A couple of weeks ago Teva held a call to announce the company’s acquisition of Auspex for about $3 billion. During the call, Teva’s CEO, Erez Vigodman, commented that “if the right large transaction shows itself, we might be engaged.” He wasn’t kidding!

This morning, Teva announced an offer for Mylan. The offer is for $82/share in cash (50%) and stock (50%), which equates to around $40 billion plus about $8.5 billion in assumed Mylan debt. Proforma 2016 leverage increases from 2.0X to 4.2X, not including synergies or asset sales. If a deal goes through, we would expect credit rating downgrades. Current ratings are A3/A-/BBB+.

Following rumors last week, Mylan publically announced the company would not be interested in selling to Teva. Complicating the situation, Mylan made a $29 billion offer for Perrigo on April 8, 2015. Strategically, we think a Teva/Mylan transaction would be positive. A transaction of this size would help to insulate Teva from the recent generic approval of its blockbuster Multiple Sclerosis drug, Capoxone (20mg dose). We believe this situation is far from over. Clearly, Mylan is not a willing participant. Laws/defense tactics in the Netherlands do not support hostile takeovers, so the transaction would most likely need to be “friendly.” Also, a few weeks ago, Mylan put a poison pill in place to make a takeover difficult. In addition, we believe there could be anti-trust issues.

There are many scenarios that could play out, including a sweetened offer from Teva. Other large pharmaceutical companies could step in and make an offer for Mylan, Perrigo, or both. Perhaps the deal falls through completely. In that case, we believe Teva hunts for another large company. Most analysts agree that a Teva/Mylan transaction makes sense over a Mylan/Perrigo merger. We think Mylan board members will be hard pressed to consider a transaction with Teva, especially if the valuation is improved.

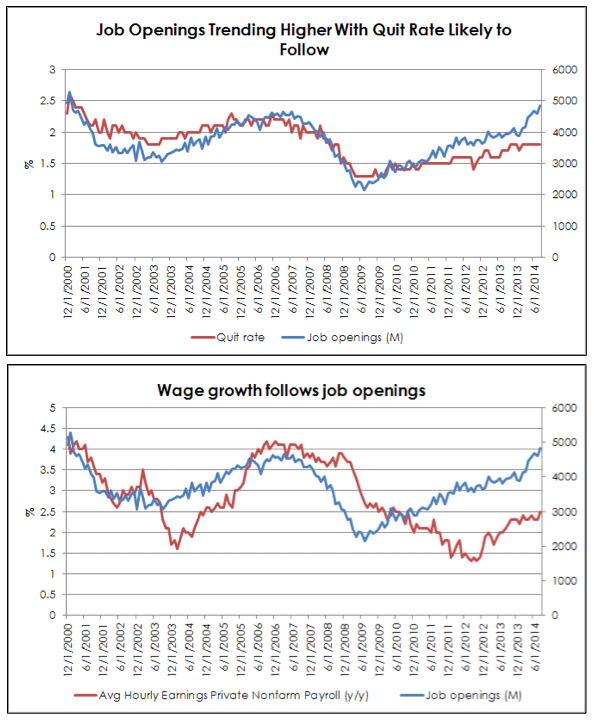

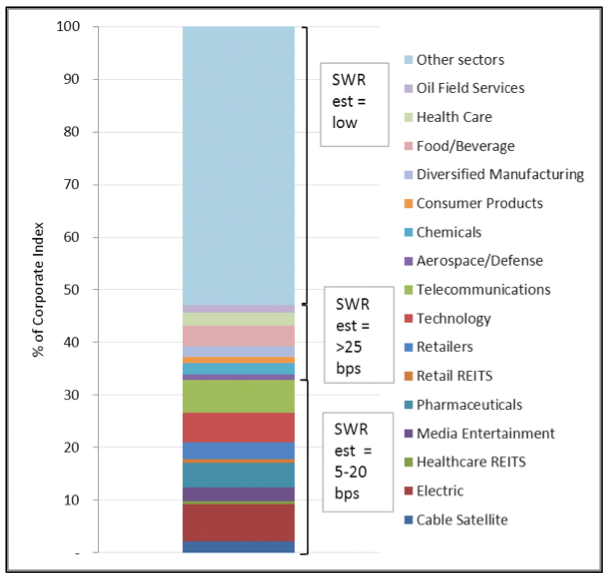

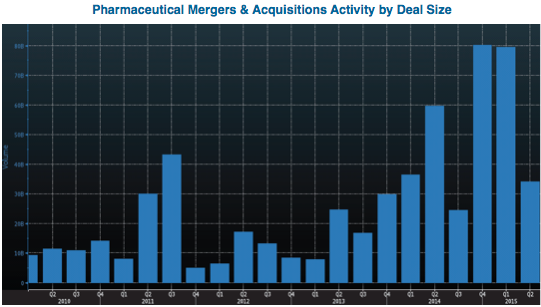

The graph below illustrates just how active mergers and acquisitions have been in the pharmaceutical space over the last two years. We expect 2015 to be another record year. Limited organic growth is being offset by acquisitions which are being financed with large cash balances and low interest rate debt. Despite the releveraging that we expect to take place, the sector has significant capacity to add debt given solid balance sheets and strong cash flow generating abilities. While this trend is typically not good for credit ratings and spreads, we believe the business risk of the sector is improving as operations become better diversified and growth prospects are improved. We continue to position portfolios to take advantage of attractively priced opportunities.

Michael J. Ashley

Principal and Senior Corporate Credit Analyst

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.