First Quarter – 2013

- Corporate Market Generates Modest Excess Returns vs. Treasuries

- Financial Sector Outperforms Industrials and Utilities; BBBs Outperform As

- Company Fundamentals Remain Sound But Idiosyncratic Risk Has Increased with Two Leveraged Buyouts Announced

- Headlines in Europe and Sequestration in the US Resulted in Minimal Spread Volatility

- AAM Expects Similar Performance from Corporate Bonds in the Second Quarter

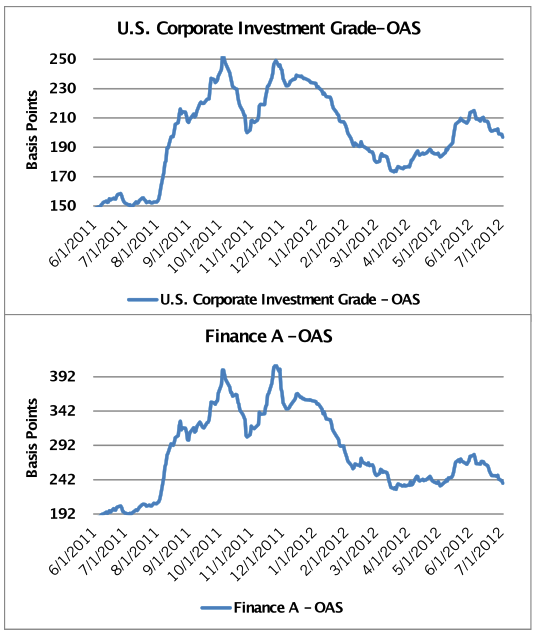

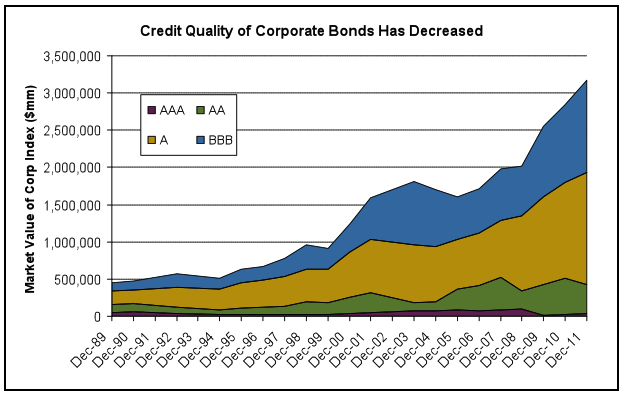

Investment Grade Corporate Bond Spreads Tighten Modestly

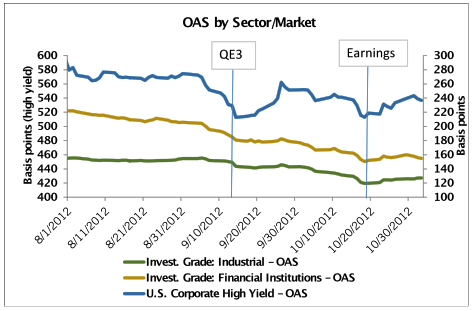

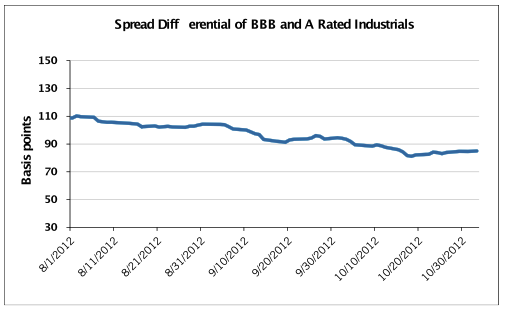

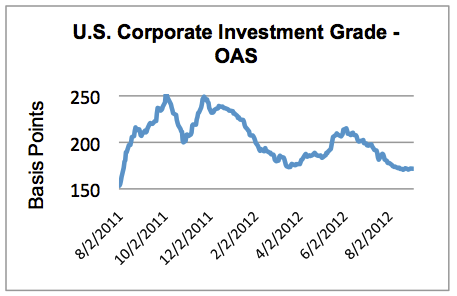

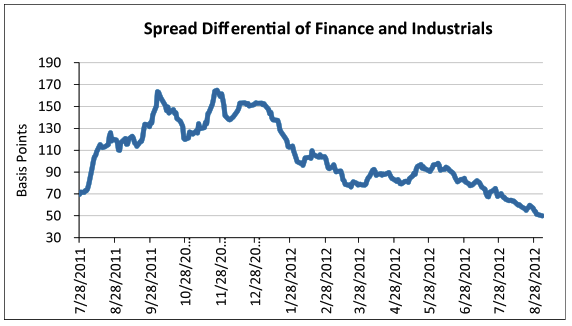

