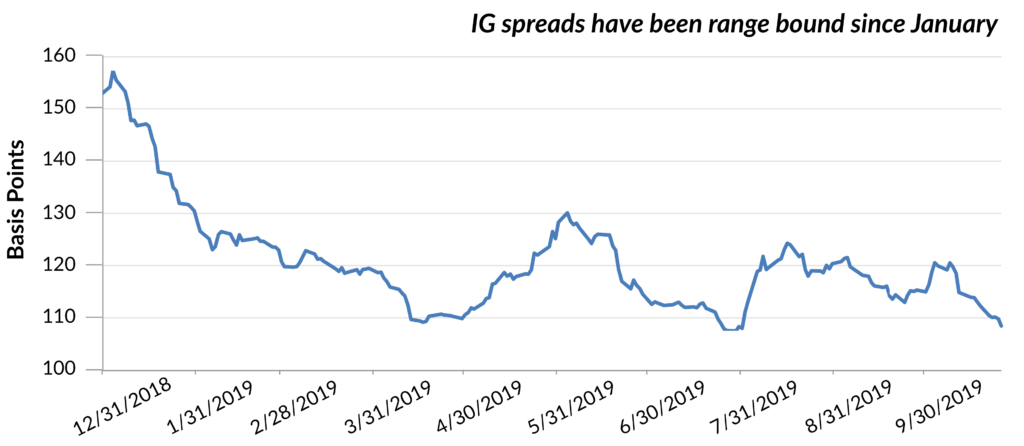

The blow-out in corporate bond pricing over the past two weeks has raised the question “are we seeing the bursting of a credit bubble?” We do not believe this is the case, but rather that we are seeing a fear driven flight to cash by investors as they digest the rapidly developing coronavirus situation and the knock-on effects on the economy. This is compounded by the inability of capital constrained Wall Street intermediaries to take large amounts of corporate inventory on balance sheet which has further widened bid/ask spreads.

The recent moves by the Fed should help, including reinstating the CP backstop facility and providing support for investment grade corporate bonds in the primary and secondary markets. The new issue market is open for investment grade credits viewed as defensive (i.e., telecom, utilities, food/beverage). Moreover, banks are being encouraged by the Fed to support consumers and business which are facing financial hardship due to COVID-19. We are seeing waves of headlines from banks of all sizes canceling their share repurchase programs and providing more support for borrowers. Private lenders are also working with customers to enhance liquidity, although transparency in that market is much more limited.

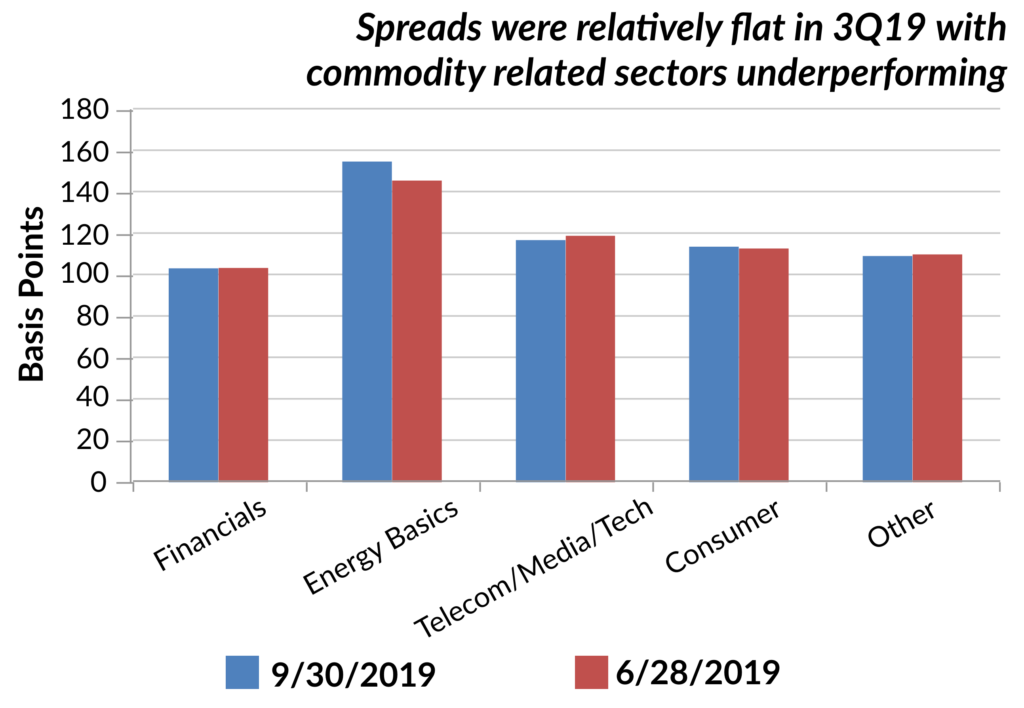

Corporate credit risk needed to reprice in the current tumultuous environment. Companies, even in defensive sectors, like telecommunications, have withdrawn guidance given the unknowns related to the virus and the changes they have to make to their business to accommodate people during this time. Equities have repriced given the uncertainty in both earnings and the cost of capital. This spread widening reflects the increased volatility and illiquidity as well as default risk as the probability of downgrades increases. For BBB-rated corporate issuers, it is more meaningful which is why the spread difference between A and BBB credits continues to widen substantially. We are starting to see the credit ratings of companies directly impacted by the pandemic downgraded or placed on negative outlook by the rating agencies (e.g., DIS). Rating agency actions are difficult to predict in these environments as they have their own internal politics and risk policies.

This environment is a reason why companies maintain liquidity facilities and manage their debt maturity schedule. At this point, we look to prior recessionary periods to guide what might happen next. We had expected spreads to widen to 200+bps if a recession became a “base case,” and now the question is related to the timing and extent of the recovery to determine the peak in spreads. We estimate that approximately 25% of the investment grade corporate market or $1.6 trillion is reflecting the increased risk of falling to high yield with about 10% trading like high yield credits today. According to Moody’s about 12-13% of BBBs were downgraded to high yield in the mid-1980 and 2002 recessions. Therefore, while spreads could continue to widen, the market is already reflecting elevated risk of downgrades to high yield. We continue to expect downgrades will occur, but the order of magnitude to approximate $500 billion.

We expect spreads and liquidity to stabilize when there is a reduction in virus related uncertainty and it is clear that the Fed programs and fiscal initiatives are working to cushion the economy. Until then, we would expect volatility to remain elevated.