Keeping It Simple

- Corporate Bond Market Outperformed Treasuries in July

- Near Term Outlook Uncertain with Politics in the U.S. and Europe

- Cost Cuts are Likely in the Near Term as Gross Margins are Compressing

- Simple Business Models Look Attractive

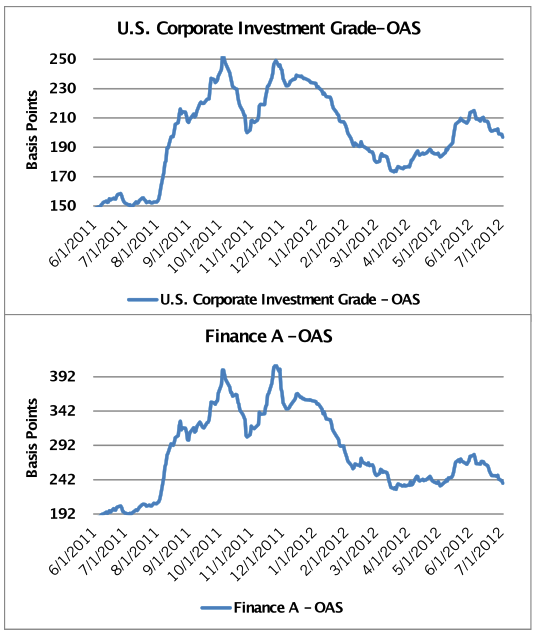

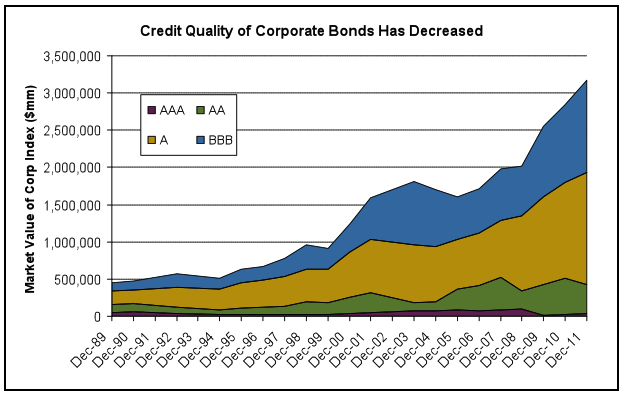

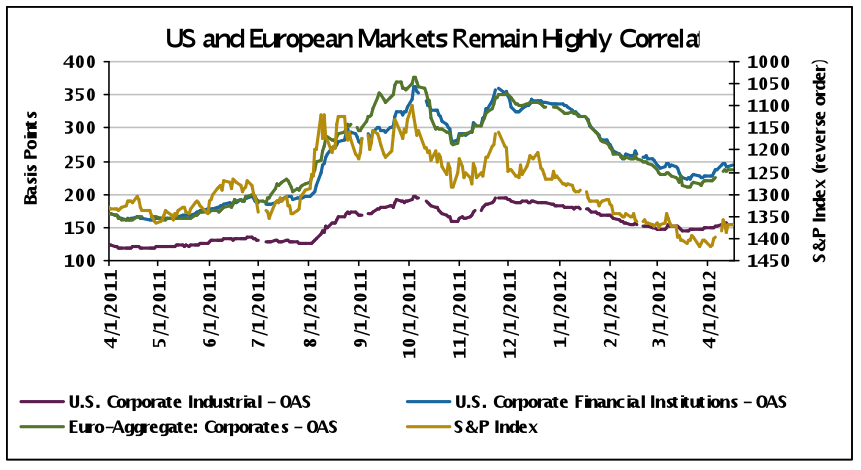

Investment Grade Corporate Bond Spreads Continue to Tighten in July

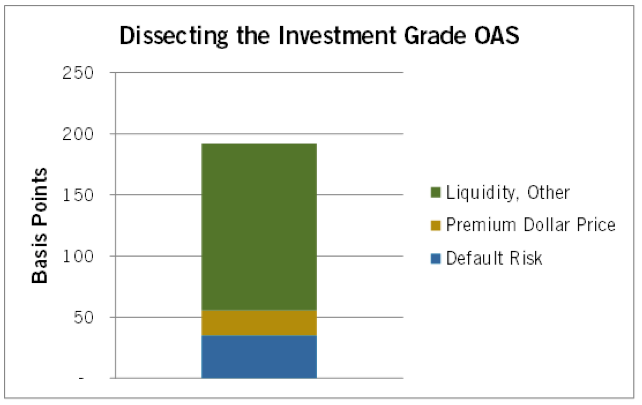

Investment grade corporate bond performance in July was strong across all three broad sectors and rating categories. The market earned 1.62% over Treasuries in July, increasing the year-to-date excess return to 4.35% per Barclays Capital. “BBB” rated securities have earned 4.30% over Treasuries and “A” rated securities 4.69% year-to-date (1.63% and 1.68%, respectively, in July). From an industry perspective, Media-Cable outperformed in July (3.17% excess return) and Supermarkets underperformed (-1.56%). The domestic high yield market also performed well, earning 1.25% over Treasuries in July, bringing the yield for the B/BB market down to an all time historic low of less than 6%. In Europe, its Corporate market had a good month as well, earning 0.58% of excess return in July according to Barclays Capital. New issuance in all markets was fairly robust, and for most deals in the domestic investment grade market, new issue concessions remain lackluster.

