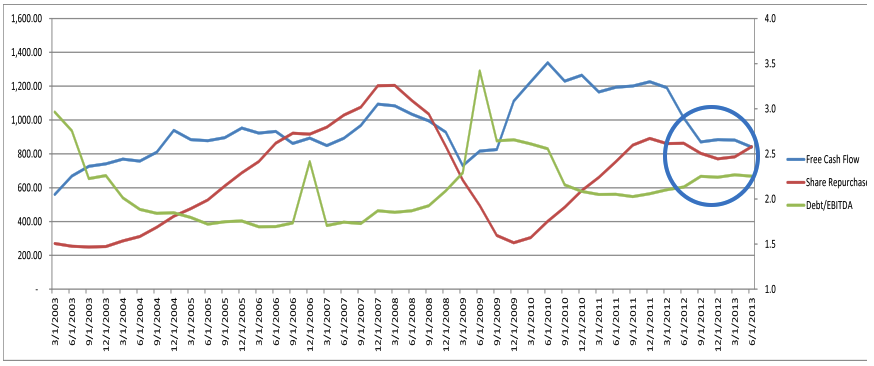

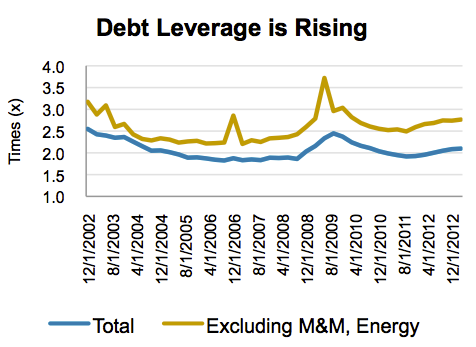

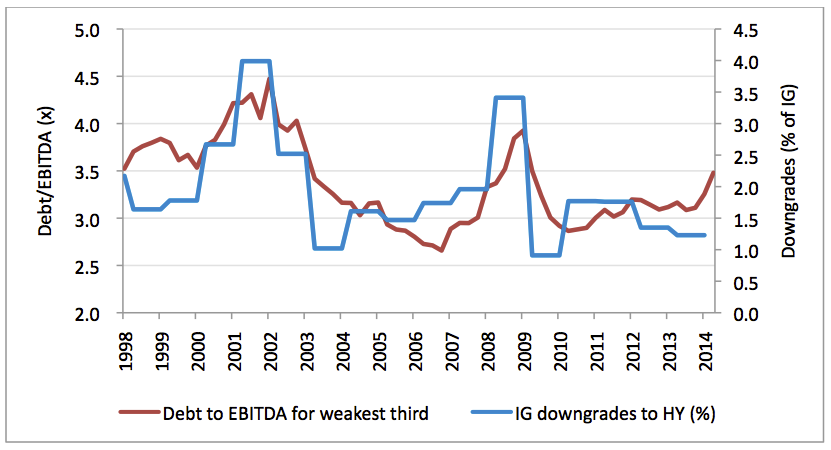

We have witnessed a marked decline in credit quality since mid-year 2014, as commodity prices have declined and debt has increased to fund shareholder returns and M&A. When measuring the debt/EBITDA leverage of about 400 nonfinancial, nonutility investment grade credits and isolating the bottom third each quarter (defined as those with the highest debt leverage), leverage is approaching 4x, which is quite high considering the economy is still expanding. As seen in Exhibit 1, leverage has increased when the economy contracts, resulting in increased downgrades to high yield. While the rating agencies claim to assign ratings that reflect performance through an economic cycle, this has not generally proven to be the case.

Exhibit 1: Rating Downgrades to High Yield Expected to Increase

Sources: Leverage – AAM (Includes over 400 nonutility and nonfinancial companies); Downgrades – S&P 2014 “Annual Global Corporate Default Study and Rating Transitions,” Diane Vazza, April 30, 2015

