Thanksgiving is here and Christmas is right around the corner. This is a very important time of year for the retailers as up to 40% of annual revenues are realized during the holiday season. The retail industry has performed well this year despite concerns stemming from the fiscal cliff situation and continued low growth in the U.S. Various analysts and trade organizations predict that holiday sales will be up anywhere from 2% to 4%. We believe that sales for this year will come in at the upper end of that range. The following article explores some of the more important drivers of our analysis.

The Consumer’s Economic Position Is Improving but Big Issues Remain

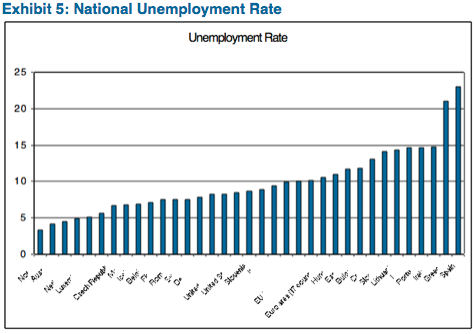

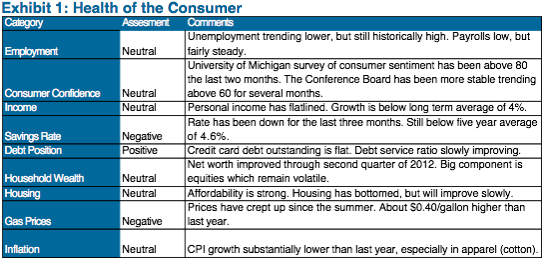

The most important driver of retail sales is linked to the strength of the consumer. The following table (Exhibit 1) summarizes our analysis of nine different factors which illustrate the typical consumer’s economic position. We make an assessment of the individual factors based on a comparison to last year and to a longer term history.

These factors are more positive than last year. We moved from “negative” to “neutral” positions in consumer confidence, housing, and the inflation categories. Looking ahead to developments in Washington, DC, the prospect of lower income from the expiration of the payroll tax cut and jobless benefits are key issues on the minds of consumers. A resolution, in the near term, could impact retail sales. In addition, GDP in the U.S. has tapered off throughout the year and is not expected to be significantly better in 2013.

Statistical Analysis – Purely Quantitative But Continues to Support the Case

Looking back at data over the last twenty years reveals a significant correlation (73%) between “Back to School” retail sales (August and September) and “Holiday” sales (November and December). To complete this analysis, we used the Bloomberg Same Store Sales Composite Index which includes a variety of retailers in the department store, discounter, and specialty subsectors. The model predicts “Holiday” sales of 4.3% when using 5.2% for the “Back to School” sales observed in 2012. This would be significantly better than the average, which was 3.0% over those twenty years.

Seasonal Hiring Resembles Last Year

The National Retail Federation predicts that between 585,000 and 626,000 seasonal workers will be hired this year. This compares to 607,500 last year and is well below the pre-recession numbers which were closing in on 700,000. According to another survey, 39% of employees plan to make some of their seasonal hiring permanent which is up from 30% last year.

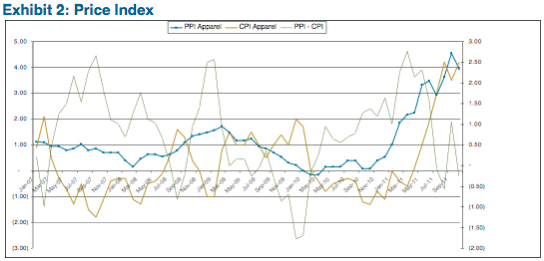

Better Inventory and Margins Create Pricing Flexibility

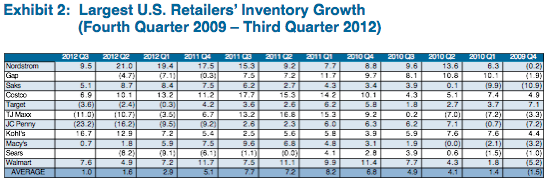

Consumer shopping patterns are not expected to be significantly different this year. Consumers are focused on finding good values/deals which will result in significant promotion activities from stores. We expect a similar buzz around “door busters” and late night/early morning shopping. This year, we believe that retailers are in a better inventory position than last year. We take a look at inventory growth (year/year) in the second quarter and third quarter for the largest retailers in the U.S. over the past three years (Exhibit 2). As you can see, the average growth is significantly down from the last couple of years.