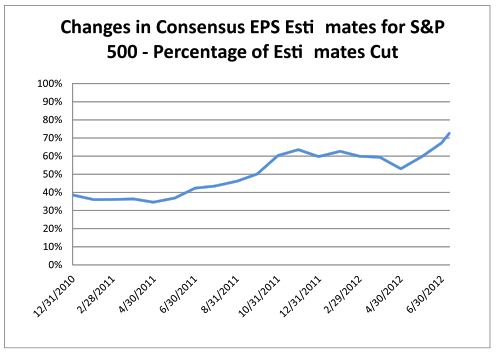

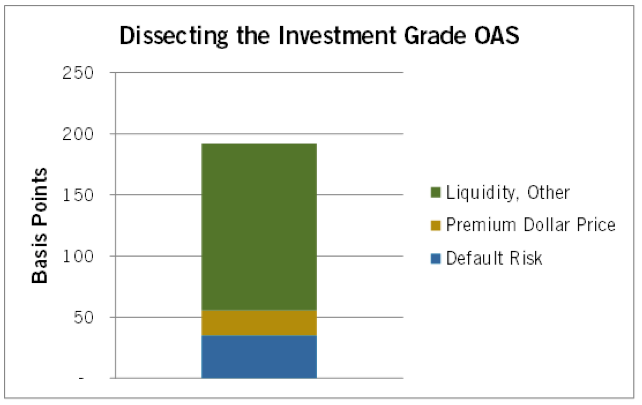

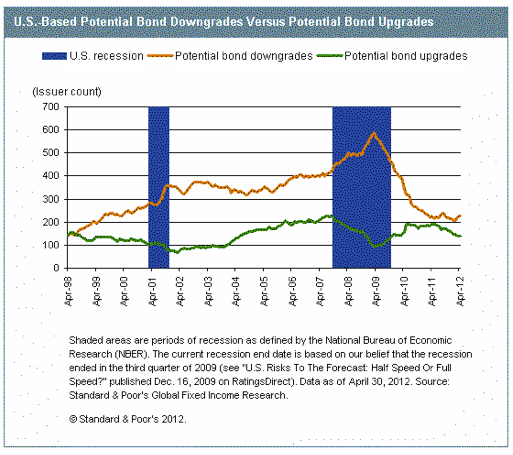

The Investment Grade Corporate market started the year well, as spreads tightened 8 basis points (bps) in response to fiscal cliff resolution and better than expected economic data. After the first week, the enthusiasm waned with increased event risk (e.g., Dell leveraged buyout (LBO)) and investor concern with the technical support of the fixed income market if rates moved sharply higher. Spreads have been stable despite the government spending reductions, Italian election uncertainty, and the Cyprus bail-out (Exhibit 1). New issuance in all markets remains healthy, and new issue demand has been very strong with deals remaining well oversubscribed.

