[toc]

This November has been full of surprises. The Cubs won the World Series and Trump won the White House. As we head into the holiday season, I can’t say that either will be a major driver of retail sales, but I can say that there will be Cub’s jerseys under the tree for our kids this year.

This is always a critical time of year for retailers because they realize up to 40% of their annual revenues during the holiday season. Based on adjusted figures from the U.S. Census Bureau, retail sales (excluding auto and gas) for holiday 2015 were up 3.0%. We believe that sales for this year will be stronger, up 3.25% to 3 .75%. The following report explores some of the key drivers of our analysis.

The Consumer Is Solid

The most important driver of retail sales is the strength of consumer’s confidence to spend money. The following table summarizes our analysis of nine factors that contribute to that level of confidence measured year over year.

Exhibit 1: Factors Affecting Consumer Confidence

| Factors | Position | Explanation |

| Employment | Neutral/Negative | 5% or below for the last 12 months. Payrolls bounced from May, YTD down 18%. |

| Consumer Confidence | Neutral | Michigan and Conf. board look healthy. Conf. above 100 last 2/3 months. MI may be weakening. |

| Income | Neutral | Adjusted income continues to grow. Less growth so far this year (YTD AVG 2.7% vs 2015=3.6%). |

| Savings Rate | Neutral/Positive | Savings rate trend slowly moving down vs moving up last year. Below 6.0% for the last 5 months. |

| Debt Position | Neutral/Negative | Credit card debt is climbing. Grew 6.2% in Aug (5yr high). Debt service ratio stabilized. |

| Household Wealth | Neutral | Net worth improved 2Q’16. Y/Y growth loosing steam. Real estate continues to be the main driver. |

| Housing | Positive | Affordability is trending up last 3 months. Price Y/Y growth is up YTD. Volumes are up especially new. |

| Gas Prices | Neutral | Moving off the lows of FEB. Around the same price this time last year. |

| Inflation | Neutral | CPI index is slowly climbing. Y/Y growth has averaged around 1% YTD. |

The overall picture resembles last year’s as housing prices and sales continue to improve. Home-related retailers Home Depot and Lowe’s experienced strong and consistent same store sales, reflecting home owners’ comfort with their equity position as well as the transition from “rent” to “buy”. While the savings rate has trended down, credit card debt continues to grow steadily, reflecting improved consumer confidence. This seems to be a fairly healthy trend, however we believe it warrants continued monitoring due to the potential for poor credit card performance which could signal a delay in spending.

Employment trends may be the most important determining factor for consumer health. We continue to see a steady to improving unemployment number while maintaining sensitivity to payroll numbers given earlier published data as well as the general trend versus last year.

The Election Is Over but will Consumers Spend?

