The relationship between the oil and rail industries goes back over 100 years to the days of the Standard Oil Company, run by John D. Rockefeller. Rockefeller offered the railroads a steady volume of business for a preferred rate. Soon competitors either went out of business or were acquired by Standard Oil. That close relationship deteriorated in the early 1900’s when a system of pipelines was built, which effectively eliminated the need for railroads to ship crude oil given the cost effectiveness of the pipelines. It has only been in the last couple of years that the rail industry has, once again, proved its importance to the oil industry. In this white paper, we will talk about why this has occurred and how important it is to the rail industry. We will also debate the longer term prospects for the rail industry with a focus on a couple of expected trends.

The Growth in Oil-by-Rail Has Been Incredible

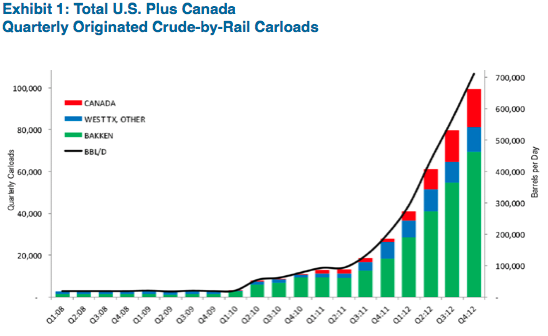

The growth in the shipment of crude oil-by-rail has boomed in the last couple of years as illustrated in Exhibit 1. In the U.S. alone, carloads have increased from 9,500 in 2008 to 233,811 in 2012.

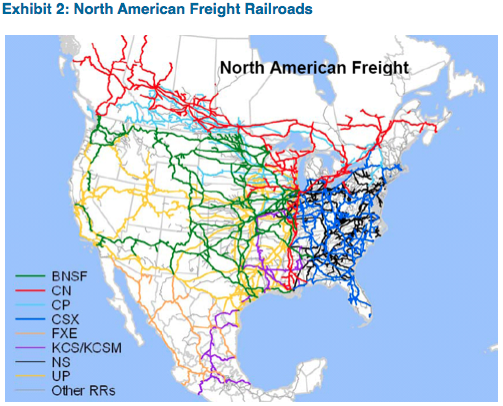

Major advancements in drilling technology, especially horizontal drilling and hydraulic fracturing, coupled with attractive commodity prices have led to rapid crude oil production in major shale formations in North America, most notably the Bakken in North Dakota. Refineries are generally located on the Coasts and in the Gulf, far away from shale plays in the middle of the continent such as the Bakken. The ramp in production has left a huge demand for transport of crude oil given the lack of pipeline infrastructure currently available to move the oil from production sites to downstream facilities. Also, we expect the oil sands in western Canada will be a huge source of production in coming years. The extensive network of track (Exhibit 2) made railroads an easy solution to this problem.

Based on current data, railroads move about 10% of the oil production in the U.S. In some areas, such as the Bakken, rails transport about two thirds of the production.

In addition to transporting oil, rails also ship large amounts of frac sand (crush resistant sand used in the hydraulic fracturing process), cement, and casing to producers of oil and natural gas. According to Burlington Northern Santa Fe, every horizontal drilling rig requires about 40 railcars of materials. Rails also transport chemicals to producers of heavy oil which combine with the oil to allow for movement through a typical pipeline.

Many Advantages When Shipping by Rail

The vast rail footprint gives shippers the ability to move oil to almost any refinery in North America. This has become very important given changing demand factors and pricing opportunities in different regions of North America. For example, a refinery on the East Coast, which historically has bought Brent crude oil barged in from the North Sea, has switched to West Texas Intermediate (WTI) oil. Even with the extra cost of transporting WTI by rail, the lower cost of WTI versus Brent still leaves the refinery at a cost advantage.

Movement of oil by rail is quick. In unit train configurations, which translate into about 72,000 barrels of crude oil, transit time is about five to six days for travel from the Bakken to the U.S. Gulf Coast compared to about 40 days for a pipeline. In addition, new infrastructure (loading and unloading terminals) for railroads can be built in a matter of months while building a pipeline can take years to complete. These factors make it much easier for the oil and gas industry to respond to production issues and price discrepancies.

Typical contracts for railroads are one to five years compared to ten to twenty year take-or-pay contracts for pipelines. This allows small to medium sized producers with a lack of financial resources to secure transportation at a reasonable cost. This also increases flexibility for producers given volatile commodity markets and offers protection against pipeline operating problems.