Exhibit 1

Source: Barclays Capital, AAM

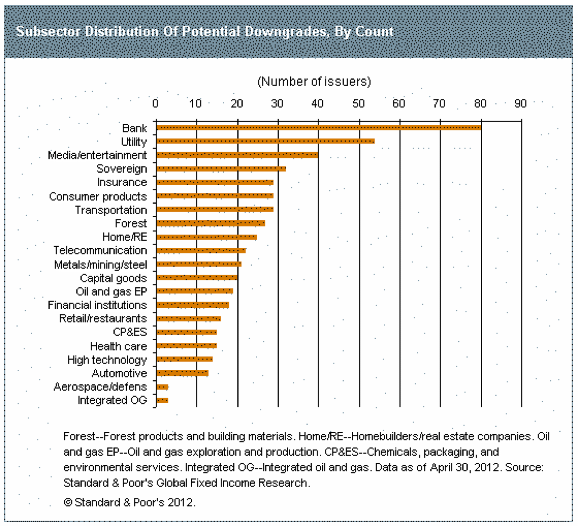

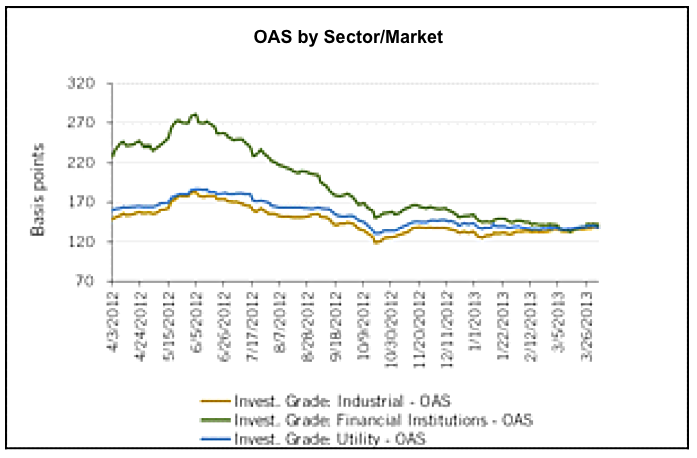

The Investment Grade Corporate market earned 0.28% over Treasuries in the first quarter 2013 per Barclays. The Finance sector continued to outperform as did BBB rated securities (Exhibit 2). Investors looked to Finance and Utilities as safe haven sectors as opposed to the more event risk prone Industrial sectors like Energy, Telecommunications, Technology, and Consumer NonCyclicals. Industrial bonds with long maturities performed particularly poorly (-101 bps), as investors recognized the lack of spread protection in the face of increased volatility.

