If You Build It, Will They Come?

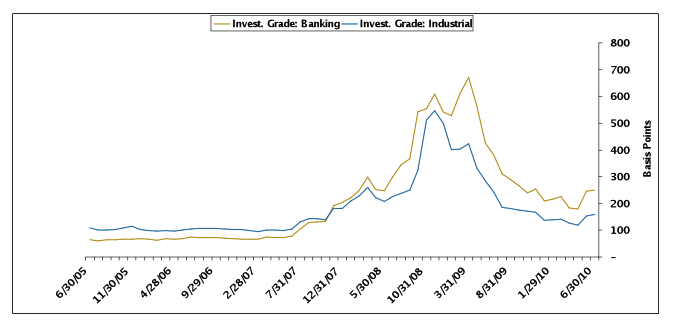

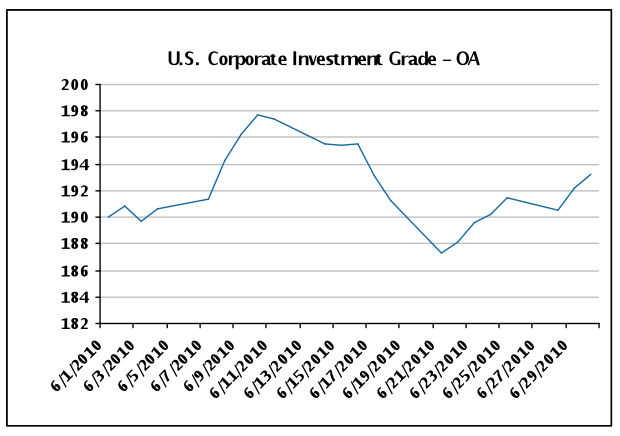

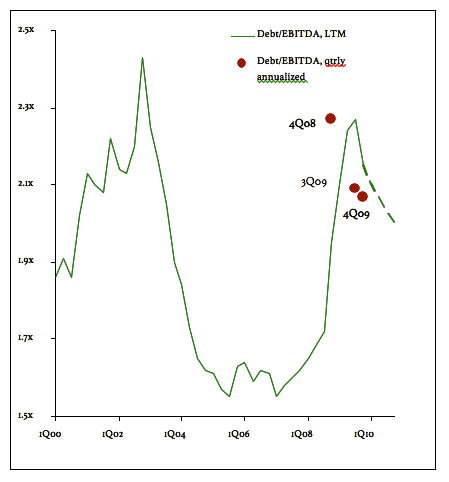

The elevated mood of the markets continued in October. The Corporate bond market, using the Barclays Corporate Index, generated 55 basis points (bps) of excess returns in October with all maturities posting positive excess returns, and the long end finally outperforming (99 bps long vs. 39 bps intermediate). This has not been the case for most of this year, as reflected in Exhibit 1. The long end has negatively affected the overall market return. Corporate treasurers have been taking advantage of the low yields and improved market sentiment, as new issuance has been very robust over the last couple months. We expect this trend to continue throughout 2011. We believe the deleveraging is largely completed, and companies will look to issue next year primarily to refinance maturing debt and fund acquisitions and shareholder friendly actions.

Exhibit 1

| Excess Return across the Curve (1/1/2010 – 10/29/2010) | ||

| Maturity, years | Excess Return, bps | % of Corporate Index |

| 1-3 | 208 | 19 |

| 3-5 | 234 | 19 |

| 5-7 | 220 | 12 |

| 7-10 | 124 | 25 |

| 7+ | -173 | 26 |

| All | 99 | 100 |

Source: Barclays

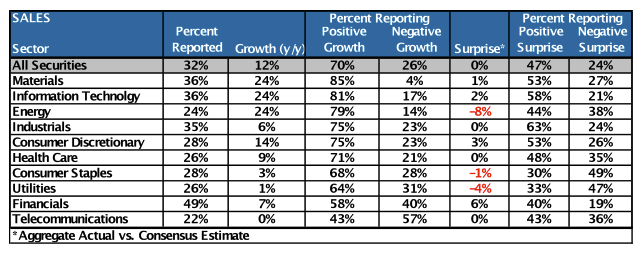

Typically, in December, we provide a recap of corporate supply for the year and a preliminary forecast. This exercise is important for portfolio managers to proactively manage their credit and industry exposures along the Treasury curve. And, at times, supply is a primary driver of spreads. This has been the case over the past two months. To review, investment grade new issue supply was much greater than expected in 2009 as: 1) deals were pushed back following a 2008 shutdown, 2) companies sought to term-out short-term debt and commercial paper, and 3) spreads, at historical wides, were very attractive to buyers. The original estimate for 2009 was for new issuance to drop by 38%. However, due to the above factors, supply increased by more than 50%. Yet, the heavy issuance was easily absorbed. For 2010, like the beginning of 2009, it was expected to see lower supply due to: 1) higher rates, 2) increased cash balances at corporations, 3) improving corporate profits, and 4) low refinancing needs. The estimate for this year was for gross new issue, excluding noncorporates/144a, to be down 24% (including noncorporates/144a down 18%). However, supply will again be higher than estimates, as reflected in Exhibit 2.