As a result, we expect retailers will need to price competitively, but may not have to resort to “fire sale” pricing versus last year. We expect retail margins to be stronger going into the end of year as overall costs have come down. In particular, retailers were able to benefit from lower cotton prices earlier in the year when orders for holiday merchandise were made. All in all, it does not appear that retailers are increasing volume to drive sales as was the case last year. If the retailers get the sense that sales are trending below expectations, they have the ability to adjust pricing given a stronger margin position this year versus last year.

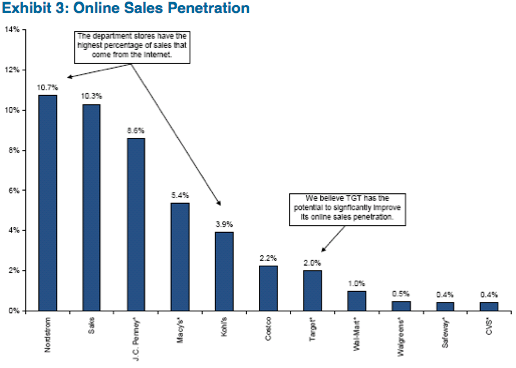

Online Shopping Continues to Gain Importance

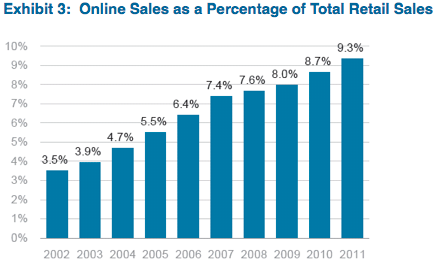

Cyber-shopping will, once again, be very important this year. We continue to see the push from brick and mortar retailers to enhance their online shopping capabilities. This year, we have heard retailers will match online pricing from retail websites, including pure online retailers such as Amazon.com. Wal-Mart has a new system that checks online pricing every 20 minutes. Last year, online sales were up 14% in November and December. According to a survey by the National Retail Federation, 51.8% of consumers are expected to shop online the year compared to 46.7% last year. The importance of having a strong online interface for retailers is increasing. Exhibit 3 shows that online sales as a percent of total retail sales are growing.

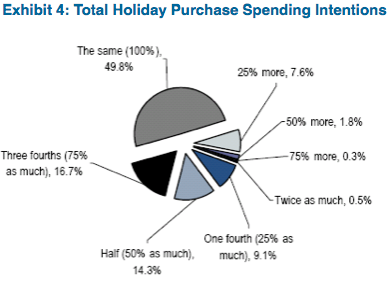

NPD Survey Is Positive for 2012 Holiday Sales

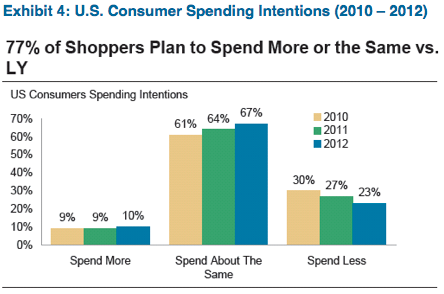

According to a recent survey by the NPD Group, consumers are expected to spend more this holiday season. An estimated 77% of shoppers are expected to spend more or the same this year, compared to 73% last year and 70% in 2010. These findings represent over 3,600 completed surveys.

Weather and Nuances of the Holiday Calendar Should Help

Weather and the changing calendar are always important factors for holiday spending. Last year was one the warmest holiday shopping seasons on record which impacted seasonal items (i.e., coats, scarfs), which are more important to the department store segment. This year, November is expected to be similar to last year, and December is expected to be significantly colder. This should be a positive driver, assuming that a heavier than normal amount of snow does not keep shoppers from driving.