Exhibit 2

Source: Barclays Capital, AAM

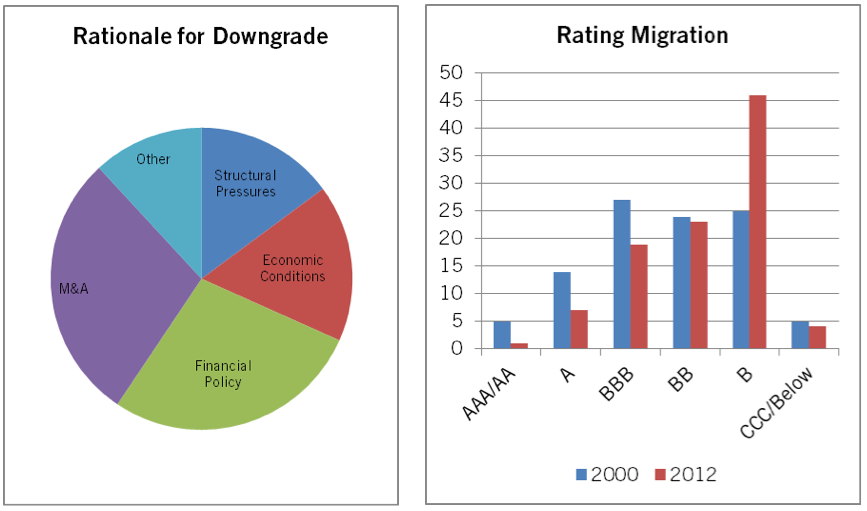

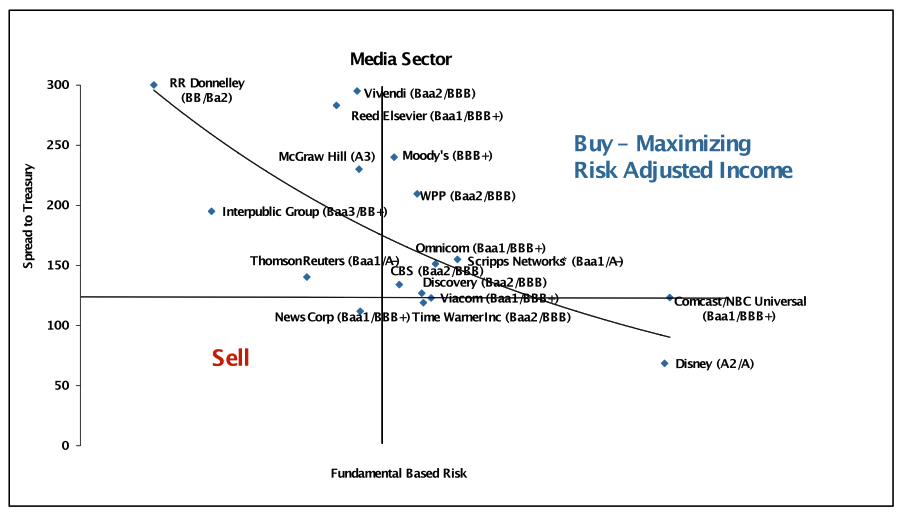

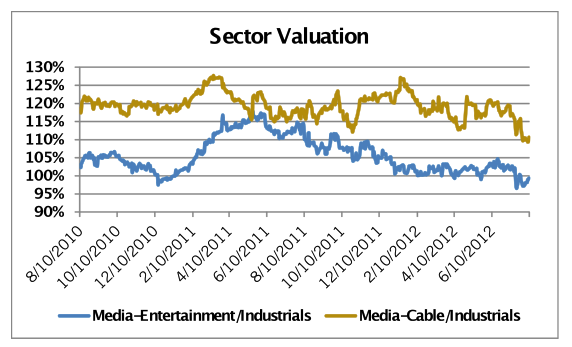

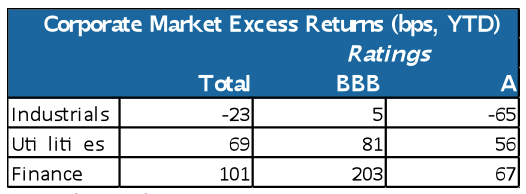

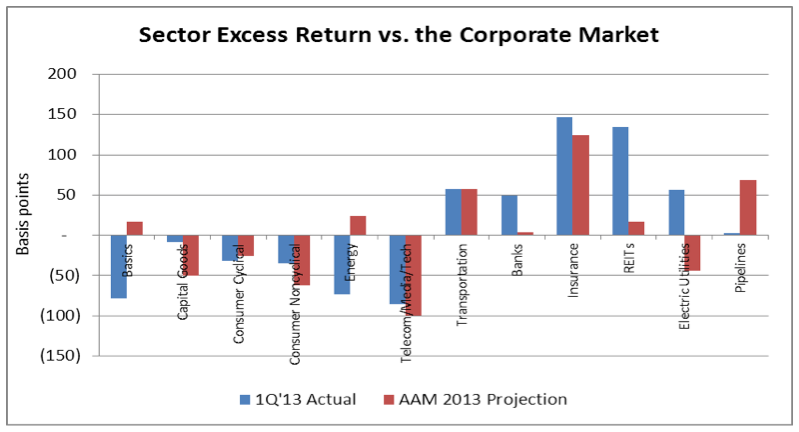

Exhibit 3

Exhibit 3 shows the difference in industry excess returns vs. the Corporate market overall for the first quarter of 2013 and our expectation for the entire year. It is clear that Finance has exceeded our expectations thus far. Not only has Insurance performed strongly, but Banks and REITs as well. In Industrials and Utilities, we are taking advantage of current market levels, and believe the following are particularly:

Unattractive

- Telecom, Media (Networks), Technology – We believe softening credit fundamentals, heightened event risk, and the prospect for new issuance are not reflected in relatively tight spread levels.

- Electric Utilities – We anticipate fundamentals to remain relatively stable in 2013 given our modest domestic growth expectations. However, we anticipate the sector’s excess returns to be among the weakest due to limited spread compression opportunities and its OAS, which trades well inside of its one year average.

- Food & Beverage – Event risk is very high in this sector due to LBO risk (e.g., Heinz) and pressure to generate satisfying returns for shareholders including spin-offs and mergers and acquisitions. Fundamentally, we like the large, global participants with strong brand equity and balance sheets, but they offer little value from a spread perspective.

Attractive

- Energy – We believe that most of the Energy space is fairly valued. However threats of increased investor activism at Hess, Transocean and Nabors in January 2013 combined with good fundamentals has provided opportunities in the Oil Service subsector, which we now value attractively (To read more, please see our recent white paper, “[download id=”11″]”

- Metals & Mining – New issuance has re-priced this sector, and we have taken advantage of that opportunity. We expect that commodity prices will be volatile but should be supported by better demand from China. We expect mergers and acquisitions will pick up this year, resulting in attractive new issuance opportunities.

- Pipelines – We have a favorable relative value opinion of the Pipeline sector due to positive growth characteristics, improved credit profiles and comparatively cheap valuations.

