Elevated Selling activity Pressures Muni Relative Valuations to Weaker Levels

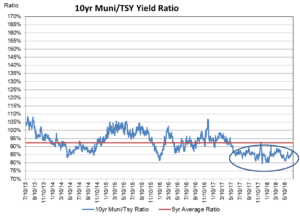

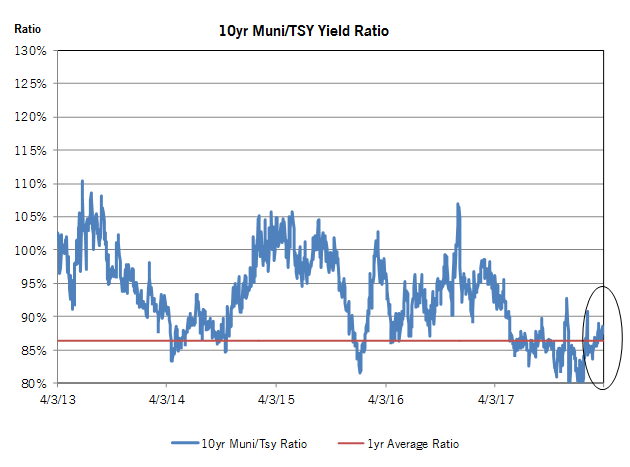

After a sloppy finish to the first quarter, tax-exempt municipals performed relatively well for most of the second quarter. First quarter performance was hampered by a very elevated level of bid list activity that was primarily tied to the selling from banks. Data provided by Bloomberg on the aggregate par amount of bid list activity reveals that selling flows peaked at the end of the quarter, with a 10-day average in excess of $1 Billion per day. That was 60% above the 3 year average. The selling pressure resulted in 10 year nominal spread relationships between munis and Treasuries to widen by 23 basis points (bps) between Jan 22nd and the end of the quarter.

Since that time, bid list activity has moderated quite a bit, with the 10-day average falling by 35% to $670 million per day on June 5th. Although new issuance for the 2nd quarter was up a significant 48% relative to the first quarter, the reduction in selling activity, combined with a firm buying tone from the retail or household investor segment, was enough to generate a substantial amount of outperformance relative to taxable alternatives. Nominal spreads to Treasuries on a maturity-matched basis tightened by 28, 18 and 17 bps in 5, 10 and 20 year maturities, respectively. This sizable contraction in yield spread levels resulted in tax-equivalent yield levels for property and casualty companies to reach 2018 spread lows of -89, -103 and -84bps versus ‘A’-rated corporates as of June 5th.

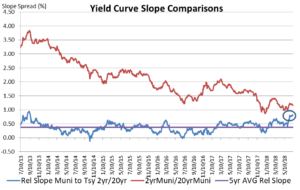

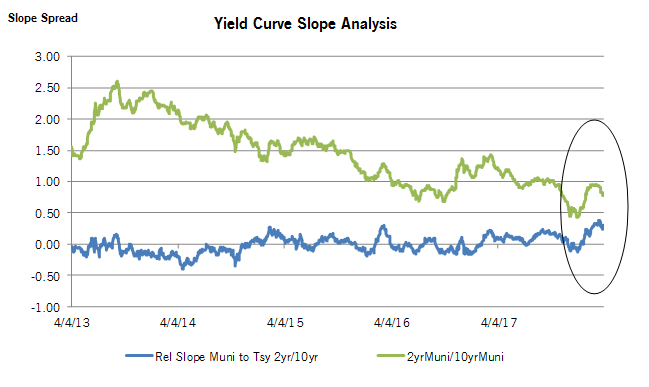

These new and very unattractive relative valuation levels seemingly sparked another round of selling for the balance of the quarter. From June 6th to June 27th, aggregate daily bid list activity surged 45% to $970 million per day, with the lion’s share of this activity concentrated in the 1 to 10yr maturity range. Broker/dealer inventory levels, as reported by the Federal Reserve, show that inventory levels of municipal fixed rate bonds with a maturity between 1 and 10yrs spiked by 60% between May 30th and June 27th. The net result of this selling pressure and the surge in inventory levels helped produce a significant steepening bias to the muni yield curve on both an absolute and relative basis. The slope of the muni curve between 2 and 30yrs moved steeper by 22bps, and relative to the Treasury curve, the muni curve steepened by 41bps. As we enter the 3rd quarter, the shape of the muni curve looks very attractive. The relative slope or the excess steepness of the muni term structure versus the Treasury curve from 2 to 30 yrs now stands at 84 bps or 2.3 standard deviations (z-score) steep relative to the 1 yr average.

In looking at our outlook for the 3rd quarter, we are looking for an improved tone over the next two to three months, based in large part on very favorable technicals. The market is expected to see a 22% drop in new issue supply relative to the 2nd quarter’s $96 Billion. Additionally, the sector will also absorb the strongest flows of the year from coupons/calls/maturities. When incorporating the surge in these reinvestment flows, net supply during the quarter is expected to fall from negative $7.8 Billion in the 2nd quarter to negative $52 Billion. We expect that this improved technical condition will result in better relative performance during the quarter, which should also lead to a flatter yield curve and tighter tax-equivalent yield spreads relative to taxable alternatives. For our property and casualty company portfolios, our goal will be to continue to look at opportunities to take advantage of any significant outperformance and rotate out of the sector and into taxable sectors with a much better tax-adjusted return profile.

_____________________________________________________________________________________________________________________________________________

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. Registration does not imply a certain level of skill or training. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns. This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.