Product purity and efficiency is higher when using rails. Products are not mixed when moved by rail. Refiners have lower risk of contamination and are able to target certain grades of oil. In addition, diluents are not needed to transport heavy oil given the use of heated tank cars. When transporting heavy oil, pipelines require mixing with chemicals or lighter oil which can account for about 30% of the volume. This requires additional cost and time for separation at the refinery.

Rails do not have the same regulatory issues that pipelines confront. Pipelines need to cross extensive environmental hurdles when being built. In addition, there are substantial geographic obstacles when building a new pipeline especially in heavily populated, urban areas such as the East Coast.

The biggest disadvantage for rail transport of oil is the cost. The typical cost of moving crude oil from the Bakken to the Gulf Coast by rail is $14 to $19 per barrel compared to $7 to $11 per barrel using a pipeline. There are more components involved when shipping oil by rail including getting the oil to the uploading facility, transferring the oil to tank cars, leasing the cars, and off-loading the oil once the tank cars get to the refinery. In addition, with more “touches” there are more opportunities for problems to occur.

Impact on Railroad Industry is Growing

For the railroad industry, the risk/cost is minimal as the majority of capital is borne by the midstream and refining companies. Numerous participants in these sectors have been actively investing in infrastructure, including new transload facilities and tank cars. These costs come at a fraction of the cost of building a new pipeline which can run into the billions of dollars. The railroad industry needs to maintain the tracks and locomotives, which also comes at a cost; but, of course, are also used to ship other products.

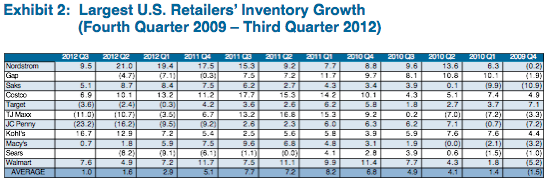

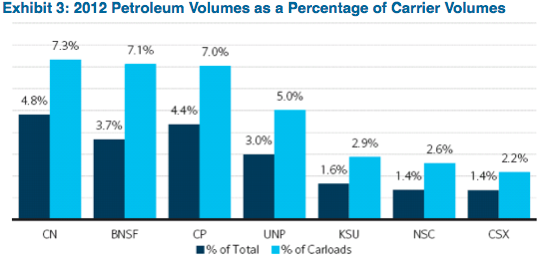

All of the large railroad companies are benefitting from the oil-by-rail craze, especially those operating in the west where the Bakken resides. Exhibit 3 is a chart of the Class 1 rails and their percentage of business coming from the transport of petroleum products which includes crude oil, gasoline, and other related products. When you exclude intermodal traffic (only look at commodity business), the impact is much more significant. For the first quarter of 2013, petroleum products accounted for 5.6% of commodity carloads compared to 1.8% for the fourth quarter of 2007.

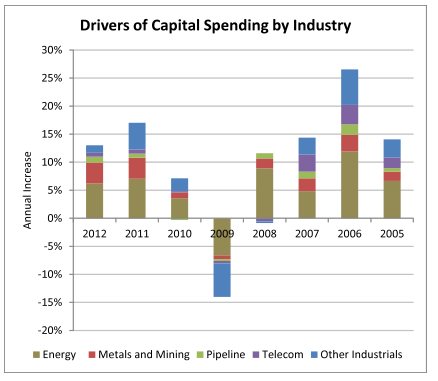

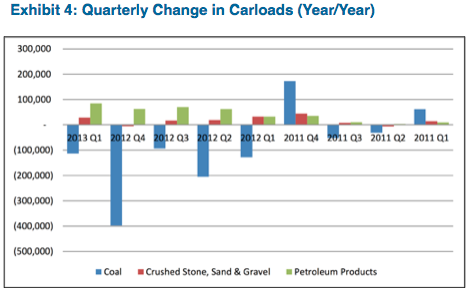

The same developments that have helped the railroad industry with the growth of oil-by-rail have hurt the rail’s coal business. The energy industry has produced a lot of natural gas which has resulted in low gas prices that are now competitive with coal prices. As a result, the railroad industry has lost a lot of carloads of coal to natural gas as electricity generation has switched to natural gas. While this continues to hurt the rails, the transport of crude-by-rail has eased the pain and in some quarters completely offsets lower coal shipments, as shown in Exhibit 4. We also account for added shipments of frac sand due to the oil-by-rail craze.