Industry Highlights – Banking and Energy

As part of our investment process, analysts internally present industry specific topics that are relevant to fixed income investing. Two of these presentations in the first quarter included Banks – Orderly Liquidation Authority (OLA) and Energy – Transformational Times in North America.

We highlighted OLA in our “[download id=”10″]” and since that time, Moody’s reiterated its Negative Outlook on the systemically important U.S. Banks. This Outlook reflects its concern that regulatory support is weakening given the prospect of a credible resolution regime (enshrined in OLA). Concurrent with the expectation for a formal OLA proposal later this year, Moody’s expects to update its bank holding company rating support assumptions by year-end. Worst case, if Moody’s removed its notching for systemic support, Bank of America and Citigroup could see their bank holding company ratings lowered to Ba1. Our expectation is for Moody’s to remove a notch of rating support, resulting in one-notch downgrades across the board. Given our fundamental outlook and the spread tightening to date, we do not expect material spread tightening for the large domestic banks in the near term. To read more about the risks on the horizon for the banking sector, see “[download id=”9″]”

In Energy, we presented the potential for liquefied natural gas (LNG) exports from the U.S, in the intermediate term with the expectation of a domestic oil production surge and ultimate approval and construction of the Keystone XL pipeline. We expect the energy revolution to be a driver of economic activity in the U.S. in addition to the housing recovery and a deleveraging consumer. Specifically, we are taking advantage of transportation companies such as relevant pipelines and railroads. Railroads will benefit from the production regardless of the construction of the Keystone XL pipeline, as they currently transport crude oil from the burgeoning Bakken Shale in the Great Plains to the refineries located in the Gulf Coast, mid-Continent and Rust Belt. If the Keystone XL pipeline was built, they would remain critical in the transportation of materials such as the chemicals used to transport the oil to the refineries through the pipeline. Moreover, the low natural gas prices in the near to intermediate term is beneficial to US manufacturers, potentially allowing them to reclaim manufacturing activities lost in the 2000s from emerging market countries.[1]

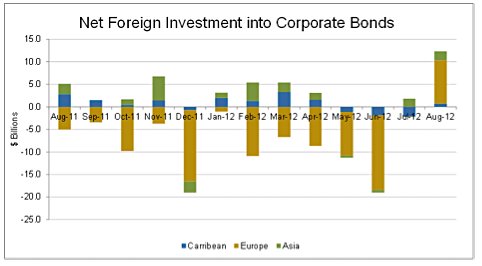

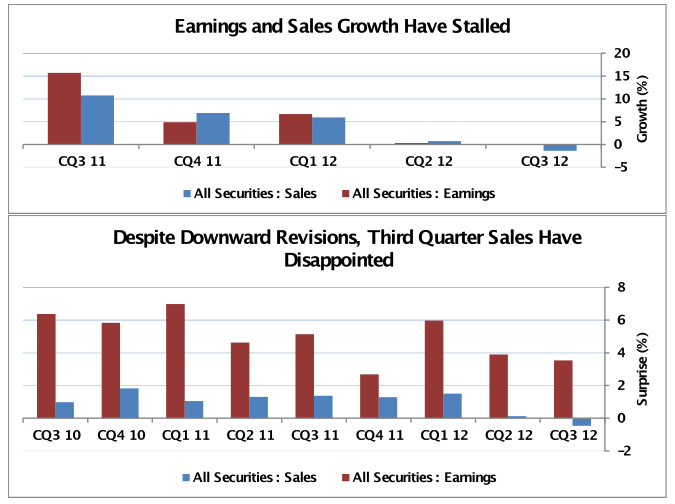

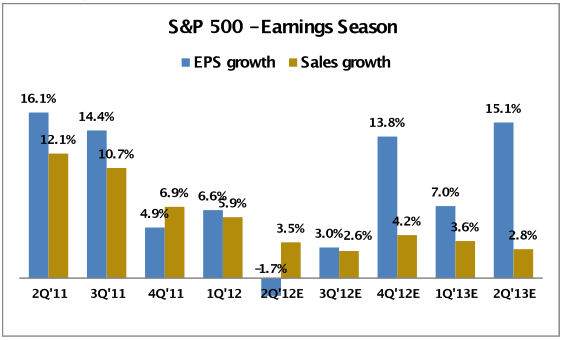

Fourth Quarter Earnings Season Exceeded Lowered Expectations

Earnings and sales growth were better than expected in the fourth quarter of 2012, with the companies in the S&P 500 reporting sales growth of 3.7% and earnings growth of 9.2% versus the fourth quarter of 2011. All sectors but Energy reported positive sales growth in the fourth quarter. The Finance sector posted the strongest performance with sales growth of 22%. The aggregate EBITDA margin fell modestly in the fourth quarter, continuing its downward path since the peak in 2011. Management commentary was marginally positive in particular about China.