Ratings Risk and Defaults

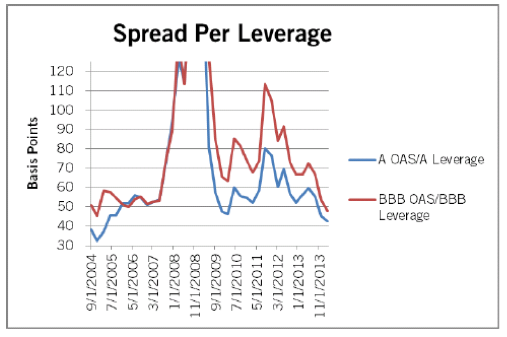

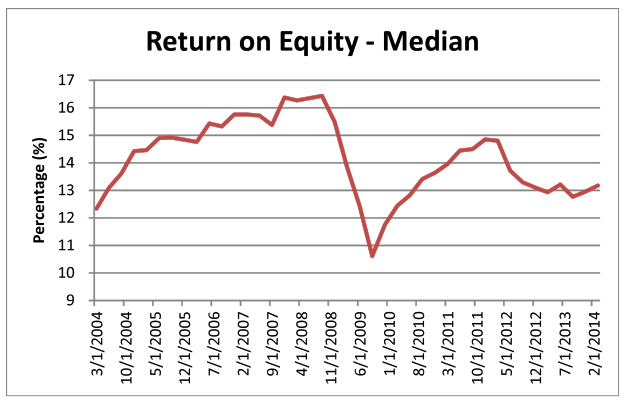

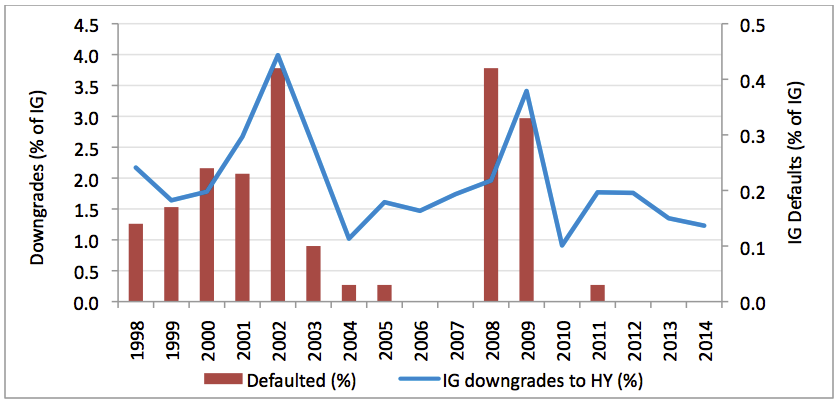

Simply, leverage is increasing and we expect rating actions to follow. As one would expect, increased leverage has been positively correlated with the percentage of investment grade companies that have defaulted, as shown in Exhibit 2.

Exhibit 2: Investment Grade Defaults Increase as Ratings Migrate Lower

Source: Standard & Poor’s 2014 “Annual Global Corporate Default Study And Rating Transitions,” Diane Vazza, April 30, 2015