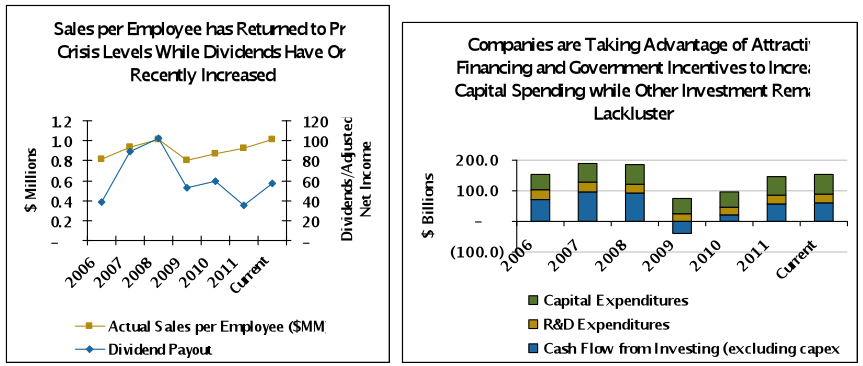

Company Fundamentals are Strong but Weakening

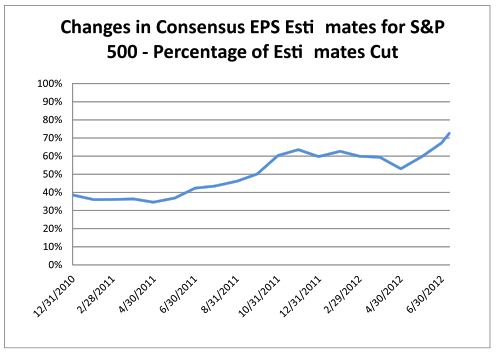

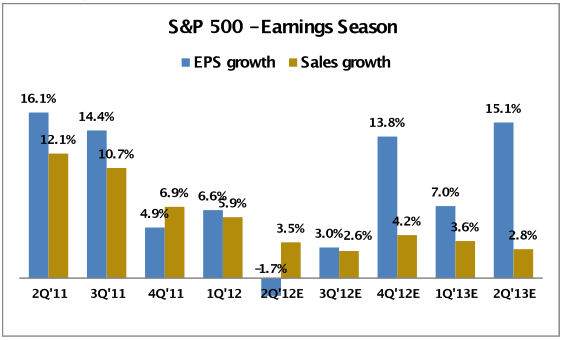

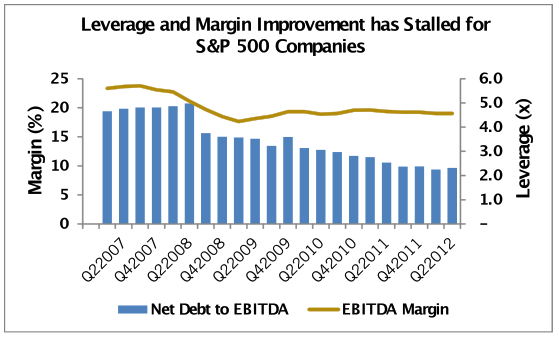

Like the equity market, the corporate bond markets benefited from central bank statements in Europe and the United States that implied willingness for further quantitative easing and economic support. After an initial wave of negative reports, earning reports came in broadly as expected with revenue surprises in Finance and Energy offset by weakness in Materials and Utilities. All sectors but Materials posted better than expected earnings in the quarter. That said, management commentary was either fairly cautious or uncertain about the second half of the year, and with the dollar continuing to fall and growth slowing worldwide, we believe management teams will look to cut costs more aggressively over the next six months. Debt leverage increased this year for the first time since second quarter 2008, as measured by net debt to EBITDA for S&P 500 companies, from 2.26x at the end of the first quarter to 2.33x at the end of the second quarter. Moreover, for 200 high yield issuers that have reported results, EBITDA growth was marginally positive (0.6% year-over-year) and revenues were up 1.5%, but Cost of Goods Sold increased 2.2.[1] This has been the trend for the S&P 500 constituents since the fourth quarter of 2011. Accordingly, we expect companies to pull back on more discretionary spending and reduce headcount and/or capital spending.

Politics will be a Drag on the Economy

The potential deterioration in consumer confidence from an election that reminds voters of domestic fiscal and economic challenges not to mention the drag on the economy if Congress does not act to raise the debt ceiling and/or prevent the fiscal cliff ($600 billion of tax increases and spending cuts due January 1, 2013), is not conducive for business related expansion. Economists are beginning to assign probabilities, recognizing the difficulty of doing so as the election is very close. Goldman Sachs recently published their thoughts on the fiscal cliff, assigning a probability of 33%. Goldman’s base case is a slight drag from fiscal policy of 1.5% in 2013 due to the payroll tax expiration and slowing government spending.[2] That is better than the 4% contraction if Congress allows us to fall off the cliff, placing the economy in a recession.

How has AAM been Investing in Corporates?