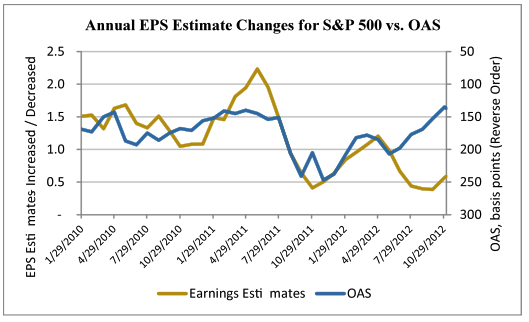

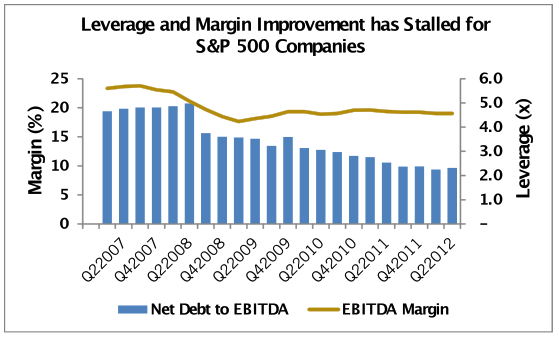

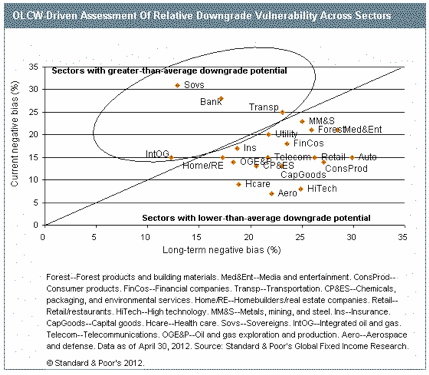

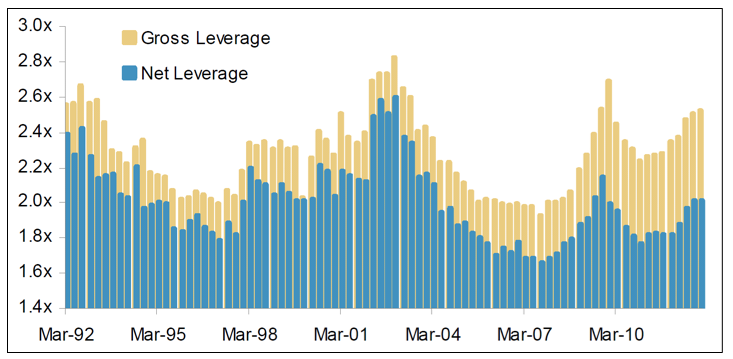

As earnings growth slows and debt balances grow, gross debt leverage continues to creep higher, but it remains lower than its peaks in 2003 and 2009, especially on a net debt basis (Exhibit 4).

Debt leverage has increased for Metals & Mining companies due more to falling cash flows, as the global economy (mainly China) has cooled, bringing commodity prices down. Whereas, acquisitions have resulted in increased debt balances for sectors such as Consumer and Healthcare. The level of cash on balance sheets continued to grow throughout the year.

Exhibit 4

Notes: Gross leverage is Total Debt/ LTM EBITDA. Net leverage is (Total Debt Less Cash/EBITDA.

Notes: Gross leverage is Total Debt/ LTM EBITDA. Net leverage is (Total Debt Less Cash/EBITDA.