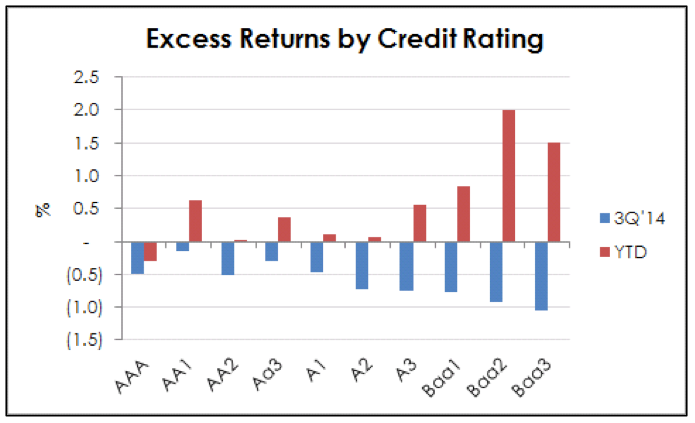

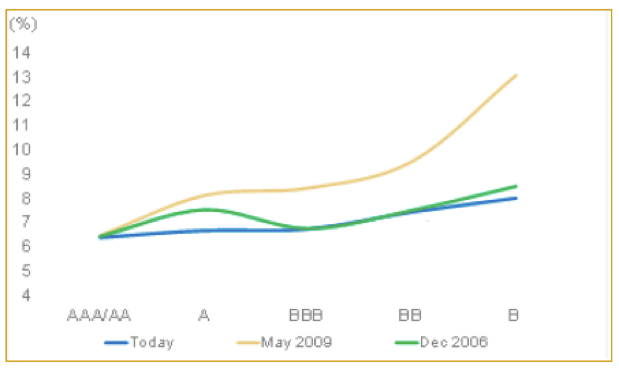

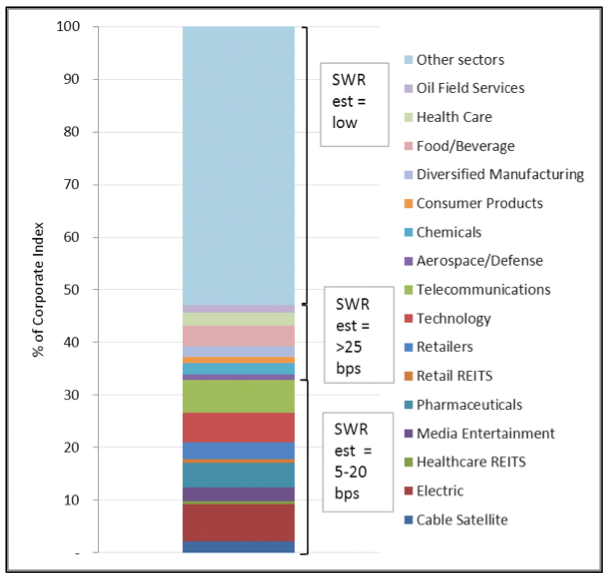

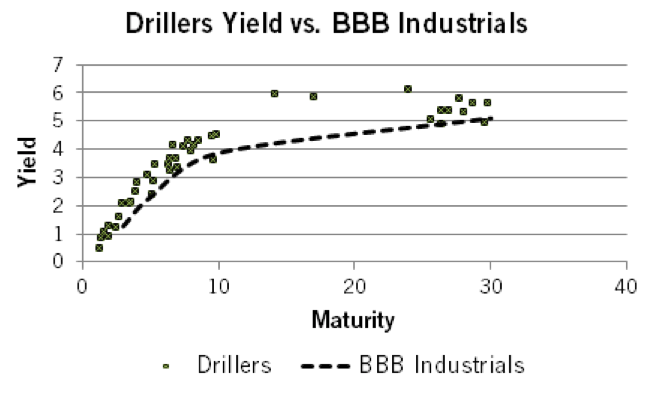

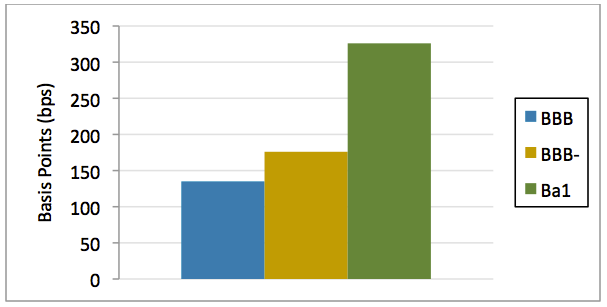

The first question to ask is “are investors getting paid for the risk?” Our answer is “no,” we do not believe investors in low investment grade rated securities are being appropriately compensated. As Exhibit 3 shows, a one notch downgrade into high yield should result in a one percentage point increase in spread versus Treasuries. That has a material impact on the pricing of that security, and the default risk increases as well.

Exhibit 3: Rating Risk is Not Reflected in BBB- Securities

Source: AAM using five year maturities for BBB and BBB- rated securities; Barclays OAS for Ba1 rated securities with a duration of 4.8.

Market Liquidity

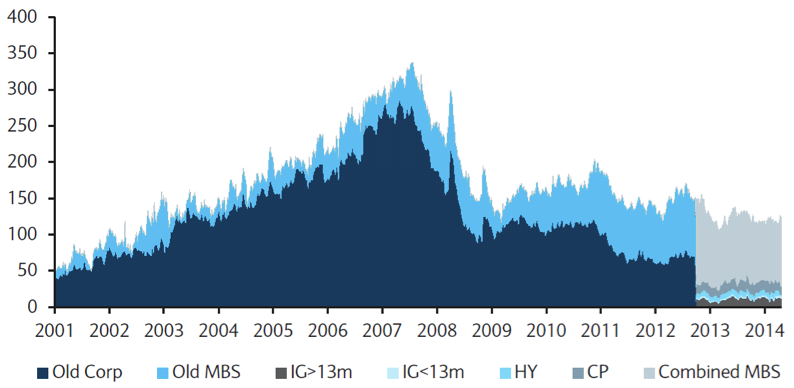

The second question becomes “if investors are not getting paid for the risk, can they simply sell the security?” Our answer is “it depends.” In the equity market, if an investment analyst believes the stock will underperform, the stock can be sold into the marketplace. The corporate bond market is an over-the-counter market, which means dealers act as intermediaries, quoting where bonds can be sold or purchased. Regulators have made it more onerous for these intermediaries to hold positions due to increased capital requirements and tighter risk limits, resulting in a much smaller secondary debt market (Exhibit 4). The decline from $280 billion in 2007 to a low of approximately $20 billion in 2014 is remarkable.