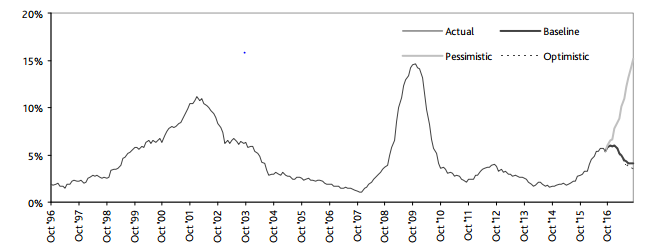

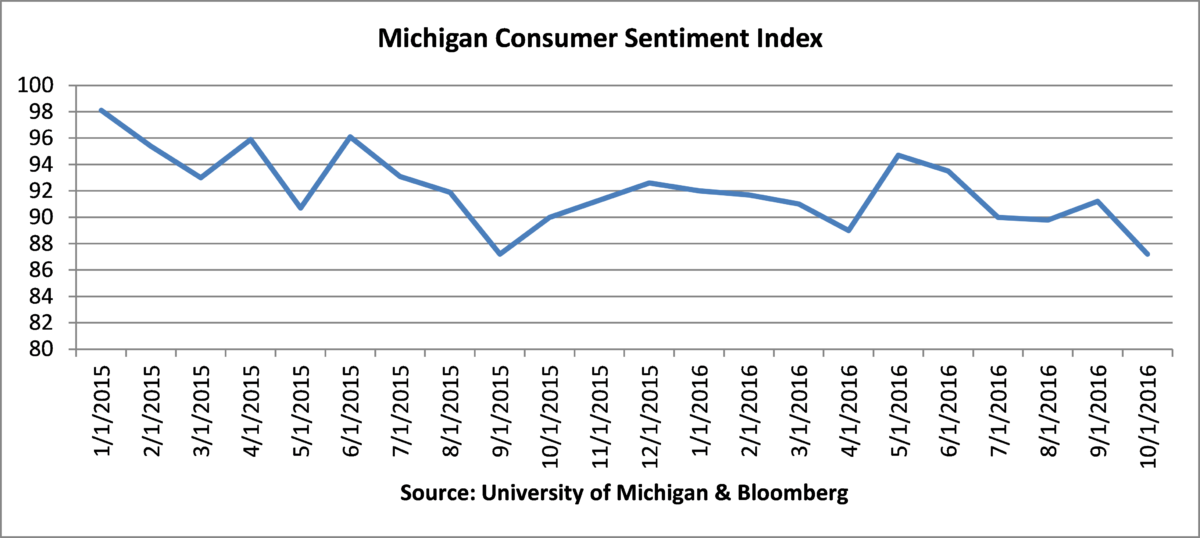

This presidential race has been one of the most interesting and contentious in recent history. Prior to November 8, various sources reported consumers were putting off spending because of the uncertainty associated with the election. In a poll conducted by the National Retail Federation in mid-October, more than a quarter of consumers said the election will impact their spending plans for the holidays. 43% said they will be more cautious with their spending due to the uncertainty of the election cycle. The University of Michigan Consumer Sentiment Index experienced a significant move lower in October of this year. As shown below, October was the weakest reading we have seen since September of last year. We believe this has to do, in part, with the election.

Exhibit 2: Consumer Sentiment Index

Questions remain even now that our 45th President has been elected. Some degree of personal tax cuts coupled with an attempt to stem escalating healthcare costs will benefit a large percentage of consumers. And, the expectation of a thicker wallet in coming years may boost consumers confidence this holiday season.

Auto Sales Will Not Slow Spending

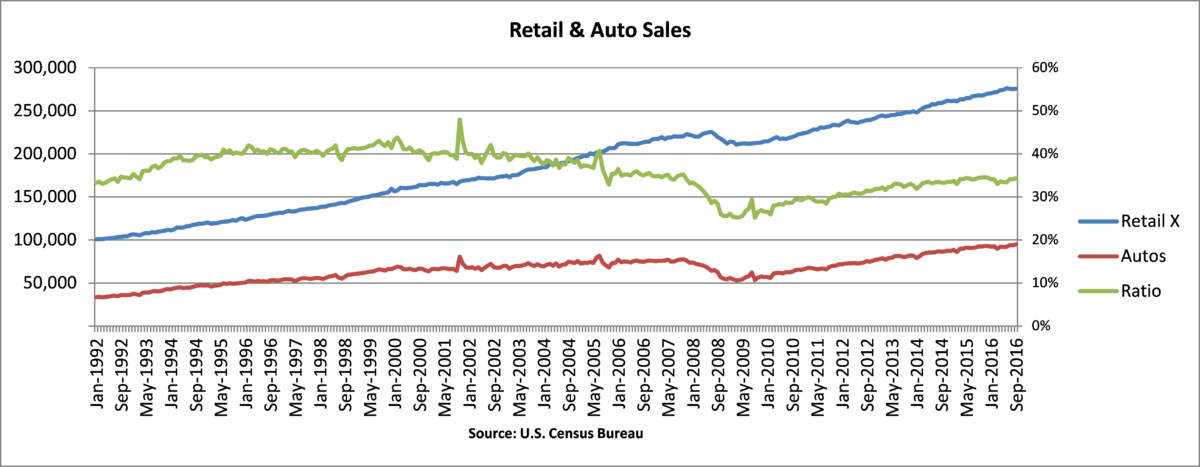

A significant amount of consumer spending this year has been on big ticket items, including new cars and home appliances. The fear is that spending on these items could negatively impact holiday season shopping for various discretionary purchases. According to the Advance Monthly Trade Retail Report issued by the U.S. Census Bureau, motor vehicle spending accounts for about 20% of total retail spending. Year to date through September, spending on this category was up 2.8%. According to Wards Automotive Group, auto sales of 14.4 million cars for 2016 (through October) are about unchanged versus last year. Several sector analysts feel that auto sales are close to peak levels.

We took a closer look at the history of auto sales and what impact they might have on overall consumer spending. To do this we used data from the monthly retail trade data completed by the U.S. Census Bureau and compared the Motor Vehicle & Parts Dealers portion of spending to retail spending. The result is graphed below. What we observed is that retail spending (not including auto) is growing faster than auto spending. The ratio of auto spending to retail spending has ranged between 33%-35% for the last 31 months. Based on this information it appears there is still opportunity for auto sales to grow without impacting retail spending and motor vehicle spending may even go down if we have in fact reached peak auto sales.