Source: Morgan Stanley Research, Bloomberg, Yieldbook

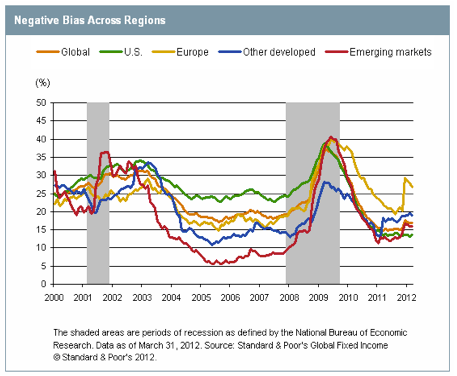

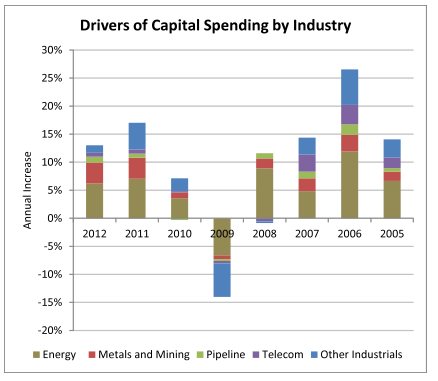

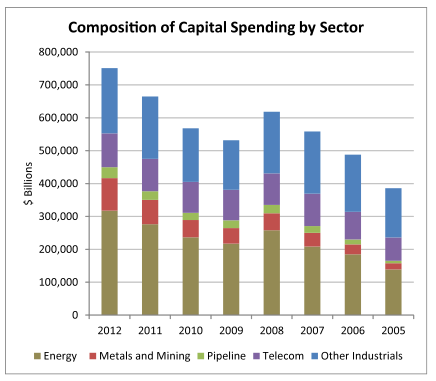

Capital spending remained quite strong in the fourth quarter, increasing 13% year-over-year or 4% vs. the third quarter. We continue to believe that the low cost of funds and the lower level of systemic risk (given the central bank support) will incentivize management teams to invest in their businesses. That said, we expect the rate of growth to continue to decline in 2013, driven primarily by the lower level of spending from Metals/Mining and Energy companies, which comprise a dominant share of the overall level of capital spending (Exhibits 5A and 5B).

Source: AAM, CapitalIQ (analysis based on 280 Industrial companies)

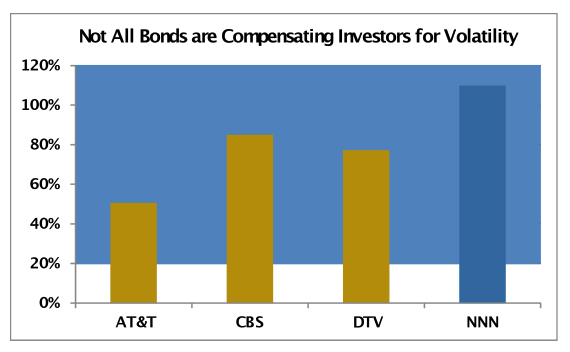

Lastly, the very low cost of debt and reduced systemic risk (given worldwide central bank support) are resulting in an increased appetite for leverage. We are witnessing this as credits such as CenturyLink, AT&T, ADT and Safeway increase debt to reward shareholders, resulting in modest rating downgrades. Extreme examples are the leveraged buyouts for Dell and Heinz, and Verizon’s publically stated goal of buying Vodafone’s 45% stake in Verizon Wireless, which would cost more than $100 billion and likely result in its low-A ratings to fall to mid/high BBB.

AAM Expects Similar Performance from Corporate Bonds in the Second Quarter

First quarter earnings season has started and we expect companies to continue their trend of surprising to the upside, as expectations have been set fairly conservatively. The second quarter is expected to be the softest from an economic perspective in the U.S. due to the fiscal tightening. Since the second quarter is expected to be soft, we expect spreads to remain relatively stable. The catalyst for change is likely to occur later in the quarter when investors should have a more informed opinion of the trajectory of growth in the second half. We would not expect that to occur earlier based on management outlooks or commentary in earnings calls, but it is a possibility.

We continue to expect the Corporate market to generate positive excess returns vs. Treasuries in 2013 driven primarily by yield (vs. spread tightening). The level of excess return year to date has been underwhelming due to two main reasons: (1) the underperformance of high quality Industrials and (2) the underperformance of long end maturities. We would not expect either to reverse in the second quarter unless the trajectory of growth expected for the second half of 2012 is modified lower.

Written by:

Elizabeth Henderson, CFA

Director of Corporate Credit

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

[1] Manoj Pradhan, “Market Insights: EMs must respond to US industrial revival,” Financial Times. April 10, 2013, accessed April 10, 2013