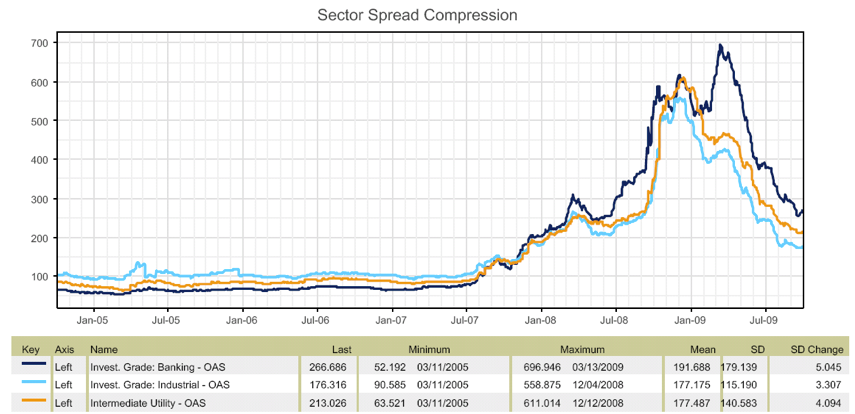

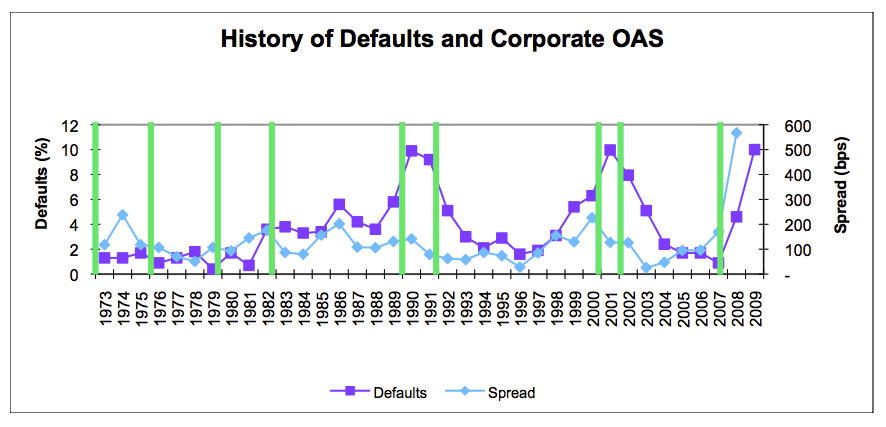

After a long run of positive excess returns, the Corporate Index posted a modestly negative month of excess returns in November, -8 bps (basis points) per Barclays. This was mainly due to the poor performance of hybrids, specifically relating to banks that received state aid in Europe. Excluding hybrids, the Index would have posted +4 bps. The OAS of the Index closed the month at 207 bps, 189 bps excluding hybrids.

Economic data was once again the focus for investors, and one topic in particular that garnered attention was the small business sector of the U.S.. There are a couple of often used measurements for the health and sentiment of this sector. First, is the quarterly Business Employment Dynamics (BED) survey from the Bureau of Labor Statistics, which reports job creation and destruction by firm size albeit at a considerable (8-month) lag. The data collection started in 1992 and shows that approximately one-third of the job growth since that period was due to the small business sector. However, in the initial stage of economic recoveries, the percentage is larger. Thus far, the BED survey is not signaling a proportionally higher retrenchment in jobs in the small business sector vs. medium and large, but again, the survey is dated.

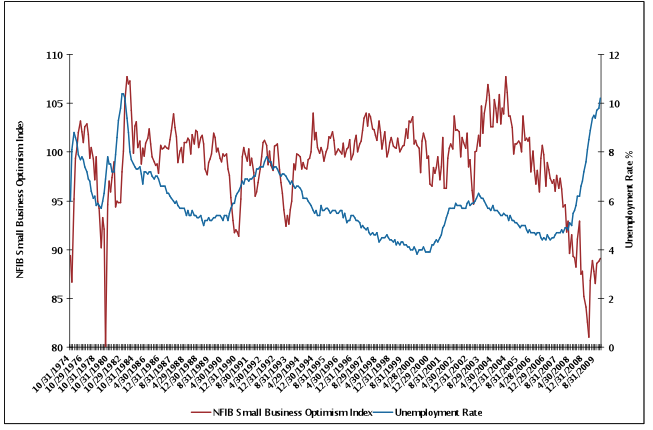

A more forward looking measure of small business sentiment is the NFIB optimism survey, which has collected data since 1973. The recent data continues to show improvement after a low of 81 posted in March 2009 (Note: The lowest reading for the Index was 80.1 in April 1980), but absolute sentiment and conditions remain very weak. The last number reported on November 10 for October 31, 2009 was 89.1. There are many interesting points to highlight. Notably, in the 1980-1982 recession, the Index was below 90 for one quarter. In this recession, its been below 90 for six quarters. Moreover, levels below 90 were also seen in 1974 when Treasury yields were 7-8% and rising, the Bank Prime loan rate ranged from 9-12%, and BBB Corporate bond yields were 10+%.[1]

Many point to the inability to obtain credit as the reason for small business struggles, although the data does not necessarily point to it as the primary reason. The Federal Reserve’s senior loan officer survey shows an improvement in tightening standards for commercial and industrial loans (C&I) for small firms, although very few banks eased standards. The NFIB survey also reported that 29% of small businesses reported all of their borrowing needs met (for reference, 36% reported the same in 2006-2007) vs. 9% who reported problems obtaining desired financing (6-7% in 2006-2007). And, a modest 4% said that financing and interest rates were their “most important problem” as opposed to 33% that cited poor sales, 22% taxes, and 11% government regulations and red tape. As one would expect, interest rates were a much bigger factor pre-1990 when 10-35+% of respondents reported this as their main issue. This compares to “poor sales” as a main issue, which was never this high. We are not saying that tight credit conditions are not one of many problems plaguing small businesses, but it is not the main problem or problems for that matter. The lack of demand for credit is more likely due to the record low levels of capital spending (current and expected), decreasing inventory stocks and prices and thus, sales and profits.

Lastly, what does all of this mean for unemployment and GDP? The current NFIB data shows that a seasonally adjusted net-negative one percent of owners plan to create new jobs. We did a simple regression, using the NFIB data, quarterly change in U.S. real GDP, U.S. initial jobless claims, and U.S. unemployment. What we found is although the NFIB data is a very good leading indicator and therefore, statistically significant for each variable, it is not a good predictor of the ultimate value due to the lack of explanatory power. The R-squared in each regression never exceeded 35% despite adjusting for time lags, etc. As Exhibit 1 shows, the time lag between the trough of the NFIB Index and the peak of unemployment in recessionary periods ranges from three years to less than one.

Exhibit 1: Small Business Optimism and Unemployment

Source: Bloomberg

The conclusion we draw is that the availability of credit alone will not fix the small business problem nor should it. We continue to believe that U.S. consumers and businesses have seen the abyss and do not want to return. This means savings rates will remain higher and businesses more liquid and conservative. This should support a reduction in capacity and therefore, consolidation, a near term negative for job creation. What does this mean for the Corporate Bond market? We believe it supports Investment Grade spreads in general, as large businesses get stronger and investors consider it an attractive investment relative to more risky assets that are more exposed to lower tier, weaker firms and have rallied considerably this year.

This information is developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as ‘AAM’), and their respective officers and employees. Any opinions and/or recommendations expressed are subject to change without notice.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient.

[1] Federal Reserve – https://www.federalreserve.gov/releases/h15/data.htm