Exhibit 3: Retail vs. Auto Sales

Statistical Analysis – Model Predicts Brighter Holiday

A review of data from the last twenty three years reveals a significant correlation (81%) between “Back to School” retail sales measured in August and September and “Holiday” sales as measured in November and December. To model the 2016 trend we used the U.S. Census Bureau’s monthly retail trade data which includes a variety of retail businesses (excluding motor vehicle and parts dealers and gasoline stations; sales in those segments have been more heavily impacted by factors outside the control of consumers).

Our regression model predicts “Holiday” sales of 3.11% when using the 2.89% actual for “Back to School” sales in 2016. Comparatively, 2015 “Back to School” sales of 3.37% led to actual “Holiday” sales of 3.00%. If the model is correct, “Holiday” sales of 3.11% in 2016 would be below the 23 year average of 4.2%.

Seasonal Hiring Looks Similar to Last Year

The National Retail Federation predicts that between 640,000 and 690,000 seasonal workers will be hired during this holiday season (NRF Website).To give context, this is compared to 675,300 hired last year and 697,500 hired in 2014 (NRF website). Companies, including Macy’s, Kohl’s, and Target seem to be adding holiday staff in a somewhat conservative manner as compared to last year. Meanwhile, e-commerce leader Amazon is hiring 120,000 seasonal employees, up 20% from last year. Shipping giants FedEx and UPS are predicting a similar holiday season to 2015. UPS expects to complete 700 million deliveries worldwide, only 100 million more than last year, between Thanksgiving and New Years (3Q Earnings Transcript). Based on this data, we believe retailers are expecting a similar holiday season vs. last year.

Online Shopping Remains Strong – No Slowdown in Sight

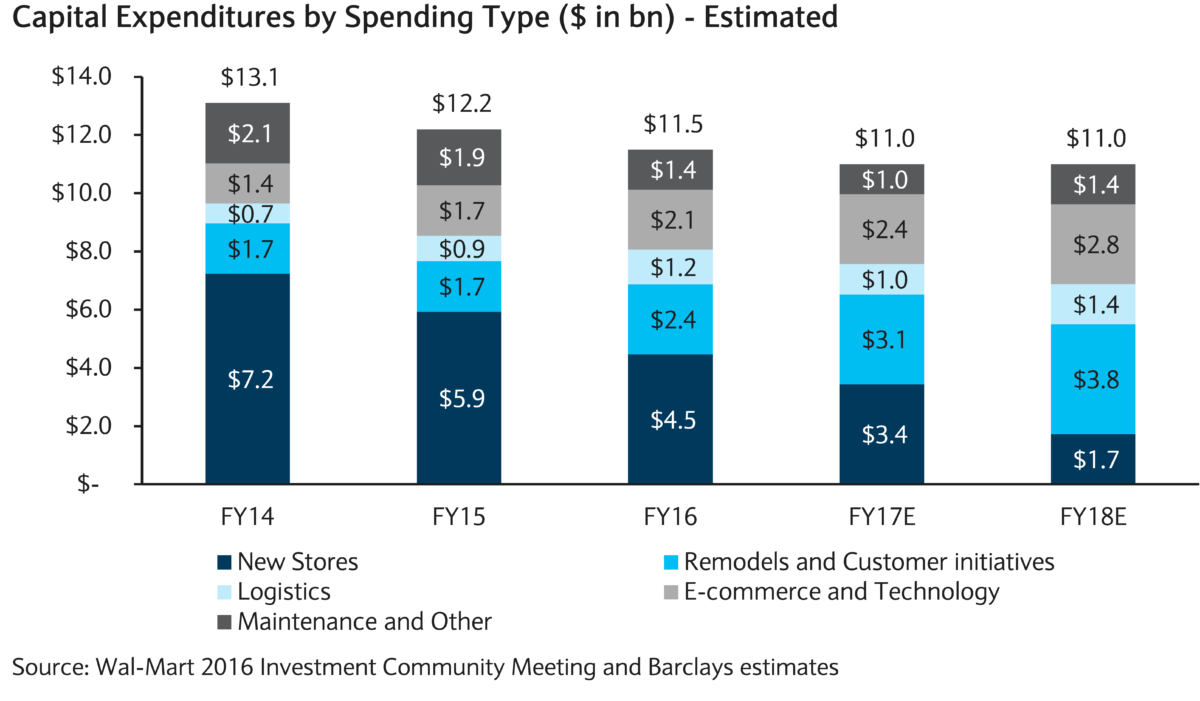

Online retail sales continue to gather momentum, but even with the incredible advancements in this area, most shoppers still want to visit an actual store. Some items simply need to be touched or tried on before being purchased. In addition, holiday shopping can be a very sentimental experience, something that the internet can’t mimic with the click of a button as compared to physical stores. Having said that, most of the major department stores are significantly investing in their e-commerce strategy. Below is a graph that segments an estimate of spending by Wal-Mart through 2018. There has been a clear trend to spend less on new stores and more on e-commerce and remodels.