Exhibit 2

Source: Barclays

There has been about $560 billion in gross new issuance (excluding noncorporates/144a) this year. Annualized, that would make 2010 about 2% higher than 2009 and about 34% higher than the 2010 estimate. However, the breakdown by sector is important. The majority of issuance this year has been in Financials, as seen in Exhibit 3. Annualized, Financial issuance will be up 59% this year while Industrials and Utilities will be down 25% and 28%, respectively. Meanwhile, Financials will make up 50% of the 2010 gross issuance while Industrials will be 43% and Utilities 7%. Why is this important? Fixed income investors need diversification, particularly as allocations to high grade Corporates have remained heavy throughout 2010. Exhibit 4 shows the allocation to Corporates in High Grade mutual bond funds while Exhibit 5 shows how insurance companies have been struggling to deal with the lack of diversified credit supply, having to allocate more of their heavy cash balances to Treasuries. At the end of the third quarter this year, High Grade funds and insurance companies together held about 40% of outstanding high grade bonds.

Exhibit 3

Source: Barclays

Exhibit 4: Allocations to corporate bonds within High Grade bond mutual funds

Source: Company filings, JP Morgan

Note the Barclays Capital Aggregate Index is comprised of 19% Corporates, 36% Structured Products, 46% Treasuries and other government bonds

Exhibit 5: Insurance Companies are Struggling to Deal With This Lack of Credit Supply, Increasing Demand for Treasuries

Source: NAIC Statutory filings, JP Morgan

Note: Corporate Credit includes both High Grade and High Yield bonds; Structured Products include ABS, CMBS, and RMBS; Mortgages = Mortgage Loans

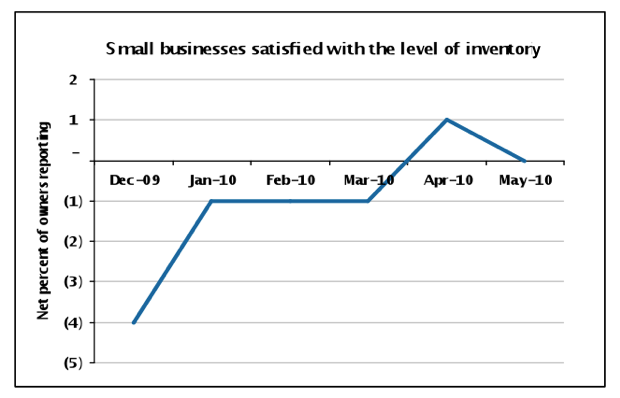

Supply seemed to come in clusters this year. Yet, it was easily absorbed. Exhibit 6 shows the 2010 monthly gross issuance versus 2009, while Exhibit 7 depicts the 2010 monthly net (including maturities and redemptions) issuance versus 2009, along with spread performance of the Barclays Corporate Bond Index. Focusing on the two busiest months this year, March and September, we see that spread performance was actually positive (e.g. spreads tighter) both months. March 2010 saw $67 billion of net new issue but spreads were 23 bps tighter on the month. September saw $86 billion of net new issue and spreads were 11 bps tighter. Yet, spreads were wider in April, May, and June when net new issue was slow. Macro factors concerning slower economic growth, sovereign credit risk, and financial sector regulation occupied the market’s psyche during this period. These underlying factors drive both issuance and spreads, which is why one cannot prove a causal relationship between supply and option adjusted spread (OAS). If one regresses supply with OAS, it is a positive relationship and statistically significant, but supply does not explain the movement in OAS (a low R squared). As more variables are presented, supply becomes statistically insignificant and the relationship is negative.

Exhibit 6

Source: Barclays

Exhibit 7

Source: Barclays

The $560 billion issued this year is about $56 billion per month or $14 billion per week. As of this writing, there is only about 6 more weeks left in 2010 for active markets. As such, we may see only about $84 billion more in gross issuance, which would put 2010 at $645 billion or down about 2% versus 2009. However, as fixed income investors remain overweight credit, we expect any remaining supply to be easily absorbed. It is still too early for 2011 projections as our team is still pouring through third quarter earnings announcements and company estimates. However, the early read shows that gross issuance could be flat to moderately higher versus 2010.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

Source: Barclays

Source: Barclays