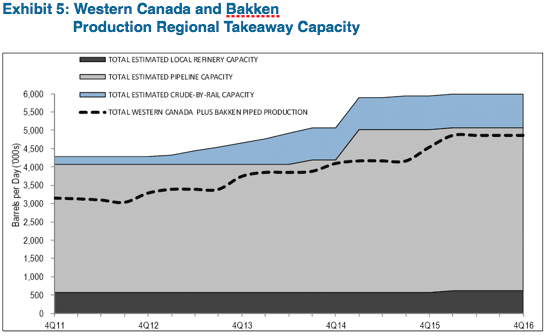

Over the next two to three years we feel confident that the oil-by-rail story will continue to be strong. As shown in Exhibit 5, pipeline capacity is expected to be tight as production growth stays strong. This leaves little room for delays or operational errors and bodes well for improving oil carloadings.

According to Raymond James, U.S. and Canada carloads of oil are expected to more than double in three years from 281,022 in 2012 to 772,527 in 2015. This would represent a much more significant piece of the pie for the rails especially given our expectation of strong margins for this business. There are several things that could slow down this growth including limited tank car availability, less than expected loading and unloading capacity, and environmental concerns. Bigger picture, we would expect that volumes of oil shipped by rail would fall if oil prices were to drop significantly from current levels as producers might cut production.

Longer Term Impact Vary

This oil-by-rail trend is very fluid driven by a number of different factors. Longer term, we do not expect rails to replace pipelines but to serve more as a complement. The pipelines have an unbeatable cost structure which will help them regain market share once the system is up and running. We believe that the rail industry has proven itself in a short amount of time as a legitimate source of crude oil transportation. The rails offer a good source of diversification for producers and users of crude oil. The large amount of investment in the oil-by-rail platform by the refining and midstream industries makes us feel comfortable that this is not just a passing fad. In some geographic areas (East Coast) we expect the oil-by-rail story to remain strong and for some products (Alberta Oil Sands) we believe the competition with pipelines will still be compelling.

One area to watch longer term is movement of oil-by-rail to the coasts. We are already seeing this ramp up, especially in the East, as pipeline capacity is low and expected to be limited in the future. Coastal refineries are taking advantage of lower cost shale oil while displacing more expensive foreign waterborne crude imports. In addition, the oil shipped from the Bakken is higher quality oil which is more easily processed and more environmentally friendly, key demands for these particular refineries. New pipeline capacity and changing pricing dynamics will have a lot to do with the direction of oil transport across North America. As new pipelines are constructed on route to the Gulf Coast, we believe that a glut of oil will hit that will discount the local oil price of Light Louisiana Sweet (LLS). Producers of oil will be incentivized to ship oil to the coasts where the benchmark is Brent, which we expect will be significantly higher than LLS.

As mentioned before, we expect production of Canadian heavy oil to be very strong in the near to intermediate term. We expect that a lot of that oil will end up in the Gulf Coast. That grade of oil works well with the more advanced refineries in that region. New pipelines running through the middle of the United States will facilitate the transport of that oil. In addition, oil imported from Mexico and Venezuela continues to be on the decline which will free up refining capacity. There are a couple of extra costs associated with the shipment of this heavy oil via pipeline. First, is the volume penalty. A chemical, called diluent, has to be added to this heavy oil to enable movement through a pipeline. For example, 40 barrels of diluent would need to be added to 100 barrels of heavy oil. So transportation costs are based on 140 barrels not 100 barrels raising costs by 40%. The other major cost is getting the actual diluent, which many producers in Canada may have to import from the southern U.S. Therefore, producers are effectively shipping 180 barrels which raises the cost by a total of 80%. This makes the shipment of this heavy Canadian oil by rail much more cost competitive as the rail industry uses heated tank cars which do not require the addition of a diluent.