Exhibit 4: Capital Expenditures by Spending Type

According to the U.S. Census Bureau, E-commerce now accounts for 10.1% of total retail sales. We believe that figure is closer to 17% if you take into account the segments that are not currently at risk of an internet presence such as auto sales, restaurant/bar sales, and gas station sales. YTD growth for the online category was 10.8% through September easily beating the next best category, Personal Care which was up 7.1%. According to the National Retail Federation (NRF), the average shopper said that 56.5% of their shopping will be completed online, up from under 50% last year. In addition, mobile devices are now much easier to use and are playing a bigger role in the consumer shopping experience.

E-commerce has made everything about shopping easier and more convenient, including researching a product, finding the best price, and determining the best way to take delivery. Retailers are expanding their online assortments and offering an increasingly more efficient and inexpensive (free) delivery system. In addition, retailers are becoming more creative about how to use their online platform. For example, Foot Locker launched a new app that allows users to sign up for newly released shoes through a lottery system. The customer avoids long lines and frustration while staying in touch with the latest product offerings. We expect that this kind of positive experience goes a long way in keeping customers interested and more likely to follow through on the purchase.

Trade Group Surveys Expect Higher Growth in 2016

We have included a summary of three trade groups which publish their views on upcoming holiday sales. While each of them uses a different data set to support their expectations, the more important aspect is the change in growth year over year. In addition, we thought it would be interesting to look at how accurate each group has been over the past three years. Based on this data, we wouldn’t favor any one of these trade group’s prediction over the other.

Exhibit 5: Holiday Sales Predictions

| Forecast | Actual | Forecast | Actual | Forecast | Actual | Forecast | |

| 2016 | 2015 | 2015 | 2014 | 2014 | 2013 | 2013 | |

| Deloitte | 3.6 – 4.0 | 3.6 | 3.75 | 5.2 | 4.25 | 2.8 | 4.25 |

| National Retail Federation | 3.6 | 3.2 | 3.7 | 4.1 | 4.1 | 3.1 | 3.9 |

| Intl. Council of Shopping Center | 3.3 | 2.2 | 3.3 | 3.6 | 4.0 | 3.4 | 3.4 |

According to National Retail Federation (NRF), shoppers will spend an average of $935.58 in 2016. When compared to the last 12 years, 2016 will be the second highest, the peak remaining $952.58 in 2015. About 63% of the total will go towards gifts with the balance to be spent on holiday related items including food and decorations. Shoppers plan to spend most of their time in department stores, online, and in discount stores. The most popular present is expected to be gift cards followed by clothing.

Weather & Calendar Give the Edge

Weather and the changing calendar are always important factors for holiday spending. According to Weather Trends International (WTI), this holiday season is expected to be much colder while precipitation is predicted to be less than last year but still above normal. The ideal weather for department stores is cold and dry. Retailers want shoppers to buy winter products but not be turned away by heavy snow.

The days between Thanksgiving and Christmas are key shopping days. This year, those days total 30 (26 is the minimum, 32 is the maximum) versus 28 last year. In addition, there are nine total weekend days to shop, one more than last year and Christmas and New Years both fall on a Sunday. This makes a strong “eve” shopping day more likely and the day after a legitimate shopping day given that most business offices are closed the Monday following the holiday.

Conclusion

We are optimistic about 2016 holiday spending because just about every variable is lining up for a better year than 2015.

- The consumer continues to be in good shape as unemployment inches lower and wages grow.

- We are not concerned that big ticket purchases, including autos, will alter overall behavior.

- Online purchases continue to provide a headwind for overall sales.

- Seasonal hiring patterns appear neutral while weather/calendar may create a slight edge to final results.

- This holiday season post-election consumer sentiment is the biggest wildcard.

On Macy’s 3Q earnings call on 11/10/16, an analyst asked CFO Karen Hoguet what her thoughts were now that the election is over. Her response:

“I have no clue. I have no clue. We’ll all watch together.”

Written by:

Mike Ashley

Michael J. Ashley is a Principal and Corporate Credit Senior Analyst at AAM with 19 years of investment experience. Prior to joining AAM, Mike worked at Northern Trust Global Investments with responsibility for following investment grade industrials including credits in the basics, energy, consumer products, media, and retail sectors. Mike earned a BA from the University of Iowa in Management Information Systems and an MBA from DePaul University in Finance.

For more information about AAM or any of the information in the Retail Outlook, please contact:

Colin T. Dowdall, CFA, Director of Marketing and Business Development

colin.dowdall@aamcompany.com

John J. Olvany, Vice President of Business Development

john.olvany@aamcompany.com

Neelm Hameer, Vice President of Business Development

neelm.hameer@aamcompany.com

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.