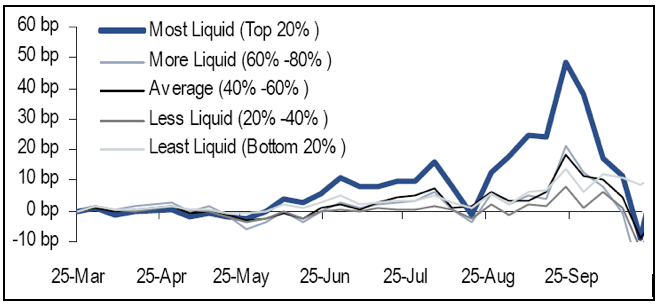

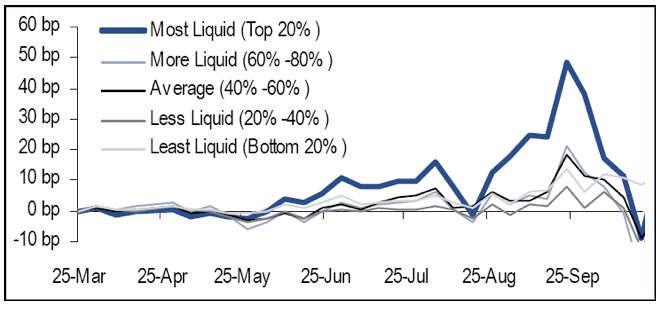

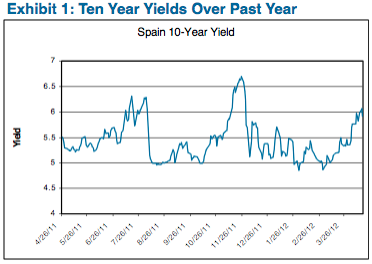

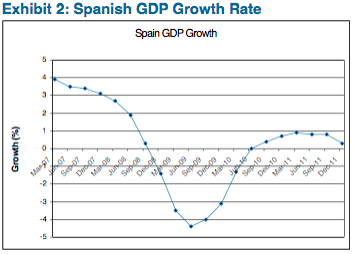

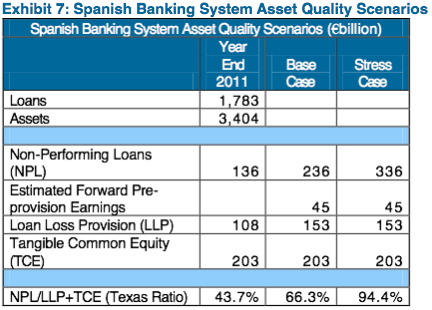

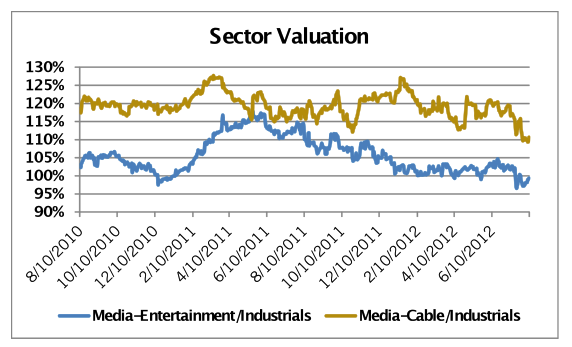

Economically, we expect growth to remain slightly positive in the U.S. for the second half and issues in Europe to resurface in early fall, expecting Spain to request assistance from the “Troika” (European Union (EU)/European Central Bank (ECB)/International Monetary Fund (IMF)), and China to continue to support its economy as growth slows. With this volatility, we expect Corporate spreads to widen, leading to a buying opportunity. Over the past month, we have been reducing our exposure to sectors and credits that are economically sensitive with spreads that are rich and vulnerable to underperformance (Exhibit 1). This includes Media related credits that have recently outperformed (Exhibit 2). We believe advertising spending could be less than the market expects as companies pull back to preserve margins and growth remains stagnant.

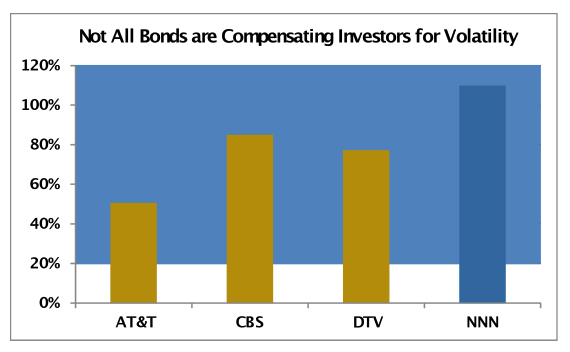

We have been selectively adding credits in the new issue market, private and public, which offer attractive yields to compensate for liquidity and size of the enterprise. In this period of market illiquidity and political complexity, we prefer investing in simple business models where one is getting paid for liquidity and business risk. As an example, National Retail Properties (NNN) issued a 10-year bond at 3.8%. It is a mid-BBB rated REIT with a $3.2 billion market capitalization. It was one of a select few that did not have to cut their dividend during the financial crisis given their prudent financial management. Their business is straightforward, managing triple-net leased retail properties. Under the triple net lease model, tenants are signed to long-term (typically 12 to 15 years) leases that include automatic rent increases and adjustments for capital improvements and taxes (all inflation/pricing risk retained by lessee). The company underwrites new acquisitions based on the attractiveness of the real estate first and foremost (ease of re-leasing, if the lessee fails), although it also carefully underwrites the lessees and typically does not enter into leases with businesses that have less than a 7 to 10 year track record. An issue size of $325 million and total public debt outstanding of $1.5 billion means this issuer is difficult to find in the secondary market.

