What does a Leave vote likely mean?

• Considerable volatility in risk assets globally

• Likely recession in the UK

• Actual transition out of the EU taking 5 to 10 years

As the June 23rd UK referendum on whether to leave the EU (colloquially termed Brexit) approaches, we thought it worthwhile to address recurring client questions about the implications of a Leave vote.

At the time of publication, multiple polls indicate the Leave camp has pulled ahead of the Remain camp. We believe that a Leave vote would be more consequential in the near-term, so we wanted to examine potential effects of the same.

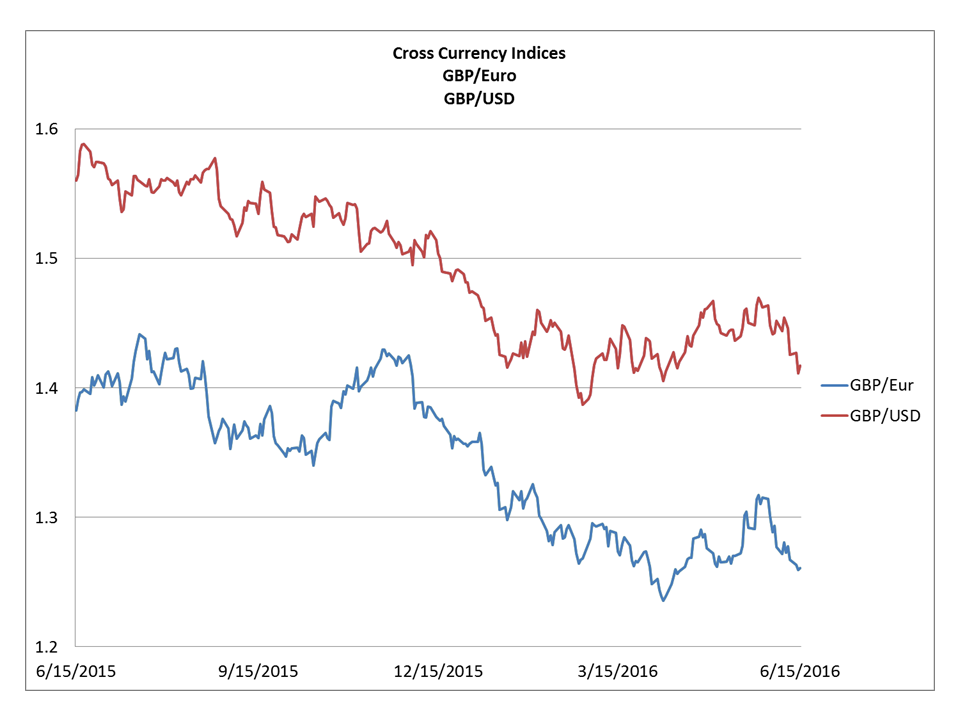

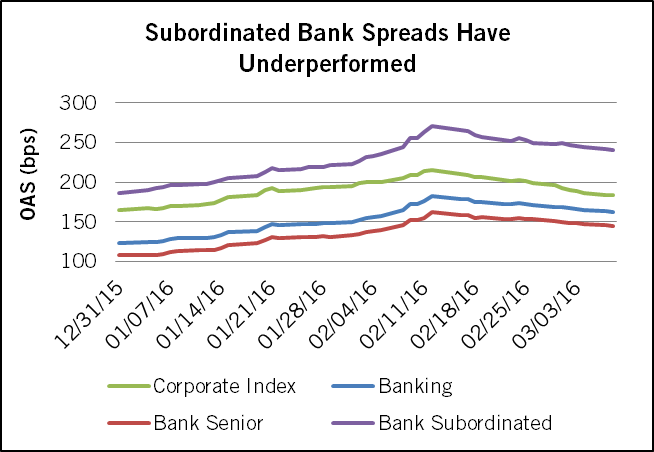

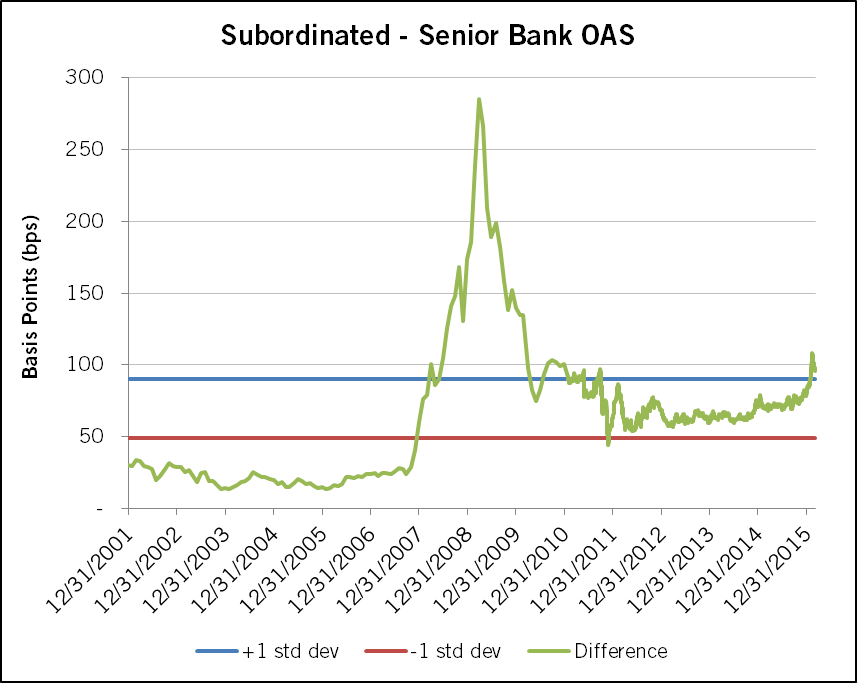

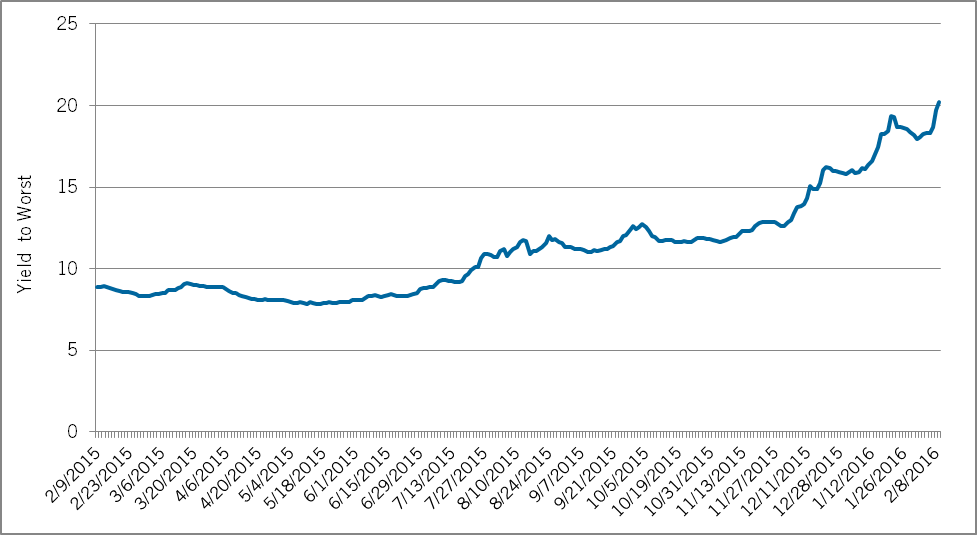

The immediate impact would likely be a continuation of recent trends in financial markets; the Pound has been weakening since May and in the past week GBP risk assets have been selling off. Interestingly, the UK Gilt market has rallied over the past two months and has outperformed both UST and Bunds market, despite some speculation that it would underperform relative to other developed sovereign curves. We would expect considerable volatility in risk assets globally and particularly in the UK and EU in the event of a Leave vote. There is potential for disruption in the money markets as well, with a potential for a buyers’ strike in relation to UK and European banks, but many of the liquidity programs put in place by the BOE, ECB and the Fed in response to the 2011/12 Eurozone crisis remain in place, so we remain sanguine about systemic liquidity.

In the intermediate-term, the bigger concern is macro-political. The most likely outcome of a Leave vote would be a UK recession, as continued GBP weakening and re-negotiated trade/tariff treaties with the EU put pressure on an already large current account deficit. Business sentiment surveys have already begun to highlight unwillingness by UK businesses to engage in major capital investments until the outcome of the referendum is known. While the BOE MPC would likely provide systemic liquidity support, we are uncertain of ability/willingness to support the UK economy via monetary policy, particularly if a weakening GBP aggravated already rising inflation. Given the size of its economy, a UK recession will likely affect other countries within and outside of the EU.

Source: Bloomberg