Exhibit 4: Net Primary Dealer Positions in Corporates, Commercial Paper, and MBS ($B)

Source: Federal Reserve, Bloomberg, Barclays Research

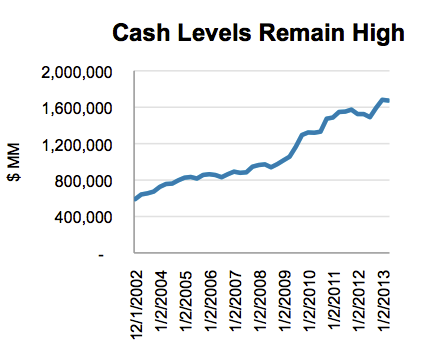

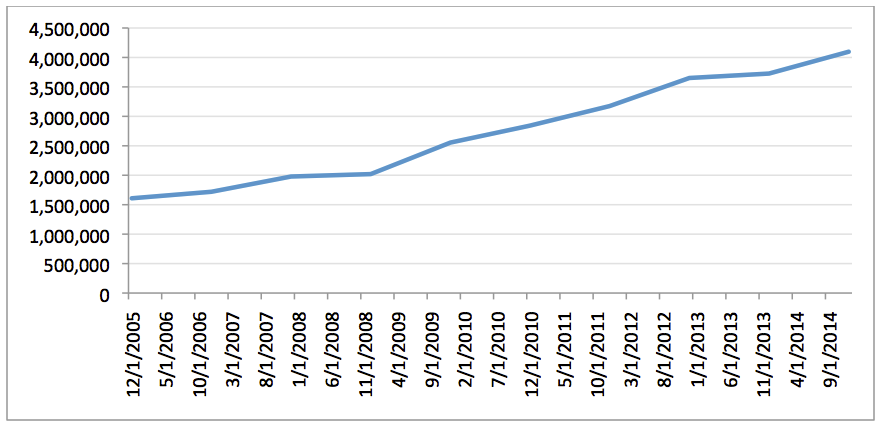

While the secondary debt market has fallen in size, the amount of debt outstanding has increased, as interest rates have declined (Exhibit 5). Where dealers used to control 4-5% of the market, they control less than 0.5% today.

Exhibit 5: U.S. Investment Grade Corporate Debt Market ($MM)

Source: Barclays Corporate Index, AAM

The illiquidity of the corporate bond market has caught the attention of the Federal Reserve and has been the topic for many financial reporters. Although many investment managers have talked about developing electronic trading platforms, they have failed to penetrate the market. According to the Financial Times[note]Michael Mackenzie “Search for liquidity tests corporate bond market,” Financial Times, November 4, 2014, accessed July 20, 2015, https://www.ft.com/cms/s/0/9ee487fa-4e43-11e4-adfe-00144feab7de.html#axzz3gYs9Ufrj.[/note], Greenwich Associates, a consultancy, estimates that 16% of institutional trading of investment-grade bonds is done via electronic platforms. And, while electronic trading is gaining some traction, it has involved smaller sized trades (i.e., less than $1 million) versus $5 million and higher.

Summary

Therefore, the bond market’s illiquidity may present challenges to larger managers who want to execute on the ideas originated by their investment staff. At AAM, our size allows us to be nimble and gives our portfolio managers the opportunity to execute on the ideas our team originates. We believe as the cycle matures and rating downgrades increase, smaller managers have a greater ability to differentiate and to outperform their larger peers.

Elizabeth Henderson, CFA

Director of Corporate Credit

For more information about AAM or any of the information in the Corporate Credit View, please contact:

Colin Dowdall, CFA, Director of Marketing and Business Development

John Olvany, Vice President of Business Development

Neelm Hameer, Vice President of Business Development

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.