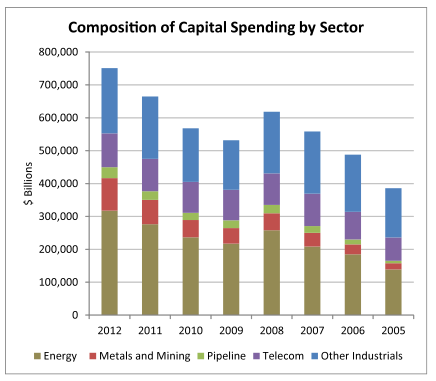

Oil-By-Rail Has Neutral to Positive Implications for Our Credit Outlook

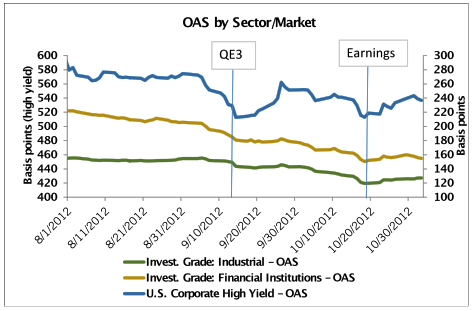

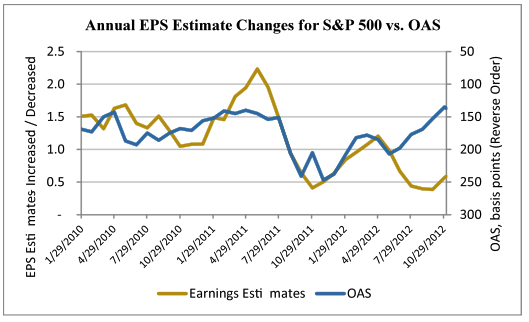

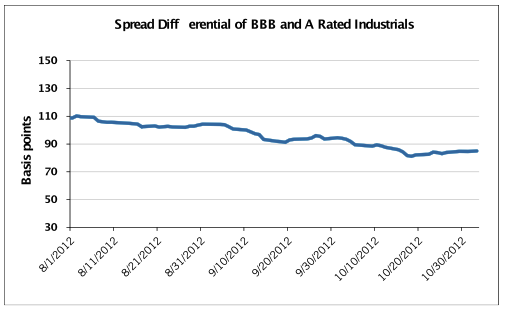

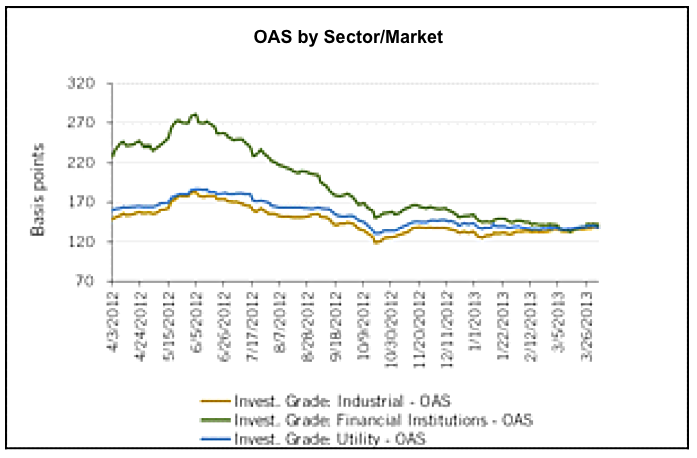

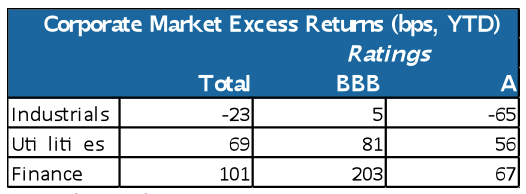

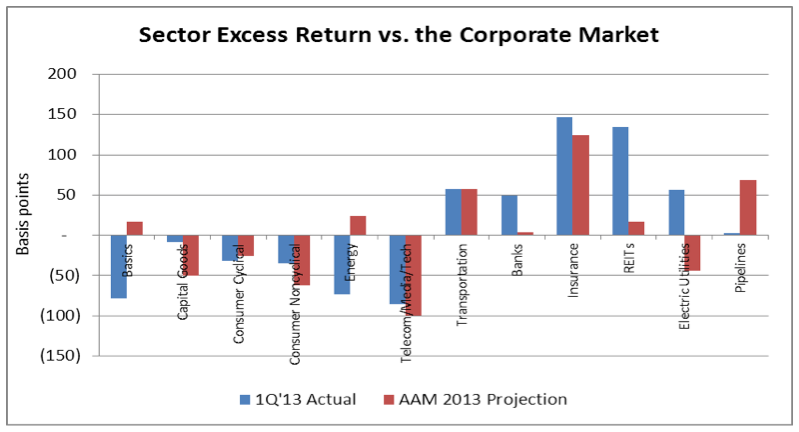

From a credit perspective, we continue to be positive on the railroad industry. The rails have grown into a better diversified and more efficient mode of transportation. The industry has gained market share and profits from pricing opportunities given the cost benefit advantage enjoyed by shippers. We expect volumes to follow U.S. GDP as the rail industry ships most of the everyday items used by the typical consumer. While we don’t believe that the oil-by-rail opportunity is a game changer, we think it can only help the bottom line for all of the class 1 rails. As explained above, the boost to the railroad’s oil business comes at a good time given disappointing results from coal. In the short to intermediate term, we expect the oil business for rails to be a much bigger part of the overall business than ever before assuming the price of oil stays relatively high and production remains robust. In terms of credit ratings, we expect the rail industry to migrate into the high-triple-B to low-single-A category. The OAS of the sector is almost on top of the broader set of industrials. We have assigned an attractive relative value recommendation to the rail industry given our expectation of fundamental improvements and spreads that should trade significantly through industrials.

Michael J. Ashley

Vice President, Corporate Credit

For more information, contact:

Colin T. Dowdall, CFA

Director of Marketing and Business Development

colin.dowdall@aamcompany.com

1 “Moving Crude Petroleum by Rail,” Association of American Railroads,(December 2012):1, accessed May 8, 2013, https://www.aar.org/keyissues/Documents/Background-Papers/Moving%20Crude%20Petroleum%20by%20Rail%202012-12-10.pdf

2 “Moving Crude Petroleum by Rail,” 4.

3 Justin Yagerman, Robert Salman, CFA, and Joshua Katzeft, “Takeaways from Houston Crude By Rail Summit,” Deutsche Bank Markets Research: Crude by Rail Update (March 4, 2013): 2.

4 Steven P. Hansen, CMA, CFA, Patrick Tyler Brown CFA, Arthur W. Hatfield, CFA, et al., “Crude Oil Comes of Age: Walk, Run, Sprint: Positioning for the Marathon,” Raymond James Global Research: Transportation and Energy Industry Report (March 25, 2013): 5.

5 Steven P. Hansen, CMA, CFA, Patrick Tyler Brown CFA, Arthur W. Hatfield, CFA, et al., “Crude Oil Comes of Age: Walk, Run, Sprint: Positioning for the Marathon,” 5.

6 Steven P. Hansen, CMA, CFA, Patrick Tyler Brown CFA, Arthur W. Hatfield, CFA, et al., ., “Crude Oil Comes of Age: Walk, Run, Sprint: Positioning for the Marathon,” 6.

7 Steven P. Hansen, CMA, CFA, Patrick Tyler Brown CFA, Arthur W. Hatfield, CFA, et al., “Crude Oil Comes of Age: Walk, Run, Sprint: Positioning for the Marathon,” 31.

8 Steven P. Hansen, CMA, CFA, Patrick Tyler Brown CFA, Arthur W. Hatfield, CFA, et al., “Crude Oil Comes of Age: Walk, Run, Sprint: Positioning for the Marathon,” 14.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.

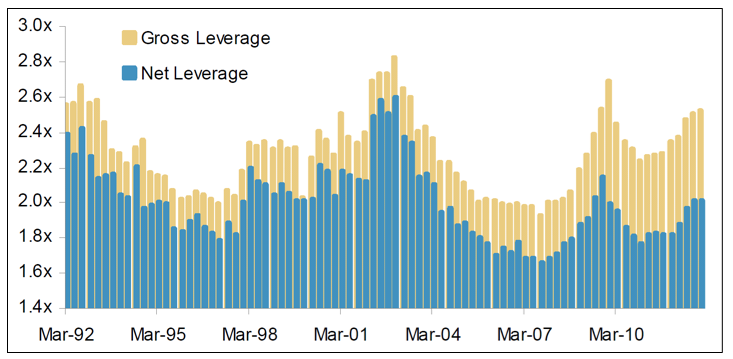

Notes: Gross leverage is Total Debt/ LTM EBITDA. Net leverage is (Total Debt Less Cash/EBITDA.

Notes: Gross leverage is Total Debt/ LTM EBITDA. Net leverage is (Total Debt Less Cash/EBITDA.