Exhibit 1

Source: AAM, Barclays Capital as of 8/8/2012. DTV=DirecTV

Calculated as the breakeven spread (OAS/Duration) divided by Standard Deviation.

Exhibit 2

Source: AAM, Barclays Capital as of 8/9/2012

Written by:

Elizabeth Henderson, CFA

Director of Corporate Credit

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

[1] Hans Mikkelsen, “Over the Hump,” Bank of America Merrill Lynch Global Research: A Credit Strategy Report (August 6, 2012): 1.

[2] Allison Nathan and Alec Phillips, “Staring Down the Fiscal Cliff,” Goldman Sachs Global Investment Research (August 8, 2012): 4-5.

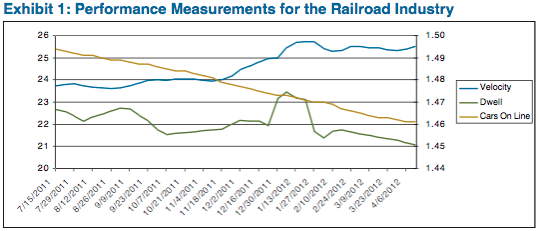

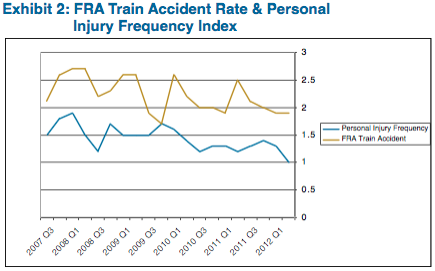

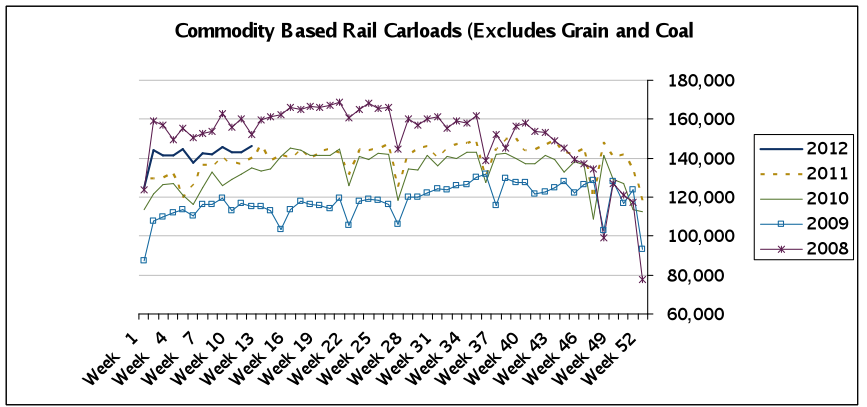

Source: AAM, Association of American Railroads

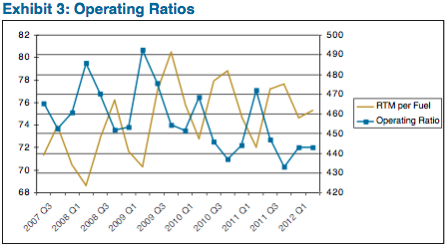

Source: AAM, Association of American Railroads Source: AAM, Bloomberg (S&P 500 Index member data used)

Source: AAM, Bloomberg (S&P 500 Index member data used)