Following a Leave vote, there would then be a two year period to negotiate a managed exit from the EU following a formal submission of resignation by the UK. Importantly, trade/tariff agreements, visa/border control, environmental treaties and financial services regulations would all need to be recast from the EU model to a bilateral agreement between the EU and an independent UK. The WTO framework, as well as the treaties that govern the relationship between non-EU members Switzerland and Norway provides some framework for what these treaties could look like. However, there may be meaningful political resistance to providing any sort of preferential treatment to the UK by the remaining EU members (as well as an incentive to make the UK “suffer the consequences” as a warning to other EU members that are considering an exit). Additionally, Norway and Switzerland’s tight relationship to the EU are based on their acceptance of most of the treaties that form the basis for the EU (financial regulations/EU judicial review/migration), which are precisely the biggest points of contention for the Leave supporters in the UK. Assuming a successful exit negotiation over two years, the actual transition out of the EU could take 5-10 year,

Domestically, the failure of the Remain campaign would likely result in a leadership fight in the Tory Party, and potentially a general election if the government falls. In addition, a UK departure from the EU would likely precipitate another Scottish referendum to remain in the EU. And finally within the EU, the success of a Leave vote might bolster the prospects of other EU skeptic political movements (National Front in France/Podemos in Spain).

Banks/Finance would likely be the most impacted sector in the wake of a Leave vote. Global banks would have to decide whether to retain their London offices as their European capital markets headquarters or shift to an EU domicile (Frankfurt/Paris/Amsterdam). RBS would likely re-domicile to London (UK Treasury still controls). HSBC likely faces the largest questions about restructuring/retaining its UK business and domiciling its capital markets businesses. Separate from the banking sector, UK domiciled corporates may come under pressure to the extent that they have significant non-GBP liabilities or cost base, and UK listed corporations may be subject to increased M&A on the basis of lower GBP and equity valuations.

Finally, consideration of a Remain vote should not be disregarded. Polling suggests that the outcome is likely to be close, and a narrow Remain vote suggests that the Tory party leadership would be in a weakened position even though they have nominally succeeded. The UK, which has always held itself at a distance from the EU, has clearly engendered ill will in the rest of the EU members in the run-up to the referendum (as evidenced by increasingly sharp public comments from member nations). As a result, even in the event of a Remain vote, we see the stability of the EU shaken.

Written by:

Sebastian Bacchus, CFA

Senior Analyst, Corporate Credit