While very unpredictable, a serious weather event can dramatically impact retail sales. We saw this in the first week of November in the Northeast with Hurricane Sandy. Citigroup estimates that same store sales for the department stores will be negatively impacted by 1.5% to 2.5%. While discounters could experience a slight benefit as much as 1.0%, as stock-up and restocking trips offset the lost traffic during the storm. There should be enough time until the end of the year for retailers to recapture those lost sales as homeowners in those areas receive insurance and begin to rebuild. Having said that, it is still very early in that process to know how spending will ultimately be impacted. It’s not unreasonable to assume that many families in those areas will spend less this holiday season.

The days between Thanksgiving and Christmas are key shopping days. This year, those days total 32 versus 30 last year. In addition, this year Christmas falls on Tuesday (It was on Sunday last year), which gives shoppers an extra day to shop on the weekend. We expect the changing calendar will positively affect the retailers.

Summary

The above analysis helps to support a more optimistic opinion on retail sales for this year. We recognize there are some major issues that are coming to a head in the near term including the fiscal cliff, which could have a dramatic impact on consumer spending. Our analysis is based on our assumption that the fiscal cliff issues will be diluted by “kicking the can down the road.” In addition, if the issue goes to the 11th hour (end of December) as we expect, then holiday sales will have already happened. While this is a major issue on consumers’ minds, it doesn’t appear that spending is being held back today. This issue becomes more of a concern for consumer spending if it does not appear that some type of resolution will be met as we head to the end of the year. Finally, we may see downward pressure on sales in the northeast as those areas recover from Hurricane Sandy. This could have a significant impact on spending this holiday season.

Michael J. Ashley

Vice President, Corporate Credit

For more information, contact:

Colin T. Dowdall, CFA

Director Marketing and Business Development

colin.dowdall@amcompany.com

1 NRF’s 2012 Holiday Survival Kit: Holiday Forecasts, Consumer Trends and Historical Retail Sales Data, National Retail Foundation, page 6

2 Adams, Susan. “Who’s Hiring The Most This Holiday Season,” Forbes, November 6, 2012, https://www.forbes.com/sites/susanadams/2012/11/06/whos-hiring-the-most-this-holiday-season-2/

3 Lorriane Hutchinson, Robert Ohmes, and Denise Chai, “2012 Holday preview: The Grinch may not steal Christmas,” Bank of America Merrill Lynch Industry Overview – Retailing, October 16, 2012, page 16.

4 Liz Dunn and Laurent Vasilescu, “Holiday Preview: O’Christmas Trade, O’Christmas Trade, the Year Can Still Be Salvaged,” Macquaire Capital (USA) The Equities Research Specialist, October 22, 2012, page 3.

5 Deborah Weinswig, Nathan Rich, Tifany Kanaga, and Ashley Hartigan, October Same Store Sales Review, Citi Research-Equities, November 2, 2012, page 4.

Disclaimer: Asset Allocation & Management Company, LLC (AAM) is an investment adviser registered with the Securities and Exchange Commission, specializing in fixed-income asset management services for insurance companies. This information was developed using publicly available information, internally developed data and outside sources believed to be reliable. While all reasonable care has been taken to ensure that the facts stated and the opinions given are accurate, complete and reasonable, liability is expressly disclaimed by AAM and any affiliates (collectively known as “AAM”), and their representative officers and employees. This report has been prepared for informational purposes only and does not purport to represent a complete analysis of any security, company or industry discussed. Any opinions and/or recommendations expressed are subject to change without notice and should be considered only as part of a diversified portfolio. A complete list of investment recommendations made during the past year is available upon request. Past performance is not an indication of future returns.

This information is distributed to recipients including AAM, any of which may have acted on the basis of the information, or may have an ownership interest in securities to which the information relates. It may also be distributed to clients of AAM, as well as to other recipients with whom no such client relationship exists. Providing this information does not, in and of itself, constitute a recommendation by AAM, nor does it imply that the purchase or sale of any security is suitable for the recipient. Investing in the bond market is subject to certain risks including market, interest-rate, issuer, credit, inflation, liquidity, valuation, volatility, prepayment and extension. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission.